Market Brief

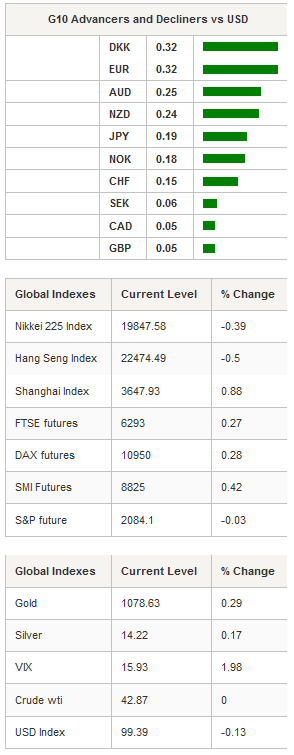

European stocks were caught in the crossfire yesterday due to mounting geopolitical tensions as Turkey took down a Russian warplane near the Syrian border. The DAX lost as much as 2% before partially erasing early day losses. The German index ended up the day down 1.43%. The broader Euro Stoxx 600 followed roughly the same pattern, losing as much as 2.04% and ending the day down 1.20%. In the US, economic data came in broadly mixed yesterday as the third quarter GDP was revised higher to 2.1%q/q (annualised) from 1.5% as expected. However, personal consumption came in on the soft side, printing at 3% versus 3.2% median forecast and first estimate. Finally, consumer confidence fell to 90.4 in November after a reading of 99.1 in October as American people’s confidence in the job market erodes. While on the equity side, the Turkey-Russia incident did not do too much damage to Wall Street as all three main equity indices end up the day in positive territory with the S&P 500, the Dow Jones and the Nasdaq up 0.12%, 0.11% and 0.01% respectively.

In Germany, the IFO business climate index surprisingly jumped to 109 in November, the highest level since July 2014, from 108.2 in the previous month. The German economy seems to have weathered the end of summer slump pretty well and the outlook looks great especially given the fact that the weaker euro will provide an extra boost to the economy. The single currency recovered in the Asian session and rose 0.32% versus the dollar, bringing EUR/USD back above the 1.0650 threshold. However, we still believe that there is further room for euro depreciation.

In Asia, regional equity indices were broadly lower with the exception of mainland Chinese markets, which were able to report gains. The Shanghai and Shenzhen Composite were up 0.88% and 1.89% respectively. In Japan, the Nikkei fell 0.39%, while the broader Topix index dropped 0.70%. Elsewhere, Hong Kong’s Hang Seng was down 0.50%, South Korea’s Kospi fell 0.34%, while in Singapore stocks retreated 1.02%.

In Australia, skilled vacancies rose 0.6%m/m in October, down from a revised increase of 1.1% in September. AUD/USD’s positive trend is gaining momentum as Governor Stevens declared that the RBA was pretty comfortable with the state of its current monetary policy. A cut in the cash rate is therefore not on the cards. After successfully validating a break of its 50dma, AUD/USD is now heading toward its 200dma standing at 0.7482 for the moment. The closest resistance can be found at 0.7382 (high from October 12th), while on the downside, a support lies at 0.7017 (low from November 8th and 20th).

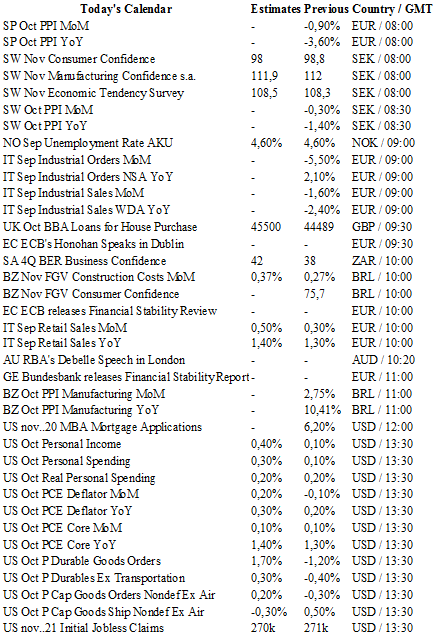

Today traders will be watching PPI from Sweden; unemployment rate from Norway; industrial orders and retail sales from Italy; MBA mortgage application, personal income and spending, durable goods orders, Markit composite and services PMI, new home sales and Michigan sentiment index from the US; trade balance from New Zealand; interest rate decision from Brazil (BCB expected to stay on hold).

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0674

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5095

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.30

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0240

CURRENT: 1.0151

S 1: 0.9739

S 2: 0.9476