’There are decades where nothing happens, and there are weeks where decades happen’’ – Vladimir Lenin.

Markets were sleepwalking into April 2nd before we had a decent sell-off in US stock markets on Friday.

However, the size of the YTD sell-off (a mere 5%) masks a very interesting pattern below the surface.

For the first time since the first half of 2008, we are observing a rare macro pattern – almost a unicorn.

The S&P 500 and the US Dollar are going down at the same time:

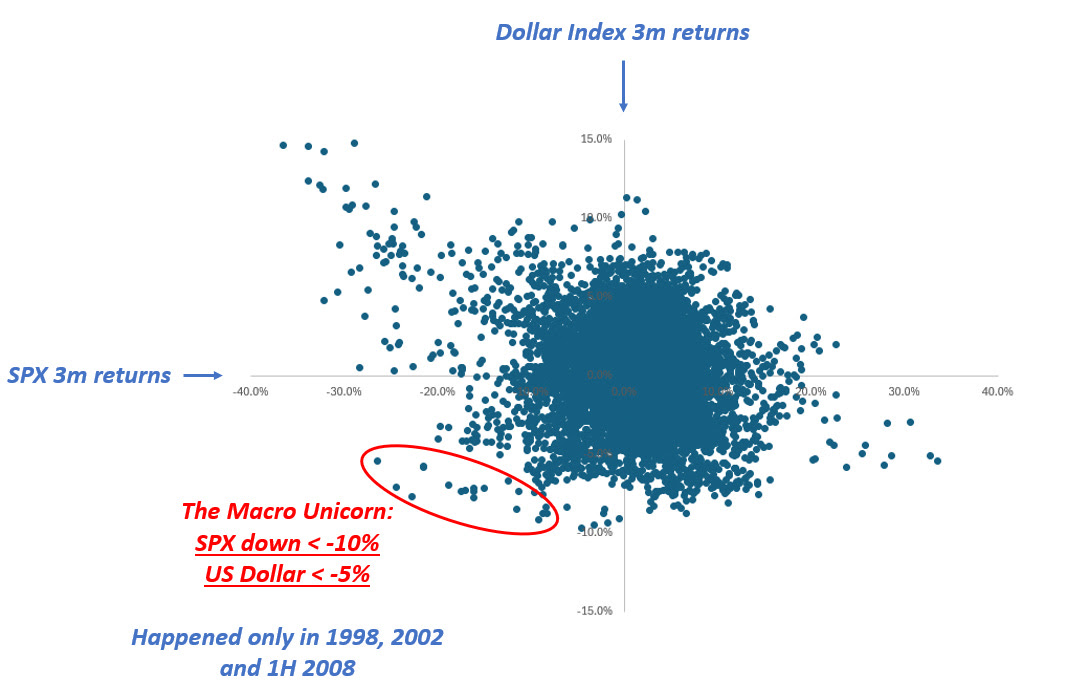

The chart at page 1 shows the 3-month rolling returns for the US Dollar Index (DXY) and the S&P 500.

Historically, large SPX drawdowns (left part of the scatter) tend to see the USD rallying heavily: the most convex USD appreciation (upper side of scatter) tends to coincide with bad equity drawdowns.

This also implies that the upper-left quadrant (SPX down a lot, USD up a lot) experiences the most elongated tail of all the quadrants.

The ‘’Macro Unicorn’’ bottom-left quadrant with SPX drawdowns happening alongside a weak USD is not very populated. It’s crucial to remember the last Macro (BCBA:BMAm) Unicorn dot goes back to July 2008.

Why was it so hard for the USD to weaken while the S&P 500 was going down?

This is because of three reasons:

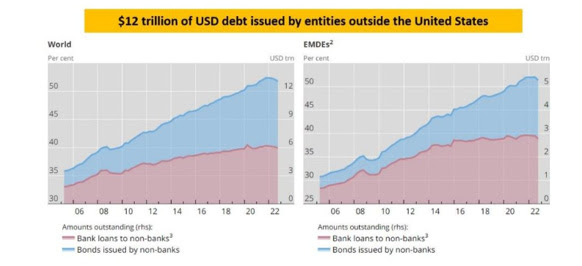

- 1) After 2008, the Eurodollar system blew up in size and never looked back;

- 2) The US aggressively swallowed global trade surpluses, and in exchange became the epicenter of all global financial flows into Treasuries and US stock markets;

- 3) Policymakers applied growth-friendly disinflationary policies and politicians postured towards defending Pax Americana on the geopolitical front

With such a combination of factors, the USD tends to appreciate during risk-off events.

A portion of the 12+ trillion dollars of USD debt issued by foreign entities has to be refinanced in any given year, and a risk-off environment that threatens to slow down global trade means all foreign entities rush to buy USDs to service their debt.

Foreign investors buy Treasuries because the Fed has your back and it will cut rates if financial conditions materially worsen – cross-border buying of US Treasuries strengthens the USD as money flows in the US.

The same foreign investors are reluctant to wind down their US equity exposures because Fed cuts will ultimately restore confidence.

Net-net, the USD goes up in risk-off events.

The only periods when the USD weakened alongside the SPX were 1998, 2002 and H1 2008.

These are all periods where US bubbles ended up deflating rapidly: think of the Dot Com bubble burst in 2001 or the US housing market crash of H1 2008 – before it turned into a global financial crisis.

These episodes all have one thing in common: a US idiosyncratic crisis.

And today, US policymakers seem to be doing all they can to generate one.

On the macro front, the US administration is injecting a large amount of uncertainty.

The ‘’no-visibility’’ approach from Trump on tariffs brings big unpredictability – and it’s also nearly impossible for US companies to plan capital expenditures and hiring given there is no visibility on tariffs.

To that business uncertainty, you need to sum up the leaked White House memo to the Washington Post which aligns with the recent Musk interview highlighting a 25-35% cut to the federal workforce to achieve budget savings close to $1 trillion/year by the end of May.

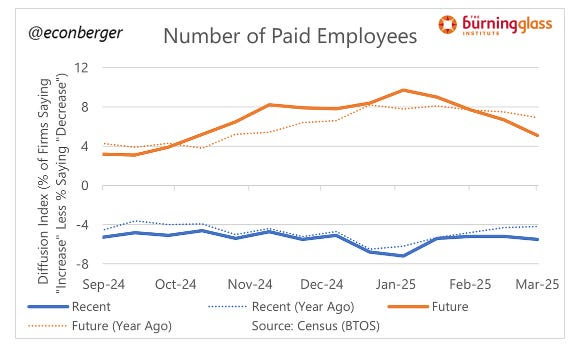

Former Linkedin Chief Economist Guy Berger looks at a variety of high-frequency leading job market indicators, and I respect him as a non-biased non-alarmist economist.

He just produced the chart you see below:

Quoting him:

‘’The diffusion index of future headcount plans is now worse than it was immediately prior to the election."

Additionally, and concerningly, pessimism about the future is also affecting the present: the diffusion index of recent employment actions is trailing a year earlier by more than pre-election.’’

And this is before the Trump administration starts slashing ~800k federal employees.

To add to the potential "Macro Unicorn" move, which stems from a US idiosyncratic crisis, we are witnessing the very first signs of the unwinding of foreign investors’ gigantic long US equity positions.

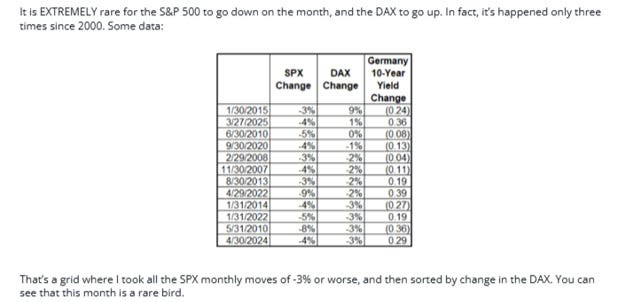

As shown by my friend Brent Donnelly, it is very rare to experience a month when the DAX is up while the SPX down – and we just experienced it:

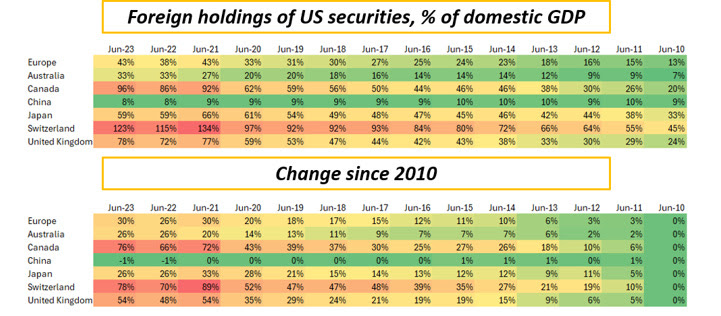

If you take a step back, you realize that foreign investors have accumulated a gigantic amount of US securities since 2010. Trade surpluses came with a USD surplus for countries like Germany or Norway, which then recycled these excess USDs back into US Treasuries and US stock markets.

Canadian and Swiss investors own US securities to the tune of 100%+ of their GDP:

What if some of these foreign whales decide to reduce their exposure to US assets?

It would make sense given the new US geopolitical stance, the non-supportive policy mix (non-proactive Fed and tighter fiscal stance), business uncertainty from tariffs and still elevated valuations.

And what if markets get caught by surprise by a sudden change in correlations?

Exactly like in early 2022 when the correlation between bonds and stocks turned positive after 10+ years of persistently negative correlation as the Fed embarked in a hiking cycle that also hurt stock markets.

The Trump administration is trying to achieve an arduous trifecta: a weaker USD, lower yields, and a robust stock market.

Historically, to achieve this rare trifecta you need very disinflationary policies (yields and USD down) and a supportive Central Bank that boosts stock market sentiment.

The current policy mix of geopolitical shifts, tariffs and macro uncertainty risks achieving a weaker USD and lower yields but at the expense of the economy and the stock market.

After 17+ years of absence, the Macro Unicorn of simultaneously weak USD and weak US stock markets could stage an unexpected comeback.

Long-term macro investors should reduce their (implicit or explicit) exposure to the USD which has historically served well as a hedge against stock market drawdowns – if the Macro Unicorn appears again, a long USD long stock position could hurt twice.

***

Disclaimer: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.