Stock markets remain in retreat mode following the latest interest rate hike by the US Federal Reserve but both currency and bond markets are forecasting more pain ahead as the hawkish Fed is not yet finished. Wall Street remains in bear market mode and Australian stocks are likely to start sharply lower in catch-up after yesterday’s holidays, probably with thin trading not helping as well. The USD continues to strengthen against everything with Euro dropping sharply below parity, with the Australian dollar and Pound Sterling still on the ropes, the latter at decade new lows. Bond markets increased in volatility across the yield curve with 10 year Treasury yields lifting to the 3.7% level with interest rate expectations still looking at another 150bps in rises by January. Crude oil closed slightly lower with Brent unable to maintain a position above the $91USD per barrel level while gold is trying to stabilise at its current lows at the $1670USD per ounce level.

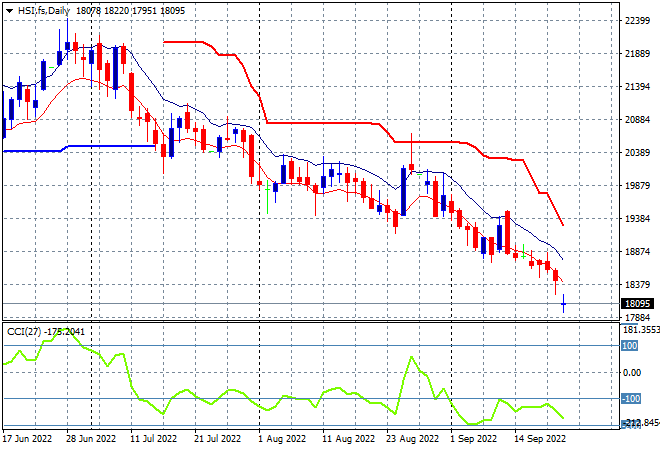

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are still trying to stabilise in the post Fed environment with the Shanghai Composite down slightly to 3108 points while the Hang Seng Index remains in bear market mode, down more than 1.6% to 18147 points. The daily futures chart is still showing a very bearish mood and a distinct lack of buying support quite evident and indeed accelerating into an abyss. The bear market continues with daily momentum nowhere near out of its negative funk:

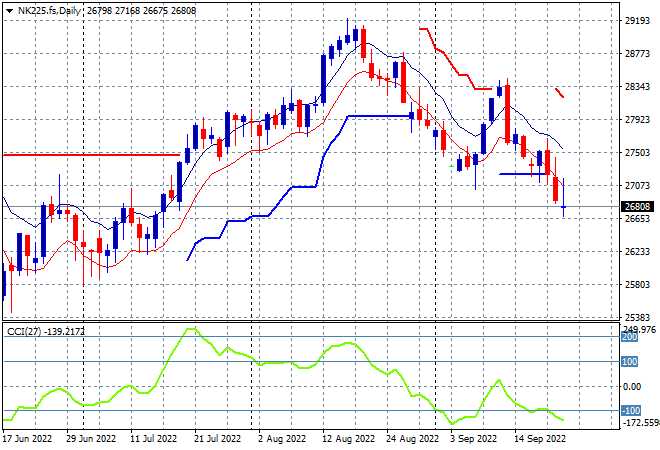

Japanese stock markets continued their slump with the Nikkei 225 closing 0.6% lower at 27153 points. The daily chart shows price action returning to the dominant downtrend after the recent dead cat bounce up to the 28000 point level with support at the 27000 point level taken out recently. Daily momentum remains negative and oversold with successive new daily low sessions pointing to a test of the June lows next as futures are indicating more selling ahead:

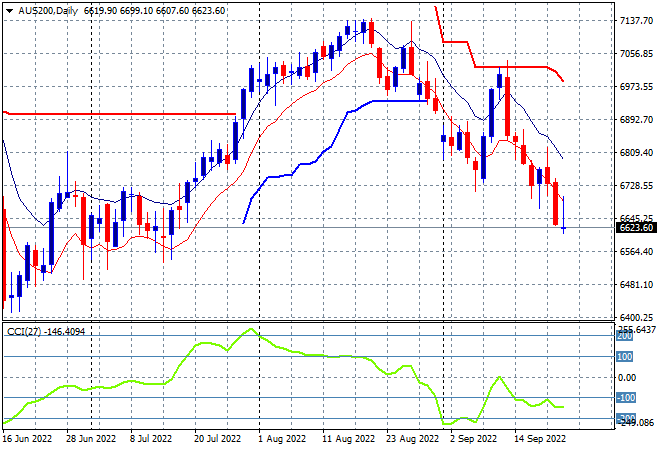

Australian stocks were closed for the Queen’s memorial with the ASX200 set to open sharply down, probably at the 6600 point level as SPI futures are indicating. Price action will be playing catch-up in line with the recent falls on Wall Street with the daily chart showing similar price action to other Asia stock markets. This downtrend is likely to test the June lows next as daily momentum remains in full oversold mode, with buying support evaporating:

European stocks continue to lose their nerve with losses across the continent again, with steep falls on the German DAX pushing the Eurostoxx 50 Index down nearly 2% lower to 3427 points. The daily chart showed how bad a big dead cat bounce that preceded this falls, following the moves off the June lows at the 3300 level that look like the next target to reach. Another bearish engulfing candle and a failure of daily momentum to get back above positive readings suggests another leg down:

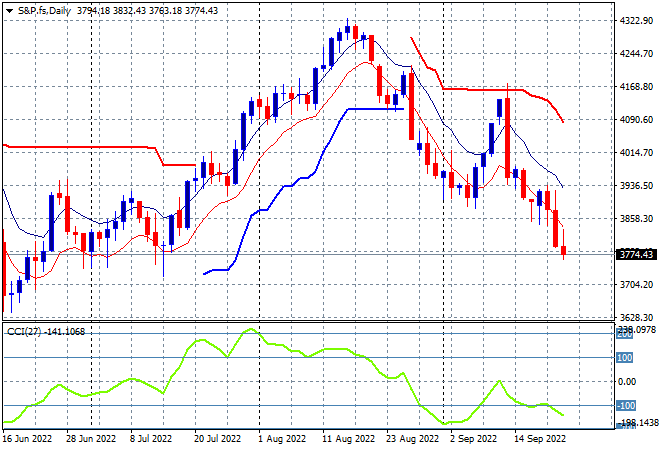

Wall Street has almost given up here fighting the Fed, with the NASDAQ down 1.4% while the S&P500 finished just over 0.8% lower at 3757 points. The daily chart looks similar to all other major stock markets showing how inline market expectations are with the hawkishness of the US Fed. Price has now returned to the June lows which wipes out all of 2021’s returns:

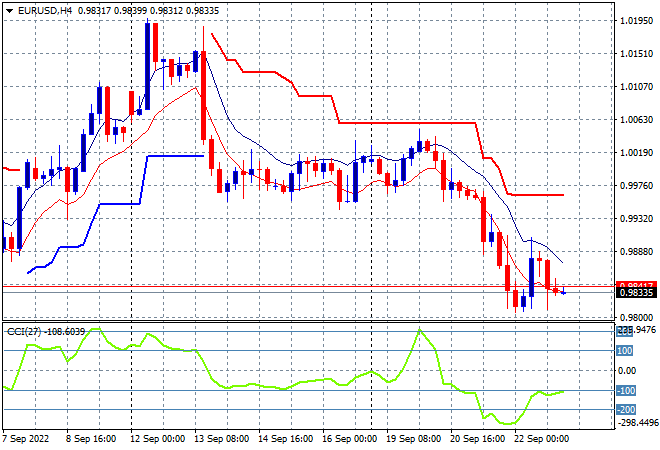

Currency markets remain firmly on the side of the USD, with Euro pushed sharply below parity and breaking through the 98 handle. As expected the union currency was broken by the interest rate hike and is likely to head lower as the Fed gets more hawkish than the ECB. Momentum has retraced slightly after becoming extremely oversold but the four hourly chart indicates more selling pressure as the high moving average is not under threat:

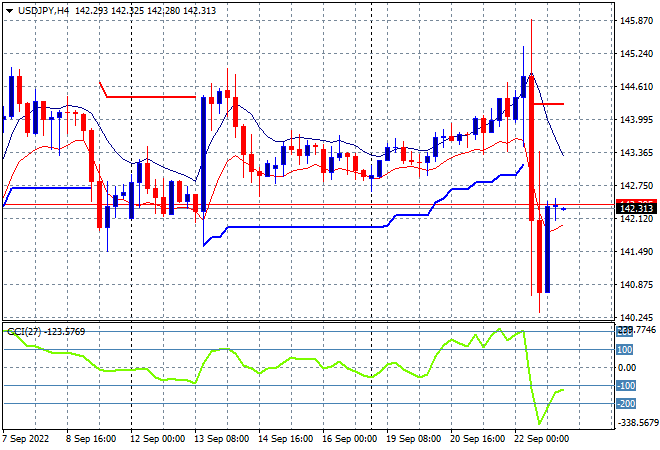

The USDJPY pair had some massive volatility after slowly melting up before the Fed meeting, moving over 500 pips in the previous 24 hours! Short term momentum however is still stuck in oversold mode despite the volatility with price action holding at the 142 handle near the recent weekly lows, indicating lower price pressure:

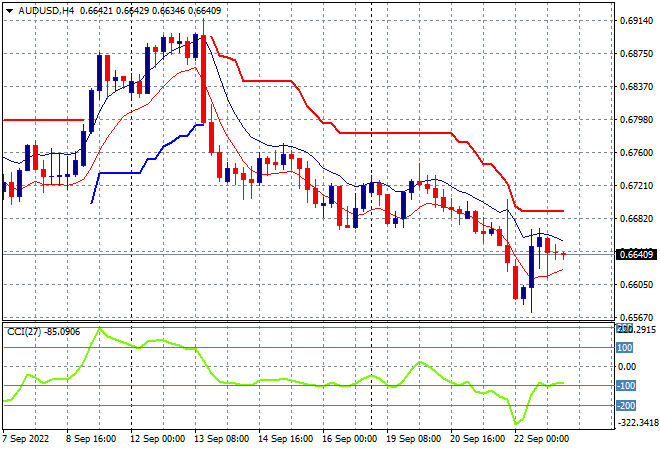

The Australian dollar cracked below the 67 handle after decelerating at the start of the week, breaking through the 66 level on Fed rate hike before coming back to the 66.40 level this morning. My contention that resistance is just too strong at all the previous levels with the 68 handle the area to beat in the short term is holding, with the 67 level possibly firming as well as trailing overheard ATR resistance is just not under any threat:

Oil markets are still chugging along on the bottom here, with no buying support evident as Brent crude is unable to climb back above its own high moving average on the daily chart, finishing below the $91USD per barrel level again. Daily momentum is still persistently negative although not technically oversold here as price action remains anchored at the recent weekly lows:

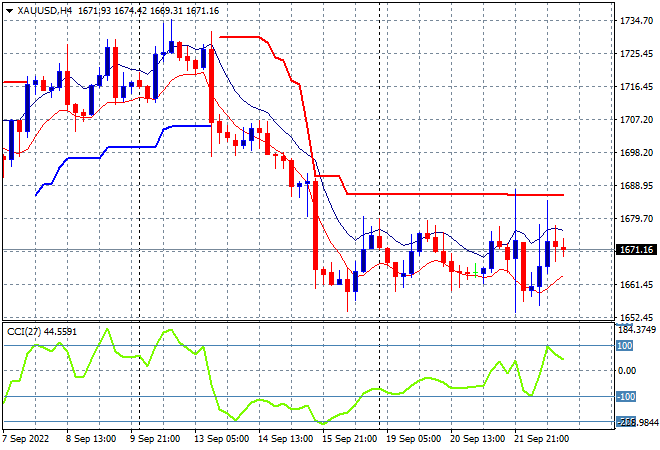

Gold like other undollars remains depressed but didn’t suffer as much volatility or downside moves in the wake of the Fed, remaining well below the key $1700USD per ounce support level – now resistance – and staying at the $1670USD per ounce this morning. This keeps the shiny metal at the 2020 lows and closes up a monthly bearish setup, but watch overhead ATR resistance for the off chance of a melt up rally: