- Gold’s not just glittering—it’s making a statement.

- When fear rises, so does demand for something solid.

- And with central banks and ETFs doubling down, the message is clear: safety has a price.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

In the middle of this month, gold prices broke through another psychological level of $3,000 per ounce, setting new historic highs just below $3,100 per ounce. The accumulation of pro-demand factors continues to effectively drive valuation, with only a slight unwinding observed.

The factors favoring buyers primarily include global uncertainty surrounding the potential onset of a tariff war, ongoing geopolitical risks in Ukraine and the Middle East, and market expectations that the Fed will begin cutting interest rates as early as June, putting downward pressure on the US dollar. Also notable are movements in physical gold, which—particularly in the case of ETFs—continue their positive trend, indicating ongoing accumulation of the commodity.

Gold Maintains Safe-Haven Status

Analyzing recent movements in gold, it is clear that this asset continues to be treated by investors as a so-called "safe haven" to which capital flows during periods of heightened global risk aversion. This has been the case since January of this year, when a new administration took office in the US, and with each passing week, its subsequent moves raise more questions rather than providing clarity.

Investor sentiment is further dampened by the resumption of offensive operations in the Gaza Strip and the slow, back-and-forth nature of negotiations along the Washington-Moscow-Kiev axis, where there are currently no signs of a lasting truce. These factors create ideal conditions for continued price increases, which could ease if de-escalation efforts were made in several areas—though that appears unlikely at present.

On the demand side, in addition to central banks, ETFs play a significant role. After strong purchases in February (+72 tons by U.S. funds), the trend has continued into March. According to data from the World Gold Council, the aforementioned U.S. funds added just over 31 tons last week—an increase of 1.8%.

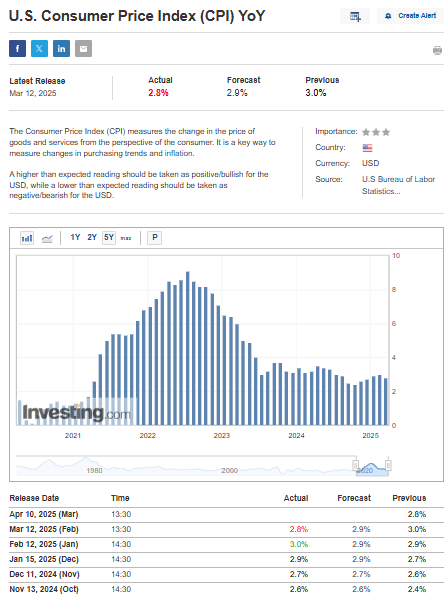

US Inflation Dynamics Stabilize

The latest data on US inflation for February showed a decline from the previous month, resulting in year-over-year figures of 2.8% and 3.1% for the core CPI.

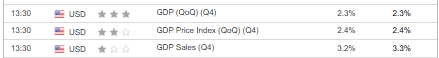

Current levels are still too high, but the stabilization of the situation gives the Federal Reserve room to maneuver if the cycle of rate cuts accelerates in response to economic data. Tomorrow, however, we will receive extremely important readings from US GDP.

If the numbers come in significantly below consensus, it could open the door for another wave of US dollar depreciation—potentially giving further support to gold buyers.

Bulls on Gold Go After $3,100 Per Ounce

After breaking the $3,000 per ounce barrier, bulls are consolidating above this level and aiming to push toward $3,100.

For those looking for suitable technical levels to enter the trend at a better price, it’s worth noting the confluence of the upward trendline and the support zone just below the aforementioned round-number barrier. A move below that could signal an opportunity to target $2,800 per ounce.

****

- ProPicks AI: AI-powered stock picks with a proven track record of outperformance.

- InvestingPro Fair Value: Instantly assess whether a stock is undervalued or overpriced.

- Advanced Stock Screener: Pinpoint the best opportunities with hundreds of customizable filters.

- Top Ideas: See which stocks billionaire investors like Warren Buffett, Michael Burry, and George Soros are buying.

Don’t miss out—subscribe now and take your investing to the next level today!

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.