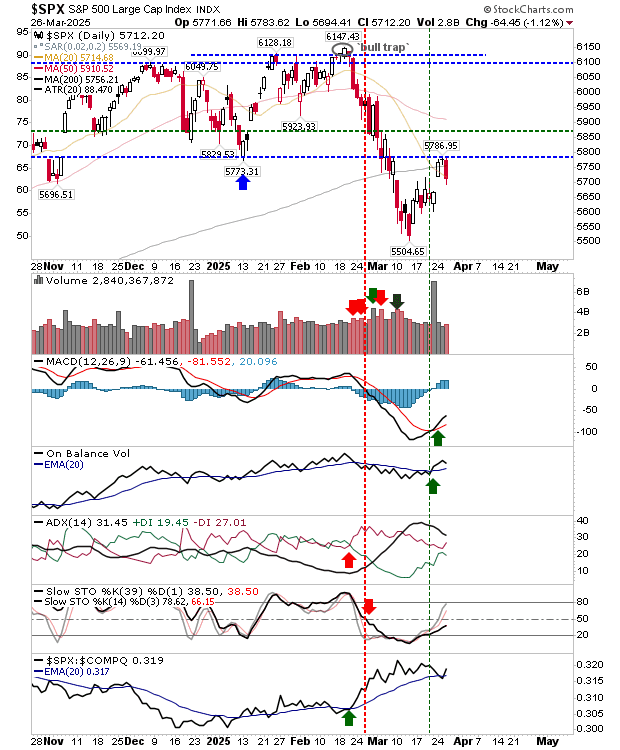

We have had the recovery bounce, now we are going to find out if this bounce is something more than just one fashioned in relief. The S&P 500 had the picture-perfect reversal off resistance, undercutting its 200-day MA in the process. Volume climbed to register distribution, but supporting technicals didn’t take too much of a hit. Monday’s breakout gap can’t close if this is a true breakout gap - i.e., if the gap closes, then a retest of 5,500 becomes favored.

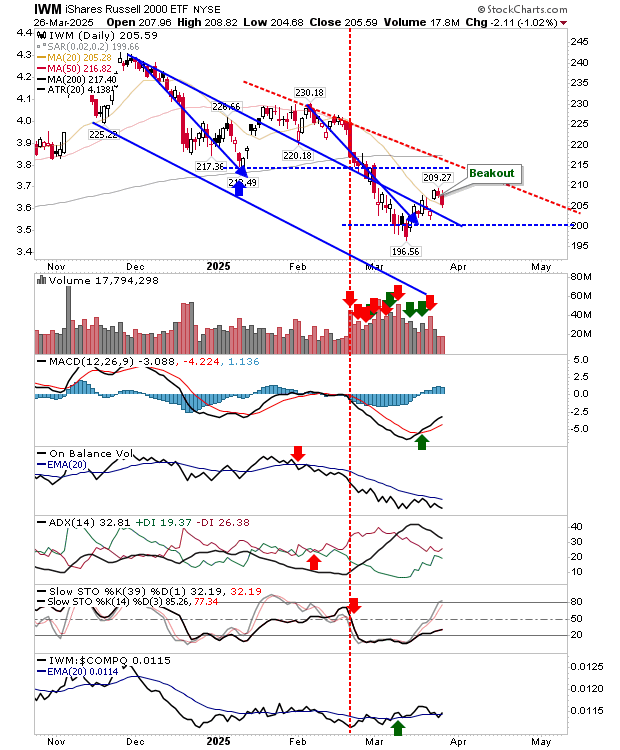

The Russell 2000 (IWM) is ready to mark a retest of $200 as part of its correction, although it’s holding the 20-day MA as support for now. The relative relationship of this index to peers has flattened over the course of 2025, giving it a wait-and-see approach for traders.

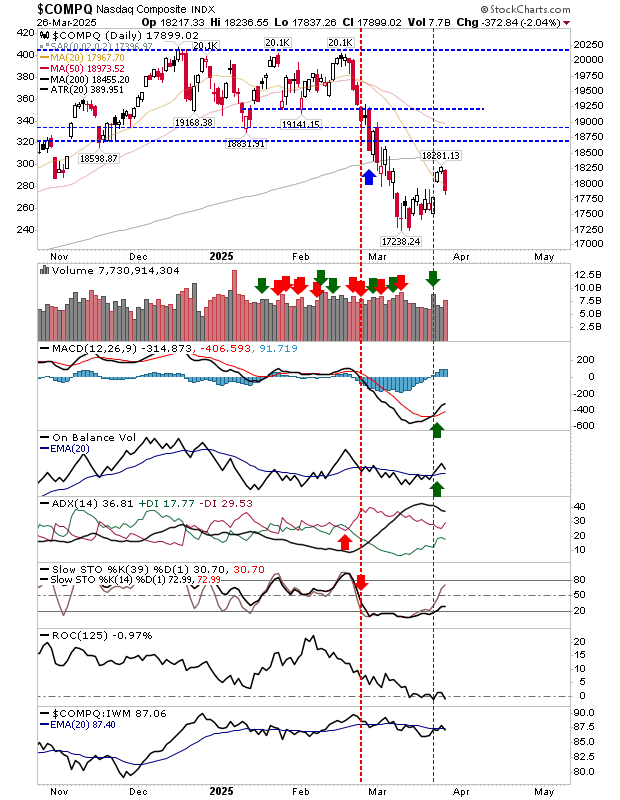

The Nasdaq is trading around its 20-day MA. Of the three lead indices, this is the one closest to closing its breakout gap and, therefore, the index most likely to retest its swing low first.

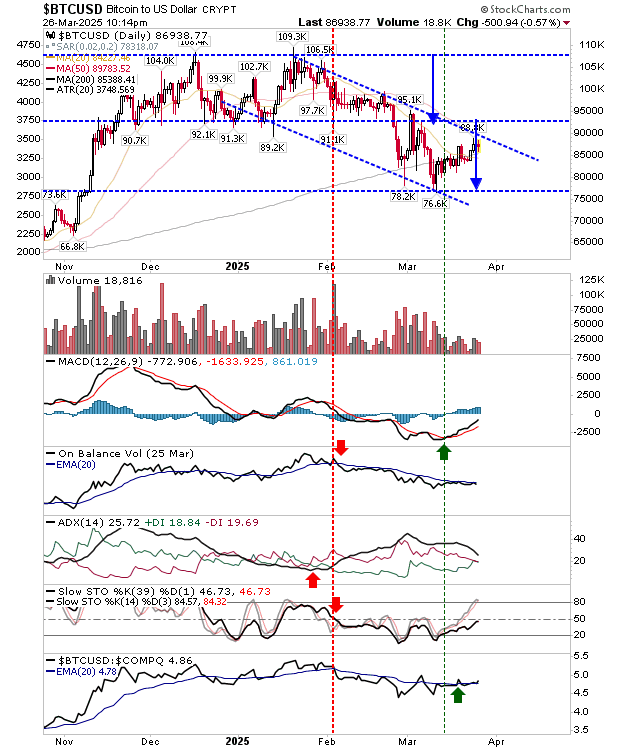

Bitcoin is slowly approaching channel resistance as it runs along its 200-day MA. Technicals are mixed with a weak MACD ’buy’ trigger while others are bearish, but On-Balance-Volume, Stochastics and +DI/-DI are very close to new ’buy’ triggers that would set up a channel breakout. One to watch.

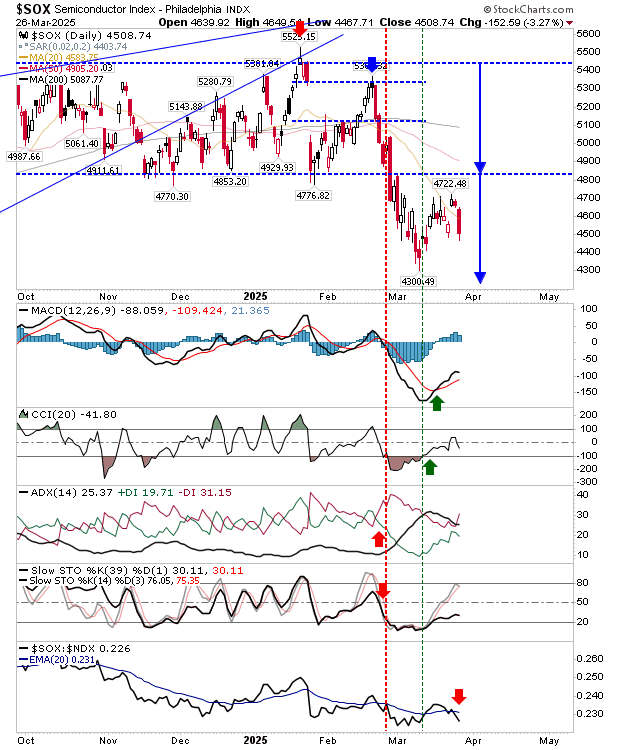

The other index we need to keep an eye on is the Semiconductor Index. It suffered a heavy loss yesterday, putting it on course to test swing lows. If this undercuts 4,300, then Bitcoin and Nasdaq will quickly follow suit with new lows of their own.

For the rest of the week, we need to see if the Semiconductor Index drags other indices with it, or if the likes of the Russell 2000 and S&P 500 can create successful support tests.