- 2022 was a dismal year for both bonds and stocks

- In the final quarter of the year, the dollar also joined the party and slumped

- Risks remain high in 2023 as history shows that a bear market never bottomed at the onset of a recession

Wall Street has closed its worst year in more than a decade.

If a severe economic recession were to play out in 2023, stocks could be headed for another downturn. History shows us that a bear market never bottomed at the onset of a recession. Recessions tend to hit stocks hard. In fact, the S&P 500 has fallen an average of -29% during recessions since World War II.

Furthermore, the dollar's rise against other currencies this year has hurt the earnings of many U.S. companies. The greenback has trimmed some of its gains in recent weeks, and a continued pullback would depend partly on investor perceptions of how hawkish the Fed is relative to other global central banks.

An Off December

Volatility increased in December with six more than -1% declines in the S&P 500.

To put this in perspective, 2022 ranks third in numbers of December sessions falling -1% or more (second only to 2008 and 2018) — and tied with 1973, 1974, 2000, and 2002.

The Nasdaq fell by -8.73%, bringing it into third place for the worst December in history, only behind 2002 (-9.7%) and 2018 (-9.5%).

Historically, the Nasdaq records its annual high, on average, on the 176th trading day, i.e., in mid-September. This year it was at the beginning of January, which is unusual since there have only been five other years in which the annual high occurred in the first two weeks (2008 was the only year in which it originated on the first trading day of the year).

As for the annual low, it usually occurs on average on the 90th trading day of the year, and there have only been four years in which the low occurred in the last two weeks of the year (just ended 2022, 2020, 2018, and 1973). Those are the only four years in Nasdaq history in which it made its annual low in December.

The only year with a similar situation in which the Nasdaq formed its annual high in the first two weeks of the fiscal year and its low in the last two weeks was 1973.

Furthermore, to find a year in which the Dow Jones Industrial Average outperformed the Nasdaq by such a wide margin, you have to go back to the dot-com bubble.

Record Quarterly Decline in the U.S. Dollar

The dollar index posted its most significant quarterly drop since 2010 and is trading around its lowest level six months after retreating from the all-time high it reached on September 28.

However, while the greenback is down more than -8% from its peak, the currency is up more than +6% since the end of 2021, the gauge's best year-on-year performance since 2015.

Among the G-10 currencies, the New Zealand dollar and the Norwegian krone were the strongest, each up more than +10% this quarter.

Bonds, Hedge Funds Also Set Negative Milestone

2022 has been one of the worst years for bonds in history, with the iShares Core U.S. Aggregate Bond ETF (NYSE:AGG) losing -16%.

There have never been two consecutive years of losses for the asset class, so the binomial 2021/2022 has done something never seen before.

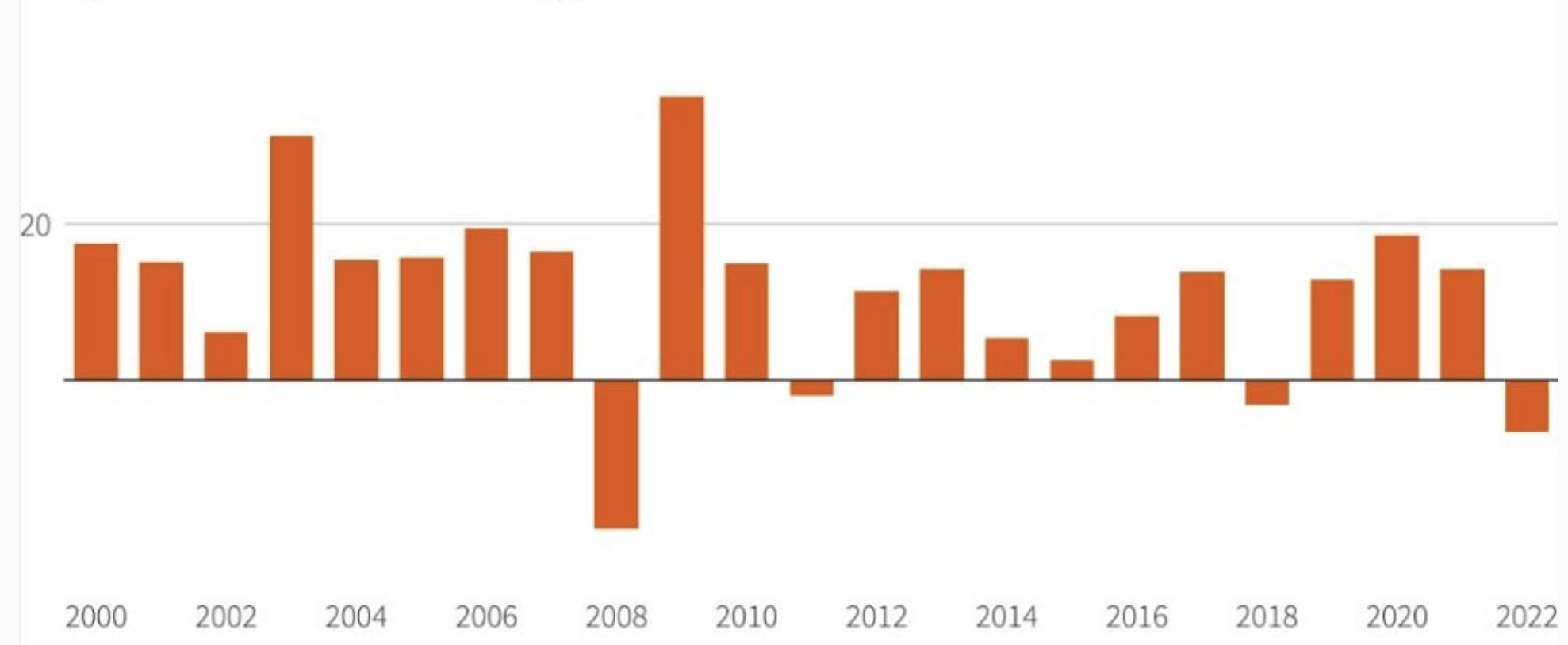

And, of course, this leads to the famous 60/40 portfolios, composed of 60% stock market and 40% bonds, falling by an average -16.7% in the year, the second worst year since records have been kept (since 1976) and only surpassed by 2008.

And that's not all. With an average loss of -6.5%, Hedge Funds also recorded their worst year since 2008.

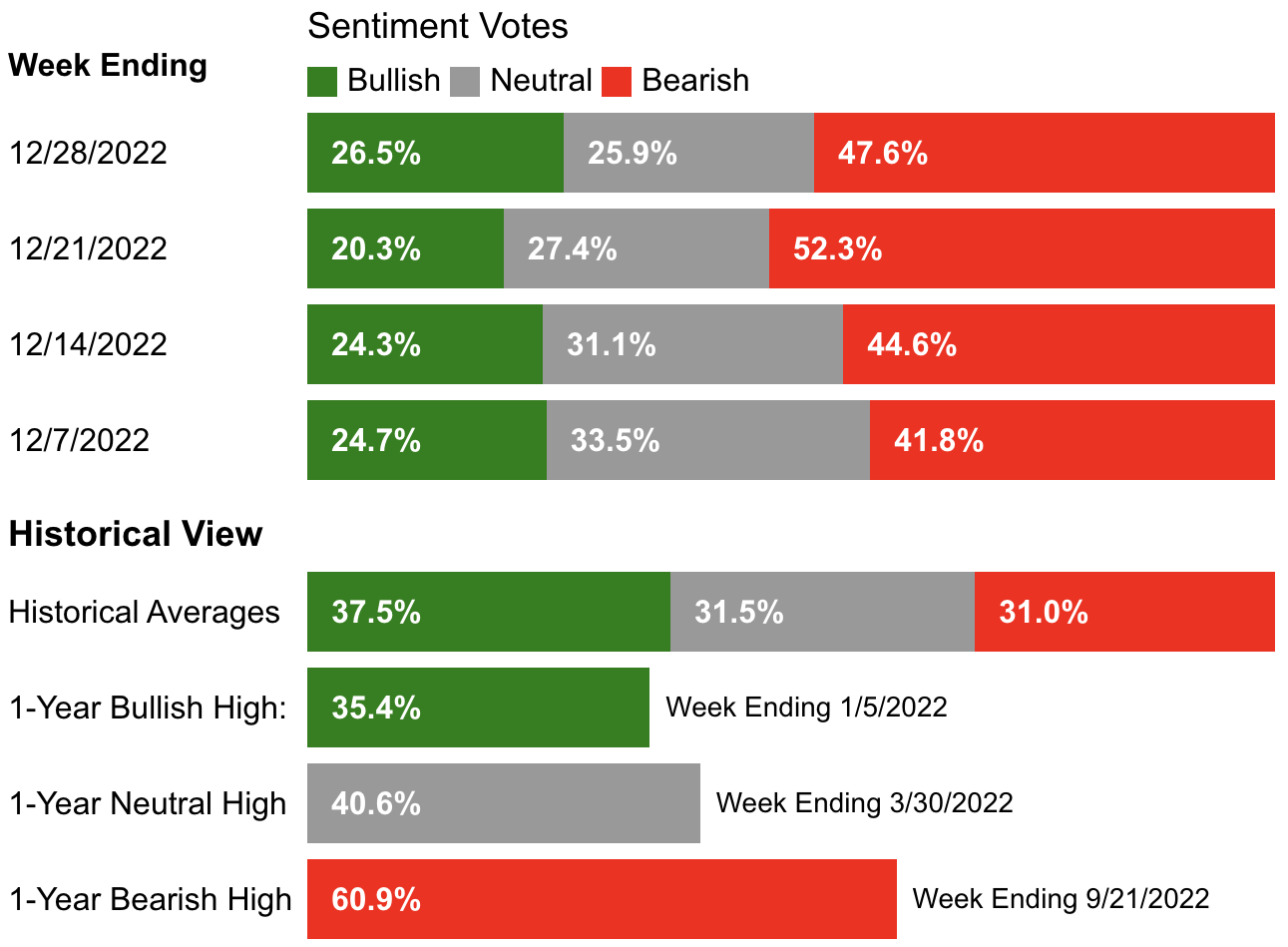

Investor Sentiment

* Bullish sentiment, i.e., expectations that stock prices will rise over the next six months, fell 4% to 20.3% and remains below its historical average of 37.5%.

* Bearish sentiment, i.e., expectations that stock prices will decline over the next six months, rose 7.7% to 52.3% and remains above its historical average of 31%.

This week's results also officially confirm that 2022 will be the first year in the survey's history (dating back to 1987) in which bullish sentiment is below its historical average every week of the year.

Global Stock Markets

The global stock market raking in 2022 has completed as follows:

- -Brazilian Ibovespa: +5%

- -Indian Nifty 50: +4.3%

- - British FTSE 100: +0.91%.

- - Spanish IBEX 35: -5.56%.

- - Dow Jones: -8.78%.

- - Japanese Nikkei: -9.37%.

- - French CAC 40: -9.50%

- - Euro Stoxx 50: -11.74

- - German Dax: -12.35

- - Italian FTSE MIB: -13.31%.

- - S&P 500: -19.44%

- - Chinese CSI 500: -21.63%

- - Nasdaq: -33.10%