It’s been the best run in three days since 2020 for North Atlantic stock markets with Wall Street leading the charge again last night as the BOE joined the rate rise party, helping lifting the FTSE although the outlook wasn’t as hawkish as expected. The USD lost ground particularly against Euro and Yen while the Aussie dollar continued to push above the 73 handle. Bond markets saw more loosening of yields, with the 10 year Treasury pushed up to the 2.2% level, building on its three year high. In commodity world, oil prices bounce back again with Brent crude gaining nearly 9%, while most metals including gold also lifted, the latter back to the $1940USD per ounce level.

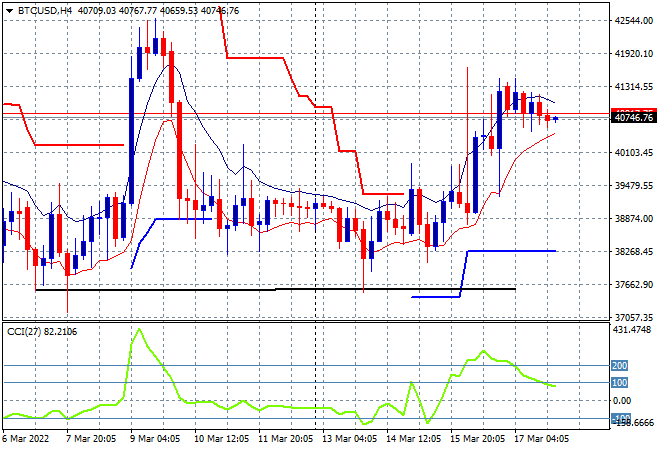

Bitcoin was again contained after seemingly bottoming out here with support building but keeping it at just below the $41K level overnight. This still keeps price below the previous weekly highs with the $42K zone the next level of resistance to get past with short term resistance quite solid here:

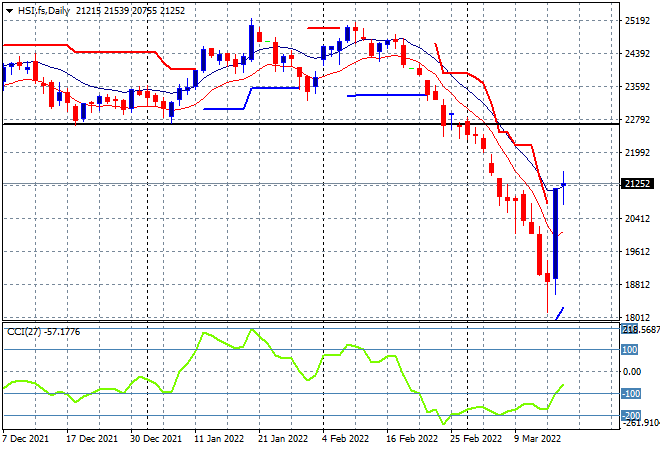

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares continued their sharp bounceback with the Shanghai Composite closing 1.4% higher to 3220 points while the Hang Seng Index put in another very strong day, up 7% as it advances past the key 20000 point barrier, closing at 21501 points. This sort of volatility remains hard to trade, to say the least, and still questions if this bounceback can be sustained or is just posturing by local authorities to stave off a proper crash:

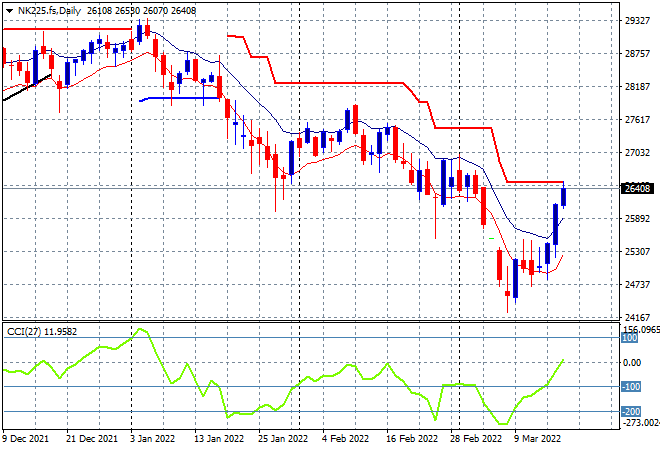

Japanese stock markets also advanced fast as well with the Nikkei 225 closing 3.4% higher at 26652points. The daily futures chart is showing more potential upside here as the possibility of a bottom is brewing alongside Wall Street’s surge. Watch overhead ATR resistance on the daily chart as the next target here to turn this swing trade into a proper rally:

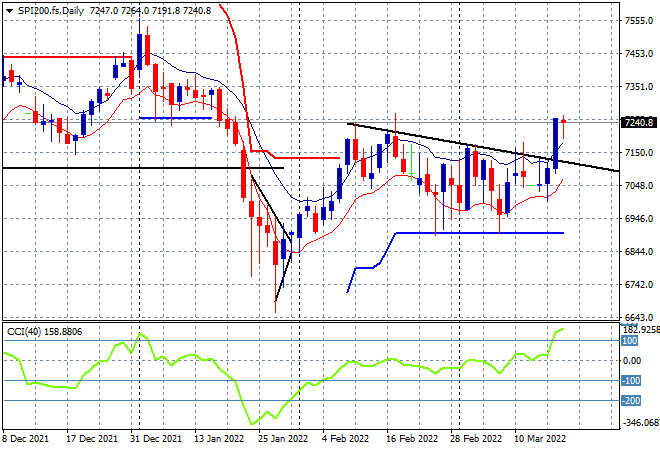

Australian stocks did well, again overshadowed by the Chinese rallies with the ASX200 finishing 1% higher to get back above the 7200 point level, closing at 7250 points. SPI futures are up nearly 0.5% on the Wall Street moves overnight, despite the much higher Aussie dollar. The lower resistance line overhead was taken out for a new weekly high so this should equate to more upside potential to finish out the trading week as daily momentum flips back into the positive zone:

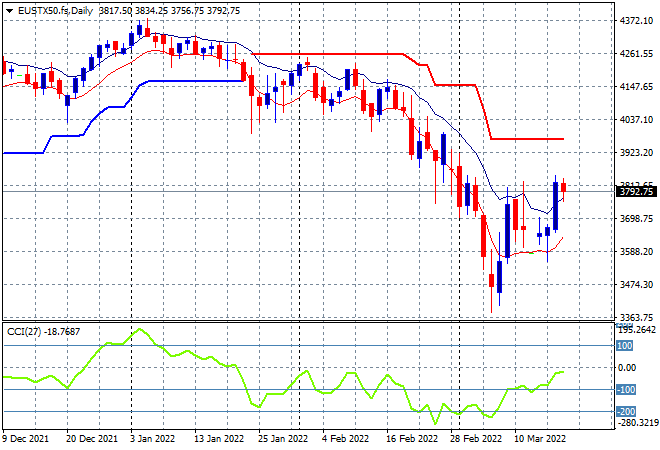

European shares saw some good sessions on the periphery with the German DAX pulling back slightly while the FTSE lifted on the BOE hike, up 1.3% with the Eurostoxx 50 index essentially unchanged at 3885 points. As I said previously to continue this swing trade and toss aside the dead cat bounce requires a proper rally that clears the 4040 point area:

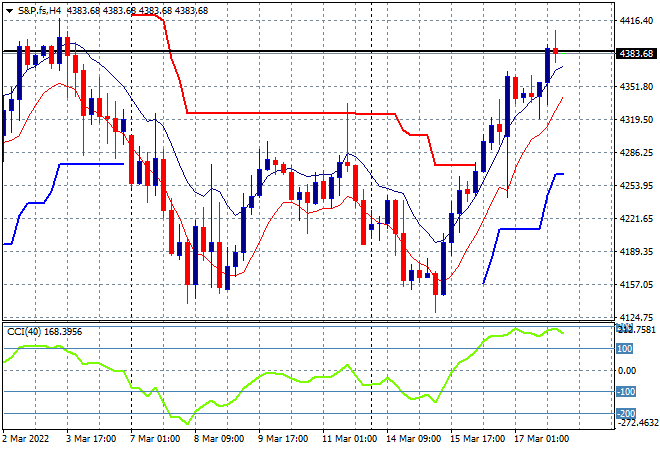

Wall Street was united across the board with the NASDAQ and S&P500 both finishing 1.2% higher, the latter at 4411 points. This rally now has price action above both four hourly and daily overhead ATR resistance as it breaches the 4400 point level, completing a weekly bottom with the potential to move out of this correction phase:

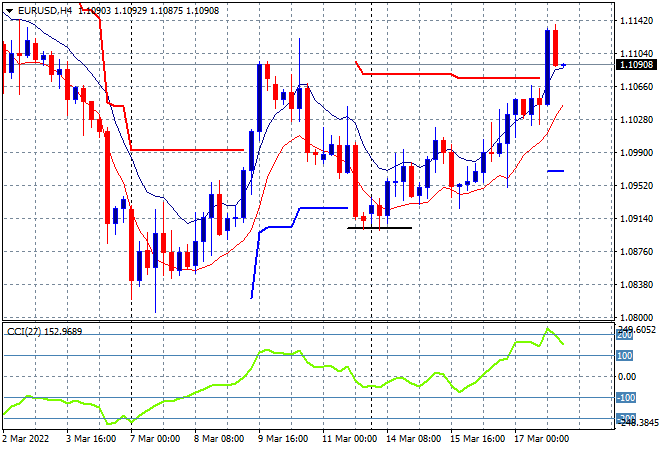

Currency markets were focused on the BOE meeting with Pound Sterling relatively contained while Euro given much more buying support with a strong lift that almost saw it finish above the 1.11 level overnight. The Ukrainian invasion continues to keep a lid on risk taking here but the four hourly chart is no longer showing hesitation with a new weekly high brewing as the union currency build out of a steep decline since the war started:

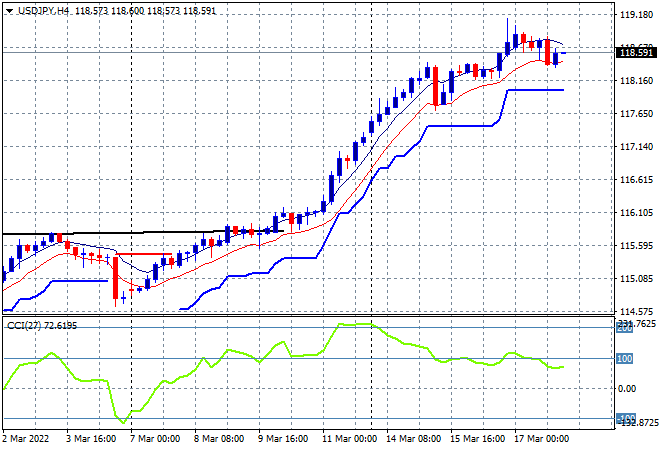

The USDJPY pair paused its push higher, but still kept well above the 118 level overnight as the USD remains a safe haven compared to Yen. Momentum has reverted from its extremely overbought status but still looks good here with a series of higher four hourly sessions that are not yet indicating a revert to mean trade, just a slow down. Support seems very strong at the 118 handle where I would place an uncle point in the short term:

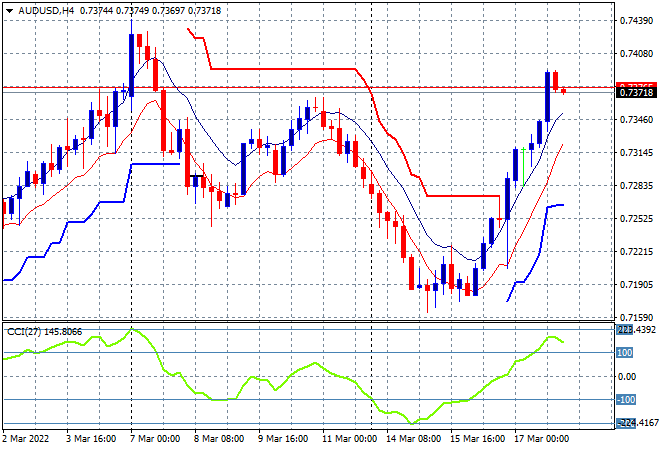

The Australian dollar continues its strong move overnight, pushing above the 73 handle as commodity prices bounced back and the USD weakened slightly in the wake of the BOE meeting. The four hourly chart shows a near return to the previous weekly highs nearer the 74 level with short term momentum now nicely overbought although slightly ahead of itself so we could see a mild pullback to the high moving average area nearer the mid 73 level today:

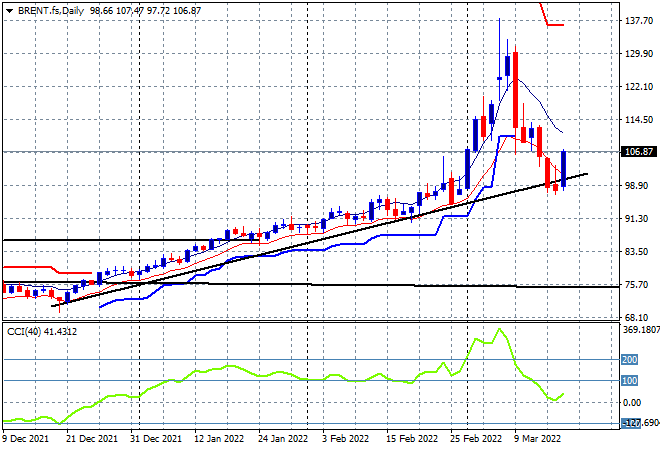

Oil markets bounced back after a week of consolidation with support definitely confirmed at the $100USD per barrel level for Brent crude, which soared nearly 9% overnight to finish nearly above the $107 level. While this doesn’t take it back to daily ATR support it does suggest that the psychologically important $100USD level is the clear uncle point going forward to take advantage of any more spikes:

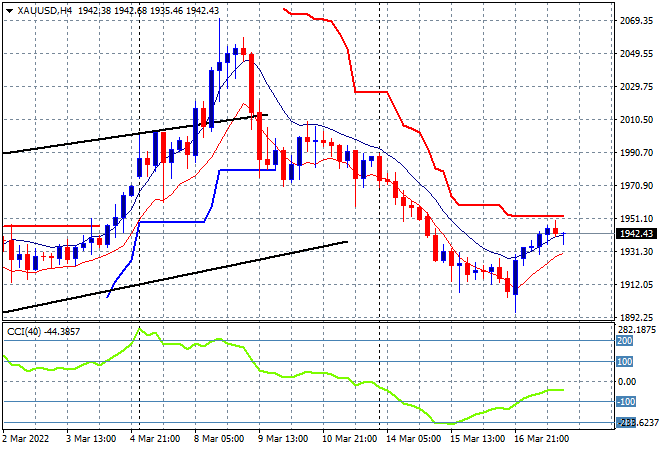

Gold was able to eke out a small lift overnight but still remains under a lot of pressure as it pushes up to the $1942USD per ounce level, having suffered a pretty big decline after shooting through the $2000 level. Four hourly momentum remains negative and overhead ATR resistance has not been cleared in the short term, so watch for any break above $1950 to keep things moving along: