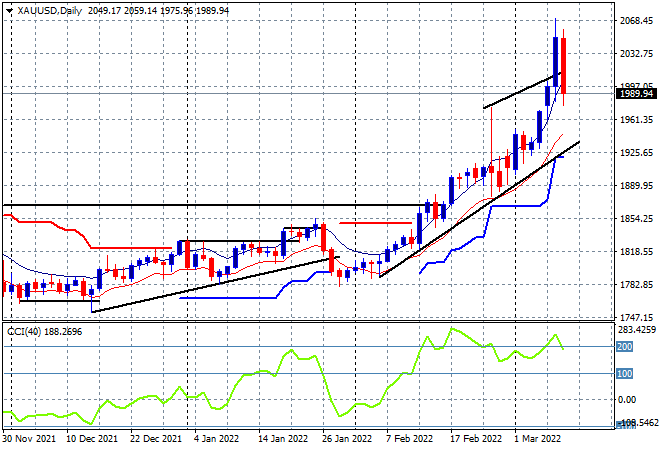

Last night saw a major reversal in fortune for risk markets with European shares surging 5-7% across the board, after having been sold off for weeks as the barbaric invasion of Ukraine continued unabated overnight, despite some hollow overtures from the Russians. Wall Street followed suit with a 2% plus gain across the board while bond yields continued to rise with the 10 Year Treasury heading through the 1.9% level as currency markets saw a big inversion in Euro which lept up nearly 200 pips while commodity currencies like Aussie and Loonie were flummoxed due to the big reversal in oil. Brent and WTI crude both lost over 10%, the former down to the $112USD per barrel level while Gold also pulled back to below the $2000USD per ounce level.

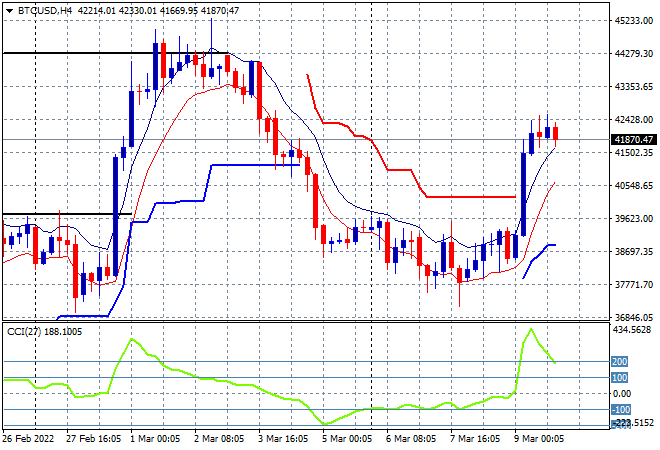

Bitcoin is floating high after its big breakout, consolidating here at the the $42K level with the four hourly chart showing a big breath of relief here as momentum comes back from extreme overbought readings. Watch for price to hold here at the high moving average, or this will be a bull trap:

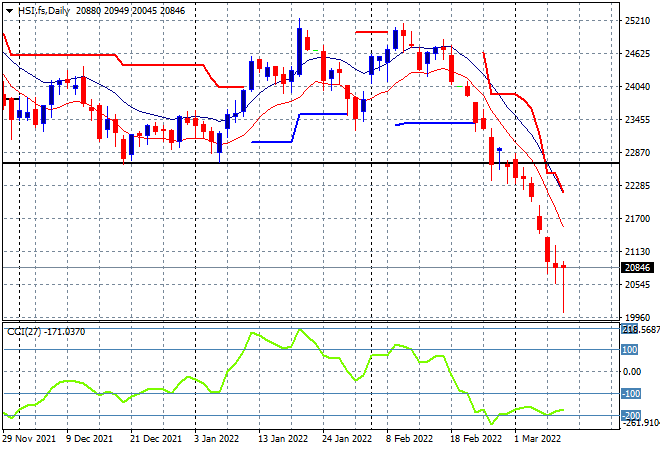

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares took another dive with the Shanghai Composite closing 1% lower to 3256 points while the Hang Seng Index was in freefall before a late rally saw it only lose 0.6% to finish at 20627 points. Price action on the daily chart remains grim indeed, with a five year low but as I said yesterday there is a growing possibility of a bounceback brewing here as this market catches its breath with the recent daily candle having all the hallmarks of a bottom. We need to see a solid bullish engulfing candle next:

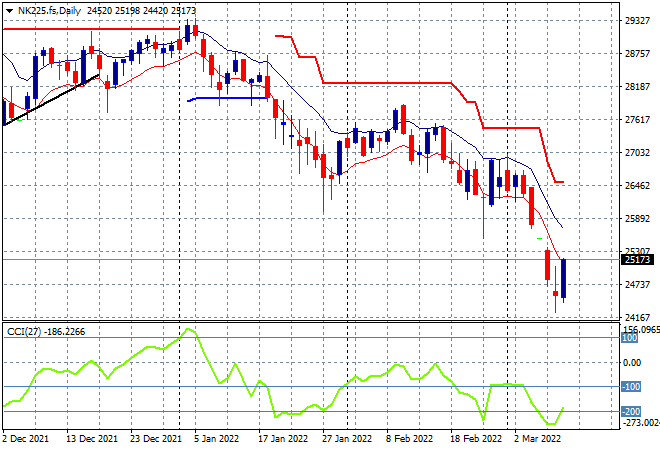

Japanese stock markets were looking to make a comeback on a strong GDP print and weaker Yen but the Nikkei 225 slumped at the close to finish 0.3% lower at 24717 points. The daily futures chart shows a bullish engulfing candle brewing on the possibility of a bottom, but this remains an ugly chart with momentum still extremely oversold and not in its favour:

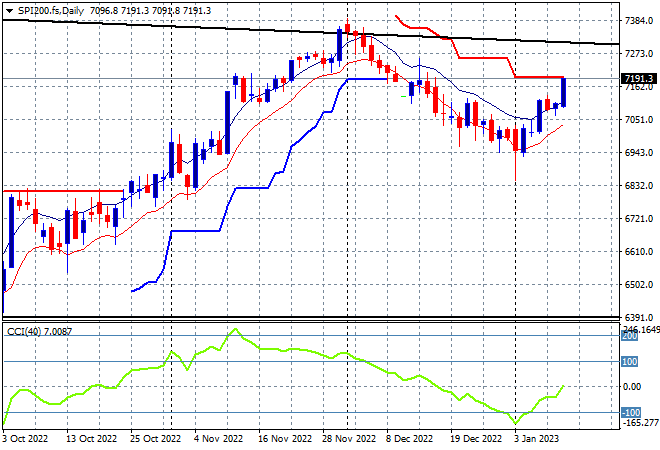

Australian stocks had the best run in the region with the ASX 200 finishing 1% higher to get back above the 7000 point level, closing at 7053 points. SPI Futures are up 0.4% or so, with the fall in the Aussie dollar overnight again helping despite lower commodity markets with energy/oil stocks likely to see a pullback today. There is still considerable resistance overhead at the previous weekly/monthly support levels so watch daily momentum that needs to get back into the positive zone soon before considering any long opportunities:

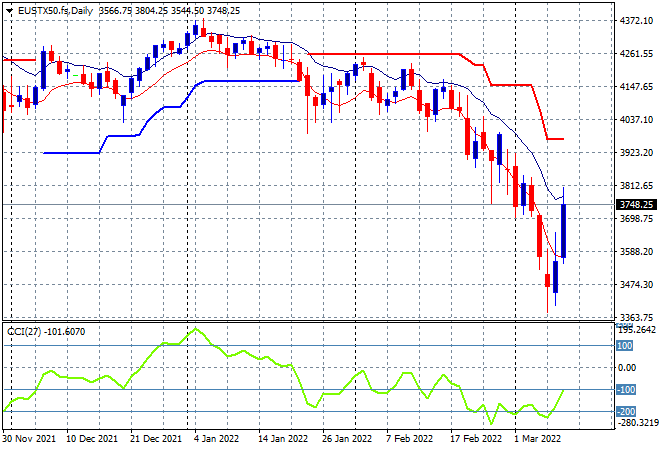

European shares had massive rallies overnight, with the German DAX the biggest mover, up nearly 8% while the Eurostoxx 50 index gained 7% to finish at 3766 points. The daily chart shows an obvious bottoming opportunity but as I warned previously, this could be a dead cat bounce and requires a solid close above the former support, now staunch resistance at the 4040 point area before this swing turns around:

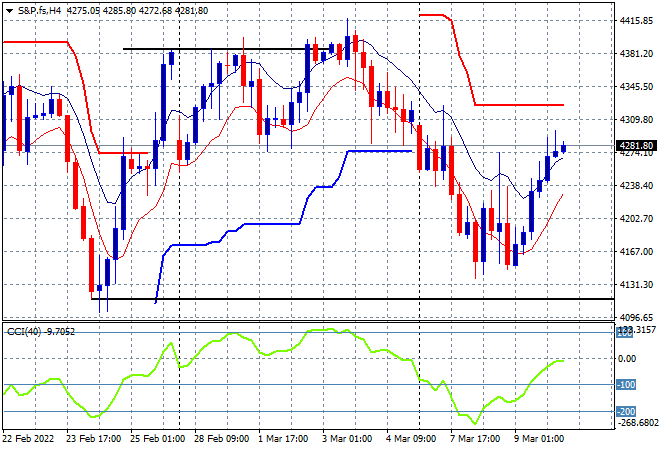

Wall Street also had a major rally, although smaller relatively speaking, it was a good sign across the board with the NASDAQ Composite up nearly 3.6% while the S&P 500 gained more than 2.5% to finish at 4277 points. This almost takes the market back to the previous week lows and fills in this current dip but is it enough to get the market fully out of trouble? The proper target here is resistance at the weekly highs around the 4400 point level, which is still a long way to go – watch oil markets for the catalyst, IMO:

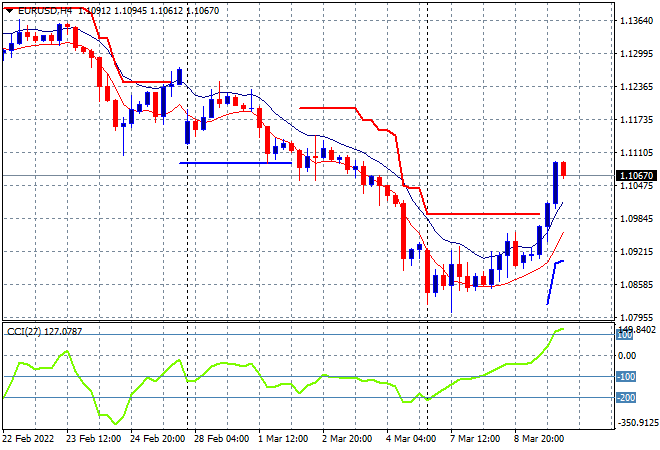

Currency markets are seeing volatility return on the possibility of diplomatic solution to the Ukrainian invasion with Euro in particular surging overnight, heading up towards the 1.11 handle in a big breakout move. The four hourly chart was showing consolidation here that I thought could be shortlived but its interesting to see how far things moved on what has only been a few words of diplomacy, let alone any big change in the Ukrainian conflict:

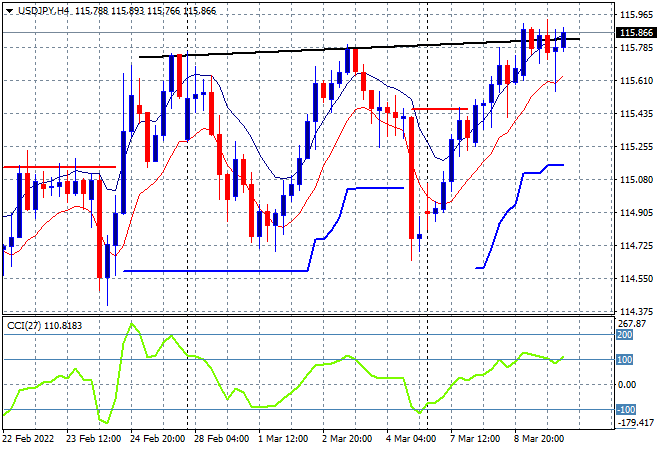

The USDJPY pair continued to consolidate from its recent climb, almost hitting the 116 level overnight but unable to make a new daily high. Yen safe haven buying is still likely to return here on bad news, so watch for another selloff and a return to weekly support at the 114.50 level if the 116 handle can’t be cleared:

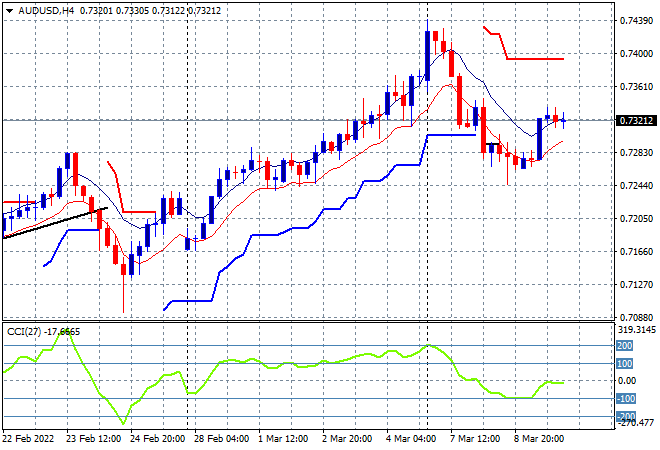

The Australian dollar had a small breakout in the early London session but then deflated overnight despite even worse falls in commodities as the USD gained strength against most undollars. This keeps it just above the 73 handle but we could see more volatility tonight as the ECB meeting and US core inflation prints provide even more catalysts. Watch for the low moving average and then support at the mid 72 level which needs to hold:

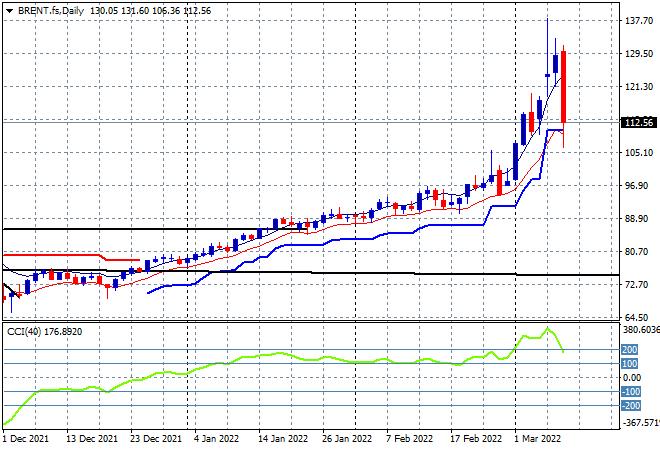

Oil markets were hit with huge reversals overnight on just the glimmer of hope in Ukraine so this speaks to what could happen if the war actually ends. Brent crude lost over 10% to finish at the $112USD per barrel level with a very volatile session. I’ve been warning for sometime now that this trend is WAY overextended and in a runaway pattern, completely beholden to macro news and catalysts as the previous daily candle was spelling doom ahead, and here we are. Its not over though by a long shot as the $100USD level should remain strong support going forward:

A similar fate for gold overnight, taking back its previous burst out that saw it consolidate back below the $2000USD per ounce level. Price should be around the $1950 level instead as shown by that lower trendline, which is where this could end up today or tomorrow as daily momentum inverts from its extremely overbought levels: