It was a busy week between massive amounts of data, and who can forget Liberation Day? I still feel that most investors think Trump is bluffing and will provide more lenient tariffs. I don’t think that is going to happen.

I don’t think Trump cares. He is trying to push through an agenda, which is all that matters to him. So while many investors may think that Liberation will mark some bottom in the market, I tend to believe that the market realizes he is dead serious about his agenda.

Besides Liberation Day, Jobs and the ISM data points will be key this week. I fear that this week’s data will not relieve the market, with the odds for stagflation increasing. It is clear that price paid indexes across various surveys and reports have gone higher, while there are also clear signs of weaker hiring in these same reports.

Additionally, this week, Kalshi is assigning an unemployment rate of 4.2%, higher than the analysts’ estimate of 4.1%. After last week’s shock core PCE report, which Kalshi nailed, we need to take the upside risk to this week’s unemployment rate seriously. Kalshi is also looking for 135k jobs to have been created, below analysts’ estimates for 140k.

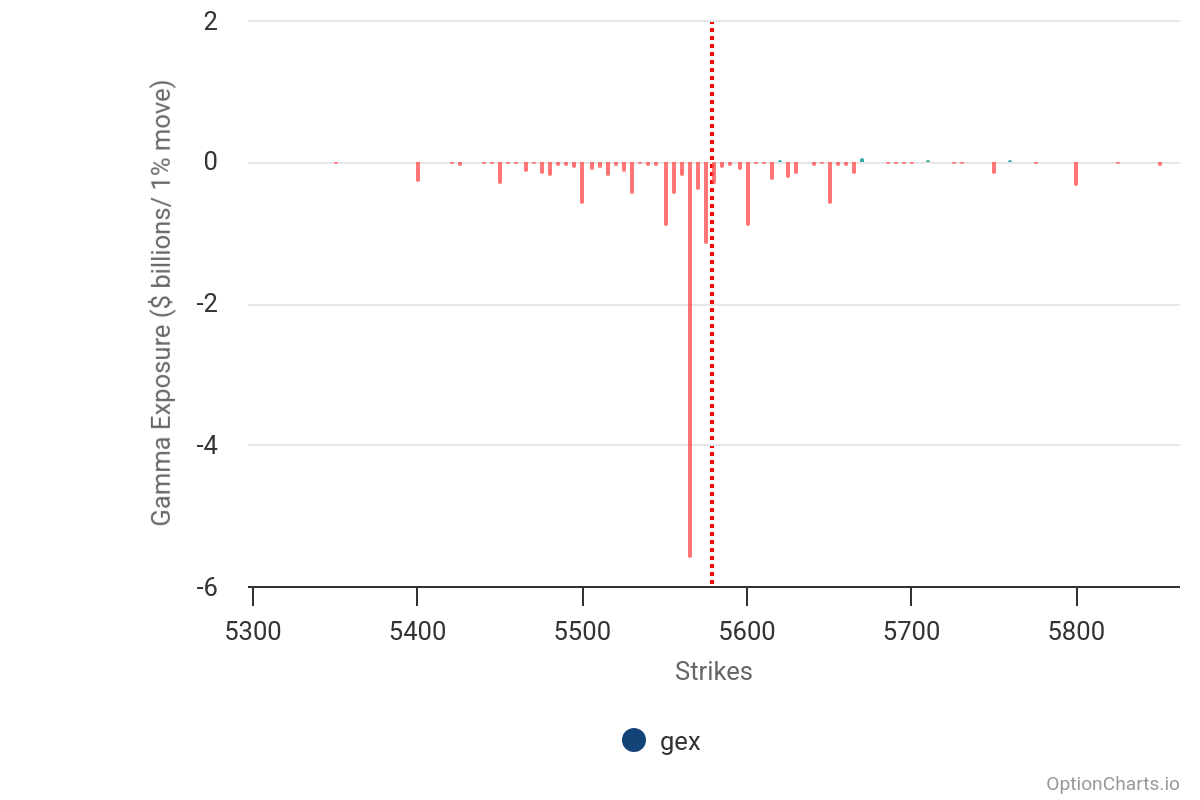

On Monday, we clear the JPM Collar Put lurking out there at 5565. That trade generally gets closed out sometime in the morning, and the new collar gets put up later in the day. Because this collar trade has become so highly publicized, they do many things throughout the day to make it difficult to game. Generally, the impact is felt on the Market On Close, starting around 2 PM ET.

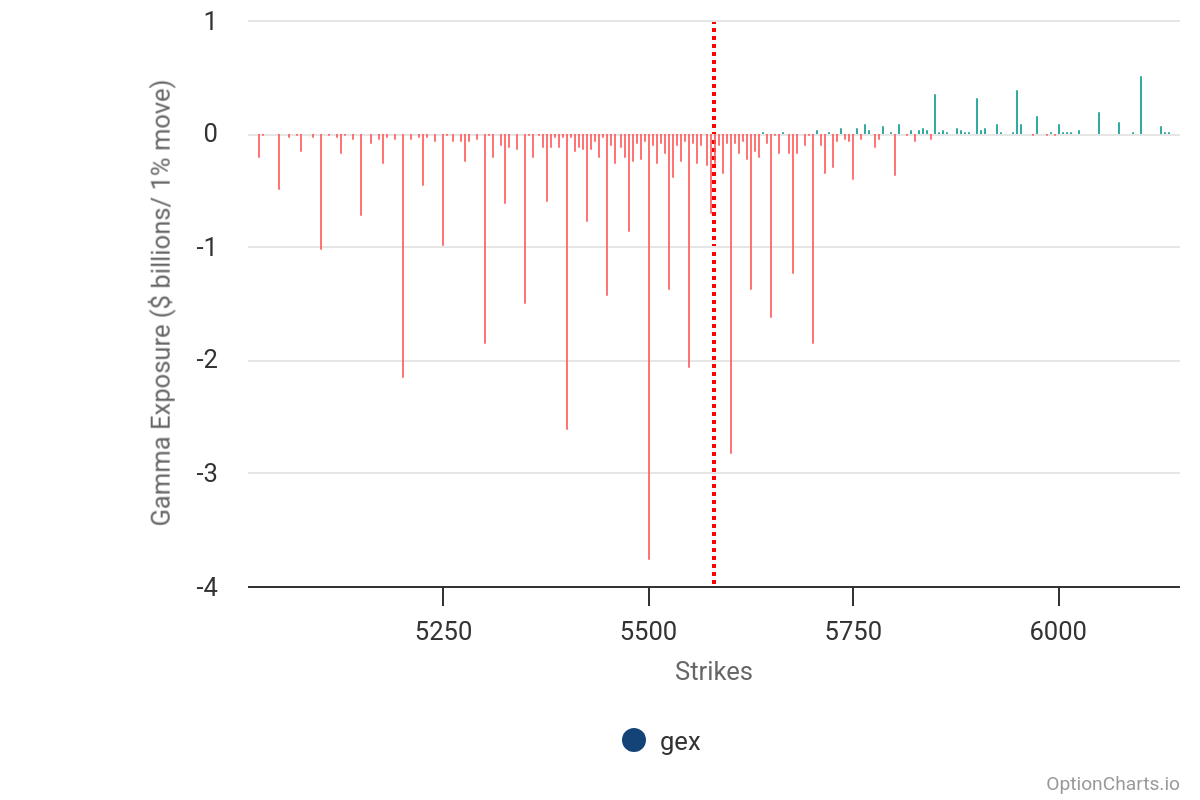

Once that clears, the Put wall moves to 5,500, 5,400, and 5,200 starting on Tuesday.

The S&P 500 is technically set up exactly as the options market describes because if we move past the lows at 5,500, the next support level is 5,400, followed by 5,200. There is no support at the 5,300 level.

If the bear flag is correct, which, again, at this point, looks accurate, then we should not only undercut 5,500 but do it relatively quickly. That means we should be below that level early in the week.

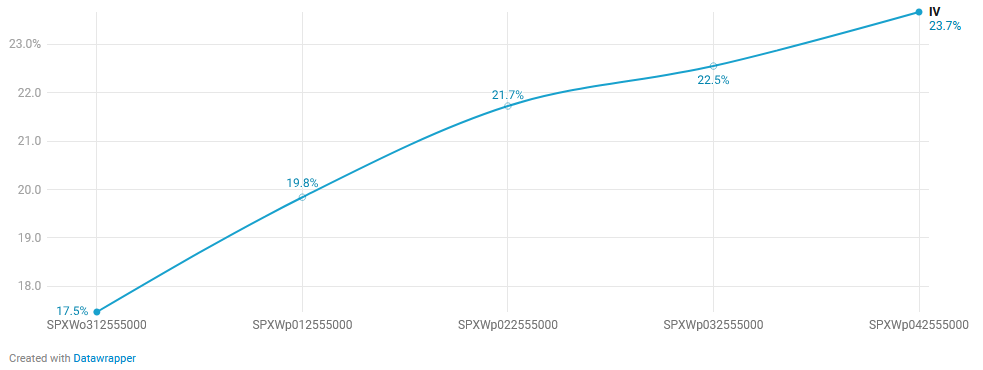

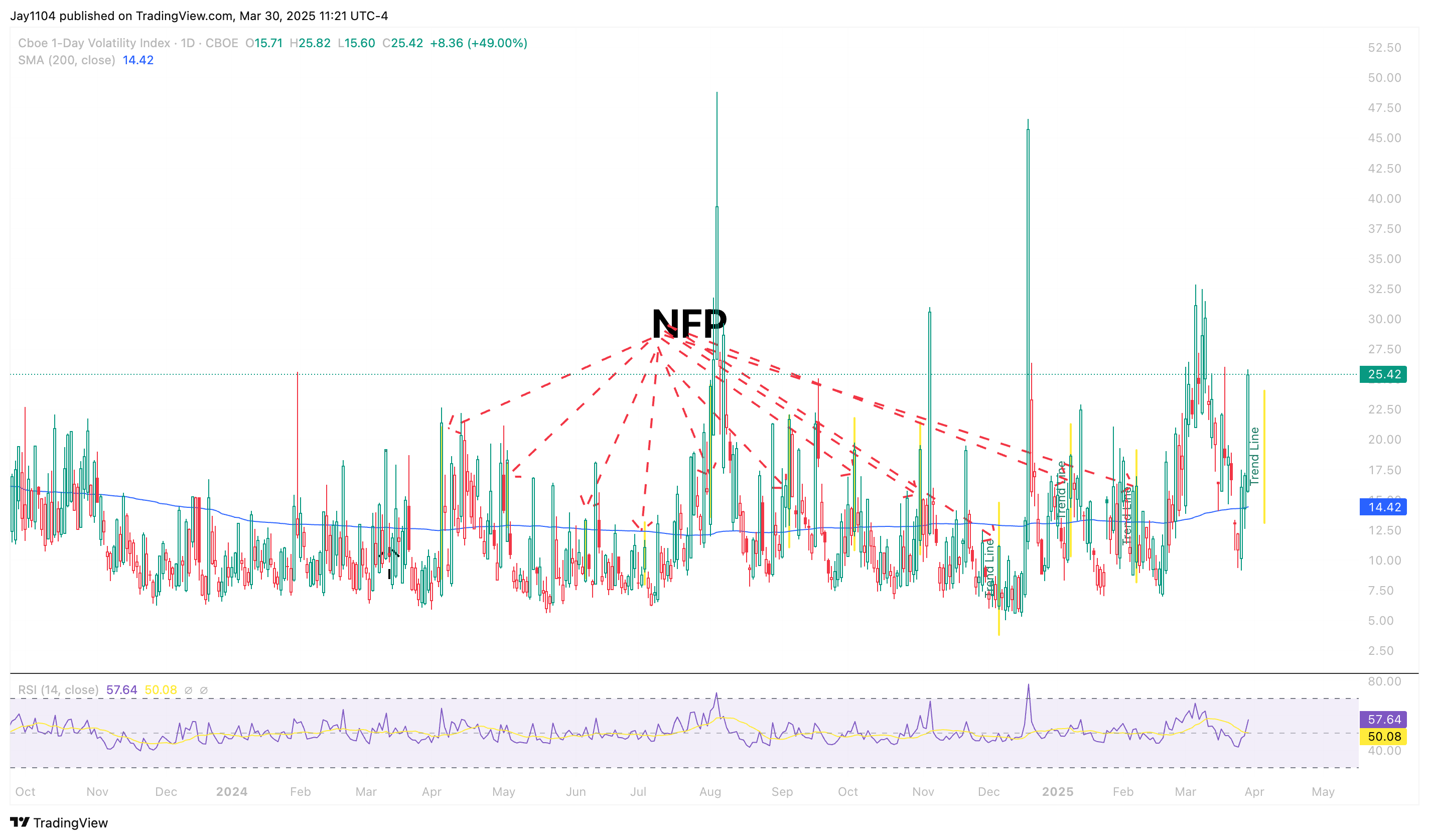

There is also a good chance that it will happen because the VIX is relatively low at 21, and is likely to rise as we approach the Job report on Friday, as noted by the term structure when using the daily options for the S&P 500 5,500 strike price, and the chances of IV being even higher by Friday are pretty high.

S&P 500 Implied Volatility

As we know, the VIX 1-day often reaches a very high value on Thursdays heading into a job report.

While the strains of quarter end should be behind us this week, it will likely be marked by rising implied volatility levels heading into the Job report. So I don’t think this week gets any more manageable, and if Liberation day goes as I think it goes, it could be a complete mess.