Market Brief

The ZEW survey was a massive disappointment for Germany yesterday. The current situation index fell to 55.2 from 67.5, well below market expectations of 64. The ZEW expectation dropped to 1.9 from 12.1, also well below market expectations of 6.5 as the Volkswagen (DE:VOWG_p) scandal and global growth concerns worsen the economic outlook. As a result, German shares spent most of the trading session under pressure - the DAX fell 0.86%. EUR/USD had a choppy session but was unable to choose a direction as news from the other side of the Atlantic failed to provide support to the greenback. US Fed Governor Tarullo said yesterday that he does not expect a rate hike before the end of the year and added that the Fed should wait for “tangible evidence” of a pick-up in inflation before considering raising rates.

The pound sterling suffered another sell-off yesterday and moved back below zero. Headline inflation printed at -0.1%y/y, below the median forecast and previous reading of 0.00%. Core inflation also surprised to the downside as it remained stable at 1%y/y in the month of September. GBP/USD dropped more than 1% to 1.5230 after the release. The cable remained in its declining channel and is getting closer to the support standing at 1.5108. We remain bearish on the pound sterling and expect further weakness, especially against the euro as the monetary union shows slightly more encouraging data. EUR/GBP is gaining positive momentum and is currently testing the 0.7483 resistance level implied by the high from May 7th).

In Australia, the better-than-expected Westpac Consumer index - printing at 4.2%m/m (s.a.) versus -5.6% in September - offered some respite to the AUD, which has fallen as much as 2.50% over the past 2 days against the US dollar. The Aussie is now taking a breather around $0.72.

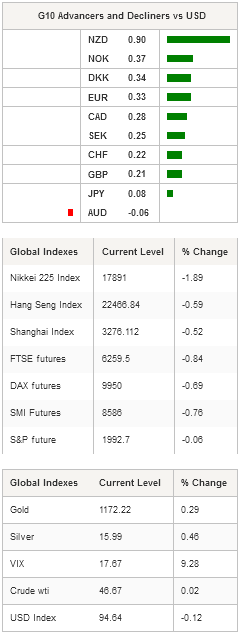

In Asia this morning, the sell-off accelerates amid a disappointing inflation report from China. Headline CPI indicated that consumer prices rose 1.6%y/y in September, while economists were anticipating a reading of 1.8%. Meanwhile, producer prices dropped -5.9%y/y, matching expectations and previous reading. Japanese equities were pairing the biggest losses with the Nikkei 225 and the TOPIX index down -1.89% and -2.15%, respectively. In the rest of Asia, the sell-off was less extreme with the Hang Seng sliding -0.59%, the S&P/ASX 200 -0.11% and the KOSPI index -0.47%. The negative mood is already spreading to European markets as futures are all turning red. FTSE 100 is down -0.84%, DAX -0.69%, SMI -0.76%, while the European gauge, the STOXX 600 falls -0.70%.

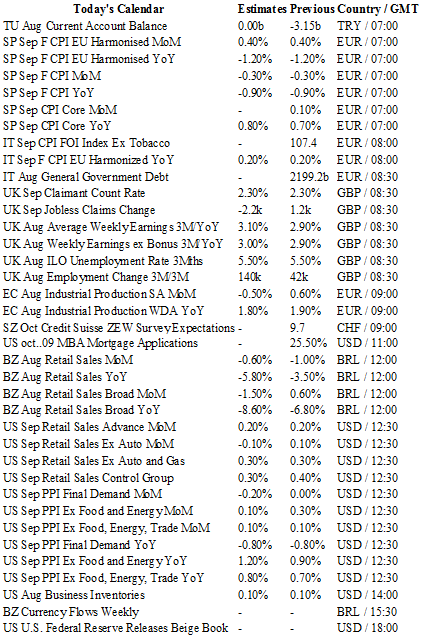

Today traders will be watching inflation reports from Spain and Italy; the job report from the UK; industrial production from the euro zone; retail sales from Brazil and the US; PPI from the US.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1460

CURRENT: 1.1418

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5278

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.62

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9556

S 1: 0.9513

S 2: 0.9259