Stocks markets again retraced on fears on the Federal Reserve hiking tomorrow night, with bond markets continuing their yield inversion. Wall Street gave back all its recent gains with European bourses still in hesitation mode. The USD strengthened against everything with Euro dropping below parity, with the Australian dollar and Pound Sterling still on the ropes. Bond markets increased in volatility across the yield curve with 10 year Treasury yields lifting to the 3.6% level with interest rate expectations still locking in a 75bps rise at the next Fed meeting, with the outside chance of a 100bps rise climbing. Crude oil closed slightly lower with Brent unable to maintain above the $91USD per barrel level while gold failed to stabilise and returned to its previous lows at the $1666USD per ounce level.

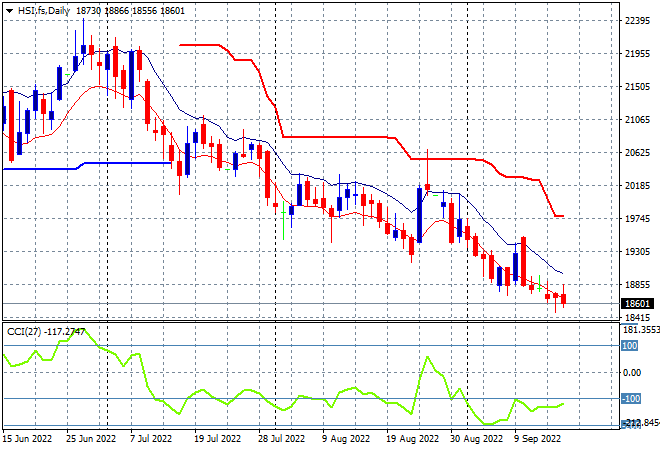

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were trying to stabilise with the Shanghai Composite up more than 0.2% to 3122 points while the Hang Seng Index is finally having a good day, up more than 1% to 18781 points. The daily futures chart is still showing a bearish mood and a distinct lack of buying support quite evident despite the recent rise. The bear market continues with daily momentum nowhere near out of its negative funk:

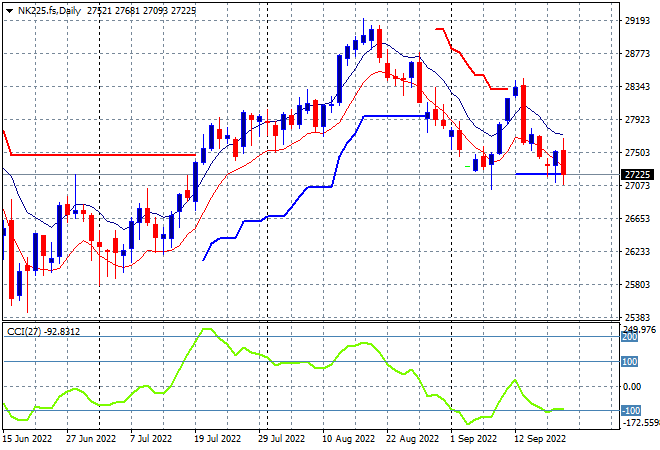

Japanese stock markets reopened after yet another holiday with the Nikkei 225 closing 0.4% higher at 27688 points. The daily chart for the Nikkei 225 shows price action still forces back to the 27000 point level where there is a modicum of support. Daily momentum remains negative and nearly oversold so watch for some support to be tested at the recent daily low sessions around the 27500 point level with futures indicating more selling ahead:

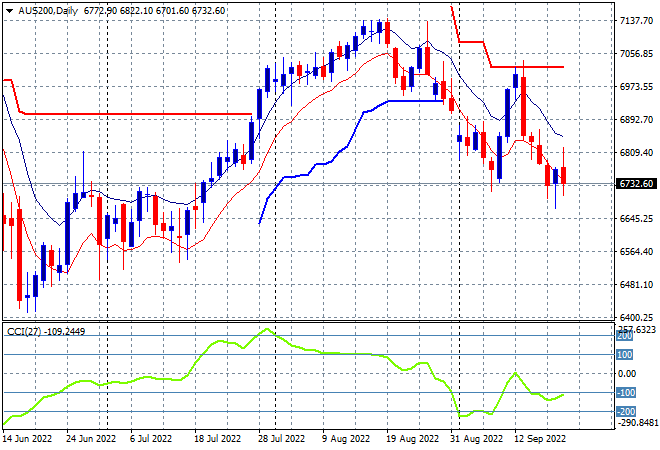

Australian stocks had the best session across the region with the ASX200 finishing nearly 1.3% higher at 6806 points. However SPI futures are indicating this will be taken back with a 1% drop on the open in line with Wall Street’s falls overnight. The daily chart showing similar price action to other Asia stock markets with price still below the August lows as daily momentum remains in full oversold mode, as key support at the 6700 will be tested next:

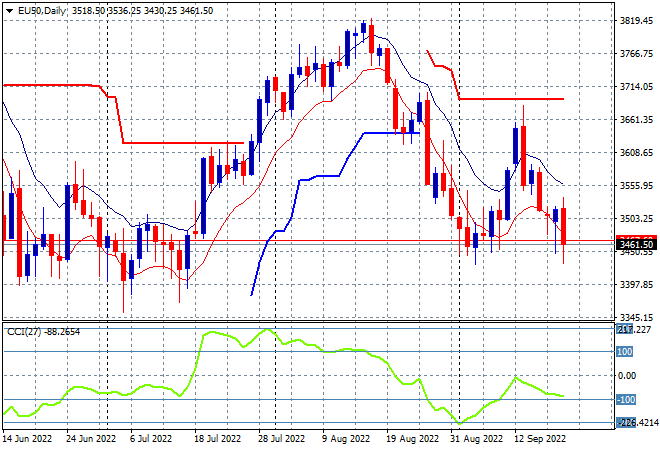

European stocks are losing their nerve with losses across the continent again, with the Eurostoxx 50 Index finishing nearly 1% lower at 3467 points. The daily chart is still setting up a big dead cat bounce, following the moves off the June lows at the 3300 level that look like the next target to reach. Another bearish engulfing candle and a failure of daily momentum to get back above positive readings suggests another leg down:

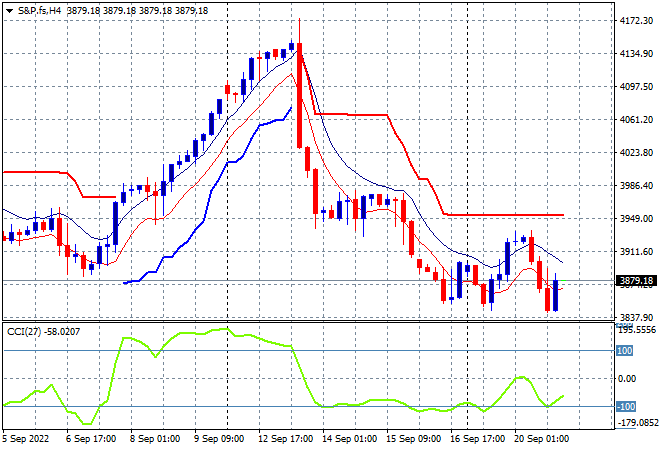

Wall Street lost its recently found some confidence which I was right in assuming was just short covering in the wake of the recent steep falls, with the NASDAQ down nearly 1% while the S&P500 finished 1.1% lower at 3855 points. The four hourly chart was showing a potential swing play here above the 3900 point level, with short term resistance at the 3950 point level equating with overhead ATR resistance the area that it couldn’t beat. Price action has now returned to the Friday lows and could break lower on tomorrows Fed hike:

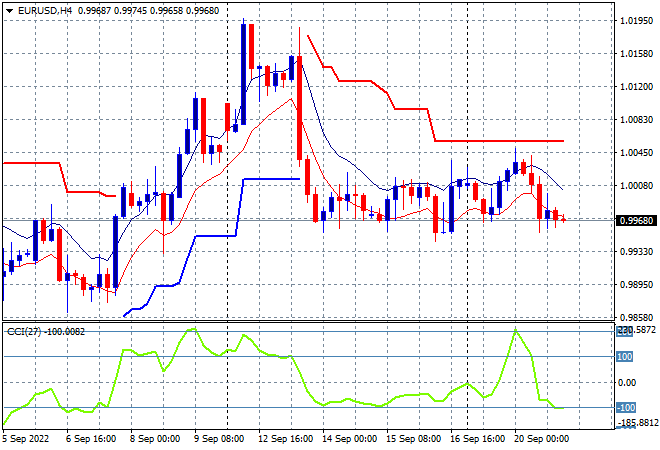

Currency markets remain firmly on the side of the USD, with Euro pushed back below parity after a small melt up move went nowhere. As expected the union currency is continuing to hover here until the next Fed meeting as I still contend that parity is actually permanent resistance. Momentum has retraced back to slightly oversold on the four hourly chart which indicates selling pressure is ready to re-engage:

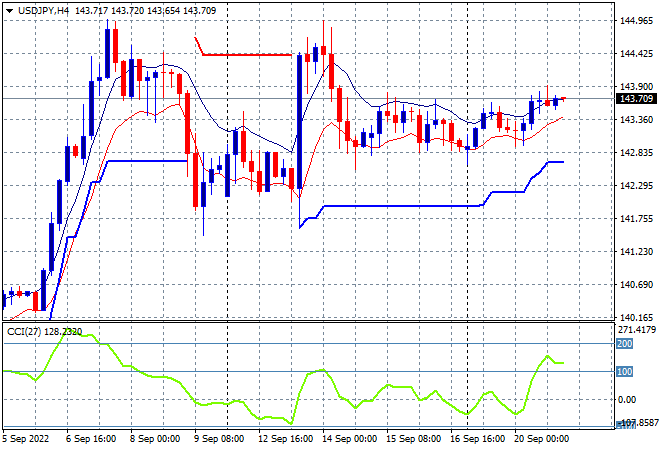

The USDJPY pair is in a similar position but with some mild deceleration following on from Friday night following the bounce up to the previous weekly highs at the 145 handle, still hovering around the 143 level. Short term momentum has switched from neutral to slightly negative, but price action in the short term is holding, so watch for any further moves below the low moving average at the 143 area:

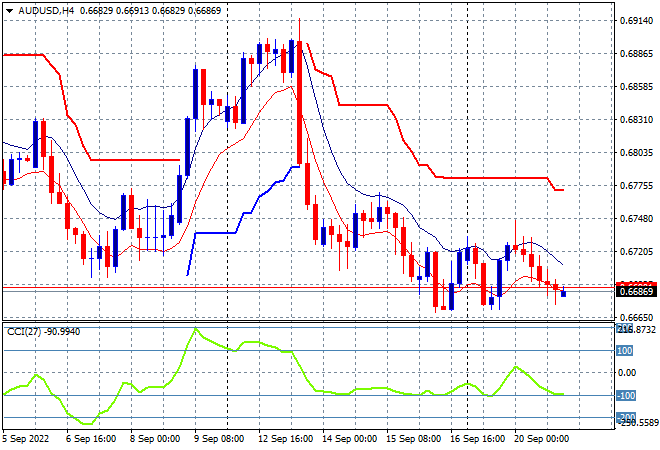

The Australian dollar is still locked in place here at the 67 handle albeit with a small uptick in price action as commodity prices rebounded slightly overnight. My contention that resistance is just too strong at all the previous levels with the 68 handle the area to beat in the short term, with price action now back on the lower trendline and weekly lows. Price action is likely to invert below the 67 handle again if it can’t make the usual swing long play after being oversold move stick:

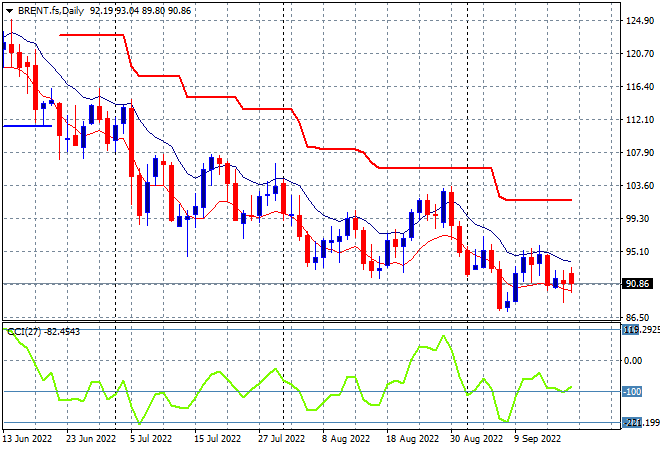

Oil markets are still chugging along on the bottom here, with not much stability at the start of the new trading week as Brent crude is unable to climb back above the $92USD per barrel level. Daily momentum is still persistently negative although potentially swinging higher as price action wants to get off the floor here at the recent weekly lows, but its a very low probability trade:

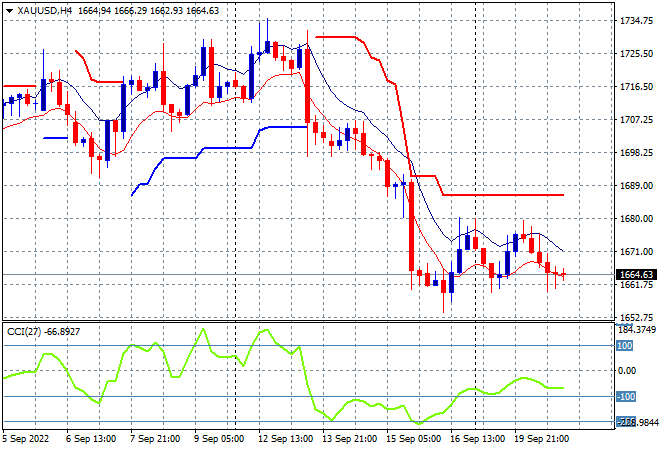

Gold like other undollars remains depressed but was able to bounce back to the Friday night highs after sharply inverting below the key $1700USD per ounce support level, finishing at the $1675USD per ounce this morning. A potential short swing play but this keeps the shiny metal at the 2020 lows and closing up a monthly bearish setup :