The USD lifted against everything in the risk complex overnight as the latest US initial jobless claims print came in under expectations. Only the Australian dollar held its ground – somewhat – after a stronger than expected domestic employment print yesterday, but Wall Street faltered despite the headline Dow lifting.

US bond markets saw a lift across the yield curve with the 10 year up more than 10 pips to the mid 3.8% level while oil prices tried to rally again on European macro concerns with Brent crude advancing beyond the $79USD per barrel level. Gold tried to hold on but fell back below the $1970USD per ounce level.

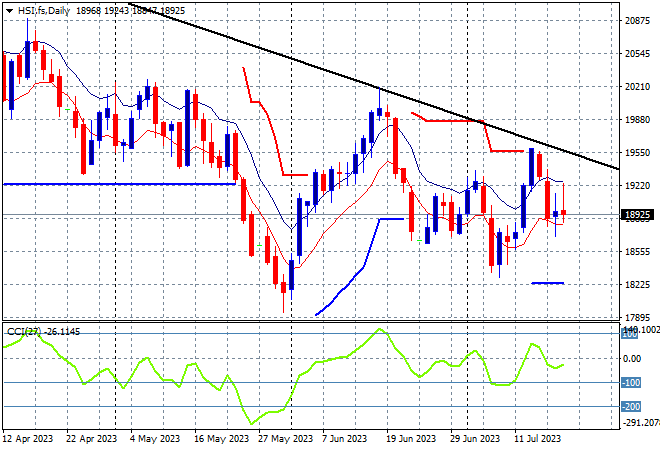

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets are still in deflation mode with the Shanghai Composite about to finish some 0.6% lower at 3171 points while in Hong Kong the Hang Seng Index is trying to rebound after its recent selling, up 0.3% to 19016 points.

The daily chart is showing how that 19000 point level as a point of control below the dominant downtrend (sloping higher black line) as confidence is trying to clawback here after almost touching the May lows. A possible breakout was brewing but has lost momentum as price action reverts to the downside:

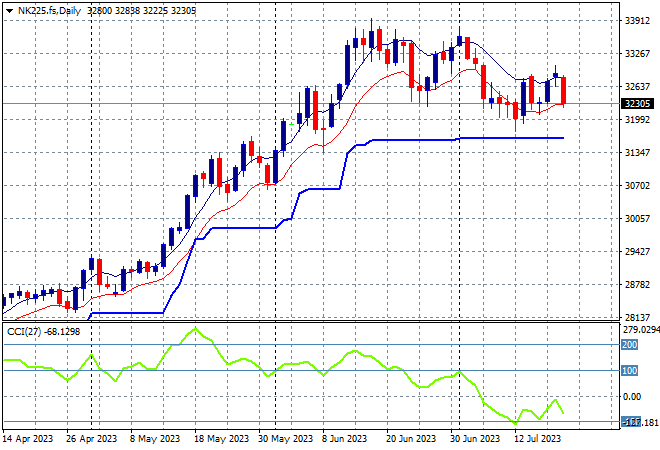

Japanese stock markets however are going the other way with the Nikkei 225 closing more than 1% lower at 32492 points.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with a welcome consolidation above that level. Daily momentum has retraced from overbought to slightly negative settings with this retracement down to the support zone possibly over as the trading week goes into the end game, as we watch for a possible breakout on any weakening Yen trend:

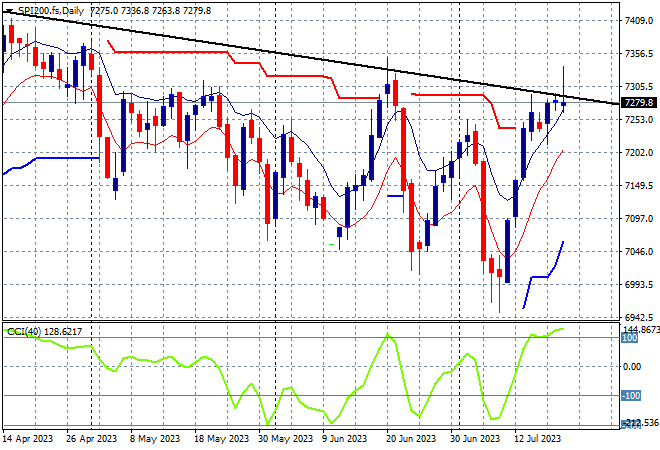

Australian stocks are putting a flat session given the upside employment figure surprise with the ASX200 closing where it started at 7325 points.

SPI futures are up slightly due to the very mixed return on Wall Street overnight, which should again test the 7300 point level which has firmed as short term resistance. Medium term price action remains on a downtrend with the daily chart just oscillating further down despite this continued bounce. Resistance overhead at the 7200 to 7300 point zone is the area to really watch with the June highs under threat next:

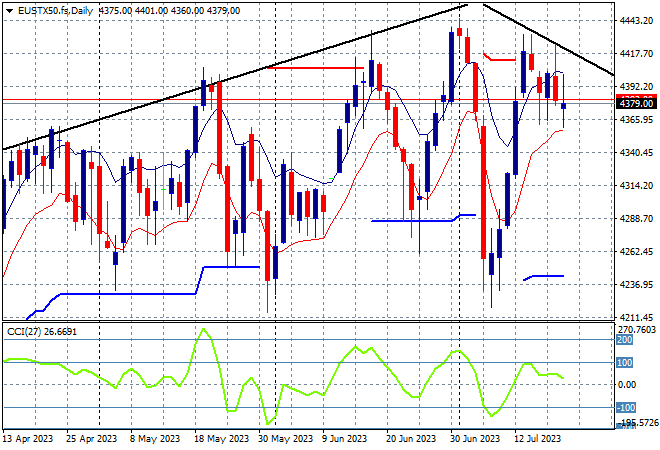

European markets were able to find their feet again on the lower Euro with the Eurostoxx 50 Index gaining nearly 0.3% overnight to remain under the 4400 point level, closing at 4373 points.

The daily chart showed this potential bull trap building even though weekly support at 4200 points had been continually defended, with weekly resistance at the 4350 points level the actual area to beat. Support has been broadly defended at 4200 points, touched three times now in as many months but the 4400 point resistance level is now firming so watchout below:

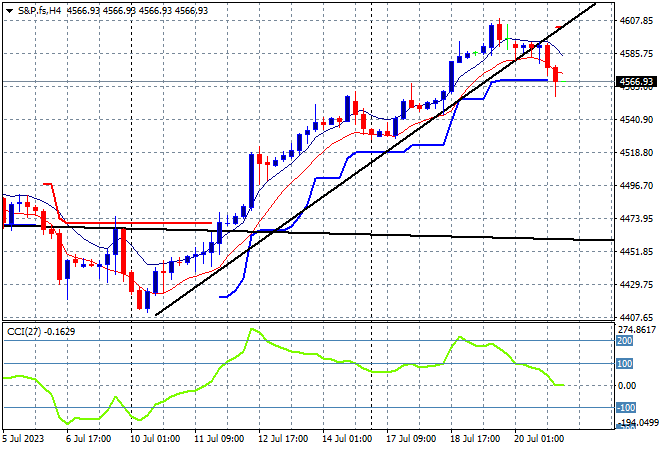

Wall Street was all over the place with the Dow up for the 9th time in a row but the NASDAQ lost over 2% while the S&P500 lost nearly 0.7%, finishing at 4534 points.

The daily chart showed robust support around the 4400 point level after the market continued to stall against the monthly downtrend from the 2021 highs (upper sloping black line) in recent weeks. This successful test of the 4500 point level as uncertainty of the Fed’s direction is cleared no longer points to a retracement as the stairs keep climbing higher:

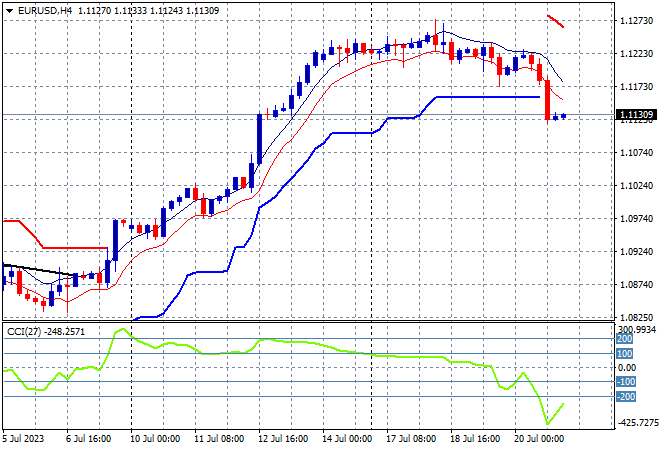

Currency markets are firming more and more to USD but surprisingly the Australian dollar was the best performer although it gave up a lot of ground post the unemployment print as other majors like Euro, Pound Sterling and Swiss Franc dropped the most.

The union currency had been holding here at the 1.12 handle all week but has broken through trailing four hourly ATR support and while the recent weeks have seen recovery of the medium term decline, short term momentum has now fully retraced out of extreme overbought mode. Watch for this test of support to now drop below the 1.11 level:

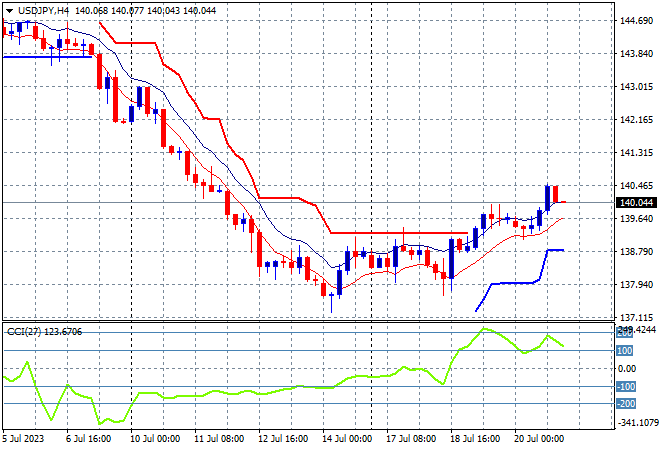

The USDJPY pair was able to find more life with a stronger USD pushing Yen lower despite domestic inflation concerns as it pushed back above the 140 handle following an epic selloff last week.

Four hourly momentum is still looking overcooked to the upside here with the return well below the June lows at the 140 level providing a firmer support level. This relatively small bounce has pushed through short term ATR resistance and could swing higher:

The Australian dollar zoomed up through the 68 cent level on yesterday’s unemployment print but was unable to push above trailing short term resistance as the USD firmed against everything.

Recent price action put ATR resistance and 200 EMA (black line) levels under threat but once the 67 handle was broken just before the CPI print this led the floodgates open, although short term momentum was overextended and the usual pullback has now transpired. As I expected its now retraced back to ATR support below the 68 handle proper:

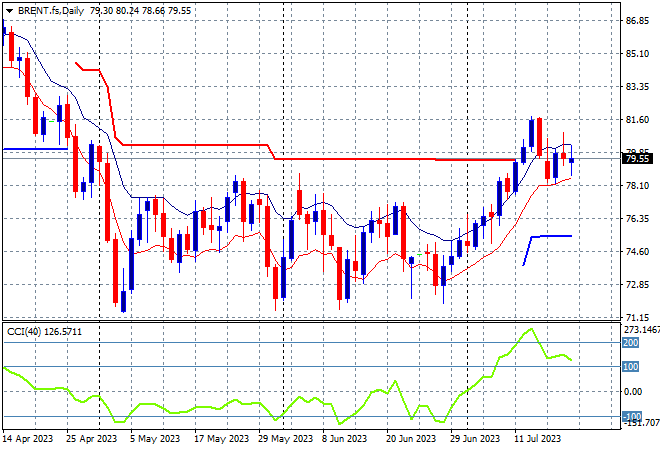

Oil markets had been reverting to mean somewhat in the wake of macro factors in Europe with another small lift higher overnight as Brent crude gained nearly 1% at the mid $79USD per barrel level to firm up short term support.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now trying to get above overhead resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance but there’s an obvious overshoot happening here to bring it back:

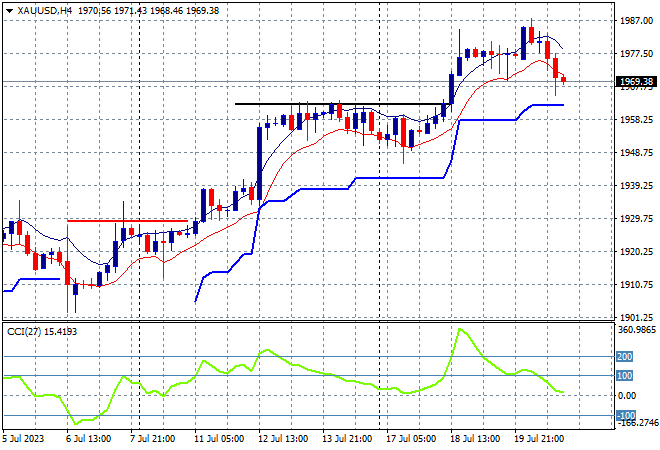

Gold had been helped along by the weaker USD all last week after recently threatening to rollover through the $1900USD per ounce level, but was unable to hold on to its most recent advance as it retraced back below the $1970 level.

The four hourly chart shows a new attempt at getting back up to the psychologically important $2000USD per ounce level, with the potential to return to short term ATR support on any blip higher in USD strength as momentum moderates: