By Ambar Warrick

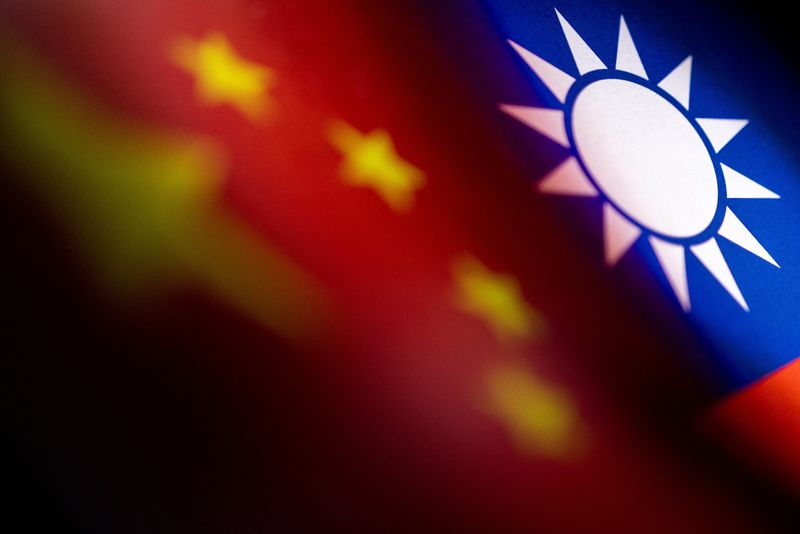

Investing.com-- Most Asian stocks recovered slightly from recent losses on Wednesday, while bourses in Taiwan and China remained pressured by a potential standoff between Beijing and Washington.

Taiwan’s main stock index and China’s benchmark Shanghai Shenzhen CSI 300 blue-chip index both traded flat, lagging their Asian peers. Bourses in both countries had lost nearly 2% each after U.S. House of Representatives Speaker Nancy Pelosi landed in Taipei on Tuesday.

Beijing had strongly opposed the visit, given that Pelosi is the highest-ranking U.S. official to visit the island in 25 years. U.S. officials had warned that China could respond to the visit with military measures.

Reports suggested that Beijing had mobilized fighter jets and ships to skim the line separating the Taiwan Strait. The country could undertake more measures as Pelosi meets Taiwan President Tsai Ing-wen.

Pelosi's visit threatens to further dent Sino-U.S. relations, and ramp up political tensions in Asia. Most stock markets across the globe logged steep losses on Tuesday.

But sentiment appeared to have improved slightly on Wednesday. Japan’s Nikkei 225 index rose 0.6% after slumping 1.4% in the prior session. Bourses in South Korea, and Thailand also recovered from sharp losses logged on Tuesday.

Hong Kong's Hang Seng index rose 0.7% on Wednesday, after plummeting over 2% in the prior session. A mix of Sino-U.S. tensions, weakening economic growth, and exposure to China's beleaguered property market rattled the city's stock market this week.

Singapore stocks were largely flat in morning trade. Shares of Oversea-Chinese Banking Corp (SGX:OCBC) jumped 1.6% after the island state’s second-largest bank logged a bigger-than-expected jump in its second-quarter profit. Shares of peer DBS Group Holdings Ltd (SGX:DBSM) - Southeast Asia’s largest bank- rose 0.9% after the results. DBS will report its quarterly earnings on Thursday.

Sentiment towards Asian stocks remained constrained, particularly after hawkish comments from some Federal Reserve officials pushed up U.S. Treasury yields and the dollar during the U.S. session.

Expectations of more U.S. interest rate hikes weighed on most risk-driven assets on Wednesday.