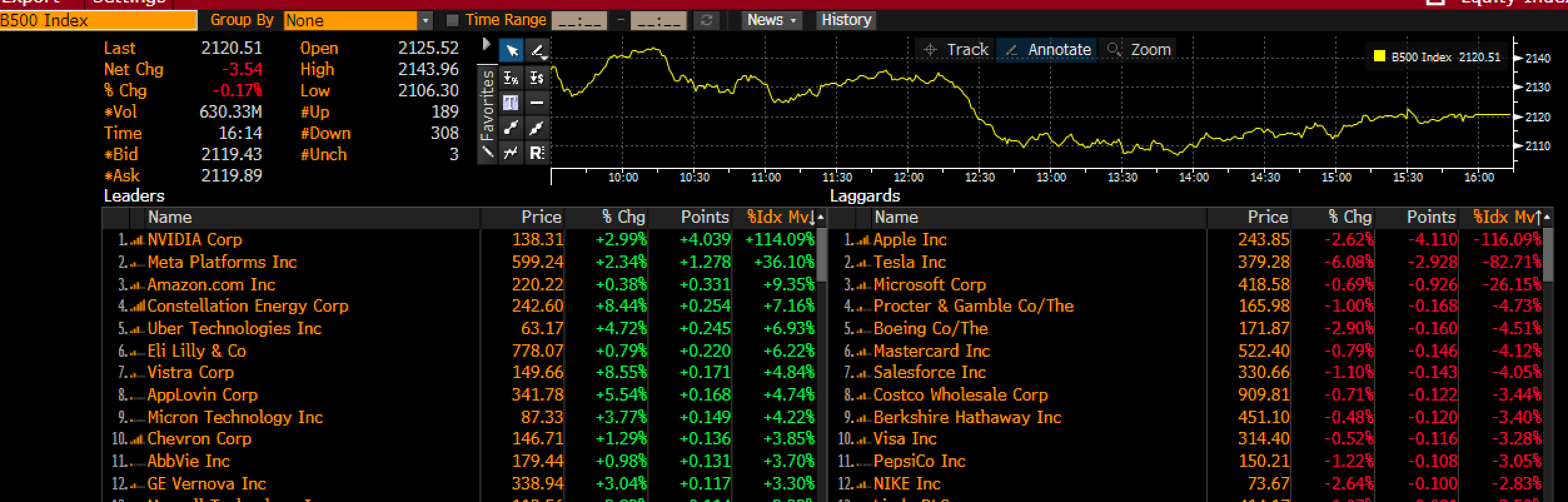

The S&P 500 started the day significantly higher, up nearly 1%, but by midday, all those gains were erased, and we ended the session down 20 basis points.

At its lowest, the S&P had been down about 70 basis points, reflecting a sharp swing from morning strength to afternoon weakness as sellers took control.

The big question is whether the neckline of the head and shoulder will break in the days to come. If it does, it could lead to a more significant drop in the 5,500s.

Market breadth also shifted dramatically. On the NYSE, there were nearly 1,300 more advancers than decliners at the open. By the close, there were 269 more decliners than advancers.

Nvidia Shields Market from Deeper Decline

Notably, NVIDIA (NASDAQ:NVDA) played a critical role in cushioning the market’s overall decline without Nvidia’s 3% gain, which contributed four points to the Bloomberg 500. The index, a proxy for the S&P 500, might have ended the day down 50 to 60 basis points instead of just 20.

(BLOOMBERG)

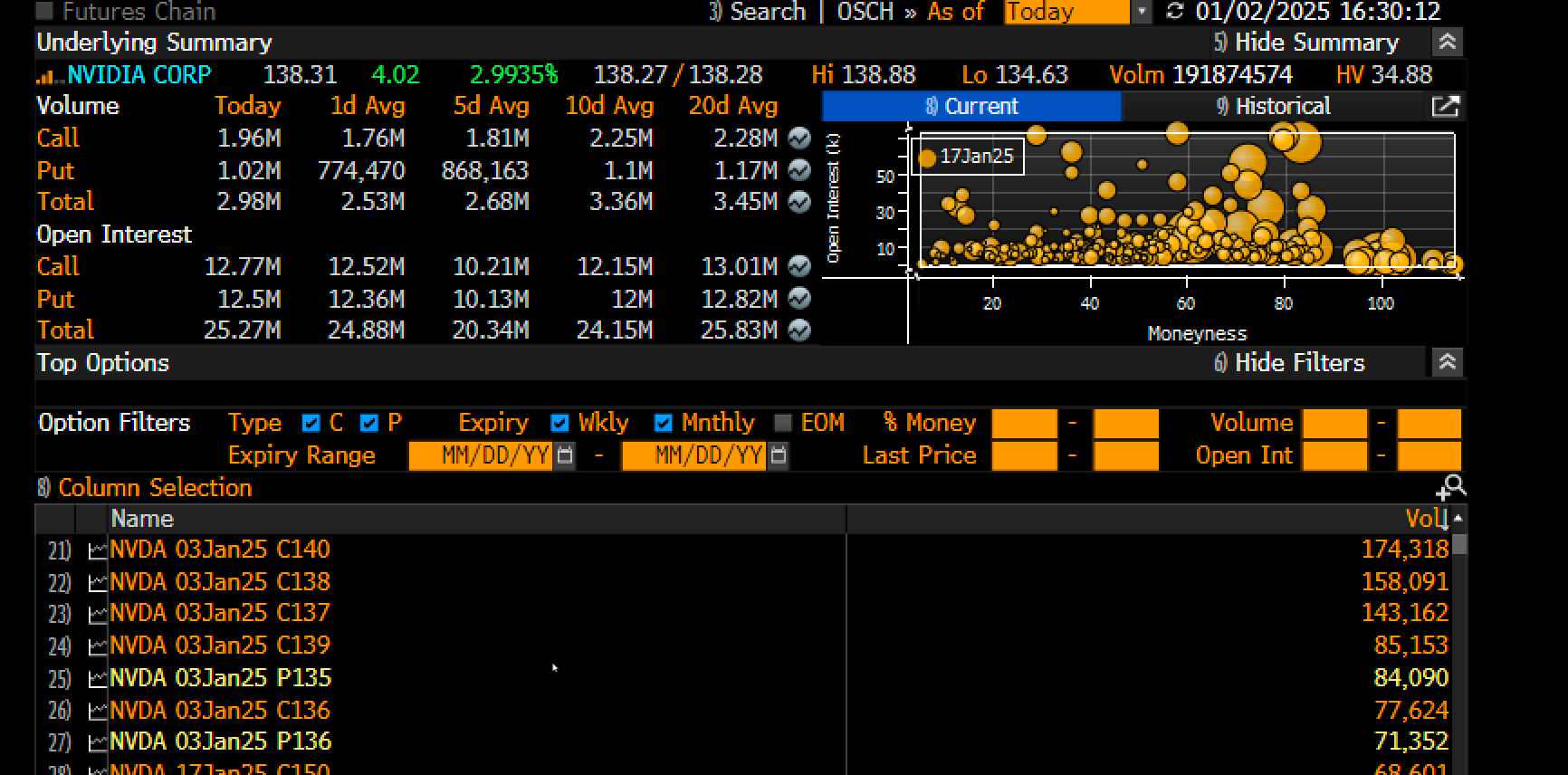

Since its high on November 21st, it appears to be in a downtrend, with resistance levels around $139.50, stemming from June highs. A break below $132 could lead to a sharper decline, but conversely, a move toward $150 is also possible, depending on market momentum and sentiment.

The options market continues to heavily influence the stock, with nearly 2 million calls traded yesterday versus 1 million puts. Call volume exceeded the five-day average of 1.8 million, driven by short-dated contracts like the January 3rd $140 and $138 calls, which were among the most active.

Implied volatility (IV) remains relatively low, around 44%, giving traders the ability to play with cheaper call options.

ISM Expected to Dip, Jobless Claims Beat Forecasts

Today’s Manufacturing ISM is expected at 48.2, down slightly from 48.4. yesterday’s S&P Global Manufacturing Report showed better-than-expected results but noted rising input costs.

Elsewhere, yesterday’s initial jobless claims, at 211,000, were better than expected, and continuing claims, at 1.844 million, were below the forecast of 1.890 million.

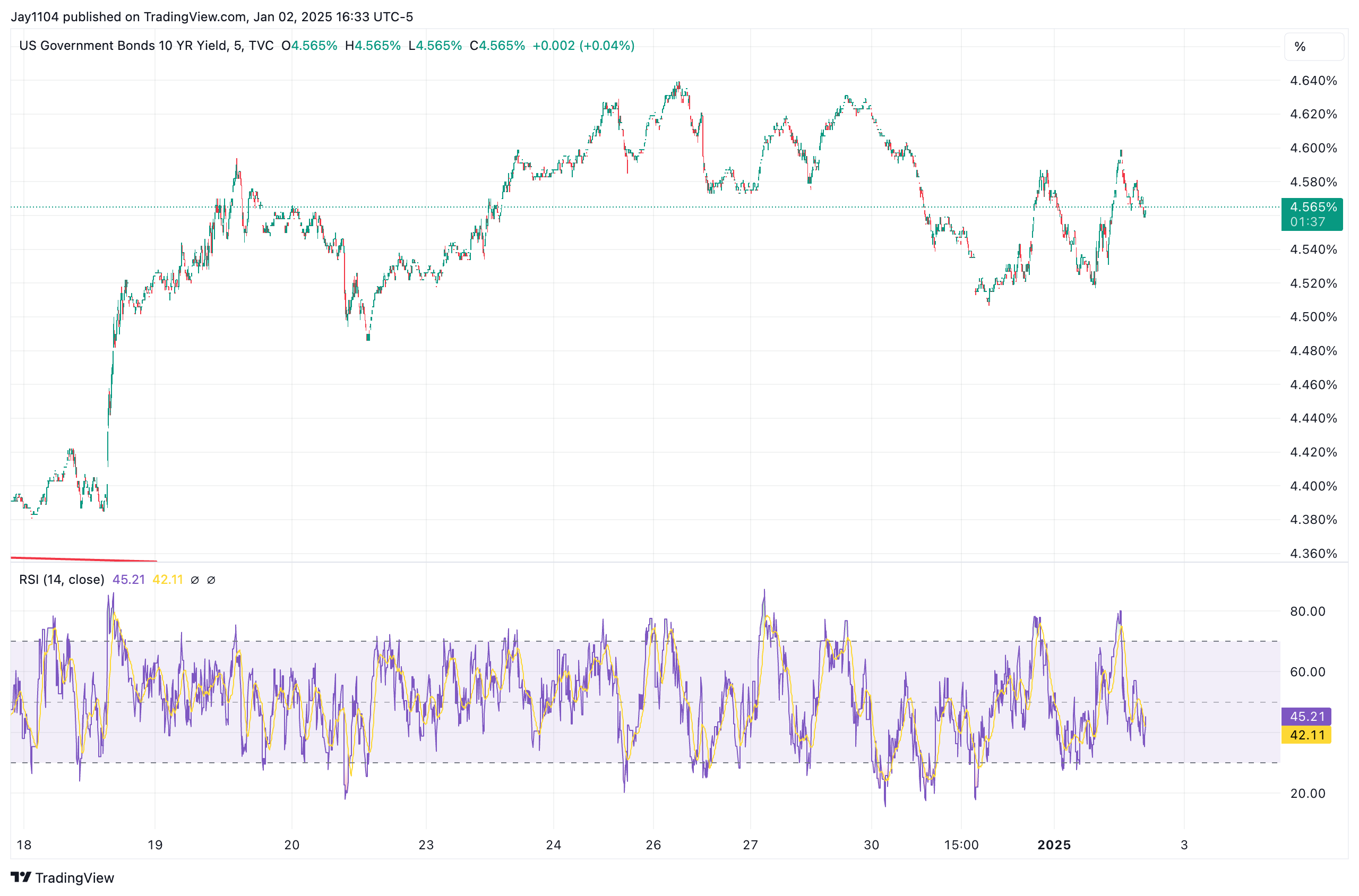

As a result, Treasury yields rebounded after starting the day lower by five bps to finish flat, keeping the 10-year yield in its 4.55%- 4.60% range. A break above 4.60% could open the door to 4.75%.

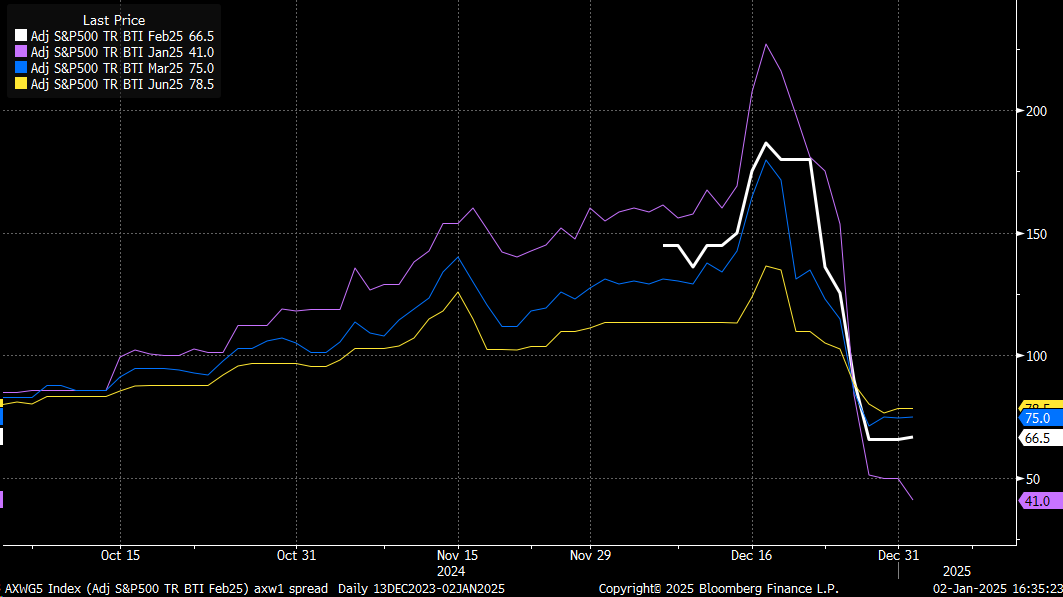

Leverage Costs Steady, Demand Weakens Sharply

Financing costs, such as the March S&P 500 Total Return BTIC futures, were unchanged, while January contracts closed lower by nine points to 41—a significant drop from December 17th’s level of 225. This reflects a continued decline in demand for short-term leverage.

Primary dealer repo activity in equities also declined last week, signaling that while leverage demand is still high, it is contracting. This confirms what the futures contracts data tell us.

Terms

- Implied Volatility (IV): A measure of the market’s expectations of future price movements for a security, often used in options pricing. A higher IV indicates higher expected volatility.

2. BTIC (Basis Trade at Index Close): A futures trading strategy that locks in the price difference between a futures contract and its underlying index at the market close.

3. Moneyness: The relationship between an option’s strike price and the current price of the underlying asset. For example, “105% moneyness” means the strike price is 5% above the current price.

4. Inflation Swaps: Financial derivatives that allow investors to exchange fixed payments for payments tied to the rate of inflation, used to hedge or speculate on inflation changes.

5. Primary Dealer Repo Activity: Transactions where primary dealers borrow or lend securities (like equities) as collateral to obtain cash or leverage, crucial for short-term market liquidity.

6. Stagflationary Reading: Economic data that suggests a combination of stagnant growth and inflation, a challenging scenario for markets.

7. Short-Dated Options: Options contracts that expire in a very short timeframe, typically within days or weeks, used for speculative or hedging strategies.