Market Brief

According to the latest Tankan survey, Japan’s business conditions worsened during the third quarter as the economy, especially the manufacturing sector, which struggles to maintain momentum. The large manufacturers’ diffusion index retreated to 12 from 15 in the June quarter, printing below market expectations of 13. When excluding manufacturers, the diffusion index increased to 25 from 23 in the second quarter, beating the forecast of 20.

However, Japanese corporations expect business conditions to worsen in the next quarter, suggesting that the BoJ will have to adjust the timing and the magnitude of its next move. The large manufacturers’ outlook index decreased to 10 from 15 in the June quarter, matching forecasts, while non-manufacturers’ outlook fell from 19 from 21 in the previous quarter, also matching consensus.

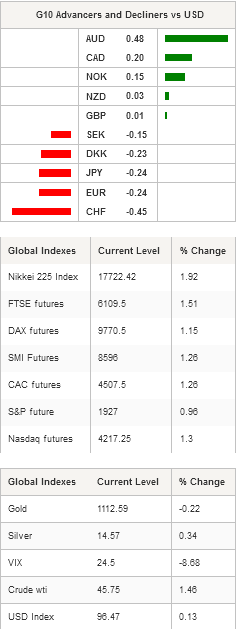

Japanese shares rallied in Tokyo as market participants view today’s tankan report as yet another sign of a slowing economy, substantially increasing the odds of an expansion of the BoJ’s monetary stimulus. The Nikkei 225 rose 1.92% to 17,722 while the broader TOPIX index soared 2.24%%. USD/JPY reacted positively to the report, increasing 0.40% to 120.10. However, the currency pair continued to trade range-bound between 119.06 and 121.33.

A little further east, in China, the situation is slightly encouraging, even though manufacturing PMIs indicate that the sector is still contracting. Caixin final manufacturing PMI increased to 47.2 from 47 a month earlier while the official index rose from 49.7 to 49.8 in September. Unfortunately, Chinese equity markets are unable to react to the headlines as they are closed for the National Day holiday. Elsewhere, Australian shares also joined the party and rose 1.80%, while in New Zealand, equities are trading in negative territory with the S&P/NZX 50 down -0.14%.

In the FX market, commodity currencies are trading substantially higher together with most commodity prices. AUD/USD successfully broke the $0.7043 resistance (high from September 23rd) to the upside but is still struggling to gain strong positive momentum ahead of tomorrow’s NFPs release. NZD/USD is heading towards the next strong resistance lying at $0.6457, the kiwi is also approaching its 50dma, standing at around 0.6460 at the moment.

In Europe, equity futures are trading in positive territory, following Wall Street and Tokyo’s lead. The DAX is up 1.15%, the CAC 40 and the SMI are both up 0 +1.26%, while the Euro Stoxx 50 gains 1.29%. EUR/USD is returning rapidly to the bottom of its 2-week range, standing at around $1.11. On the upside, a resistance can be found at 1.1277 (high from yesterday). Overall, we expect the FX market to trade roughly range-bound today as investors will be reluctant to start building positions ahead of tomorrow’s NFPs.

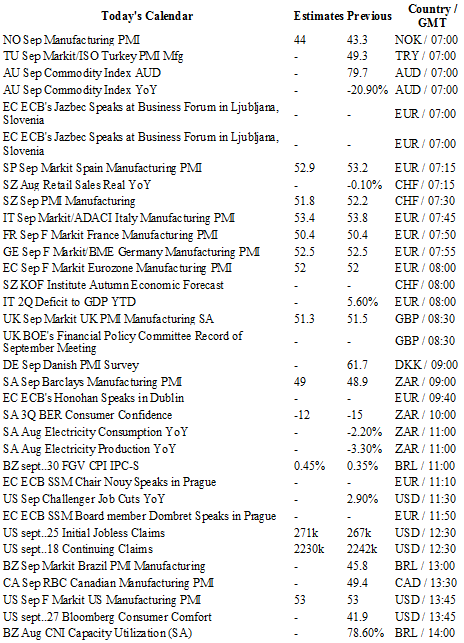

Today traders will be watching retail sales, PMI manufacturing and KOF economic forecast from Switzerland; PMI manufacturing from UK, Norway and Sweden; initial jobless claims, construction spending, Markit and ISM manufacturing and Fed officials’ speeches from the US.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1149

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5659

R 1: 1.5383

CURRENT: 1.5127

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.23

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9777

S 1: 0.9513

S 2: 0.9259