Risk sentiment remain ebullient overnight as markets basically ignored the latest disappointing US GDP print as German inflation picked up higher than expected. Wall Street and European stocks rose around 1% across the board while the USD was down slightly, as Euro remains in an holding pattern with the Australian dollar almost pushing through the 70 cent level. Bond markets saw some more tightening of yields with 10 Year Treasuries moving well below the 2.7% level while commodity prices reduced in volatility as oil prices stabilised as Brent crude stayed above the $100USD per barrel level while copper and gold both rose nearly 1.5%, the latter now at a new weekly high above the $1750USD per ounce level.

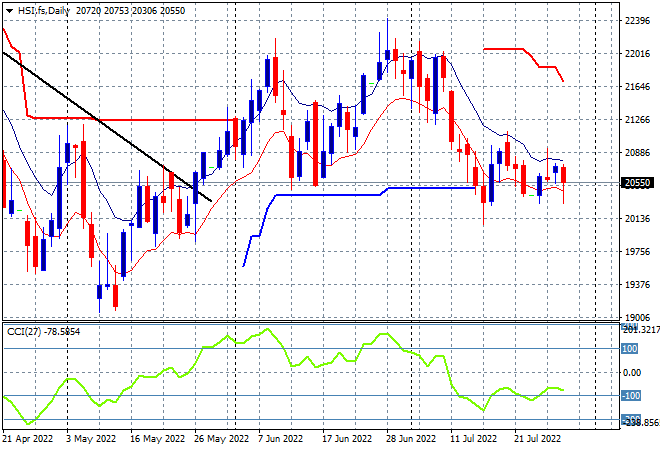

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets were up at the halfway point but slowed down into the close with the Shanghai Composite finishing up just 0.2% higher at 3282 points while the Hang Seng Index was still in retracement mode, down 0.2% to 20623 points. Sentiment continues to wane on the daily chart with considerable overhead resistance and daily momentum readings remaining nearly oversold as the previous swing play reverts back to the downtrend although some support is building at the 20000 point level:

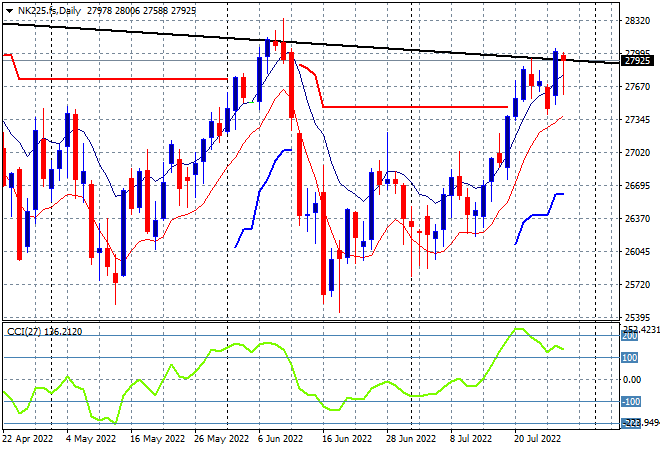

Japanese stock markets did a little bit better, with the Nikkei 225 up 0.3% to 27815 points. Futures on the daily chart are now suggesting a proper breakout after the reaction to the Fed, with resistance at the previous highs at 28000 points still the area to beat in today’s session. Daily momentum remains in an overbought status and while price has made a new weekly high, this market is in a pause phase for now with the overall monthly/weekly trend (sloping black line above) still in play:

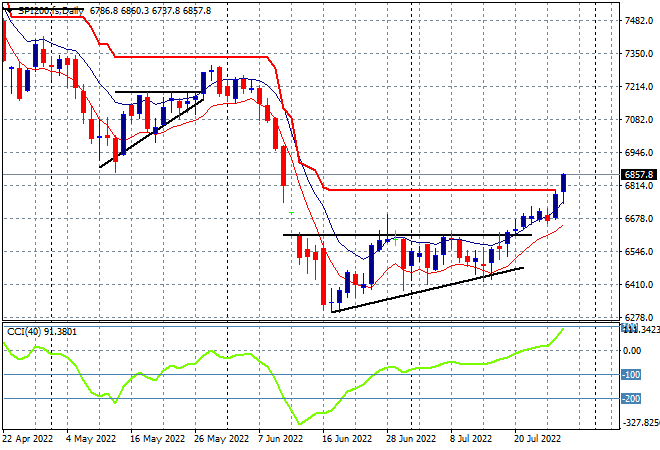

Australian stocks had a very solid lift from the Fed rate hike fallout with the ASX200 closing nearly 1% higher to almost get to the 6900 point level, finishing at 6889 points. SPI futures are up a solid 1% as the Wall Street rally continues with the daily chart firming its breakout situation in the short term as it tries to convert the recent bottom into a new uptrend. Daily momentum is building to the positive side with the potential for upside action building with a breakout above short term resistance that should push aside overhead ATR resistance to get near the 7000 point level:

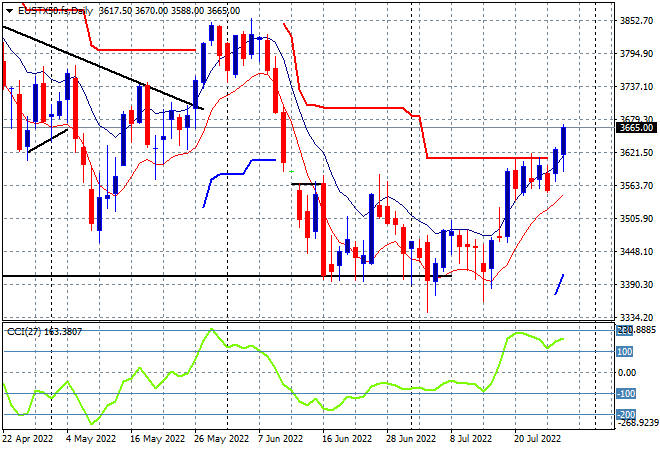

European stocks were generally positive across the continent, although the FTSE fell back in Brexit-land, with the Eurostoxx 50 index lifting more than 1.2% higher to finish at 3652 points. The daily chart shows price action moving sharply higher through overhead resistance as a bottom is formed here at the 3400 point level. Daily momentum remains overbought and ready to engage higher:

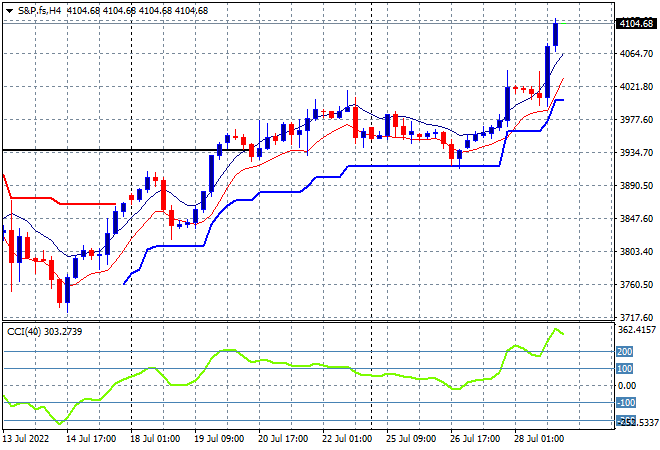

Wall Street ignored the GDP print and lifted across the board, as the NASDAQ and S&P500 both gained more than 1% with the latter closing at 4072 points, building above previous key resistance at the once elusive 4000 point level. The four hourly chart is getting really boisterous now, with momentum now pushing into the extreme overbought mode as the reaction to the Fed rate hike is the most positive in decades! The ability to get past the 4000 resistance zone staves off a further retracement, with confirmation here setting up for more upside, although a pause would be warranted going into the last session of the trading week:

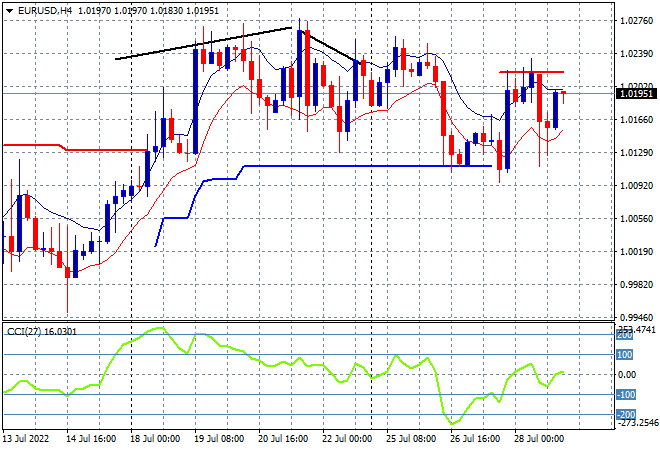

Currency markets are decreasing in volatility post the FOMC decision and now latest GDP print although Pound Sterling is still moving around in particular, but Euro remains in a holding pattern despite general USD weakness as it was pushed back up to the 1.02 handle overnight. The broad trend on the four hourly chart still shows a sideways holding pattern with that potential short term top brewing as resistance builds past the mid 1.02 level, so this fill in move post the Fed hike is not yet part of a new uptrend:

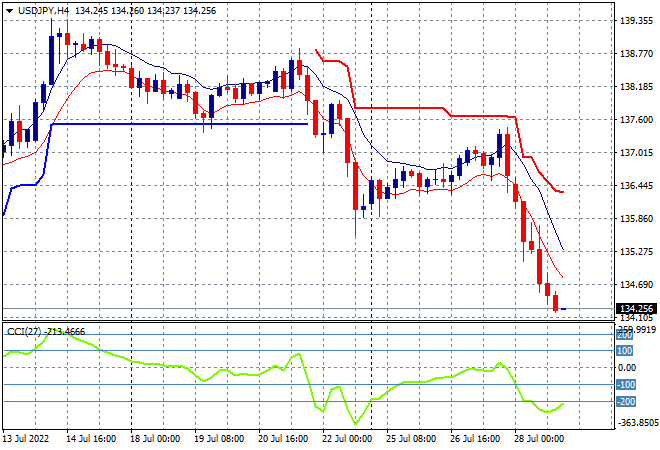

The USDJPY pair was slammed back down to the mid 134 level with another big selloff on the GDP print and following the Fed hike, as internal weakness is really showing itself here. Former ATR support at the 137 mid level has turned into solid resistance with short term momentum extremely oversold and ripe for a pullback, but there’s no evidence of any USD buyers here yet:

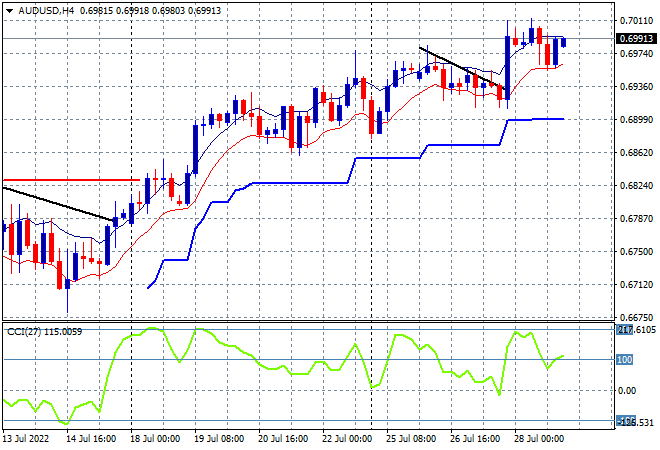

The Australian dollar remains in a strong position post the Fed rate hike but not yet extending into broader gains as the 70 handle remained elusive overnight. Now that the Fed has signalled a slowdown in rate rises, confirmed by the weak GDP print, there is the potential for the RBA to play catchup so we should see a change in sentiment to get the Pacific Peso moving above the 70 level. I’m watching for a follow through here going into the end of the week:

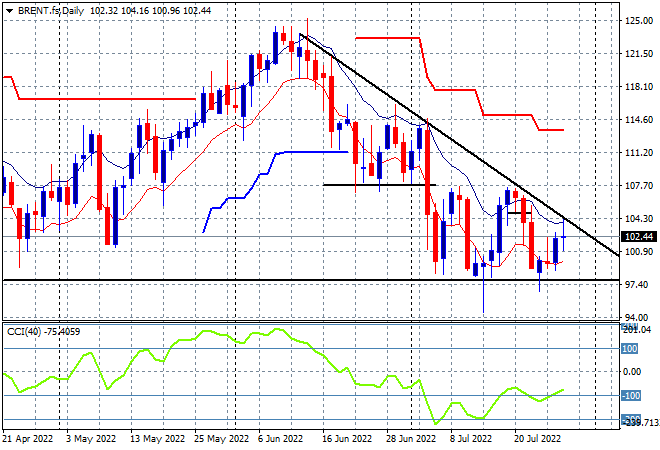

Oil markets are trying to recover after dicing with the $100USD per barrel level for Brent crude as the lower USD keeps it around the $102 level overnight. Price action failed to continue the previous week’s bounce off the $90’s lows, with the downtrend line yet to be beaten from the June highs and nor has daily momentum got out of its negative funk, so watch for the $100 level to continue to turn into resistance here:

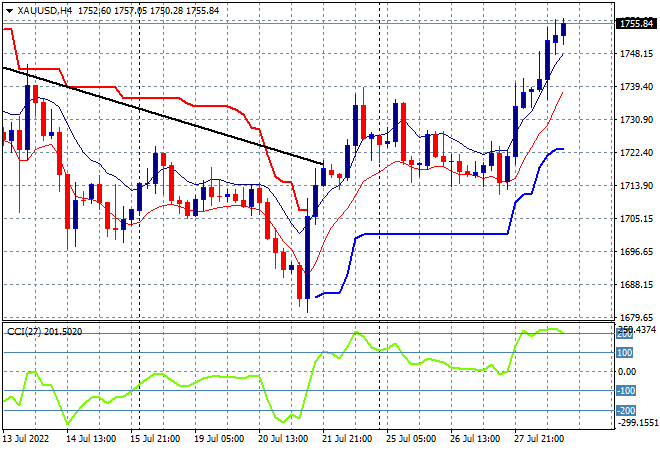

Gold lifted straight through its previous weekly high at the $1734USD per ounce level, advancing into the $1750 zone overnight for a new weekly high. This is a solid move that has pushed aside resistance to turn this bottoming action into a proper relief rally, but will it be enough to fill in months of a dominant downtrend: