Concern over European gas supplies and the fake referendums in Ukraine kept overnight stock markets contained. The USD remains strong against everything undollar with Euro still sharply below parity without any upside moves, as Pound Sterling races to join the crowd. The Australian dollar is still on the ropes, as commodity prices remain under pressure. Bond markets remain on edge with UK gilts still lifting, while 10 Year US Treasuries remain above the 3.9% level with interest rate expectations still looking at another 150bps in rises by January. Commodities tried to stabilised with oil markets coming back slightly after recent sharp falls, with Brent crude back up to the $84USD per barrel level while gold also stabilised at its recent monthly low at the $1630USD per ounce level.

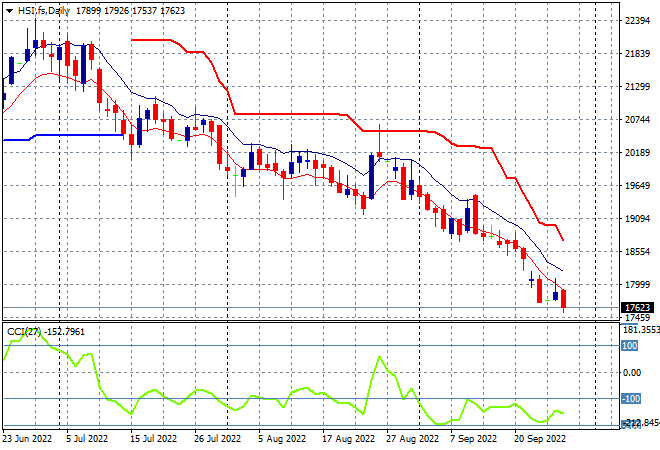

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets lifted sharply into the close with the Shanghai Composite up 1.4% to 3093 points while the Hang Seng Index was able to stave off another selloff, finishing with a scratch session at 17860 points. The daily futures chart is still showing a very bearish mood without any buying support. The bear market continues with daily momentum nowhere near out of its negative funk, but at least not getting extremely oversold:

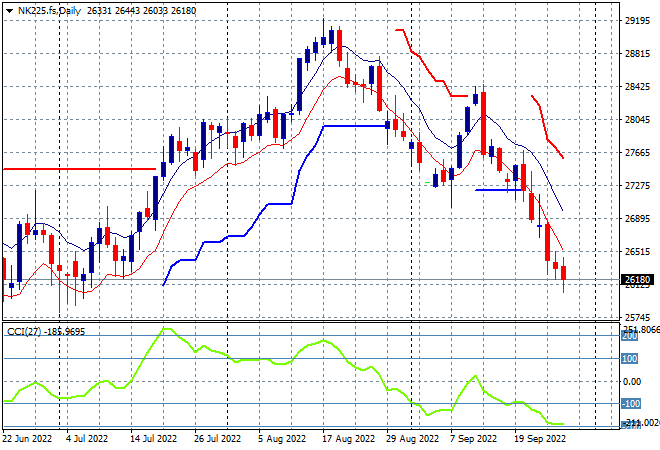

Japanese stock markets lifted a little, with the Nikkei 225 closing some 0.5% higher at 26571 points. The daily chart shows price action still on a dominant downtrend after the recent dead cat bounce up to the 28000 point level with support at the 27000 point level a distant memory. Daily momentum remains negative and oversold with successive new daily low sessions pointing to a test of the June lows next as futures are indicating more selling ahead:

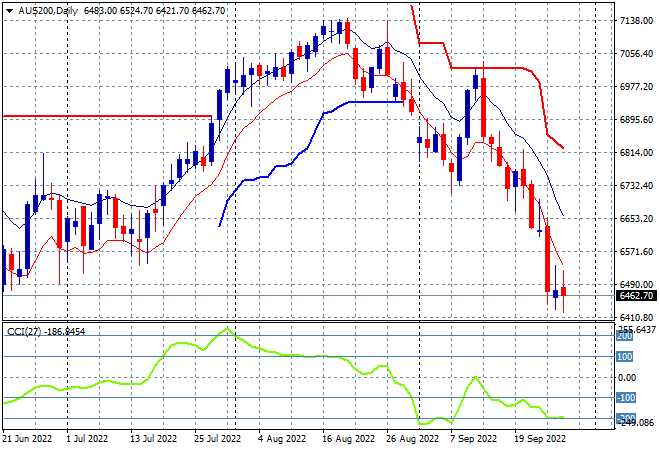

Australian stocks were able to also put in a mild bounce, with the ASX200 gaining nearly 0.5% to nearly close above the 6500 point level, staving off a new monthly low. SPI futures however are indicating all of this will be taken back , currently down 0.5% reflecting the inability of European and US stocks to recover overnight. The daily chart shows price action coming up quickly to test the June lows next as daily momentum remains in full oversold mode, with buying support just not there:

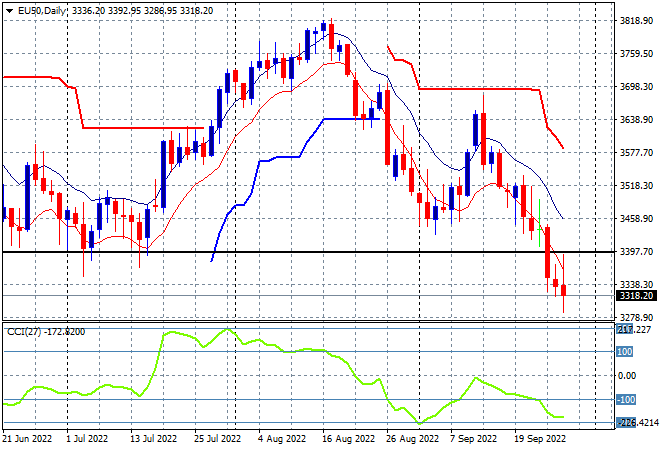

European stocks are still piling on the losses after a false deceleration signal and are still not being helped by a lower Pound Sterling and Euro. The Eurostoxx 50 Index eventually lost 0.4% to finish at 3328 points overnight with the daily chart showing price action extending below the June lows at the 3300 level with another leg down possible as daily momentum remains well oversold:

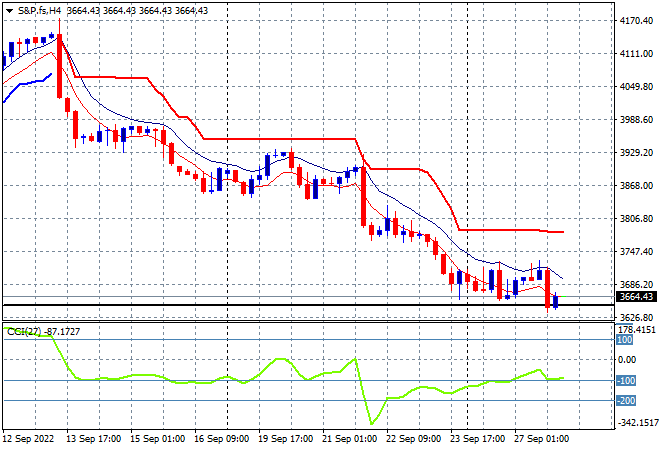

Wall Street had mixed returns but remains hesitant, with the NASDAQ the outlier gaining 0.3% while the S&P500 finished another 0.2% lower at 3647 points. The four hourly chart remains on a steady downtrend similar to all other major stock markets showing how in line market expectations are with the hawkishness of the US Fed. Price has now returned to the June lows (lower black line) which wipes out all of 2021’s returns, but momentum is indicating some deceleration here so watch for support to possibly hold:

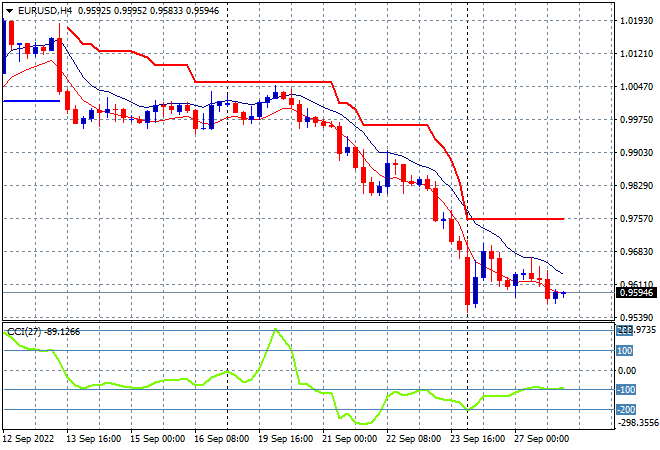

Currency markets remain firmly on the side of the USD, with the continued falls in Pound Sterling and Euro extending overnight. The union currency’s further drops below parity saw it contained well below the 96 handle as it revisits the lows from Friday night. Momentum remains nearly extremely oversold with the four hourly chart indicating more selling pressure as the high moving average has never been under threat:

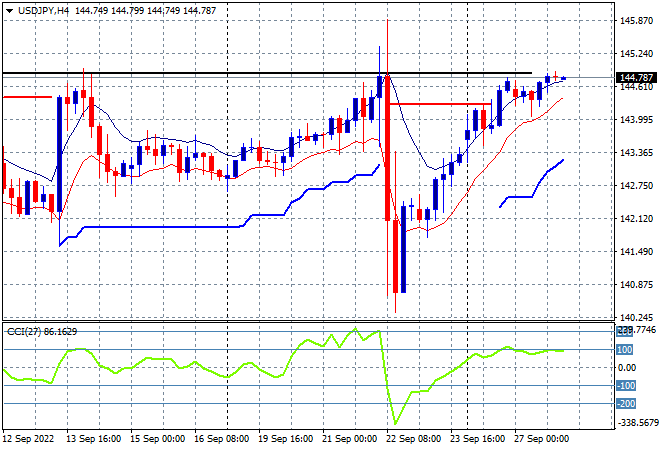

The USDJPY pair continued its slow melt up after some massive volatility last week around the Fed meeting, now settling just below the 145 level which equates to the recent weekly highs (upper black horizontal line). Short term momentum has now moved into somewhat overbought following that big volatile move, with price action coming up against obvious resistance at just below the 145 level where its likely to be rebuffed as before, although no new session lows is promising:

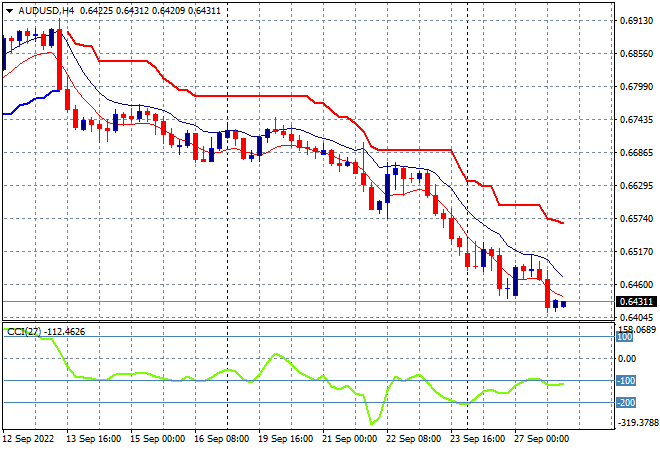

The Australian dollar continued to crack lower, now well below the 65 handle after almost cracking through the 64 cent level overnight, moving in line with risk markets and the falls in commodity prices. My contention that resistance is just too strong at all the previous levels with the 68 handle the area to beat now for the medium/monthly view while the 66 level is the area to watch in the short term, with trailing overheard ATR resistance just not under any threat:

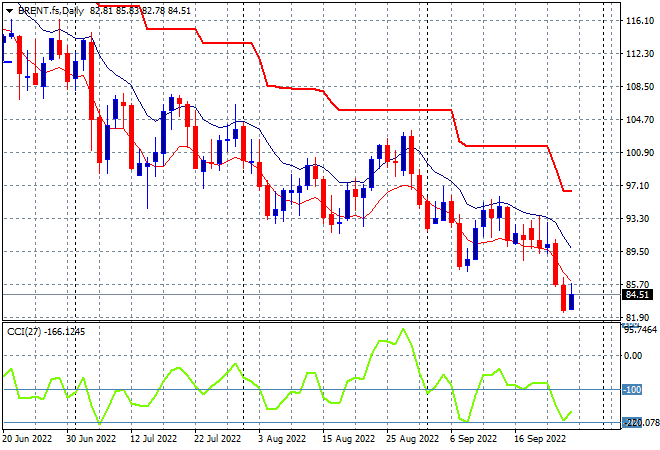

Oil markets are trying to stabilise after its collapse on Friday night, with Brent crude lifting just over 2% to the $84USD per barrel level overnight. However, this is minor given that daily momentum had been persistently negative and now technically oversold as price action is no longer anchored at the recent weekly lows with new monthly lows being made in this rout:

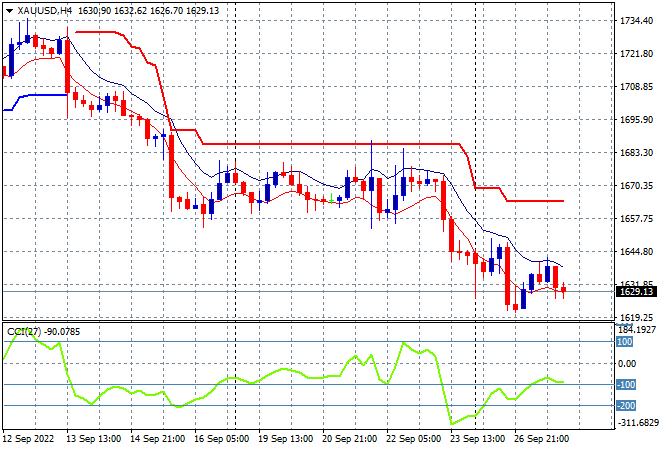

Gold is moving in line with other undollars as the USD remains far too strong against everything, with an attempt to breakout thwarted smartly as it remains well below the key $1700USD per ounce support level to finish at the $1629USD per ounce level. This keeps the shiny metal below the 2020 lows and confirms the multi-monthly bearish setup: