There’s dead cats all over the place as overnight stock markets couldn’t help but turnover and selloff as global recession fears mount combined with some poor earnings on Wall Street. Combined with near crashes in Chinese stocks as COVID restrictions continue to bite and may well impact global supply, its all looking a bit dark and rim out there in risk taking land. The USD is moving from strength to strength, although defensive Yen is finally appreciating while the Australian dollar gets poleaxed as traders wait for the sleepy RBA to wake up and pull the rate handle. Bond markets are firming again, with the 10-Year US Treasury yield falling back to the 2.7% level while commodity prices oscillated, with WTI and Brent crude oil both up over 2% as gold remains depressed right on the $1900USD per ounce level.

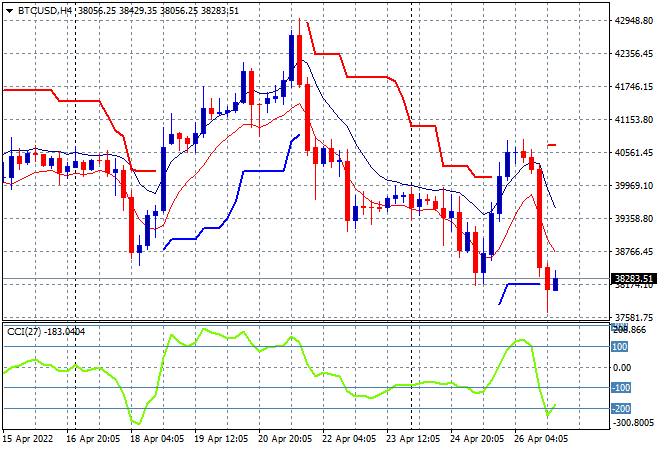

Talking about depressed, Bitcoin flopped again with one of the biggest dead cat bounces now thwarted as it makes a new weekly/monthly low at the $38K level overnight. As I’ve been saying for awhile, the lack of confidence in the crypto world could see a further retracement down to the February lows at the $37K level next and we’re almost there:

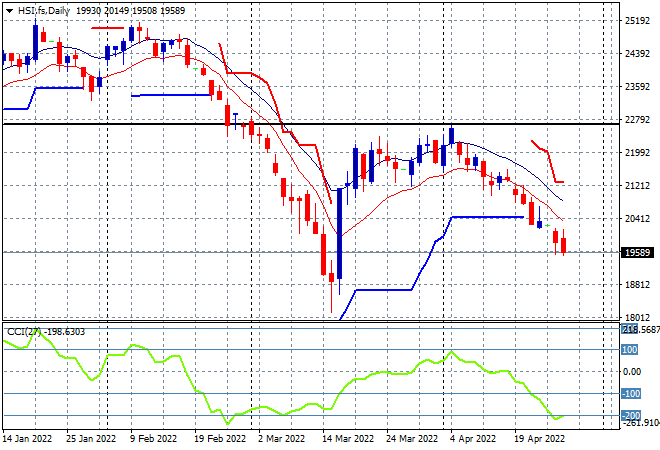

Looking at share markets in Asia from yesterday’s session, where Chinese share markets again solid off sharply going into the close with the Shanghai Composite down more than 1.4% at 2886 points while theHang Seng Index actually held on to be up nearly 0.4% at 19934 points. The daily futures chart however shows more downside potential on the open as this capitulation move is not yet over with strong resistance at the 22600 point level a distant memory as momentum remains negative – the trend is still pointing to a return to the early March lows at 18000:

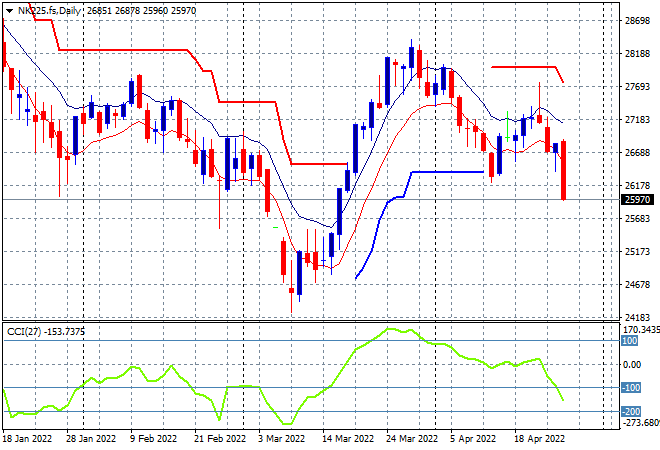

Japanese stock markets tried to stabilise somewhat with the Nikkei 225 closing 0.4% higher at 26700 points but futures are indicating a very bad start on the open as overnight volatility on Wall Street and a higher Yen dominate risk taking. Daily momentum is reverting to a negative state with price about to be smashed below previous daily ATR support as it still rejects weekly resistance at the 27500 point level. Any potential break below the low moving average will spell capitulation of confidence and a swift return to the 24000 point level:

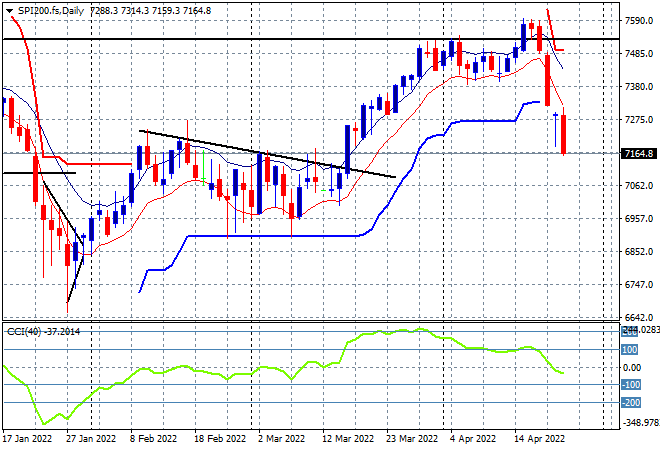

Australian stocks were the worst performers in the region with the ASX200 losing over 2% to start its truncated trading week in poor form, closing at 7318 points. SPI futures are down at least 1.5% so expect a little more carnage today leading up to the inflation report. The daily chart was showing a lot of potential with daily momentum remaining strong, but that false breakout caught out a lot of bulls as price was unable to push aside resistance at the former highs. Playing catchup to the risk off moves in overseas markets could see a big reversal down below the 7000 point level, just in time for the federal election:

European shares were somewhat mixed with some sharp selloffs, mild scratch sessions and even a lift on the FTSE but the Eurostoxx 50 index eventually finished 1% lower at 3721 points. Futures clearly show more downside on the re-open tonight in response to the broader selloff on Wall Street, with my contention of another breakdown about to come to fruition and a return to the February lows:

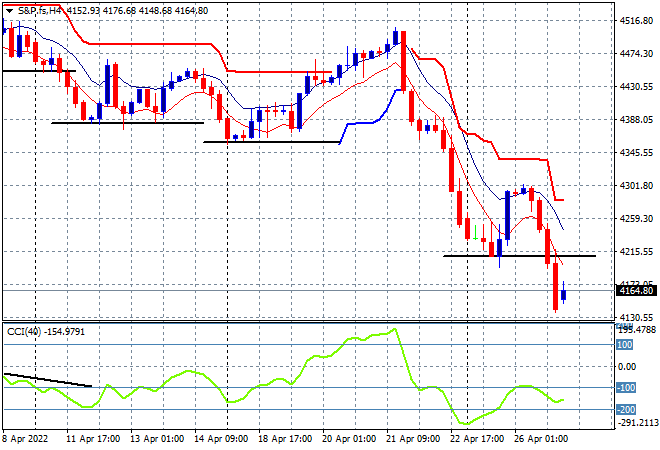

Wall Street is in correction mode with some wide selloffs across all three bourses, with the NASDAQ eventually closing nearly 4% lower while the S&P500 lost nearly 3% to finish at 4175 points. Price action on the four hourly chart shows yet another series of steps down as support is tested, a small dead cat bounce occurs and then whop! Sellers step in and the BTFD crowd cowers for cover yet again as the Fed punchbowl is taken away. The 4000 point level is the next target here on the downside:

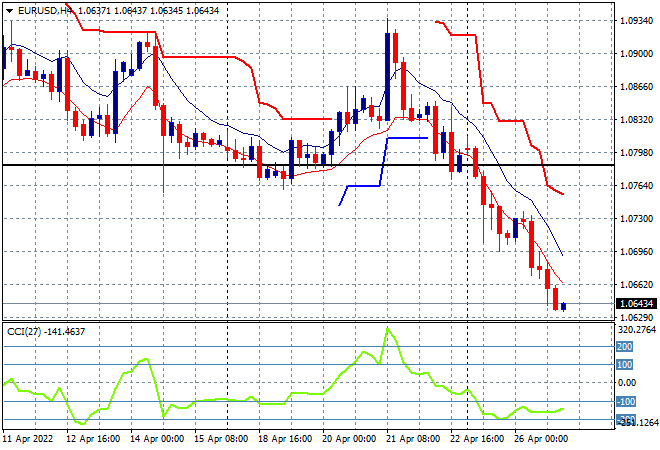

Currency markets continued to see a clear trend in a stronger USD as a wider correction in risk markets unfolds, with Euro and Pound Sterling making new structural lows overnight. The union currency had already collapsed below the 1.07 handle and was looking very weak, then continued this weakness with a move towards the 1.06 level. Substantial resistance overhead at the 1.08 level is a distant memory and I expect more downside here with a short term swing bounce before a return to the long term trend down to parity:

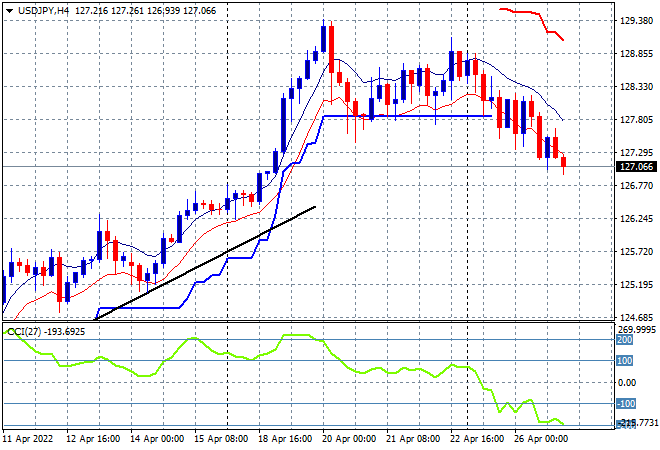

The USDJPY pair is no longer contained as growing downside volatility that had been brewing at the 128 level turned from a slip into a proper move down to 127 handle. Momentum reading were showing this with a breakdown to oversold conditions where risk off moves and a run to Yen are starting to bring this out of control trend back to reality:

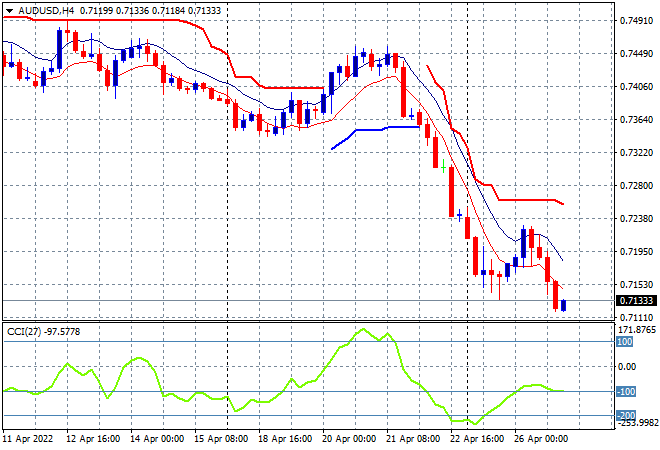

The Australian dollar was yet another dead cat bounce victim, with price falling below the mid 71 level overnight after the unlikely bottom from the previous session low was taken out. All eyes on the too late and inaccurate CPI print this morning that will likely force the RBA’s hand before the election. I’m watching for a drop below the 71 handle but expecting the unexpected too:

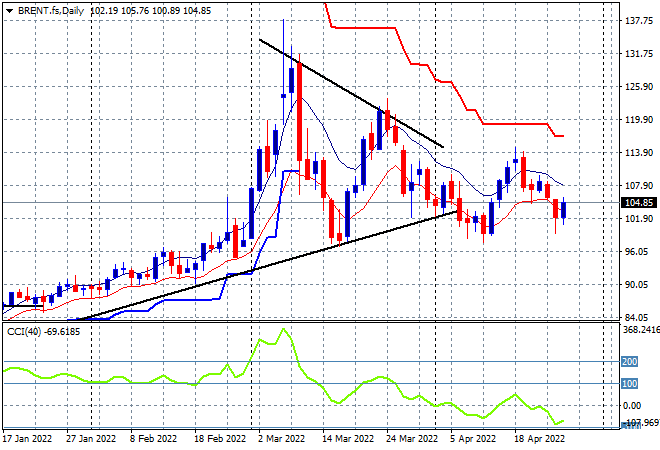

Oil markets are trying vainly to stabilise after the potential breakout was thwarted last week, with Brent solidifying above the $100USD per barrel level overnight but only just and looking weak in the short term. Daily momentum is still well in the negative zone, with minimal chance of any upside potential, with a drawback or breakdown below the key $100 level still possible with no new weekly highs being made for sometime now:

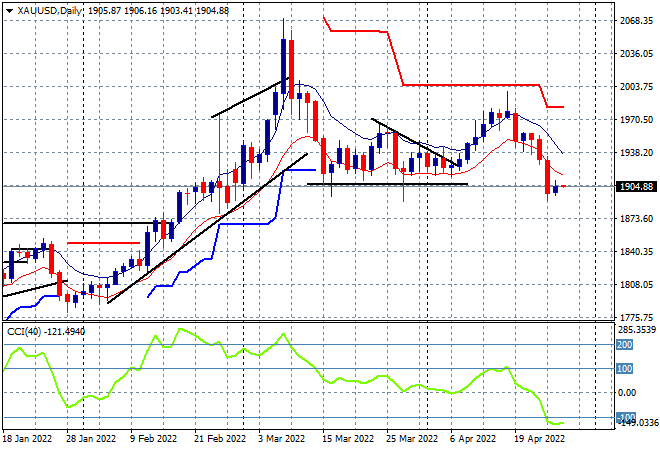

Gold remains under a lot of pressure and is anchored now at previous weekly support at $1900USD per ounce, still a very psychologically important level for obvious reasons. Daily momentum is still oversold and price action still suggests a follow through here below with the January lows around the $1800 level quite possible: