Last night saw risk sentiment unable to lift during the European session but then surge on Wall Street as the latest PMI numbers and other domestic economic data came in strong, with the USD spiking against Yen while commodity currencies surged. The Australian dollar pushed through the 75 handle while bond markets range traded as the 10 year Treasury yield oscillated around the 2.3% level. Commodities were somewhat mixed as oil prices pulled back slightly, with Brent crude below $120USD per barrel while gold lifted.

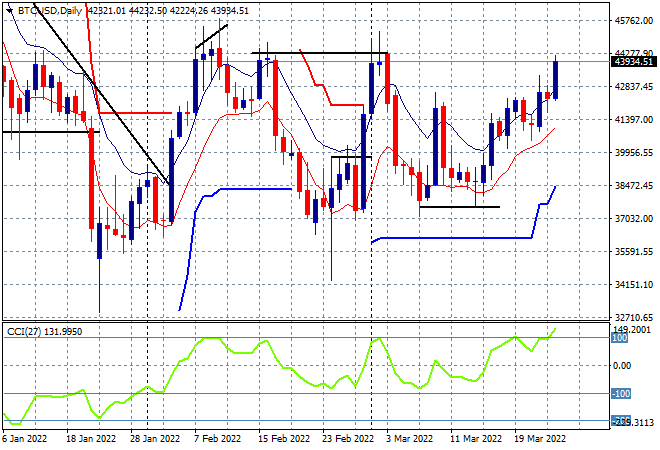

Bitcoin is now getting a move on after building upside momentum during the week and being contained around the $41K level last week, pushing through the $44K level overnight. Daily momentum is now nicely overbought but this level of resistance at the January and February highs will be critical to get through next:

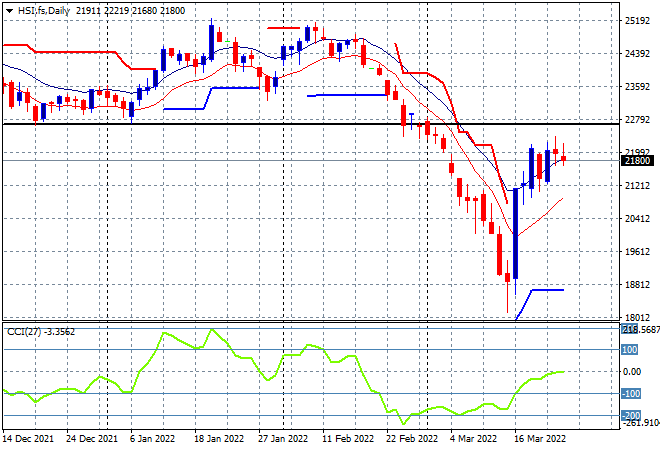

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares were the outsiders, with the Shanghai Composite closing down 0.6% to 3255 points while the Hang Seng Index was looking to put in a scratch session but sold off at the close to finish 0.9% lower at 21945 points. The daily futures chart is still showing price action poised but not ready to engage to the upside as momentum readings remain neutral and staunch resistance at the 22600 point level remains overhead:

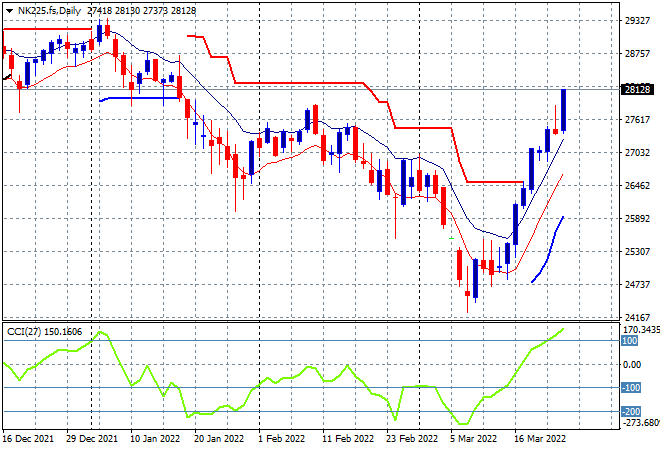

Japanese stock markets also floated along with the Nikkei 225 closing just 0.25% higher to 28110 points. Futures however are indicating a big surge on the open given the falls in Yen which continues to fuel this rally. If translated into proper price action we could see resistance at the February highs taken out and then a possible fill of all the calendar year losses so far:

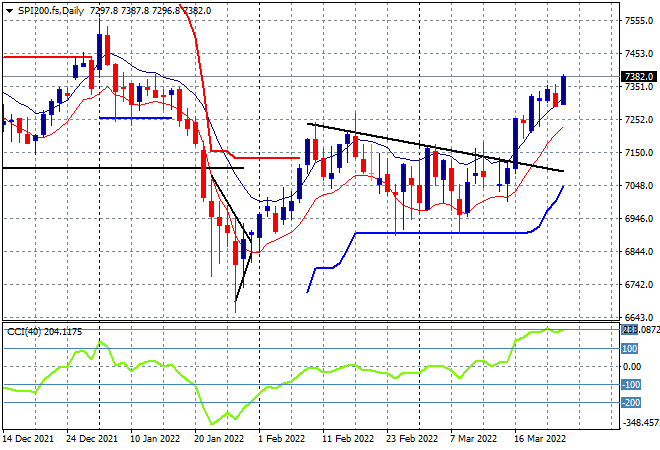

Australian stocks had a scratch session, which was better than expected, with the ASX200 lifting 0.1% to finish at 7387 points. SPI futures are up 0.5% or so on the bounceback on Wall Street so we’re likely to see a strong finish to the trading week here. The daily chart continues to show a lot of potential although momentum is getting a bit ahead of itself so I’m still watching for a potential rollover through the low moving average here:

European shares had another wavering night without much result with only the FTSE finishing with a positive session, while the Eurostoxx 50 index lost 0.1% to close at 3863 points. While price action was slowly moving the market closer away from a pure swing trade and into a reflation rally, its faltering more now without making any really substantial new daily highs. As I’ve been saying for awhile now, it really needs to clear the 4040 point area next as momentum remains neutral:

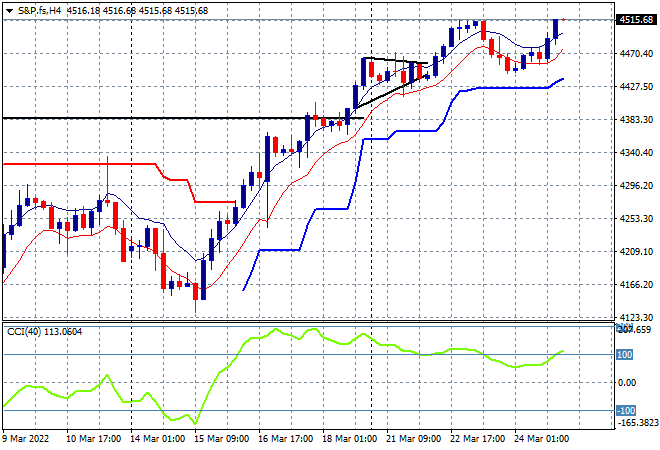

Wall Street however rebounded on the solid data prints with the NASDAQ up nearly 2% while the S&P500 finished 1.4% higher at 4520 points. Price action on the daily chart is confirming the short term view, with the double bottom formed at the March lows, and daily overhead ATR resistance well and truly cleared above the 4400 point level. This is looking good:

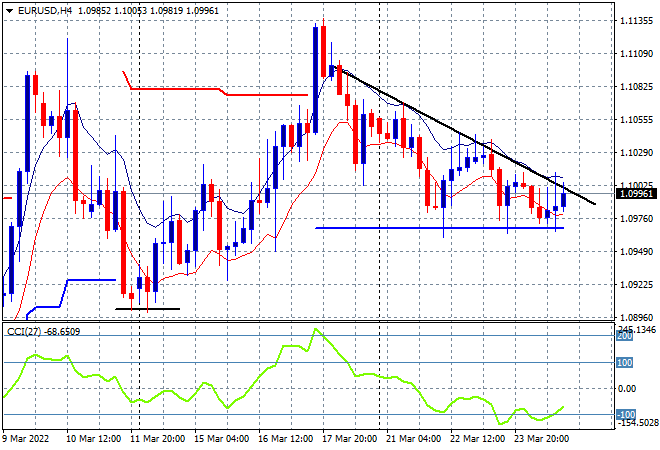

Currency markets saw no effective change to USD strength but it remains quite strong against Euro which continues to deflate as the Ukrainian invasion continues to keep a lid on risk taking. The four hourly chart continues to show a retracement down to the 1.10 handle proper. There remains the potential to fallback to the start of war position, as four hourly momentum remains negative while daily momentum is neutral at best:

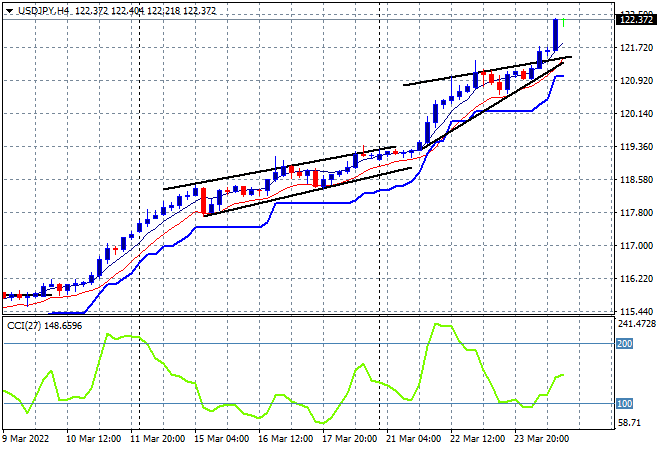

The USDJPY pair continued its push higher, seemingly going up a handle every day! This time it pushed above the 122 level overnight as the USD builds more strength against Yen in what should be an unsustainable surge – but it keeps going up and up! Momentum is extremely overbought with price now zooming uncomfortably above the previous trend channel and even a bearish rising wedge pattern that has failed. Watch short term momentum readings carefully:

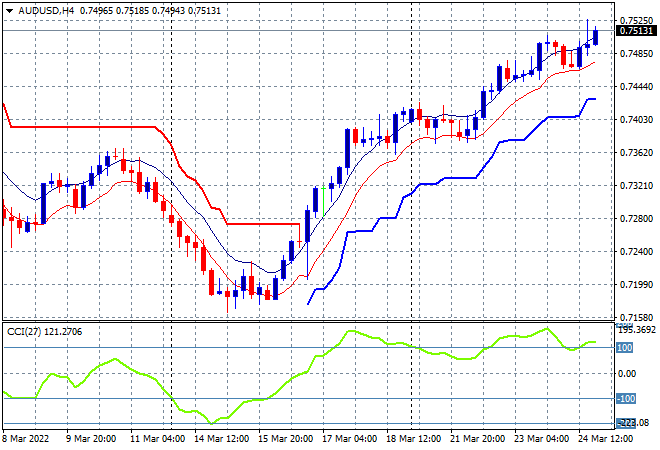

The Australian dollar also remains highly bid, this time breaking through the 75 cent level this morning as commodity prices remain mixed. The four hourly chart shows a clearance of the previous weekly highs with short term momentum remaining well overbought with the 74 level acting as strong support in the short term:

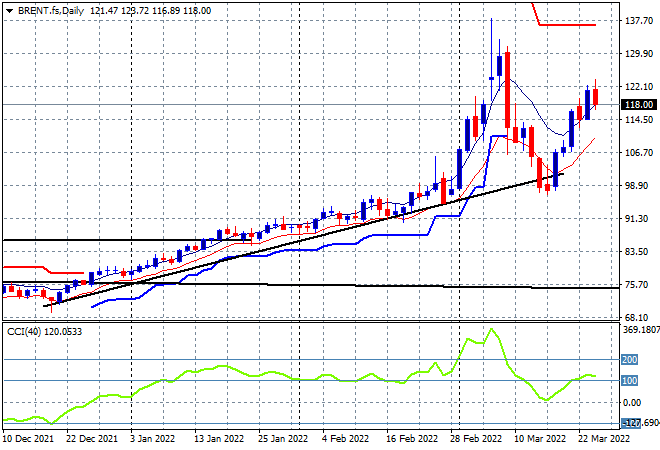

Oil markets wavered a little but remain fairly contained with a mild pullback overnight as Brent crude retraced slightly below the $120USD per barrel level. This still has the potential to return to the overshoot highs above the $130 level, with daily momentum getting back into the overbought zone:

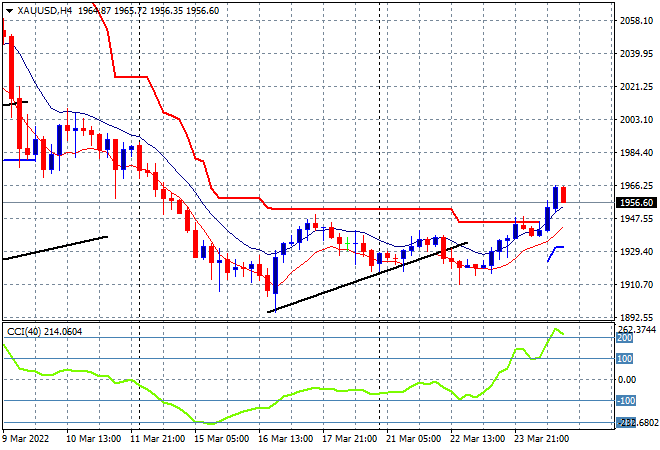

Gold was able to move sharply overnight after failing to make headway mid week and retracing below the nascent uptrend line from the $1900USD per ounce level bottom, pushing up to the $1956USD per ounce level. Four hourly momentum has switched from negative to overbought quite quickly and was able to clear overhead ATR resistance with a run to the $2000 level next: