Wall Street continued to climb higher overnight, absorbing the latest FOMC minutes with aplomb, as the USD pulled back sharply against the major currencies as a result of the less than hawkish language contained within. The S&P500 Index built on its breakthrough above the 4000 point barrier on a reversal in risk sentiment while Euro climbed up towards the 1.04 level as the Australian dollar did even better to break through the 67 cent level. The action continued in bond markets with more yield inversion as 10 year Treasury yields dropped below the 3.7% level, with softer signalling on the December FOMC meeting. The commodity complex saw sharp drops in oil prices as Brent crude closed below the $85USD per barrel level while gold was still unsteady but managed to push a little higher up to the $1750USD per ounce level.

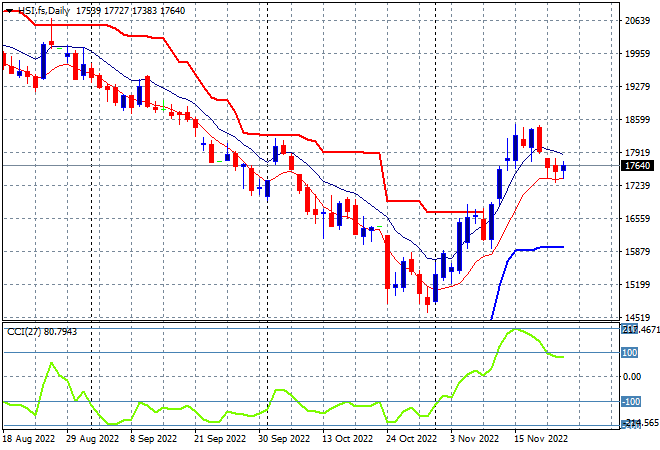

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets did better after the lunch break with the Shanghai Composite up 0.2% to close at 3098 points while the Hang Seng Index is bouncing back somewhat, closing up 0.5% to 17523 points. The daily chart is showing a small slowdown after having gained nearly 4000 points since testing the 2008 lows with the possibility of a further retracement growing but so far defended at the low moving average area. Its pretty obvious that daily momentum was getting ahead of itself before reaching the magical 20000 point level so watch this retracement to continue to test the recent daily lows below the 18000 point level:

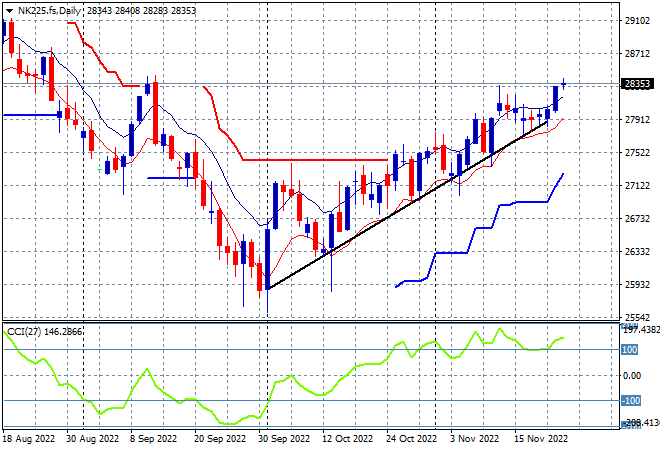

Japanese stock markets are having yet another holiday, with the Nikkei 225 chart showing a potential lift on the open playing catchup today. A further breakout maybe brewing as overhead resistance at the 27500 level is cleared and Yen reverted sharply overnight. More upside action on Wall Street should help buying confidence from here as price bounces off the trendline as daily momentum remains overbought with supporting holding nicely at the 27500 point level to continue this uptrend:

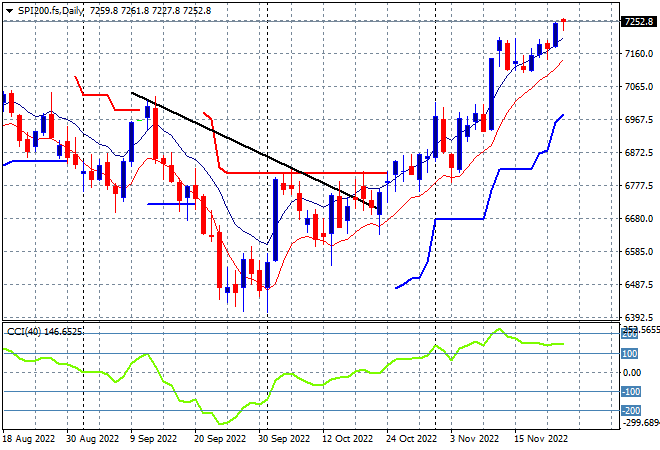

Australian stocks had a very solid session indeed, building on the previous liftoff with the ASX200 closing nearly 0.7% higher at 7231 points. SPI futures are dead flat despite the rise on Wall Street overnight, with the daily chart still looking very similar to Japanese stocks, but with more upside potential. Daily momentum remains solidly overbought, with strong support below at 7000 points as the uncle point on any pullback:

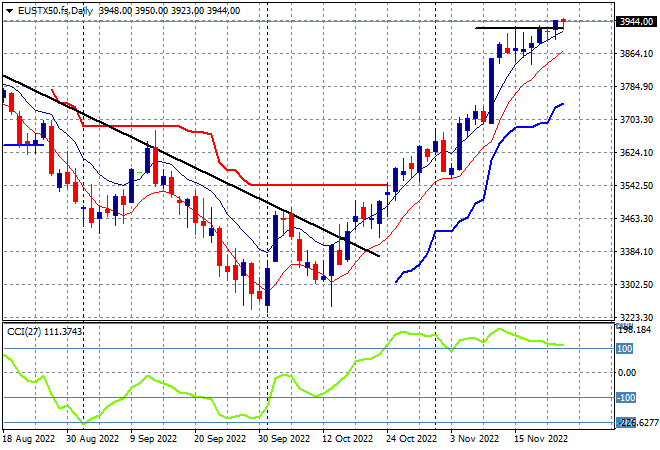

European markets kept creeping higher overnight across the continent as the Eurostoxx 50 Index finishing up 0.4% at 3946 points, although the German DAX was dead flat. The daily chart shows how the key point going forward will be clearing overhead resistance at the 3900 point area, with daily momentum having a small pause this looks good to keep going higher with the low moving average a clear uncle point in the uptrend:

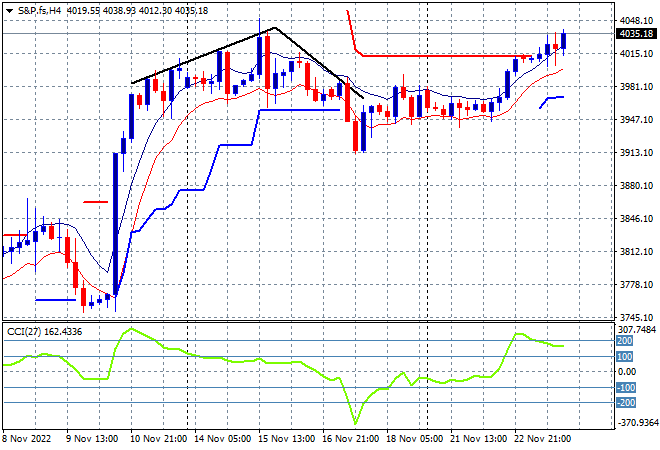

Wall Street advanced cautiously post the Fed minutes with the NASDAQ having the most gains, up nearly 1%, while the S&P500 lifted 0.6% to 4027 points. The chart picture is still very different to other stock markets as it continues to battle many more layers of resistance but the August highs are in sight after clearing the October highs and the 4000 point psychological level. Price action had been bunching up nicely here but the lack of a new weekly high was holding the market back – watch for a continued break above trailing ATR resistance and the early November high next:

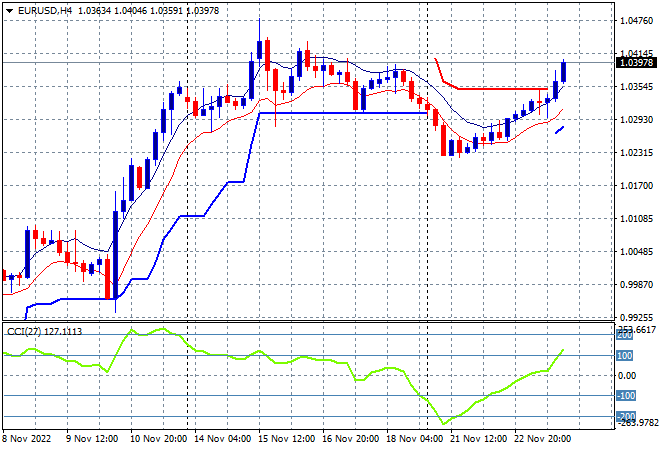

Currency markets saw a reversal in the resurgent USD in the wake of the FOMC minutes with King Dollar losing ground against all the majors. Pound Sterling made a new monthly high and Euro almost broke through the 1.04 handle to match its previous weekly highs. A rounding top pattern was forming here on the four hourly chart but has been thwarted with very strong support evident at the mid 1.02s. Watch now for resistance to be tested at the 1.0450 level next:

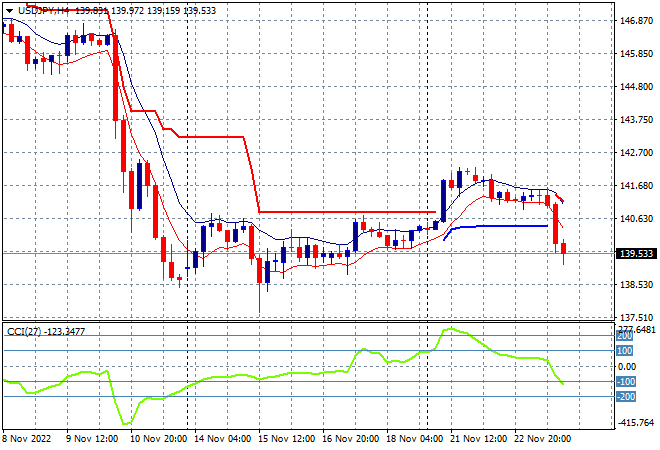

The USDJPY pair is back in depression mode after failing to travel any higher from its breakout earlier in the week, flopping below temporary support and breaking down below the 140 level overnight. This was looking good for a continuation rally that had a lot of upside potential, but four hourly momentum had already retraced to a neutral setting after being overbought, so this is not unexpected. Watch for a possible return to the previous weekly lows next:

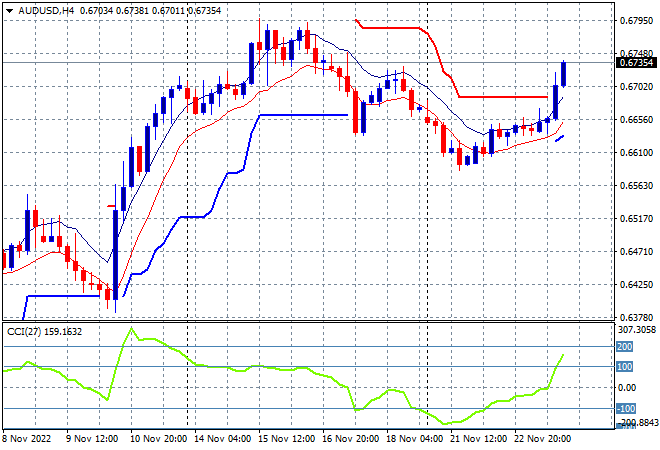

The Australian dollar had been pulled along meekly in previous sessions but violently broke out overnight with the other majors, pushing through short term resistance around the mid 66 level and breaking into the 67 handle this morning. This price action shows that traders believe the Fed may not be as hawkish as the RBA so perhaps my contention of weaker upside potential is wrong here. Watch for a ride up to the 68 cent level where very strong resistance lies to test that theory properly:

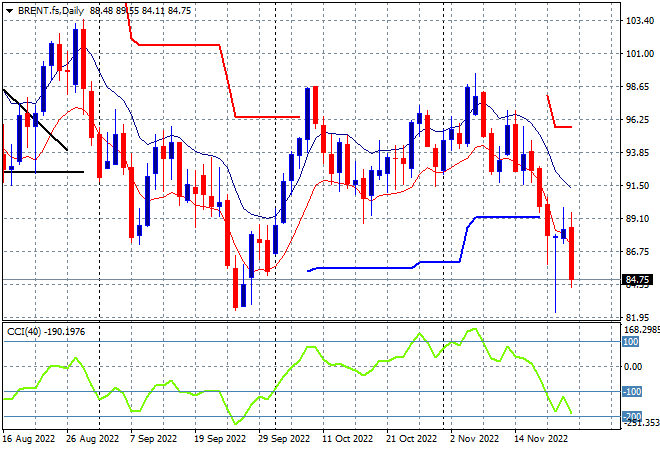

Oil markets were unable to stabilise the previous falls across the complex with another night of strong selling sending Brent crude down below the $85USD per barrel level. Daily momentum was already oversold before this move with the lack of new daily highs and the continued inability of price action to return to the magical $100 level or even clear resistance at the $98 level extremely telling. The next stage is set to test the September lows at $80 or so:

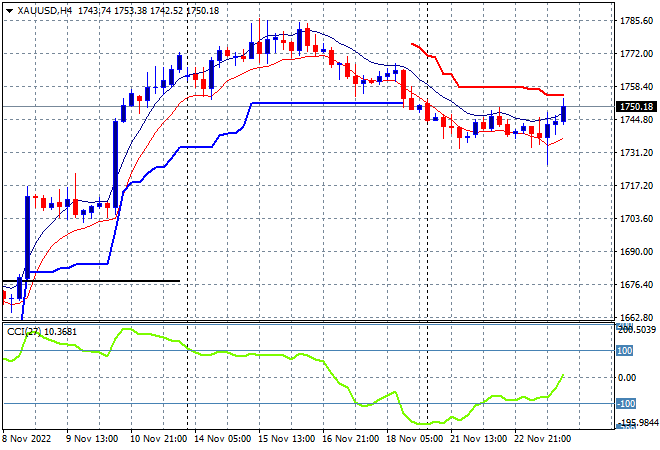

Gold is still trying really hard to stabilise after falling below short term support last Friday and despite other undollars rallying overnight, the shiny metal was still contained around the $1750USD per ounce level. While price action is still well above the October highs (upper horizontal black line) its super apparent that there are no buyers circulating around the $1800 level. Short term momentum is no longer oversold, with building potential for a swing play here to get back to the previous highs or at least get back above trailing support at the $1750 level: