Friday night saw Wall Street break the trend and pull back slightly as other bourses finished a strong trading week. The USD remains on the ropes against almost all the undollars, with Euro hovering around the 1.10 handle while the {{5|Australian dollar}] remains under pressure as interest rate expectation battles continue. 10 year US Treasury yields lifted slightly to remain just below the the 3.5% level while the commodity complex is liking the weaker USD with oil prices holding at the recent highs as Brent crude finished just below the $87USD per barrel level while gold is holding on to its own highs for the year so far, with the shiny metal retracing to just above the $2000USD per ounce level.

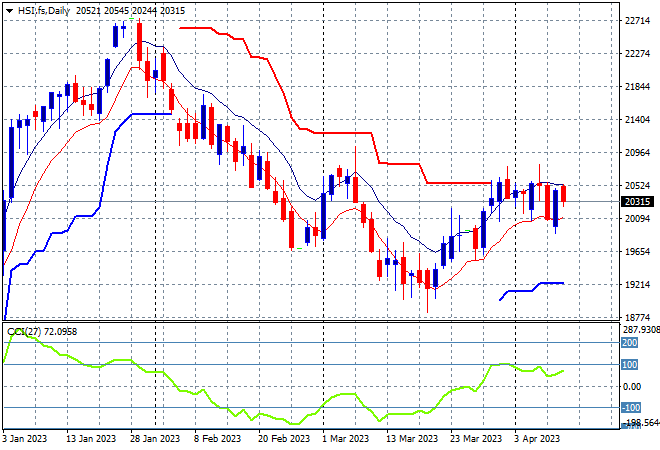

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets rallied going into the close, with the Shanghai Composite up nearly 0.7% to remain above the previous 3300 point barrier at 3338 points while the Hang Seng put on nearly 0.5% to close at at 20438 points. The daily chart is showing resistance building again at the 20500 point level with daily momentum not yet getting into overbought mode, as price action holds at the start of March position. The start of year correction may be over but requires a substantial lift above the current level before calling it a new rally:

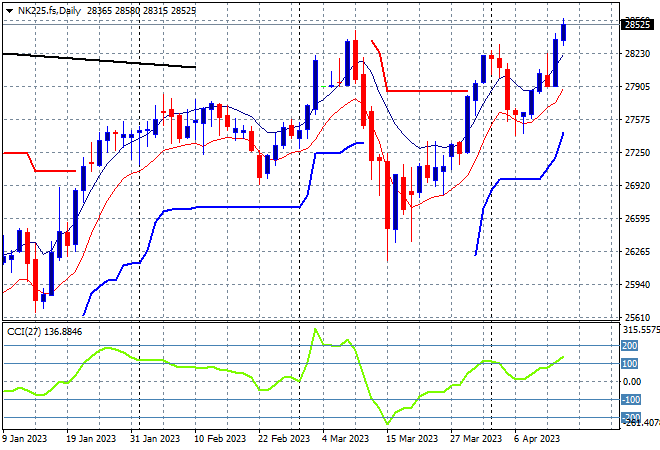

Japanese stock markets however have been able to escape their recent double dip situation with a large close above the previous highs on Friday, with the Nikkei 225 finishing more than 1.2% higher at 28493 points. The previous bounceback looked like a bull trap, but this may have more traction, taking out the March highs with futures indicating another lift on the open despite the small retreat on Wall Street. Daily momentum is now getting back into overbought conditions with support building at the 27000 point area:

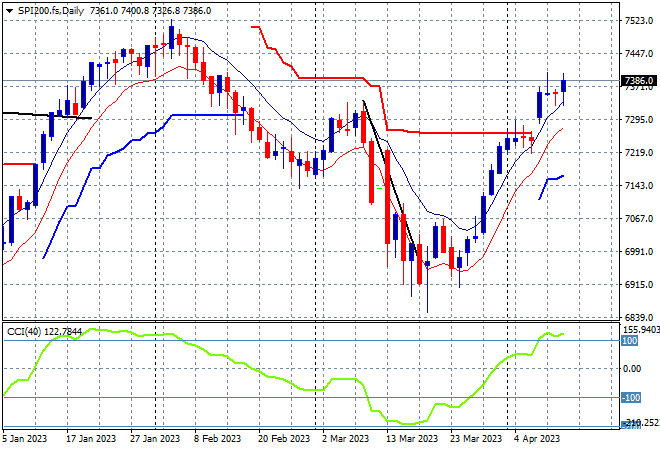

Australian stocks have been able to turn RBA volatility into further gains with the ASX200 closing 0.5% higher on Friday to almost break through the 7400 point level, finishing at 7361 points. While SPI futures are up marginally due to the slippage on Wall Street on Friday night the daily chart shows price action breaking through the March highs and ready to get back to the January high levels as daily momentum becomes nicely overbought and well supported:

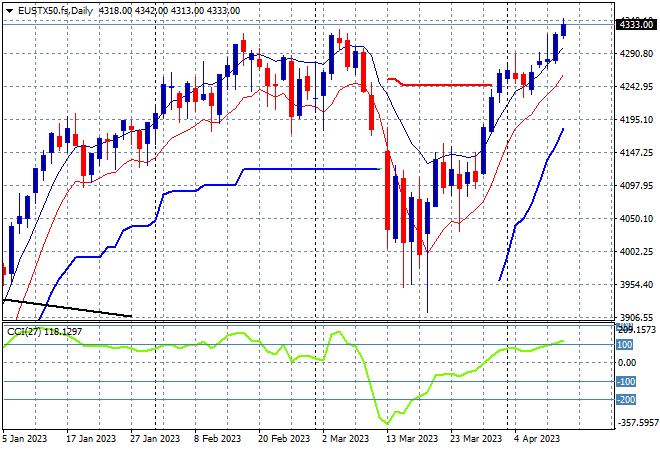

European markets are continuing their bounce back from the mid March volatility with the Eurostoxx 50 Index closing 0.6% higher at 4390 points. Another market that is extending above its previous March highs with daily momentum getting into overbought zone as well. This is setting up for further gains as the normal inverse correlation with Euro is melting away as the union currency pulls the market higher:

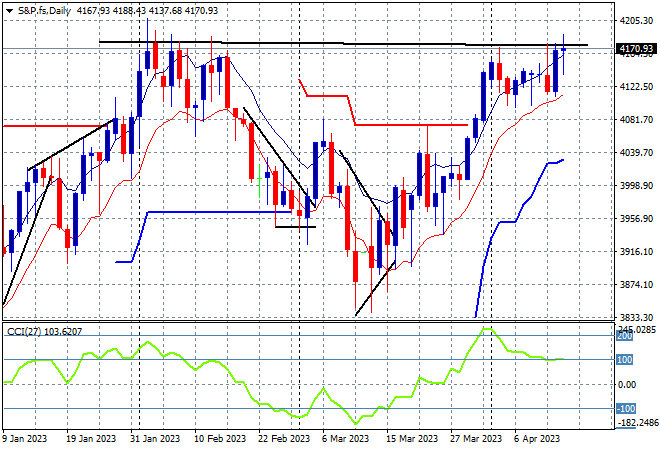

Wall Street however remains the odd one out in terms of beating its start of year highs with a tepid session Friday night that saw the NASDAQ down 0.4% while the S&P500 slipped 0.2% to close at 4137 points. The daily chart shows the previous classic bearish head and shoulders pattern now negated with a flight back up to the 4200 point level but yet unable to cross above those January highs as daily momentum wanes and retreats from the overbought zone. Watch for a potential pullback to the low moving average area that has so far held in this melt up rally:

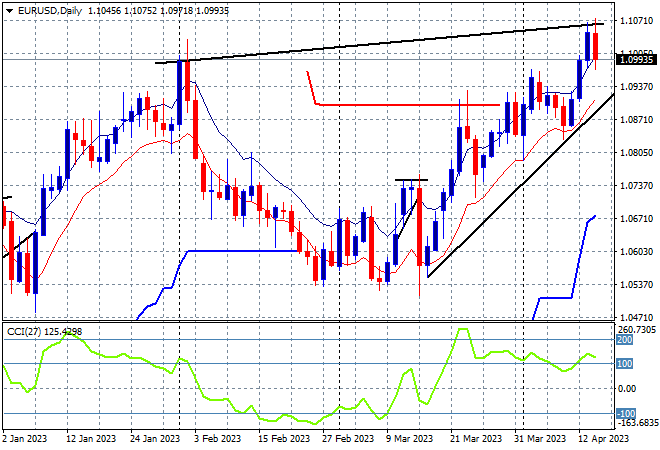

Currency markets remain in an anti-USD funk with the Euro leading the charge again, extending its March rally to exceed the 1.10 handle on Friday night before a late pullback. Recent bank worries are now in the distant pass with the Fed taking the foot of the accelerator causing this shift in undollar appreciation. Daily momentum is still overbought here but the recent price action could provide a pause going into the new trading week so watch for a test of the uptrend line:

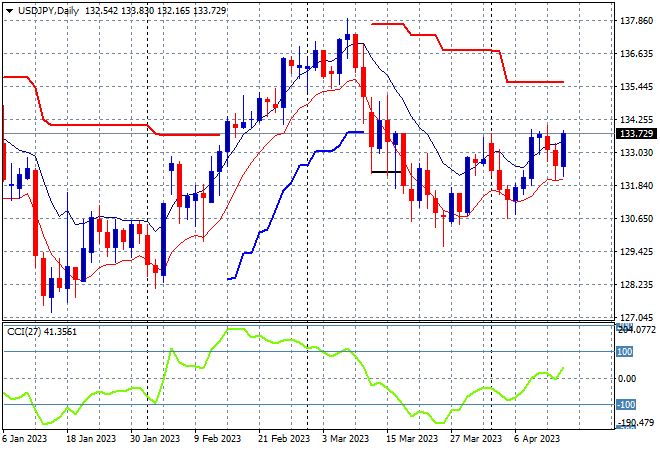

The USDJPY pair is still trying to get out of the dumps after all things USD were sold off, with a small lift on Friday night that still kept it below the 134 level and near its recent daily highs. The daily chart shows a lot of hesitation here despite a return to positive momentum, but still well off the March highs. Short term momentum readings maybe indicating a possible breakout towards the 134 handle but likely short lived:

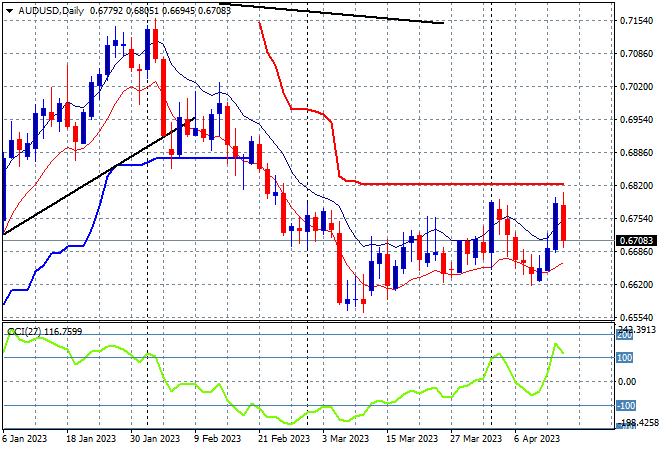

The Australian dollar remains somewhat depressed compared to other undollars with a return to the 67 handle on Friday night despite a recent attempt to breakout of its funk. USD strength is not really the catalyst here as the RBA pauses with overall price action remaining quite weak as domestic economic data falters. Pressure has yet to come off the Pacific Peso as the 67-68 cent zone is confirmed as a key level of resistance:

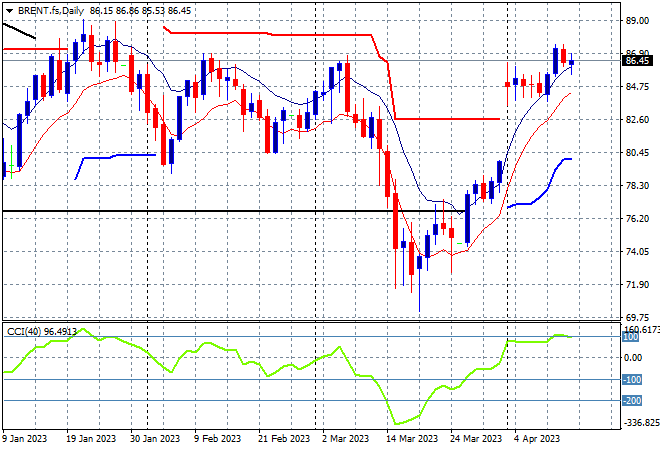

Oil markets remain in highly bought mode again with supply disruptions keeping both markers elevated as Brent crude holds on to the $86USD per barrel level on Friday night. What a turnaround since the March nadirs, getting back to the start of year holding position below the key $90 level. The overall trend from a longer term perspective could still see a rangebound condition that falls back to the December lows around the $78 level so watch for any break below the low moving average on the daily chart as signs of buying pressure exhausting:

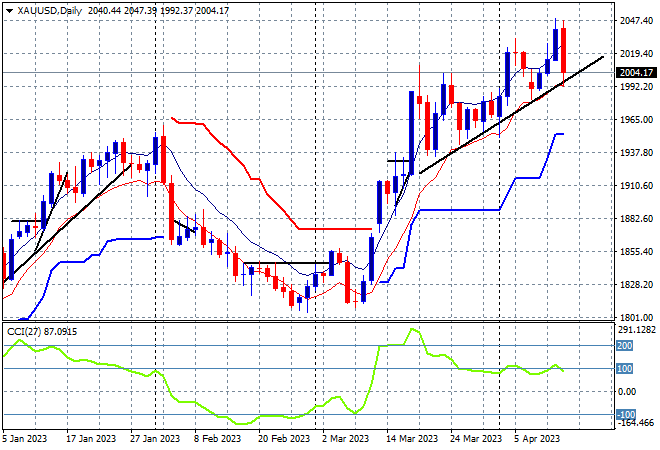

Gold has been on an absolute tear amid the recent financial chaos with a surge that cleared not only the $1900USD per ounce level but through the $2000 level where it remains on Friday night despite a short term failed breakout. Former resistance on the daily chart at the $1850 level is a memory as interest rate expectations change drastically. Watch the tentative trendline from the mid March breakout to remain supported here, although I do note than daily momentum readings are pulling well below previously overbought levels: