It was all about the Fed overnight as the long awaited rate hikes began anew, with a more hawkish outlook also given as “rate rises will be steady” throughout 2022. Potential progress in negotiations between Ukraine and invaders Russia also helped buoy spirits with European shares and Wall Street both continuing their bounceback as the USD lost some ground post-FOMC meeting rate hike. The Aussie dollar had a strong night, almost pushing through the 73 handle while bond markets were largely unchanged, with the 10 year Treasury still trading around the 2.1% to 2.2% level, remaining at a new three year high. In commodity world, oil prices deflated again with Brent crude losing over 2% to retrace below the $100USD per barrel level, while gold actually lifted after some big falls at the start of the week.

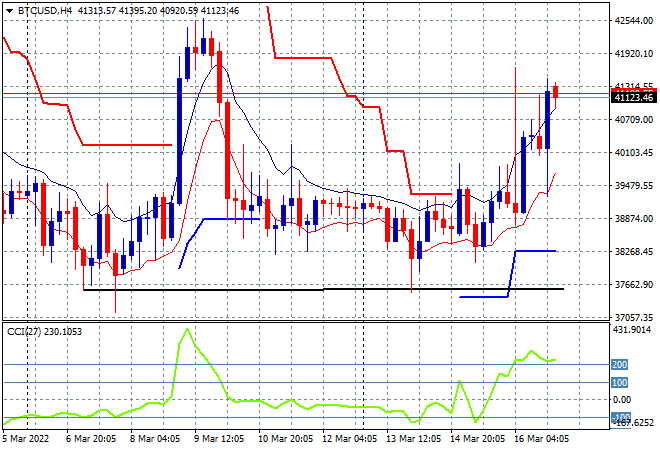

I mentioned yesterday that Bitcoin had seemingly bottomed out here with more intrasession buying and support building now pushing it well above the $41K level overnight that has almost seen it match the previous weekly highs. This is the next level of resistance to get past with short term resistance quite solid here:

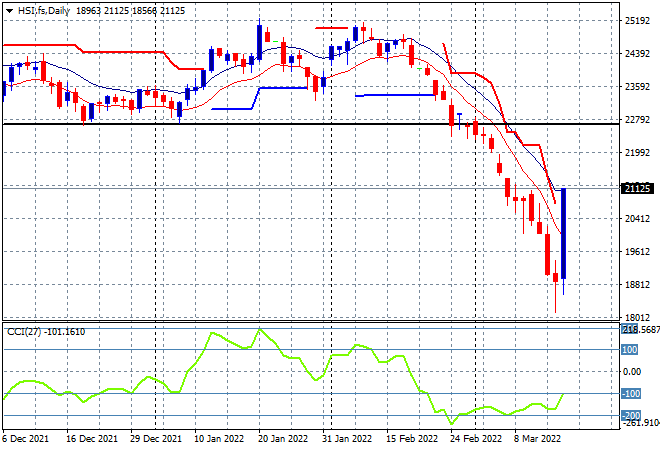

Looking at share markets in Asia from yesterday’s session, where mainland Chinese shares have bounced back extremely sharply after selling off all week, with the Shanghai Composite closing 3.5% higher at 3167 points while the Hang Seng Index is stonking it in, up more than 9% – yes 9% – as it swiftly got back above the key 20000 point barrier, closing at 20087 points. This sort of volatility is not conducive to sound investing, to say the least, with this one off price action clawing back almost half of the recent decline in one fell swoop. Can it be sustained or just short covering?

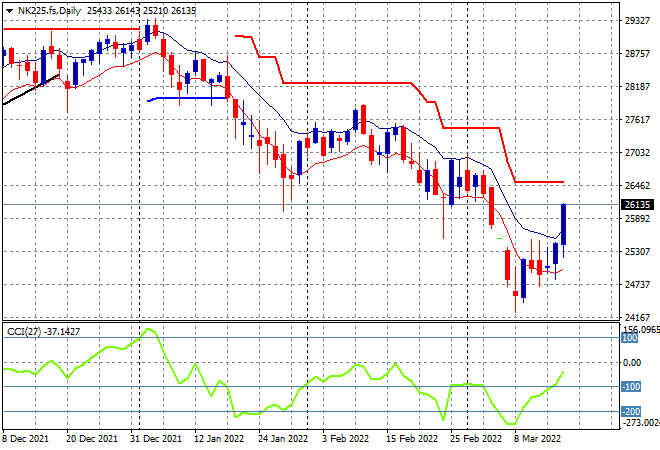

Japanese stock markets advanced in a more modest fashion with the Nikkei 225 closing 1.6% higher at 25762 points. The daily futures chart is showing more potential upside here as the possibility of a bottom is brewing as Wall Street’s surge is likely to be followed through as Yen remains weak post the FOMC rate hike. Watch overhead ATR resistance on the daily chart as the next target here to turn this swing trade into a proper rally:

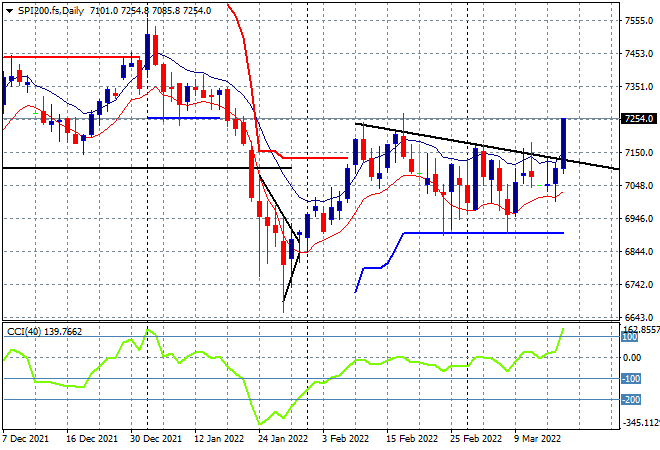

Australian stocks did fairly well, overshadowed by the Chinese rallies with the ASX200 finishing 1% higher to get back above the 7100 point level, closing at 7175 points. SPI futures are up at least 1.5% on the Wall Street moves overnight, despite the much higher Aussie dollar as a result. The lower resistance line overhead should be taken out today as daily momentum flips back into the positive zone:

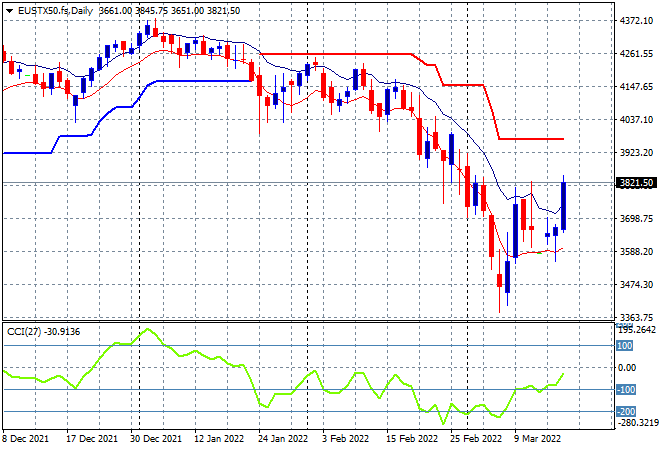

European shares are also looking more promising with solid sessions across the continent, with the German DAX rallying the hardest, pushing the Eurostoxx 50 index up nearly 4% to finish at 3889 points. This negates the dead cat bounce pattern with a solid close above the recent daily high zones and the daily high moving average. To continue this swing trade into a proper rally it needs to clear the 4040 point area:

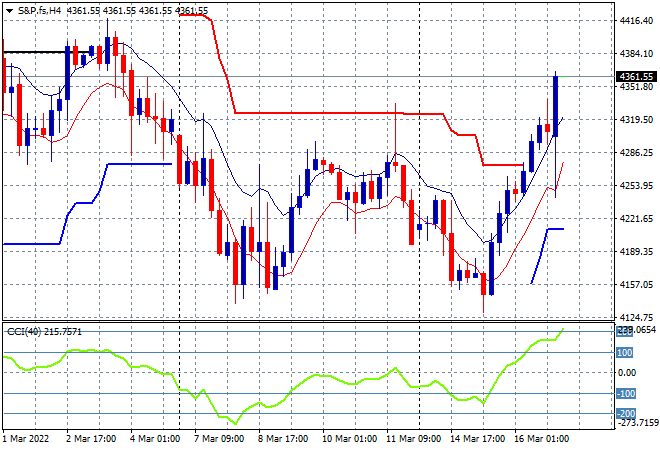

Wall Street loved the Fed certainty and had a similar solid sessions with the NASDAQ finishing nearly 4% higher while the S&P500 gained a little more than 2% to finish at 4357 points. This rally now has price action above both four hourly and daily overhead ATR resistance as it breaches the 4300 point level. The next target is obvious at 4400 points to complete a weekly bottom:

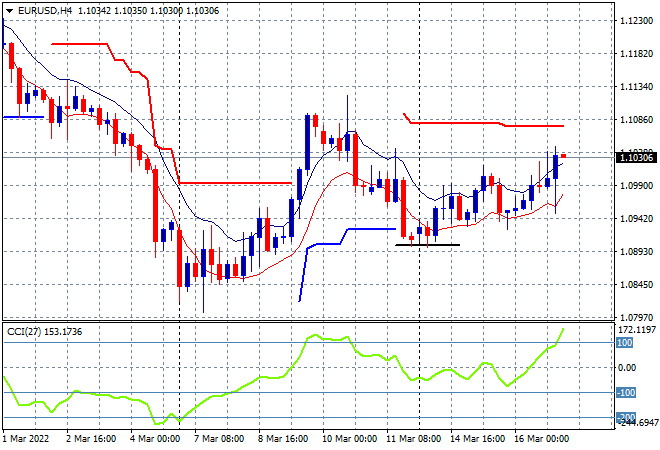

Currency markets were relatively contained given the Fed’s first rate hike with it mainly priced in as USD strength pulled back slightly. Euro remains somewhat supported with a mild lift to finish just above the 1.10 level overnight with the Ukrainian invasion continuing to keep a lid on risk taking here with the four hourly chart still showing hesitation. As I said at the start of the week, watch for a potential break above the high moving average and towards the 1.10 for a snap rally if peace talks take off again:

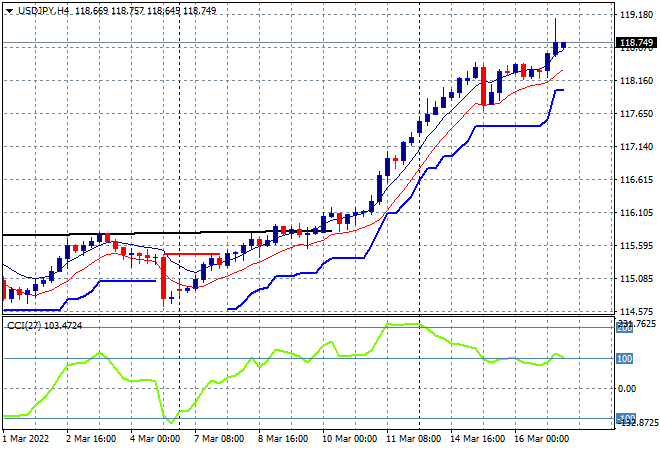

The USDJPY pair continued its push higher, keeping well above the 118 level overnight as the USD becomes the safe haven choice. Momentum has reverted slightly from its extremely overbought status but still looks good here with a series of higher four hourly sessions that are not yet indicating a revert to mean trade. Support seems very strong at the 118 handle where I would place an uncle point in the short term:

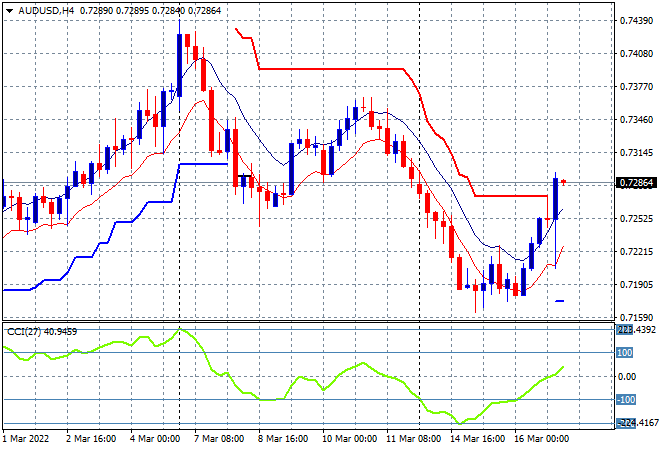

The Australian dollar had one of the biggest moves overnight after seemingly finding a bottom with a swift move up towards but not above the 73 handle even as commodity prices pull back from their recent exuberance. The four hourly chart shows a breach of overhead ATR resistance and return to the previous week’s lows but this downtrend is not yet over so watch for any further consolidation here on today’s numberwang unemployment print:

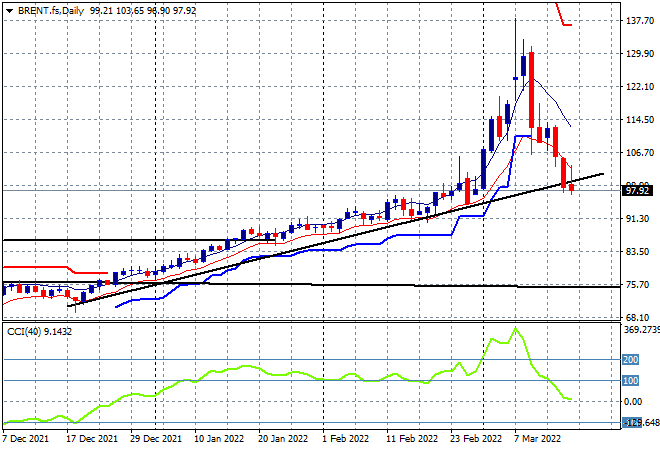

Oil markets continue to deflate here after their recent craziness as Brent crude lost just over 2% overnight, finishing well below the $100USD per barrel level for another solid daily new low, taking all the heat out. Daily ATR support is broken properly as is prior support at the $106 level, so watch for any major pullbacks (and daily closes, not intrasession volatility) below the psychologically important $100USD level:

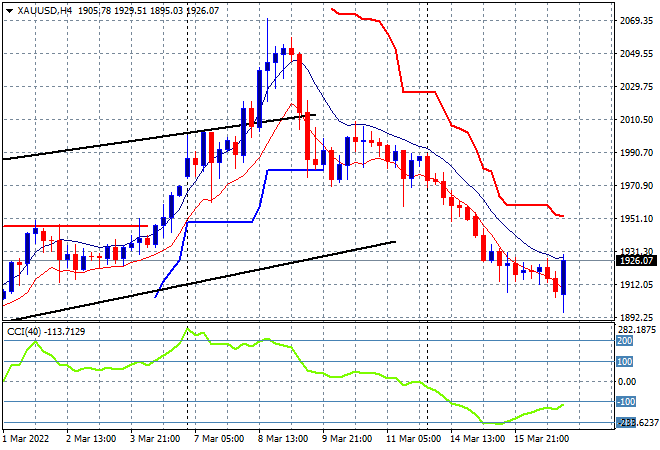

Gold continued its decline pre-FOMC meeting but had a small rally at the end to finish at the $1926USD per ounce level, but still looks quite depressed here on the four hourly charts. Daily momentum is now just at a neutral setting with daily ATR support nominally broken so watch for a further consolidation possibly down to the $1900 level next: