Risk market volatility rebounded to the upside overnight with bounces on European shares and Wall Street in the wake of the US regional bank crisis and the latest US CPI data. The USD came back somewhat on that print which came in as expected but is still strong, with US Treasury yields rising slightly on the data with the 10 year yield almost back to the 3.6% level. Currency markets still want to be anti-USD but paused most of their advances with the Australian dollar up slightly above the mid 66 cent level while the commodity complex saw oil prices breakdown again despite more OPEC production cuts with Brent crude finishing just above the $77USD per barrel level. Gold bugs are loving it however, keeping the shiny metal above the $1900USD per ounce level for a new monthly high.

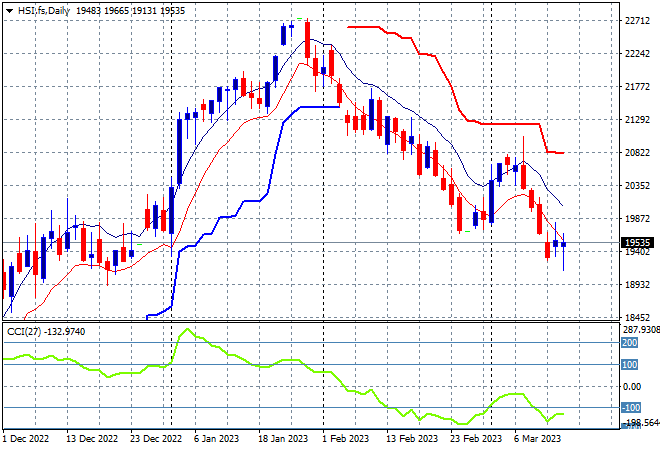

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were down across the board with the Shanghai Composite off by nearly 0.8% to remain below the 3300 point barrier at 3245 points while the Hang Seng slumped again, down 2.3% to take back the previous gains at 19247 points. The daily chart was showing this rollover accelerating as price action retraced well below previous ATR support but could be coming back today if futures are a guide although momentum is still well deep into oversold territory. This correction won’t finish until we see at least one close above the high moving average:

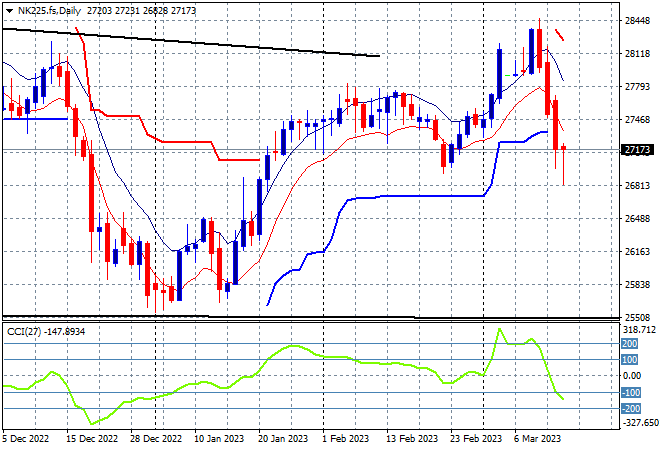

Japanese stock markets remained caught up in the volatility with the Nikkei 225 down more than 2% to 27222 points. The previous bounceback looks like a bull trap, although futures are indicating a possible small bounce on the open due to the moves on Wall Street overnight. Daily momentum has crossed into oversold readings with support now coming up at the 27000 point area which had been previously defended, as the long tails of buying support despite the preponderance of red candles do indicate some deceleration:

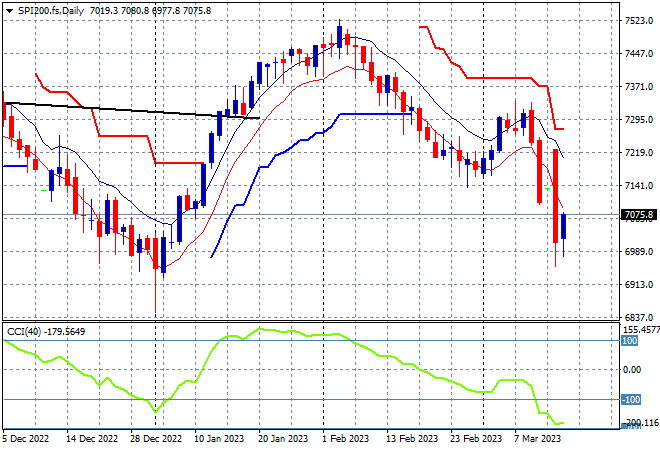

Australian stocks were again unable to escape the selling with the ASX200 closing more than 1.4% lower to almost break through the 7000 point level, finishing at 7008 points. SPI futures are suggesting a small bounce at the open, anywhere from 0.4 to 0.8% in the midst of all this volatility as Wall Street rebounded overnight. The daily chart was showing a clear downtrend after being unable to take out 7500 points, with a retracement below ATR support at 7200 points still in play although it looks like the psychologically important 7000 point level will be defended. Price action still looks really ugly here:

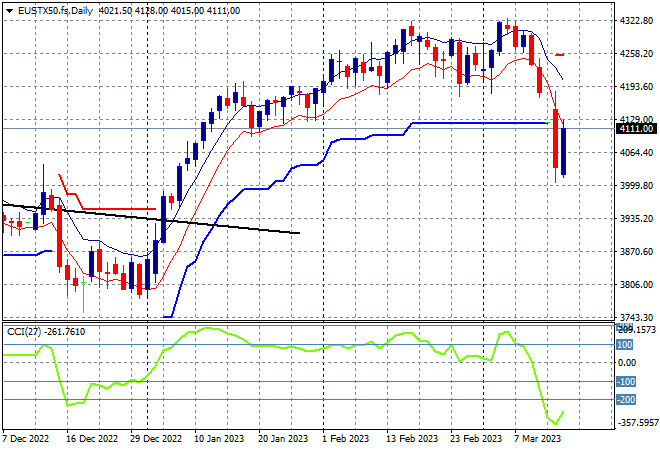

European markets put in some big short covering moves across the continent with the Eurostoxx 50 Index closing exactly 2% higher at 4179 points. It looks like this will hold as Wall Street also rebounded higher, although a small pullback is still on the cards for tonight’s session. This still wiped out most of the post Xmas uptrend with daily momentum now retracing fully from its recent overbought levels to hugely oversold. A higher Euro may create a worse headwind so price really needs to get back above previous ATR daily support at the 4140 point level:

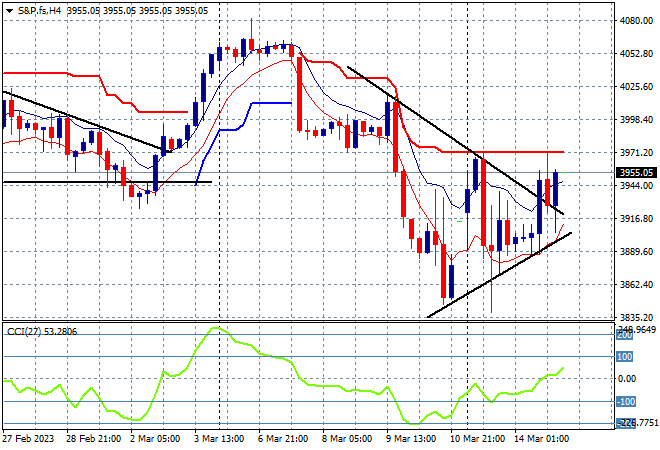

Volatility on Wall Street was finally positive given the CPI data plus Fed intervention with the NASDAQ finishing over 2% higher while the S&P 500 gained 1.6% to close at 3919 points, staving off a new monthly low. The daily chart is still looking like a classic bearish head and shoulders pattern with the right shoulder fully formed as you can see here on the four hourly chart as price action pushes above the upper edge of the symmetrical triangle pattern after almost testing the pre-Xmas 3800 point support area. Short term momentum is out of extremely oversold settings and there is some support building here but resistance overhead could be too high to clear for now:

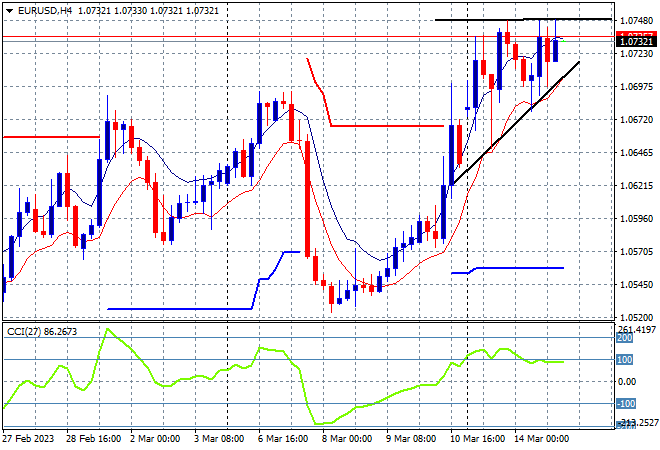

Currency markets remain in a staunchly anti-USD direction across the board, lead by Euro but resistance is now starting to form in the wake of the overnight US CPI print. This move had begun before this volatility, but is pausing at just above the 1.07 level after recently making a two week low. Through the volatility overnight the union currency made new session highs again and again, pushing for a new weekly high here with the potential to continue higher all dependent on how markets react to the rejigging of interest rate expectations:

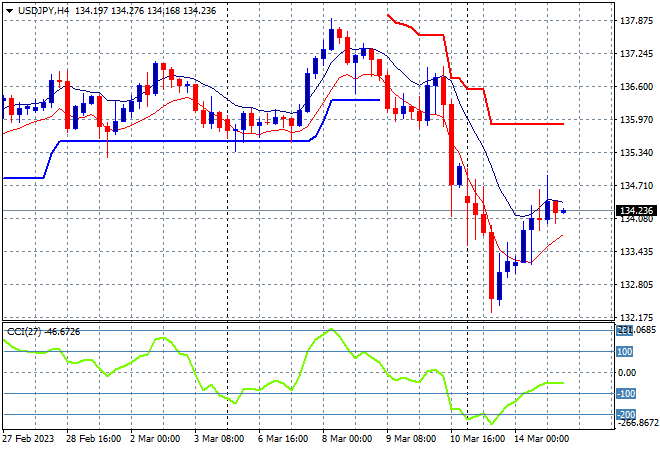

The USDJPY pair is trying to get out of the dumps as all things USD are sold off, with a mild reprieve to remain just above the 134 level late this morning. The 135 handle was the key support level that must hold but this swift reversal of the mid week fling up towards the 137 level shows there’s potentially more downside ahead as price action wants to rollover here. Short term momentum remains negative but no longer oversold with not enough indication yet of upside potential:

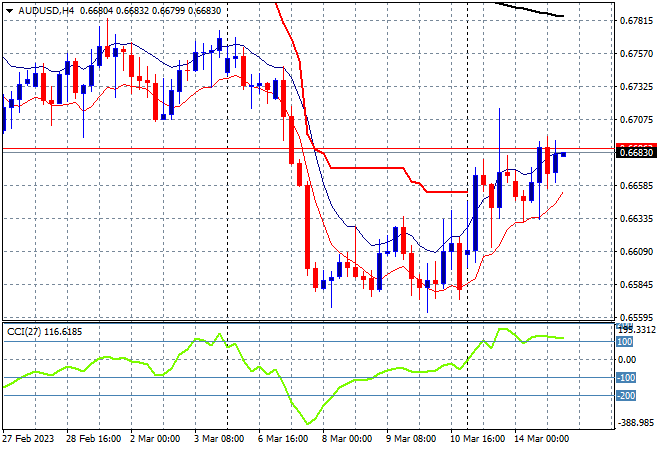

The Australian dollar is trying hard to get out of the dumps here with a continued bounce through the mid 66 cent level staving off any new daily or weekly lows after bottoming out last week. Overall price action had been quite weak following the previous local unemployment numbers that has not yet challenged interest rate expectations but with the Fed looking to ease off the throttle, pressure is now coming off the Pacific Peso. Short term momentum is remaining at mildly overbought settings which could provide more upside but the 67-68 cent zone has a lot of resistance:

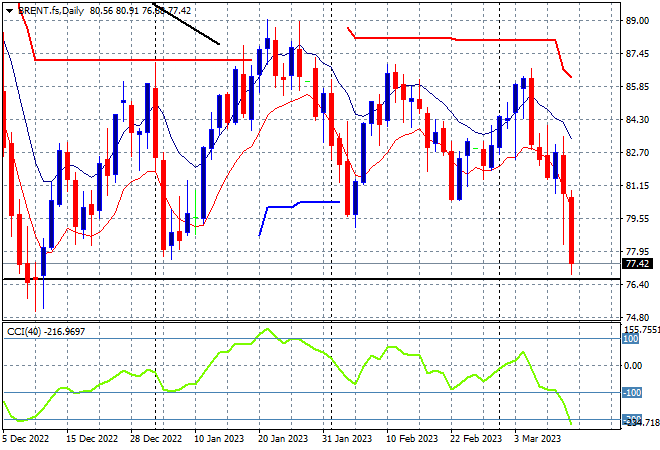

Oil markets were in retreat mode again overnight amid the volatility with Brent crude this time closing at the $77 mark after recently touching weekly lows in the wake of OPEC volatility. Daily momentum had only been nominally positive previously with no new weekly high indicating only a little bit of buying support before this move. Overall however, price action has still failed to beat the $88 highs from January which is the short term target here so watch for a test of the Xmas lows next:

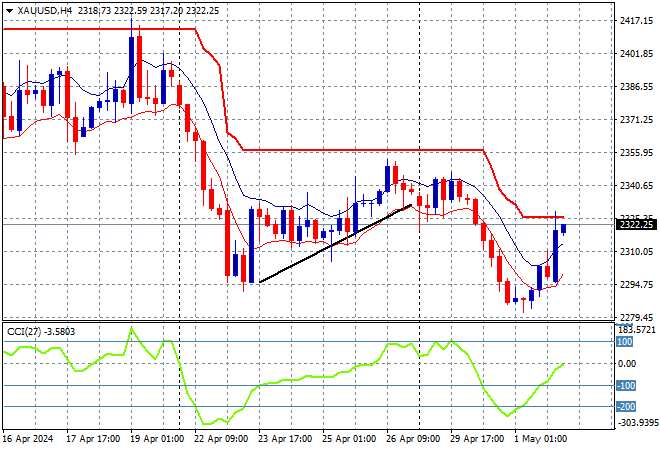

Gold has been on an absolute tear amid the financial chaos with a surge beyond expectations that cleared the $1900USD per ounce level which has so far been supported after getting way ahead of itself, finishing just above that level this morning without any new session lows on the four hourly chart. Former resistance on the daily chart at the $1850 level is a memory as interest rate expectations change drastically although this move could still prove too far, too fast with a possible retracement. Watch support to build at the former resistance level at $1850 closely: