The US PPI print that followed up the softer than expected US CPI print reinforced the notion that US inflation may yet be under control, further sending higher and bond yields dropping further as it seems likely the Federal Reserve will pull back on future rate hikes. Wall Street managed a fourth positive session in a row while European markets have nearly closed the gap on their recent mini-correction.

Currencies were all one way against USD again overnight as Euro hit a new high above the 1.12 handle while the Australian dollar broke through the 68 cent level and everything else undollar fell into line on the sell USD train.

US bond markets saw a big drop across the entire yield curve with the 10 year pulling back another 10 pips to 3.75%, while oil prices put in another new high on the weak USD with Brent crude lifting more than 2% to finish above the $81USD per barrel level. Gold held on to its bounceback to breakthrough the $1960USD per ounce level.

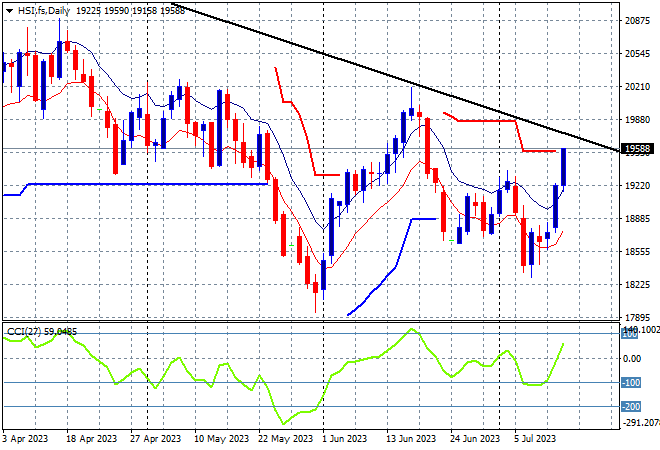

Looking at share markets in Asia from yesterday’s session with mainland Chinese share markets storming out the gate with the Shanghai Composite finishing more than 1.2% higher at 3236 points while in Hong Kong the Hang Seng Index was up nearly 3% in a strong one way move, closing at 19353 points, extending the start of week bounce.

The daily chart is still showing how the 19000 point level as a point of control below the dominant downtrend (sloping higher black line) but as confidence is trying to clawback here after almost touching the May lows we are coming to a possible breakout:

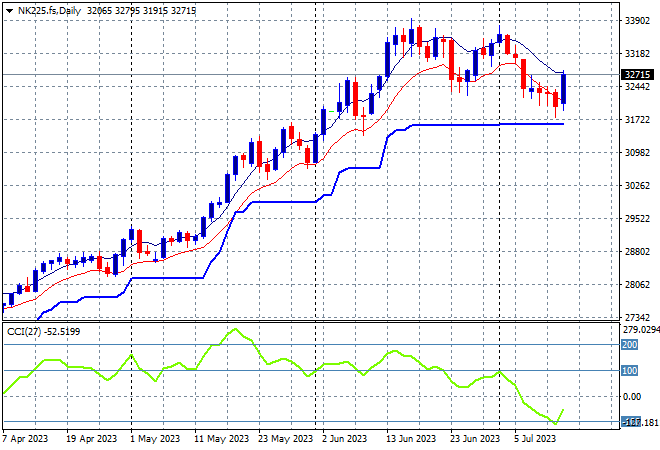

Japanese stock markets are getting in on the action as the Yen appreciation train pauses, with the Nikkei 225 closing 1.5% higher at 32419 points. Futures are indicating a much better rise on the open given the solid result on Wall Street overnight although the fast appreciating Yen is still proving a headwind.

Trailing ATR daily support has paused for sometime now as the market has been going sideways after a big lift recently, with this consolidation possibly turning into a correction. Daily momentum has retraced from overbought to now oversold settings with a further retracement back down to that support zone possible here this week as uncertainty builds:

Australian stocks also accelerated higher with the ASX200 closing 1.4% higher at 7246 points.

SPI futures are up more than 0.6% on the continued upside from Wall Street overnight, with the 7300 point level possibly under threat next. Medium term price action remains on a downtrend however with the daily chart just oscillating further down despite this continued bounce. Resistance overhead at the 7200 to 7300 point zone is the area to really watch:

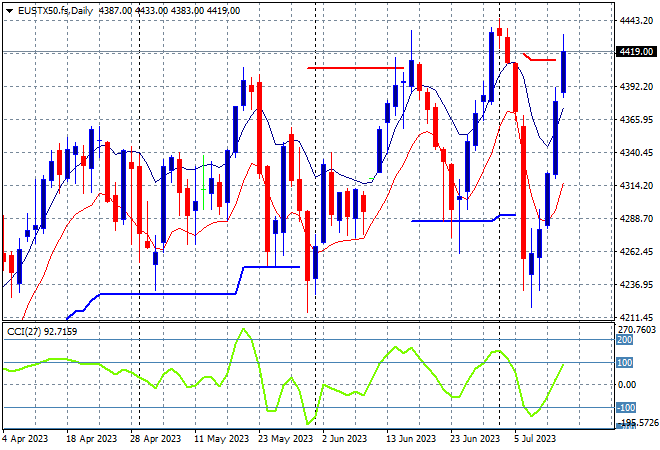

European markets have now been able to clawback most of their recent big losses with the Eurostoxx 50 Index lifting another 0.7% higher to 4391 points.

The daily chart showed this potential bull trap building even though weekly support at 4200 points had been continually defended, with weekly resistance at the 4350 points level the actual area to beat. Support this week has been broadly defended at 4200 points, touched three times now in as many months as this chart almost looks like an inverse of the ASX200 above, ready to burst higher:

Wall Street continued to find recently lost confidence on the back of the recent CPI print as the NASDAQ closed more than 1.5% higher while the S&P500 lifted over 0.8% to finally get past the 4500 point level.

The four hourly chart was showing robust support around the 4430 point level after the market continued to stall against the monthly downtrend from the 2021 highs. Another test of the 4500 point level is now probable as uncertainty of the Fed’s direction is cleared up quickly with last night’s follow up PPI print:

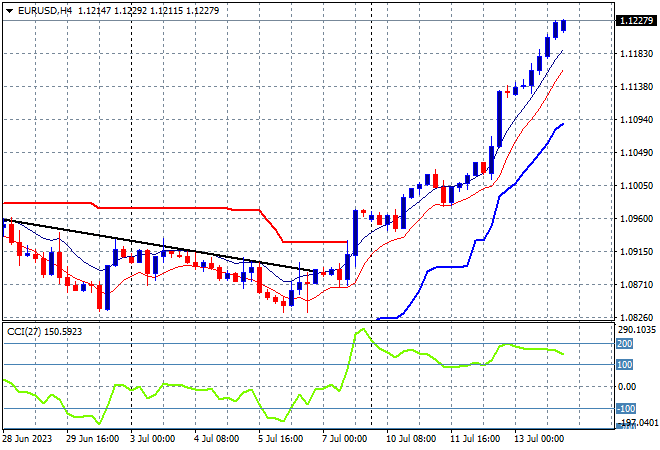

Currency markets continue to go one way against USD which is usually not a good sustainable trend but its working for now, with the follow up to the soft June US CPI print and now PPI undershooting is reinforcing the catalyst for more USD selling across the board. Euro led the charge once again, extending well above the 1.12 handle.

The union currency had been on a weekly downtrend with a small bounce but that has now turned into a new monthly high as the 1.10 is tested and found supportive for further upside. This move takes out all of the recent downside action, with short term momentum now back in extreme overbought mode with a possible pullback likely as we end the trading week:

The USDJPY pair was in a deceleration phase after its big reversal from Friday night, having lost over 400 pips but continued the selling overnight as expected with the soft CPI print, retracing just below the 138 handle.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause wasn’t enough before the NFP print to steady concern with one way price action. Four hourly momentum was looking to get out of oversold mode with the return to the June lows at the 140 level providing a possible support level but this was blown through quickly and may prove resistance ahead:

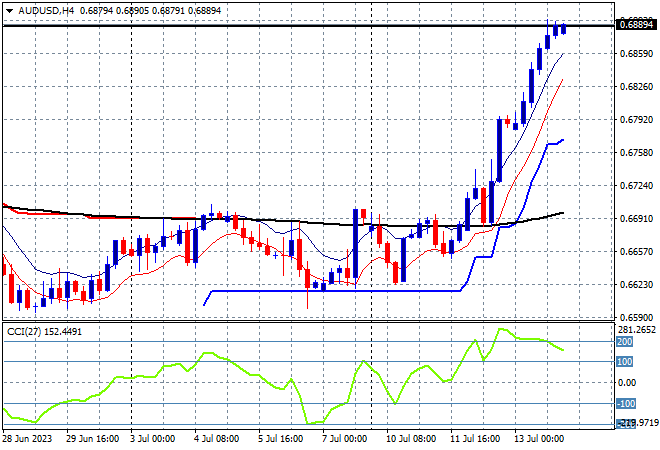

The Australian dollar is now matching its June highs just below the 69 cent level versus USD after getting on the sale train and after suffering under a lot of pressure following the RBA pause last Tuesday.

Recent price action put ATR resistance and 200 EMA (black line) levels under threat but once the 67 handle was broken just before the CPI print this led the floodgates open, although short term momentum is overextended and likely to presage a very small pullback today:

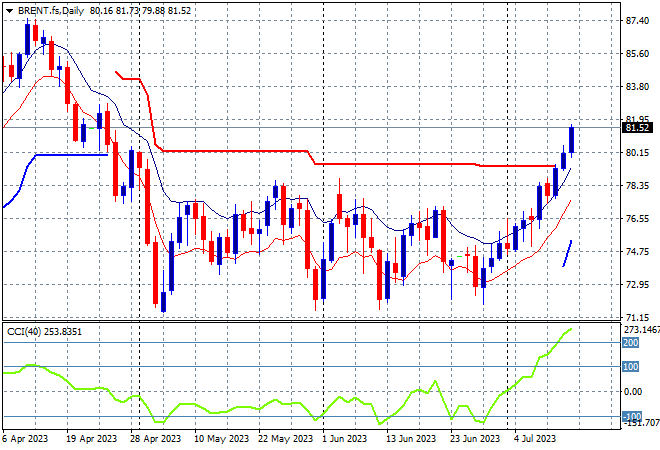

Oil markets are really taking advantage of the weaker USD and potential OPEC+ production cuts with another new session and closing high as WTI and Brent crude lifted more than 2% with the latter extending past the $81USD per barrel level.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now finally threatening overhead resistance at the $80 level. Daily momentum has picked up strongly into overbought readings with price action now clearing the last couple months of resistance:

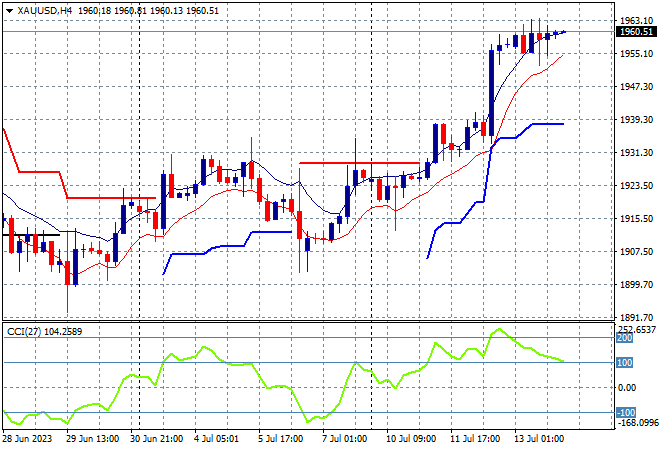

Gold is also being helped by the weaker USD after recently threatening to rollover through the $1900USD per ounce level, but is now pushing through the $1960 level although short term movement looks like stalling here.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1900 but this bounce and fill through the $1930 level alongside other undollars looks to be one way in the short term: