Well, there it is. Stocks lost there mettle on Friday night on both sides of the Atlantic and sold off sharply, bringing the whole risk edifice down with them. This all but confirms a new bear market in stocks as the various central bankers hit the breaks hard in their losing battle against inflation. The USD smashed everything undollar except gold with Euro, Pound Sterling and the commodity currencies all suffering, with the Australian dollar almost breaking through the 70 cent level. Bond markets saw a lifting of yields to new yearly highs with 10 Year Treasuries now pushing up through the 3.3% level for a four year high. Commodity prices fell back but oil remains strong, with Brent crude still above the $120USD per barrel level, while iron ore and copper dropped 2% as gold proved the most resilient to put in a new weekly high at just below the $1880USD per ounce level.

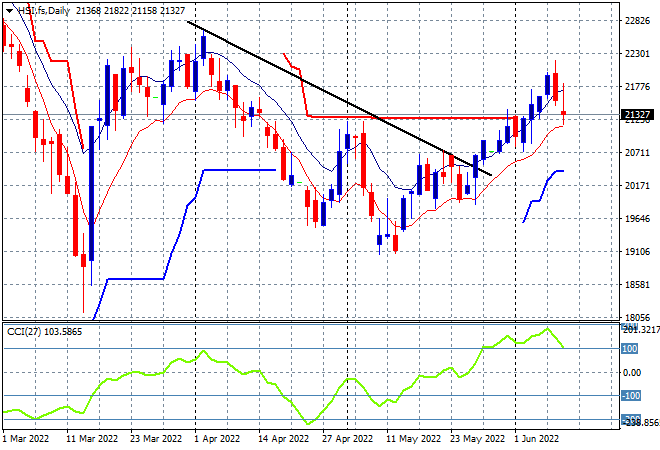

Looking at share markets in Asia from Friday’s session, where Chinese share markets were the odd ones out, with the Shanghai Composite closing some 1.4% higher to 3284 points while the Hang Seng Index remained unsteady, eventually closing down 0.3% to remain below the 22000 point level at 21806 points. The daily chart was showing price accelerating after breaking above trailing daily ATR resistance at the 21000 point level with overbought daily momentum helping translate into greater highs, but this stumble in line with other risk markets could remove the March highs near the 23000 point level as the next target:

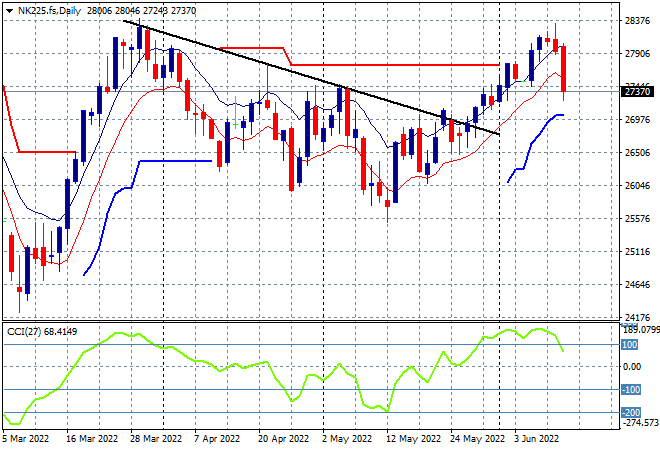

Meanwhile Japanese stock markets pulled back the sharpest, with the Nikkei 225 index closing down 1.5% at 27824 points. The daily futures chart of the Nikkei 225 was showing a strong move back above the previous daily/weekly highs, with the March highs also in sight but now stalling where it matters most as it fails to clear that high as resistance proves too strong. Daily momentum has retraced from its nicely overbought position and while the much weaker Yen has helped here, futures are indicating its not enough to forestall correlated risk sell offs as it looks like a correction is imminent:

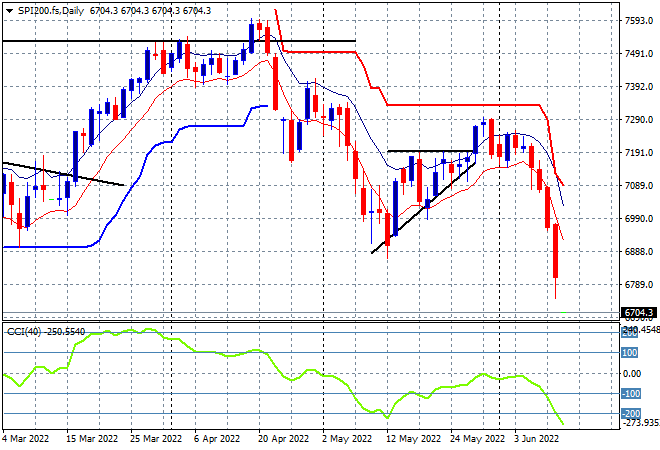

Australian stocks continued their selloff with the ASX200 down more than 1.2% finally cracking through the 7000 point level to close the week out at 6937 points. SPI futures are looking to crush the open, down at least 1.5% or over 120 points on the big falls on Wall Street on Friday night. The May lows will be completely taken out in this move and pushes Aussie stocks into bear market territory:

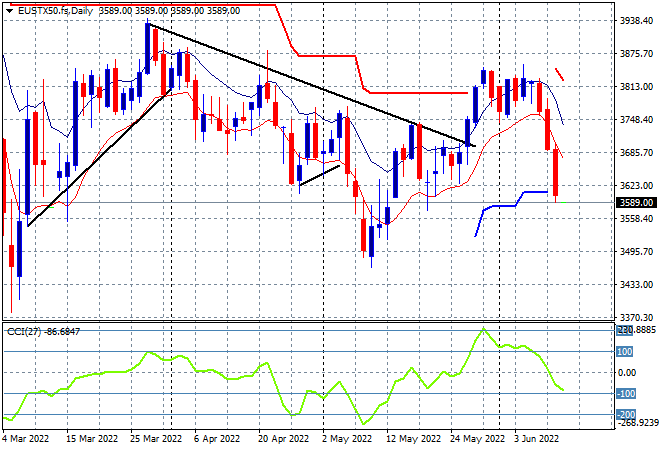

European stocks started the selloff with big falls across the continent and Brexit-land, with the Eurostoxx 50 index eventually finishing more than 3% lower at 3599 points. The daily chart picture was showing a breakout condition that stalled above the trailing ATR resistance level with subsequent lower daily lows indicating there wasn’t enough buying support before this selloff. As I said last week a return below the weekly downtrend line, with 3600 points as the next target was likely and here we are with the May lows at 3450 points next to fall:

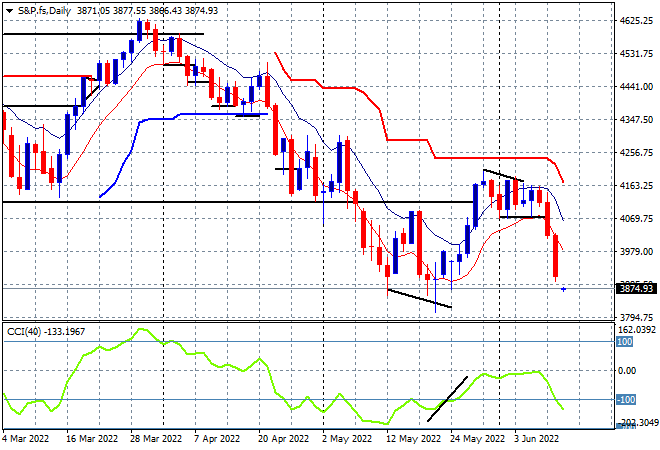

Wall Street was dumped across the board, with 2-3% losses across the three main bourses. The NASDAQ led the way with the steepest falls, down more than 3.5%, almost back to the May lows while the S&P500 lost 2.9% to finish exactly on the 3900 point level. The daily chart is showing a return to the May lows but not yet a retracement below them which would confirm a new bear market, after this dead cat bounce has ultimately failed:

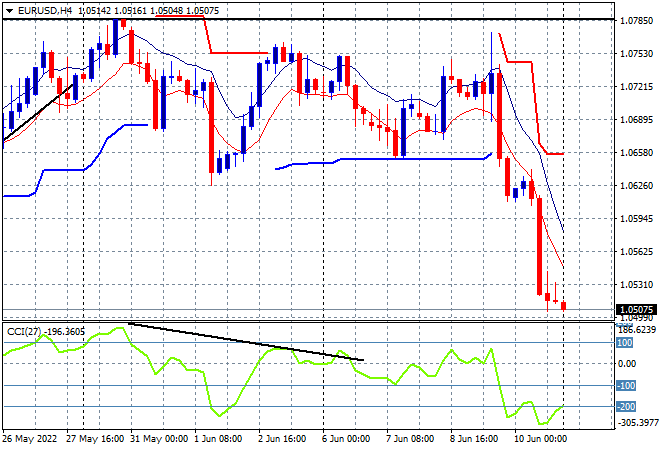

Currency markets had even greater volatility as the perennially strong USD crushed all the undollars yet again with a strong risk off mood across the complex. Euro led the charge again, following last week’s ECB meeting with the union currency pushed straight down into a new weekly low at the 1.05 level confirming the bearish weekly rounding top pattern. Price action had been contained by resistance at the 2020 lows (upper horizontal black line), for sometime now, with this crushing move setting up for a new run back to parity:

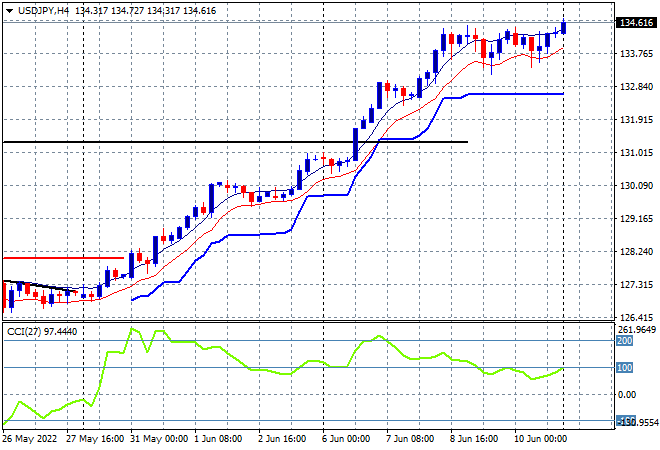

The USDJPY pair was the most stable pair again, even putting in a slightly new high as it remains resilient above the 134 level, having broadcast for awhile now that USD is still dominant. Short term momentum has slowly retraced from highly overbought levels but is building yet again, suggesting more upside action. Continuing to use trailing ATR support here will lock in profits and indicate any turning of the tide:

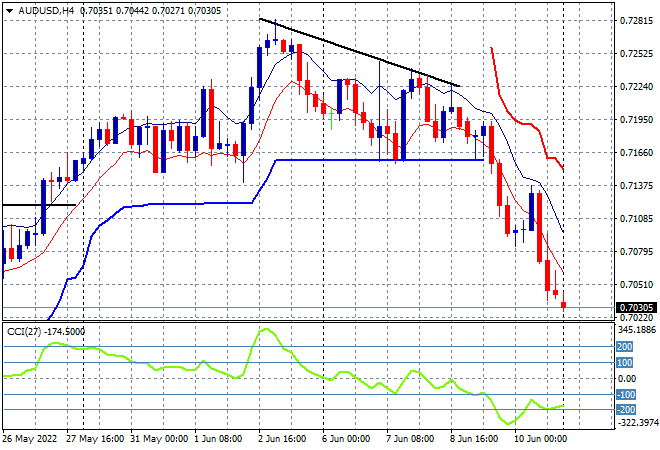

The Australian dollar was hit hard again following the previous session moves, this time moving straight down to the 70 handle for a new monthly low, as the recent 50 bps rise by the RBA becomes a distant memory. The USD is going to crush the Pacific Peso, with momentum hugely oversold and price action retracing all of the previous monthly gains and back below the previous weekly resistance level:

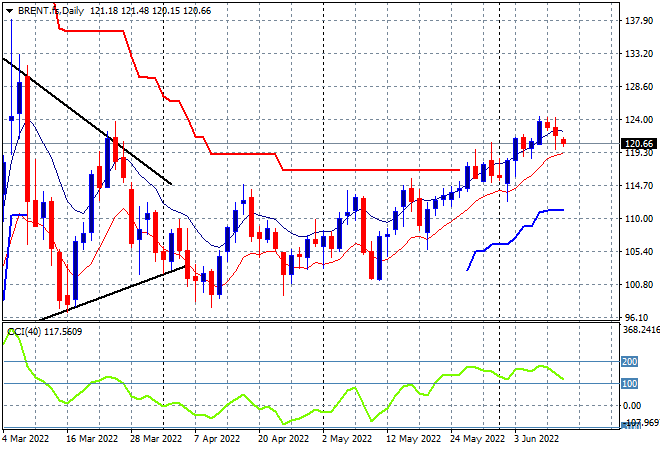

Oil markets are still absorbing the risk off volatility relatively easy aplomb with Brent crude retracing slightly on Friday night to be just above the $120USD per barrel level, with the weekly trend quite intact. Daily momentum remains nicely overbought, although is rolling over slightly, and price continues to be supported at the $115 area very firmly, so my contention of a return to the Ukrainian invasion highs at or above the $140 level still holds as long as price stays above the low moving average:

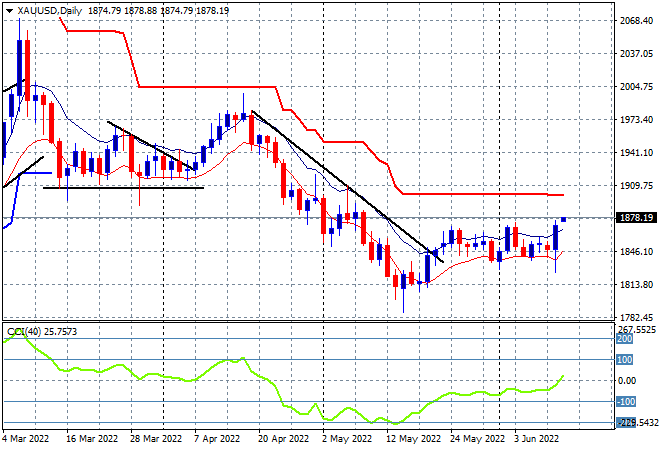

Gold was the odd one out and finally became a risk off play, jumping up to a new weekly high to close out just below the $1880USD per ounce level. This leapfrog of the $1850 wobbly support level signals a big change here and while early days yet, daily momentum has finally switched to positive for the first time since the decline started in early April. The next level to keenly watch is obviously trailing overhead ATR resistance that has not been under any threat for quite some time now: