Markets had already priced in the latest ECB meeting rate hike, with a 75bps rise barely registering on currency and equity markets. Wall Street continued its rebound while the USD was largely unchanged against the major currency pairs as the Aussie dollar remains below the 68 cent level. On bond markets, 10 year Treasury yields went back to their three month high at the 3.3% level with the next Fed meeting expectations firming again at a 75bps rise. Crude oil saw a minor lift with Brent up 1% while copper retreated above the same while gold returned to its recent lows just above the $1700USD per ounce level.

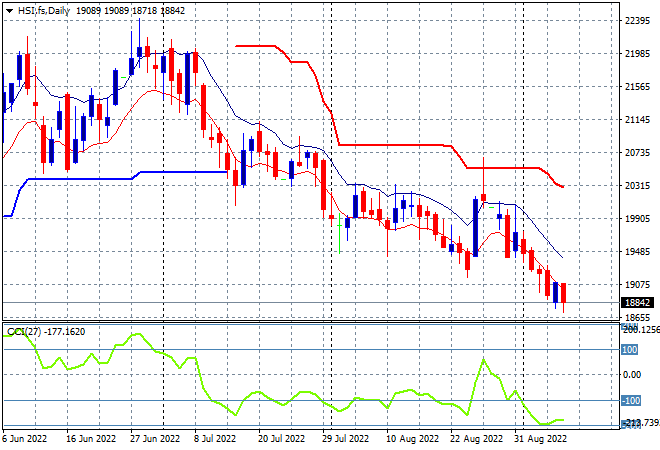

Looking at share markets in Asia from yesterday’s session, where Chinese share markets had a mild pullback with the Shanghai Composite down 0.3% to 3235 points while the Hang Seng Index is still in sell mode, losing exactly 1% to slump below the 19,000 point level, closing at 18854 points. The daily chart remains in a very bearish mood here with daily momentum extremely oversold and price action at the lower edge of the moving average channel as price action continues to fall below the May lows. This could be a bit too over extended and may result in a sharp swing rally soon, but there’s a distinct lack of buying support here:

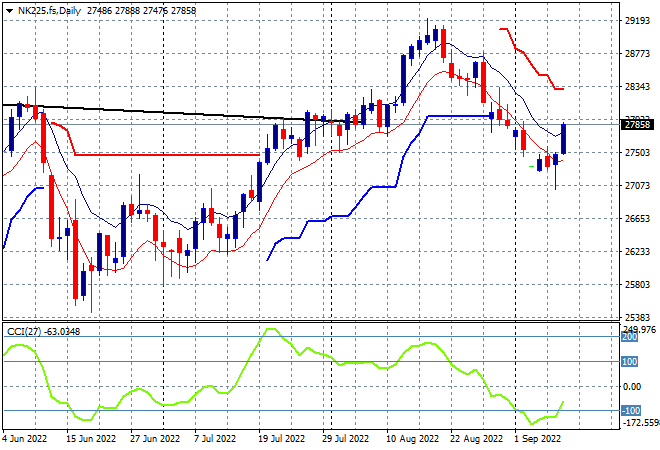

Japanese stock markets were the standouts however, despite the higher Yen, with the Nikkei 225 closing 2.3% higher to 28065 points. The daily chart is showing that considerable dip below the trailing ATR support level at the 28000 point area starting to be refilled as price heads back to the early August highs. Daily momentum has now inverted from extremely oversold to nominally negative settings, which is setting up nicely for a swing play here into the end of the trading week. Futures are suggesting more upside potential here as the 27000 point level turns into support:

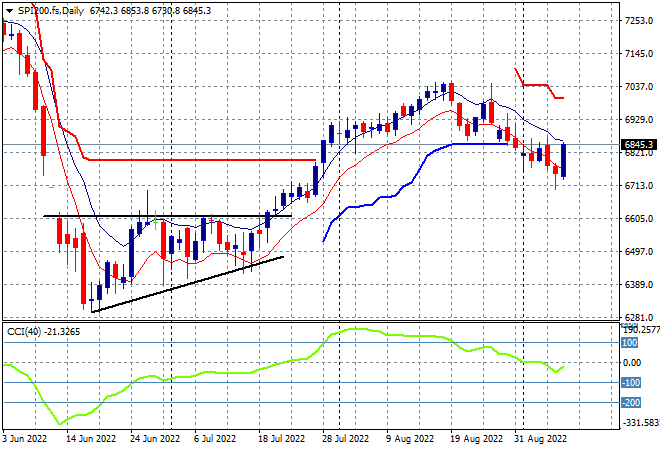

Australian stocks surged back, basically in line with overseas stocks despite lower commodity prices with the S&P/ASX 200 closing 1.7% higher at 6848 points. SPI futures are relatively flat despite the modest lift on Wall Street overnight. The daily chart shows price action just elow previous trailing ATR support at the 6900 point level, but yesterday’s rebound on the temporary reversal in risk sentiment could still be another part of this months long dead cat bounce:

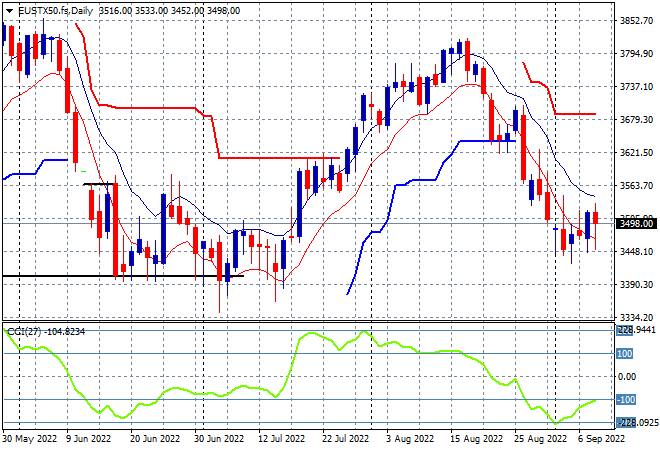

European stocks were largely positive again, with only the German DAX putting in a minor scratch session as risk sentiment improved as the ECB meeting finally came and went, giving stark direction to risk markets. The Eurostoxx 50 index eventually finished 0.3% higher at 3512 points. The daily chart was showing a tentative deceleration in price falls as price action slid down into the June lows at the 3300 level with a possible bottom forming here at the recent daily lows. Daily momentum got slightly overextended here and continues to signal a small swing trade higher:

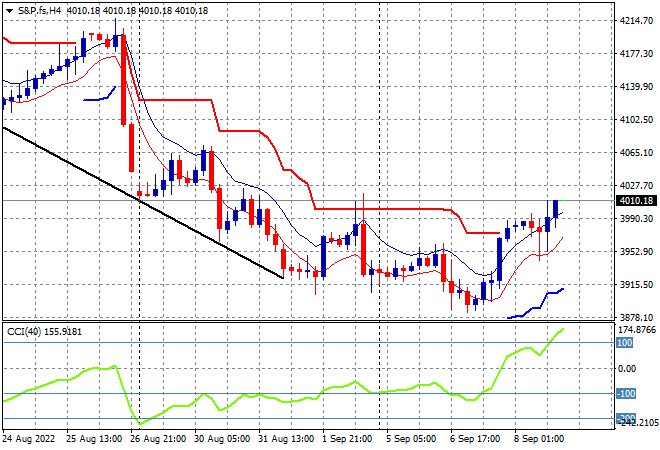

Wall Street had a second positive session in a row – something to be joyous of in this bear market – with the NASDAQ gaining more than 0.6% while the S&P500 finished exactly 0.6% higher to finally clear the 4000 point level, closing at 4006 points. The four hourly chart was showing a small deceleration move in the first half of the week and the selling exhaustion has now set in with a positive swing in momentum that has finally cleared the 4000 point level. However, as I said yesterday, its still early days so I would like to see another positive session tonight before calling this a new rally:

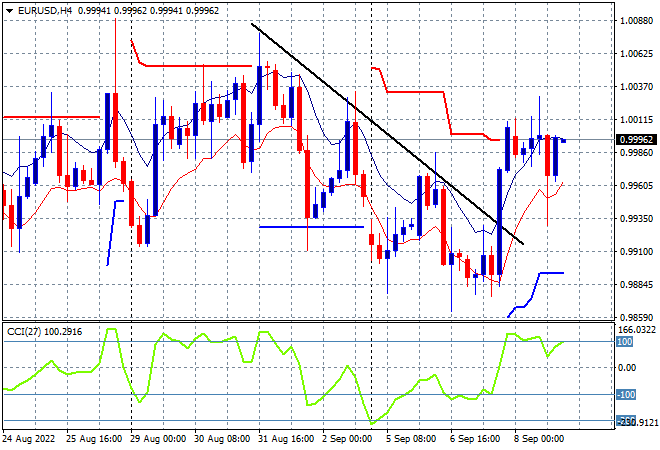

Currency markets were largely unchanged in the wake of the ECB rate hike and maintained their positions following the recent in sentiment. The USD is still in a strong position against most of the currency pairs, with Euro wavering at the parity level after recently testing new lows at the 98 handle and breaking the very short term downtrend line from last week’s highs. I still contend that parity has now turned into permanent resistance, but am watching for any breakout above that level:

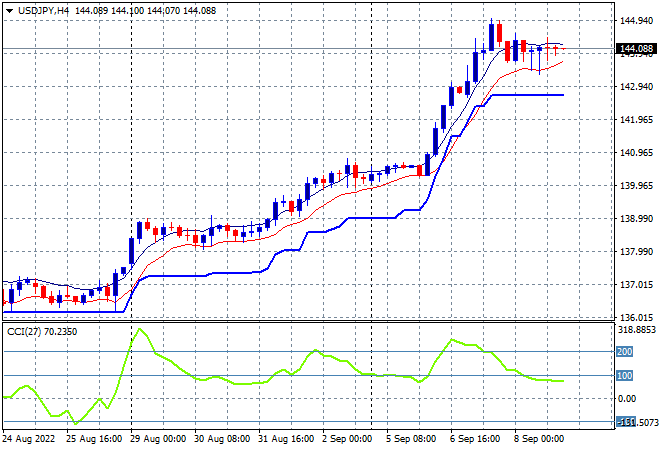

The USDJPY pair pulled back in the previous session and has remained at just above the 144 handle ever since in a very low volatile trading environment, unable to get back above the high moving average on the four hourly chart. Four hourly momentum has reverted from its overbought status but is still very positive and I still contend I wouldn’t be concerned even if this retraces back to trailing ATR support at the 142 handle:

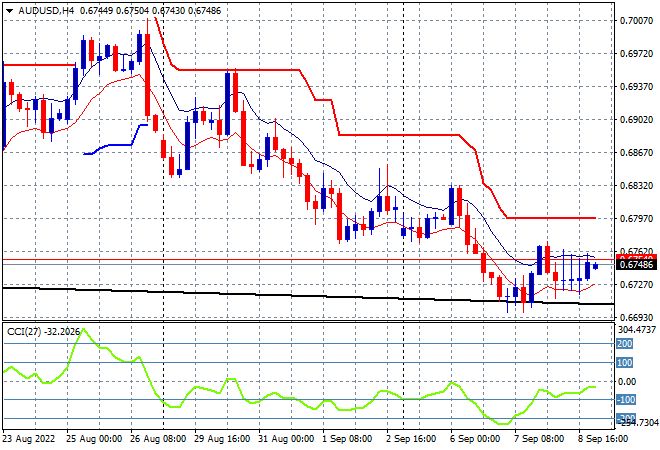

The Australian dollar was also relatively sanguine, unable to find a bid and still looking very weak against USD as we head into the end of the trading week, still at the mid 67 this morning. Resistance is just too strong at all the previous levels with the 68 handle possibly turning into the next long term resistance level. The recent weekly lows are no longer an anchor but a memory for the Pacific Peso:

Oil markets are not finding many buyers after accelerating in their selloff with recession concerns ramping up across the complex. Brent crude gained just under 1% to get back above the $88USD per barrel level overnight but daily momentum remains nicely oversold as price action is still stuck below the recent weekly lows. This could turn ugly, so watch for further session lows as the $100 level becomes very strong resistance:

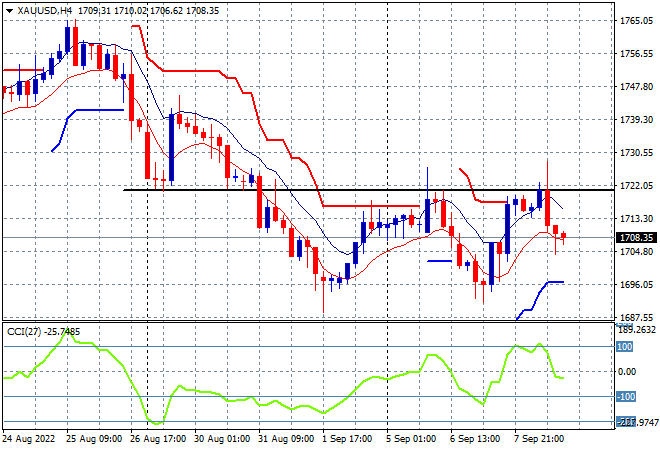

Gold can’t get a break either, proving that the commodity proxies like Aussie and Loonie remain under the thumb of the USD, with the shiny metal returning to its start of week position at the $1708USD per ounce level. Short term resistance at the $1722 area is proving too strong, with the four hourly chart showing momentum readings reverting sharply back to neutral settings at best, so watch for another return to the $1700 level: