Wall Street was again unable to advance overnight through a somewhat volatile session on both sides of the Atlantic, as European shares also stumbled on the growing conflict in Ukraine with the risk complex focusing more on next week’s FOMC meeting.

Currency markets remained under the sway of King Dollar despite the Canadian central bank surprising with a rate hike, with Euro still depressed below the 1.07 handle while the Australian dollar pulled back slightly from its post-RBA rate hike gains to just above the mid 66 cent level.

Meanwhile US Treasury yields lifted sharply on the Canadian hike with the 10 year up some 9 pips to almost through the 3.8% level while oil prices pulled back slightly, with Brent crude again finishing just above the $76USD per barrel level. Gold was hit hard with the pro-USD mood, losing over $20 to finish below the $1940USD per ounce level.

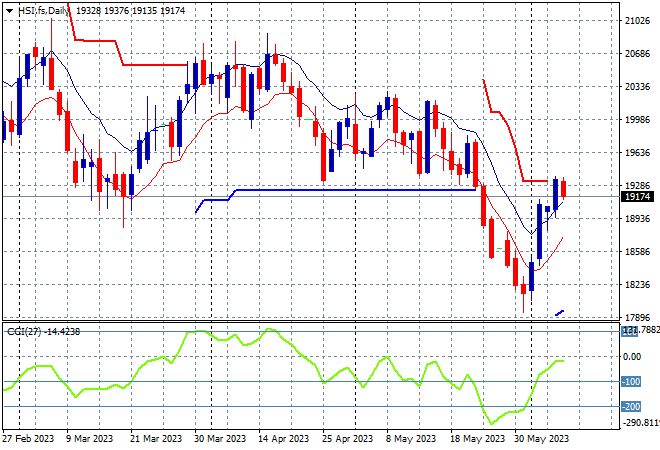

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were dead flat with the Shanghai Composite hovering just below the 3200 point level while the Hang Seng Index is up 0.8% to extend its gains above the 19000 point level.

The daily chart has been showing a decline through support at the 19500 point level with what looked like a terminal decline back to the start of year correction level well below 19000 points with a failure to make any new weekly highs since early April. This looked poised for another breakdown but several strong bounces is seeing the 19000 point level come under threat so watch daily ATR resistance here to break to make this bounce stick:

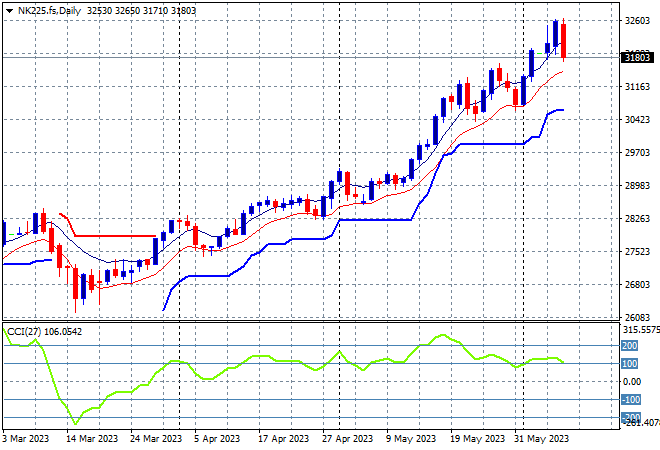

Japanese stock markets are finally putting on the brakes with the Nikkei 225 closing more than 1.8% lower at 31913 points. Futures are indicating some potential downside on the open that could finally arrest the current trajectory which looks unsustainable.

Trailing ATR daily support keeps ratcheting higher as the 32000 point level is now breached with daily momentum still above overbought settings as this market remains very well supported by a weaker Yen. But I do wonder how sustainable this is with the current daily candle looking very toppy indeed:

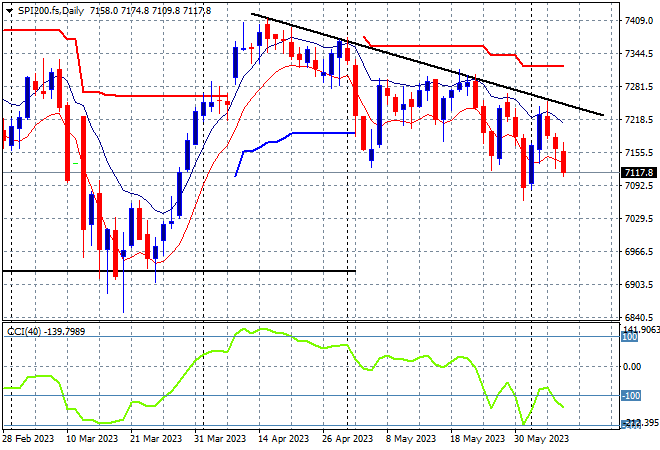

Australian stocks are licking their wounds with ASX200 closing just 0.1% lower at 7116 points.

SPI futures are down a modest 0.2% following the volatility on Wall Street overnight with that entrenched downtrend still leading to an unsettled market again. Daily momentum is switching back to the oversold zone as price action remains near its new monthly low.

Price action has been unable to break above the high moving average band with anchoring around support at the 7100 point area:

European markets had very mild scratch sessions overnight as all eyes remain on Ukraine with the Eurostoxx 50 Index drifting some 0.1% lower to finish at 4291 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but support at the 4200 point level has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next or further consolidation is likely as this market slides sideways:

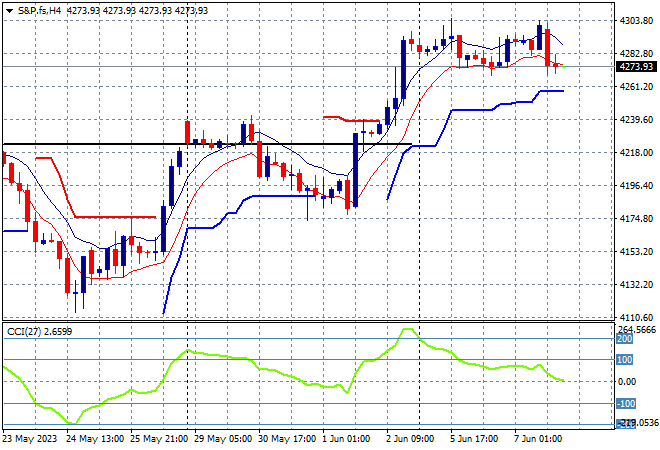

Wall Street failed again to build on optimism post the NFP print phase and while the Dow lifted somewhat, the NASDAQ lost more than 1% while the S&P500 also slipped nearly 0.4% to remain just above the 4200 key level, finishing at 4267 points.

The four hourly chart shows how support has been relatively strong above the 4100 point level with the post NFP bounce still holding well above the 4200 point area which had been medium term resistance (upper black line). This clears the previous lack of conviction to confirm a new uptrend, but watch the low moving average for any signs of selling:

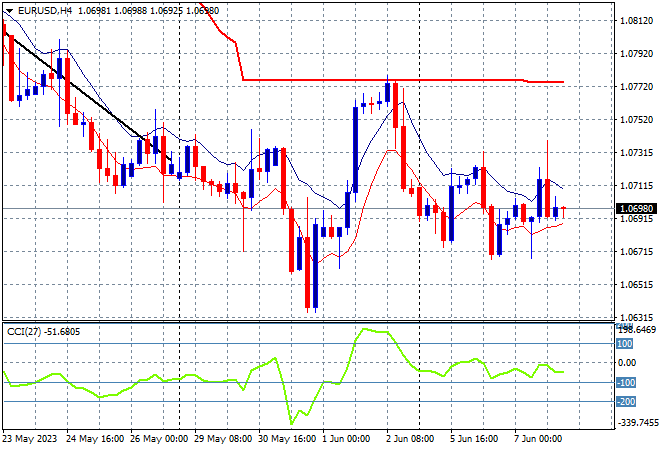

Currency markets remains on their dominant USD trend post the NFP print with only the Loonie advancing against King Dollar due to a surprise rate hike, the Euro is again looking to go nowhere, still stuck below the 1.07 handle.

Price action was a little volatile overnight but looking through the four hourly chart shows a sideways at best condition with short term momentum still somewhat negative. The union currency is still primarily on a downtrend with the 1.08 handle proving short term resistance:

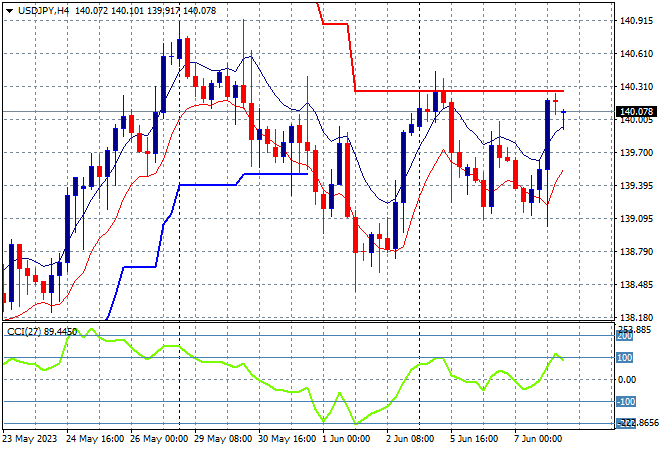

The USDJPY pair had another go at beating through resistance with another push through the 140 level overnight after previously stalling here at the mid 139 level.

The previous consolidation back down to trailing ATR support could be repeating itself here without any new daily or weekly highs for awhile now, which could become a medium term consolidation. Watch support at the 139 level proper:

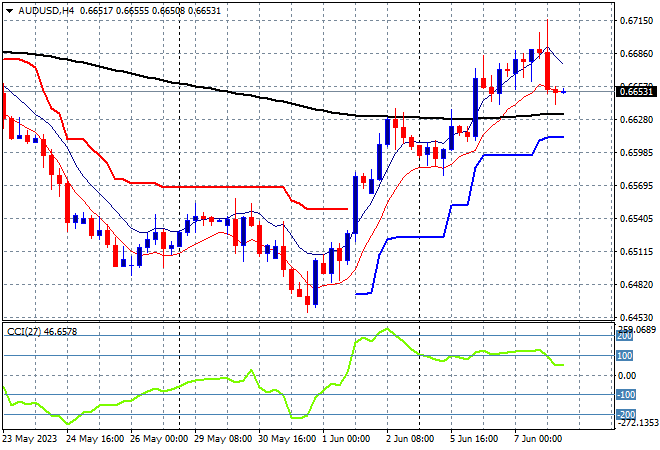

The Australian dollar remains one of the more robust undollars but did suffer a pullback after a brief look through of the 67 cent level, settling at the mid 66 level instead with the post RBA rate hike bounce still intact.

There had been some hesitation building previous to the RBA meeting, but the Pacific Peso still needs to clear previous overhead resistance at 67 cents to make this bounce stick, so while short term momentum is nicely overbought, watching for building resistance here:

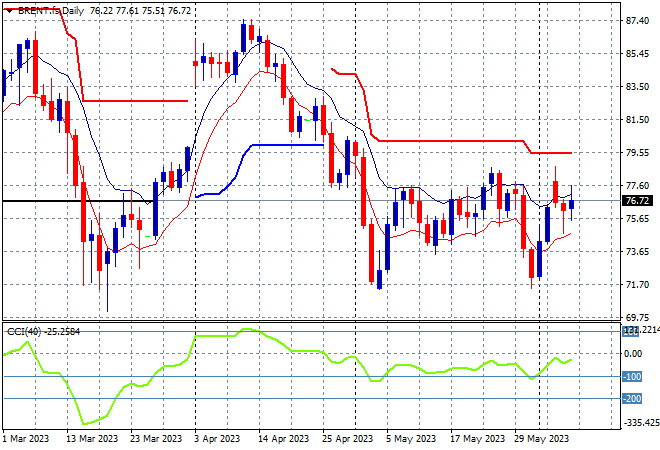

Oil markets are trying to get out of their recent funk with Brent crude consolidating again overnight at the $76USD per barrel level, despite a recovery in USD and wider energy problems escalating in Europe.

This still keeps price below the December levels (lower black horizontal line) after breaching trailing ATR support previously with daily momentum now trying to get out out of oversold mode, but still negative. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

Gold had a big fail in its comeback following the BOC rate hike overnight sending USD higher, pushing it right back down to the $1940USD per ounce level.

The four hourly chart had been showing a lot of oscillation around the $1960 level in recent weeks but with a continued failure to get back above the psychological $2000USD per ounce level still holding it back, let alone short term resistance here. This rollover sends it back to the weekly lows so watch for signs of capitulation below $1930: