Equity markets dropped sharply overnight, with Wall Street alarmed by a too strong private jobs print and the most recent ISM services survey as Fed insiders continue to ramp up concerns about inflation. The S&P500 was down nearly 2% at one stage as European stocks lost 3% or so to a new three month low on the rate hike fears.

The USD moved slightly lower against Euro but kept pushing the other major currencies down, with the Australian dollar hovering above the 66 cent level after holding strong through the RBA’s recent surprising pause.

US bond markets saw more upper movement at the long end of the yield curve with the 10 year pushing through the 4% level while oil prices continued their slow lift as Brent crude built above the $76USD per barrel level. Gold rolled over again and almost threatened to break below the $1900USD per ounce level.

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets fell again into the close with the Shanghai Composite off by more than 0.5% at 3202 points while the Hang Seng Index finished down 3% to 18569 points as fears of a soft or non-existent stimulus grew.

The daily chart had been showing hesitation at the 19000 point level after the previous weekly retracement that bounced off the dominant downtrend (sloping higher black line). Confidence has evaporated here with the May lows now in sight:

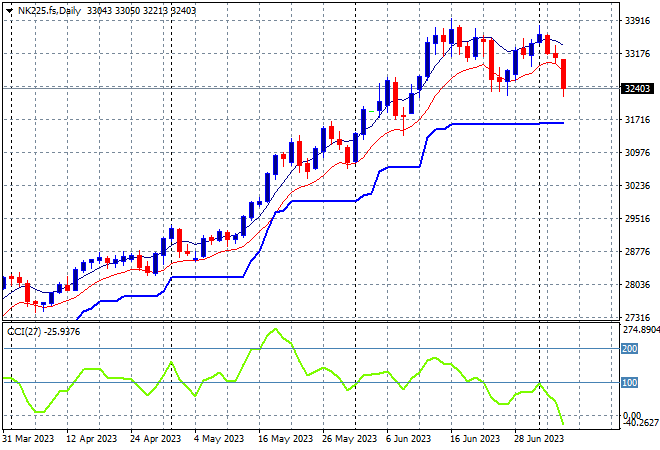

Japanese stock markets also joined in on the selling fun, with the Nikkei 225 closing more than 1.7% lower at 32773 points. Futures are indicating a further pullback given the falls on Wall Street overnight.

Trailing ATR daily support had been ratcheting higher but has paused as the market has been going sideways for over two week now with a welcome consolidation. Daily momentum has retraced nicely from overbought settings but a further retracement back down to that support zone is possible to take more heat out of this overextended trend:

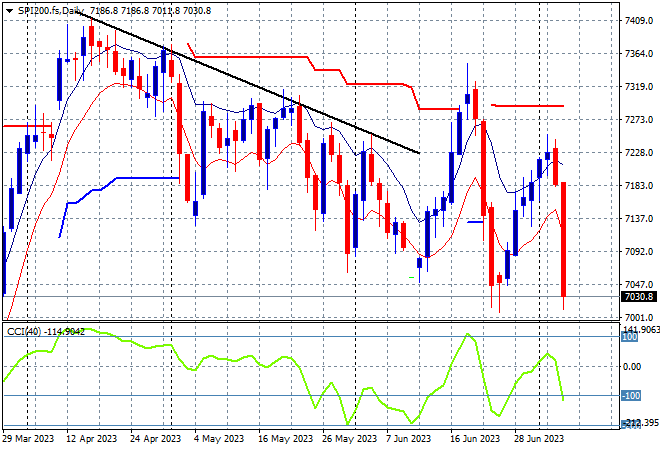

Australian stocks couldn’t escape the selling either with the ASX200 closing more than 1.2% lower at 7163 points.

SPI futures are down another 1.2% or so given the sharp fall on equity markets overnight, likely to take the ASX down to 7000 points proper. For awhile I’ve been saying that a steep recovery was required to get back to the previous weekly highs near ATR resistance at 7300 points and it seems this level was just too far out of reach as medium term price action remains on a downtrend:

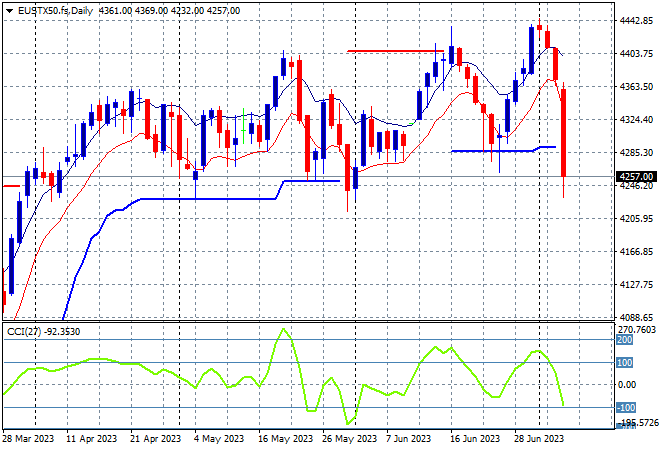

European markets were slammed overnight with big losses across the continent, with the Eurostoxx 50 Index finishing nearly 3% lower to 4223 points.

The daily chart is a potential bull trap building again even though weekly support at 4200 points has been continually defended, its weekly resistance at the 4350 points level that remains the true area to beat. While there has been a succession of higher weekly highs with momentum well supported, it hasn’t taken much to spook price action into falling sharply here again:

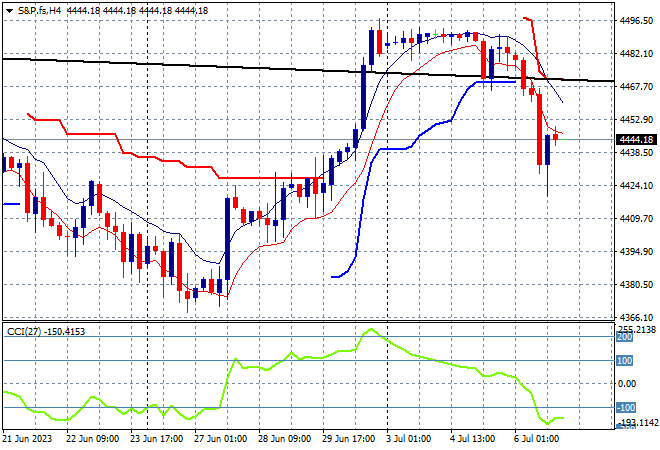

Wall Street wasn’t able to escape the carnage either although it put in a late recovery as the NASDAQ closed 0.8% lower the S&P500 at 0.7% lower, finishing at 4411 points.

The four hourly chart was showing a robust market that continues to come up against the monthly downtrend from the 2021 highs with another test of the 4500 point level now not likely. Friday night saw a sustained breakout above the 4400 point level as short term momentum switched to overbought mode and tossed aside overhead resistance but this breakdown move could see a retest of the June lows:

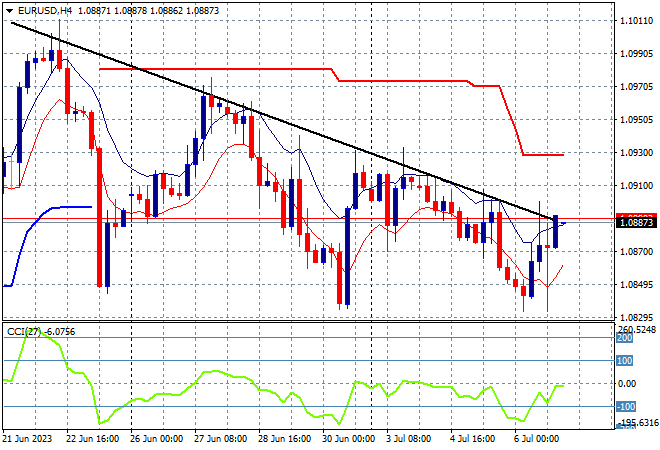

Currency markets are still mainly in a near one way move in favour of USD overnight in the wake of the latest domestic economic prints that favour more rate rises from the Fed, but Euro had another reversal that almost saw it punch through the 1.09 level.

The union currency remains on a weekly downtrend however, so this bounce must be taken in context after failing to make a new four hourly session high since the start of the trading week for what looks like a mean reversion move. The previous attempted breakout to test the April highs above the 1.10 handle has been thwarted so watch for the 1.0830 support level to come under threat next:

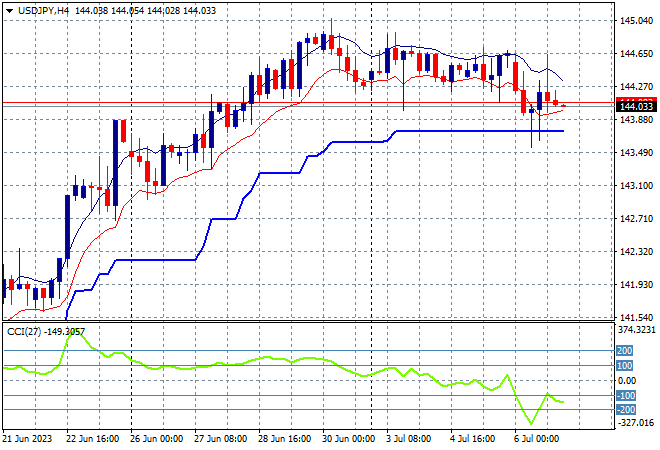

The USDJPY pair is just holding on here after a series of tiny pullbacks to steady around the mid 144 level as it fails to make another attempt at pushing through the 145 handle as Yen buyers step in.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause and Fed Chair Powell’s comment is giving the pair new life. Four hourly momentum however has retraced back from overbought mode as short term price action rolls over in this very steady uptrend:

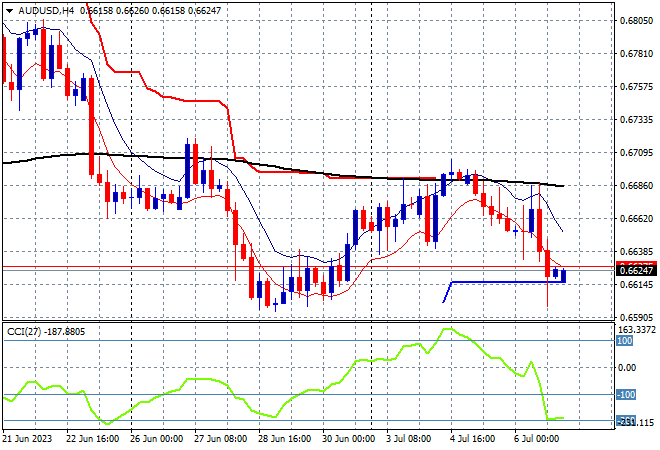

The Australian dollar remains under a lot of USD pressure following the strong domestic prints overnight after recently holding up strong following the RBA pause on Tuesday, with a retracement back to the 66 cent level proper now in train..

The holding action looked like putting the ATR resistance and 200 EMA (black line) levels under threat as it lurked just below the 67 handle but as I’ve been contending for some time now, this was going to be short lived as the Fed is expected to be much more aggressive, with a return below the 66 handle proper likely:

Oil markets were able to advance marginally overnight with planned production cuts still changing sentiment as Brent crude lifted above the $76USD per barrel level again.

Price remains stubbornly anchored around the December levels and the March lows with daily momentum only now switching to positive. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

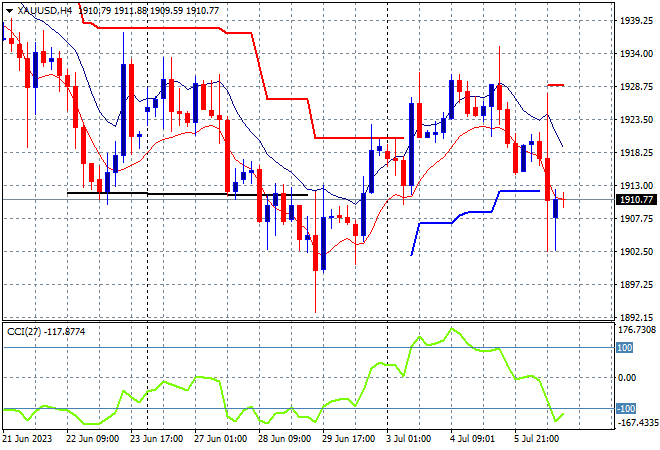

Gold rolled over again down to the $1900USD per ounce level to return to the previous weekly low before a tiny bounce this morning saw it finish at the $1910 level.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1930 but the rollover below the $1900 level could be on again as short term momentum retraces sharply: