Wall Street stalled overnight on some disappointing earnings while European markets continued their surge as the Bank of England was the latest to raise interest rates. Currency markets are still prepping for tonight’s US non-farm payrolls aka unemployment print, with the USD pulling back most of its recent gains particularly against Euro, although Pound Sterling didn’t move much on the rate rise. The Australian dollar is also still failing to climb back above the 70 level following its post-RBA rate rise walloping. Bond markets saw more tightening of yields with 10 year Treasuries pushed down to the 2.6% level with more than 100bps in rate rises still predicted by the end of 2022. Commodities remain volatile as oil prices lost nearly 3% to entrench its three month low, while gold rose to a new monthly high.

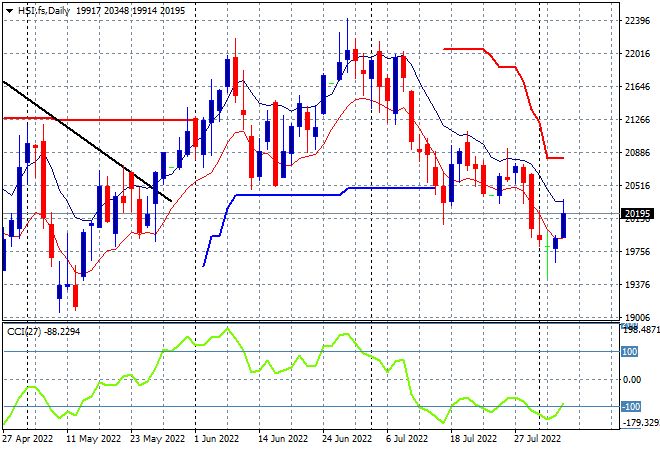

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets had a good start to the session before giving up gains midway through with the Shanghai Composite now only up 0.8% to 3189 points while the Hang Seng Index is surging through the 20000 point barrier, up more than 2% to 20176 points. Sentiment remains all over the place due to macro and geopolitical concerns with the daily chart still showing considerable overhead resistance and daily momentum readings quite negative. It looks like the May lows will come under pressure soon – but watch those long tails on the recent daily lows which maybe some support building:

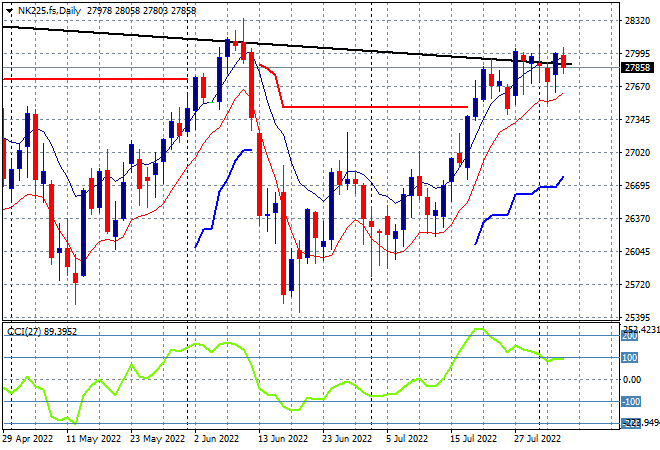

Japanese stock markets are coming back in similar fashion with a weaker Yen helping, with the Nikkei 225 up 0.6% to 27932 points. Futures on the daily chart are suggesting this pause could be turning into a breakout to finally clear resistance at the previous highs at 28000 points, but this hasn’t translated into actual price action yet. Daily momentum has retraced from its overbought status and while price recently made a new weekly high, the overall monthly/weekly downtrend (sloping black line above) is still in play:

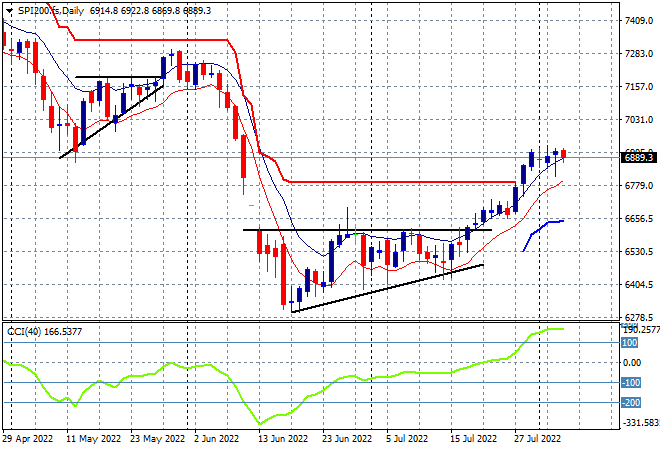

Australian stocks basically went nowhere with the ASX200 closing 0.1% higher as it continues to reject the 7000 point level, closing at 6978 points. SPI futures are up only a handful of points on the hesitation on Wall Street overnight. The daily chart still looks quite firm with a short term breakout situation trying to convert to something more sustainable. Daily momentum remains nicely overbought with the potential for more upside action to get through the 7000 point level:

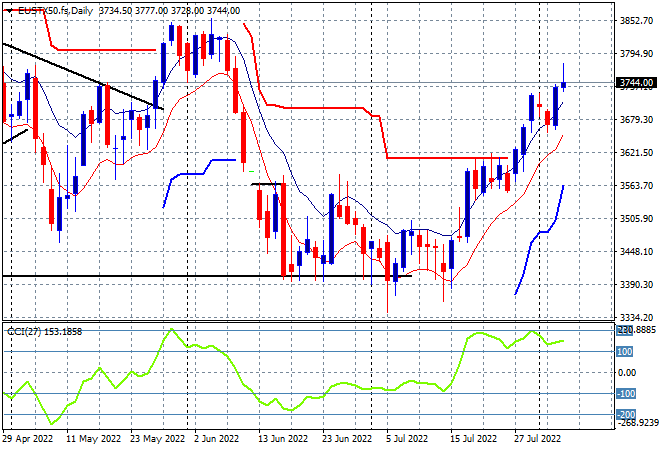

European stocks had a solid overnight session, lead by the German DAX, with the Eurostoxx 50 index extending its gains to lift more than 0.5% and close at 3754 points. The daily chart shows price action moving sharply higher through overhead resistance as daily momentum remains in overbought mode. The May highs at the 3850 point level remain the next target:

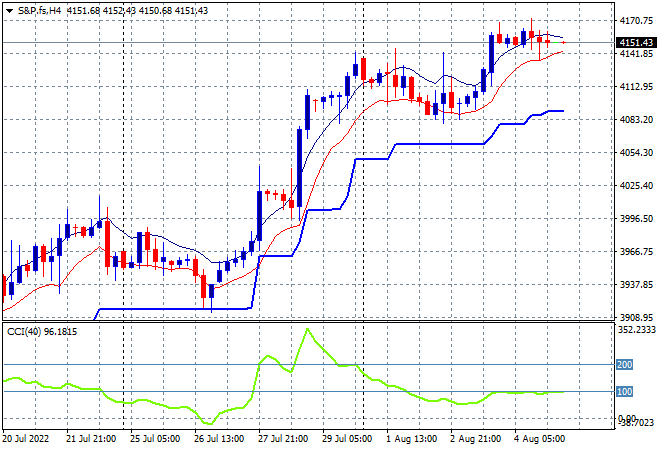

Wall Street however stumbled across industrial stocks with tech stocks still in recovery mode as the NASDAQ pushed nearly 0.5% higher while the S&P500 finished only 0.1% lower at 4151 points. Price action is pausing here above the 4100 point level as it attempts to get back to the May highs with short term momentum retracing from its overbought mode but still quite positive. Watch the low moving average for any signs of retracement at tonights US employment print:

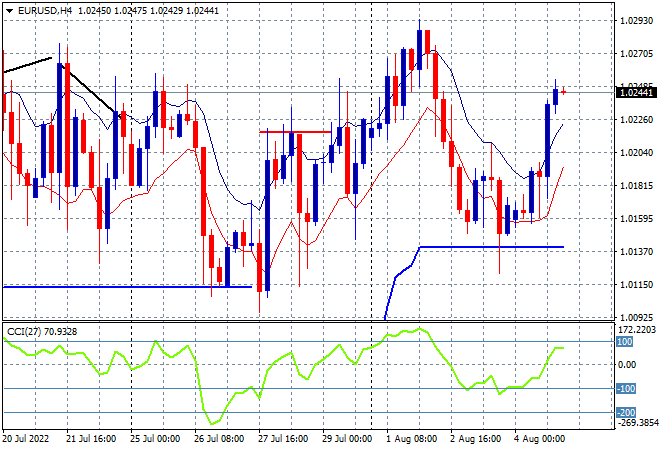

Currency markets are swapping around quite a bit due to macro and geopolitical concerns plus the added volatility of more rate rises from central banks, although Pound Sterling was non plussed against USD overnight. Euro however had a big surge back above the 1.02 handle, as this medium term sideways trend channel hit the bottom again to bounce up towards the recent highs. I still contend there’s a potential short term top brewing as resistance builds past the mid 1.02 level:

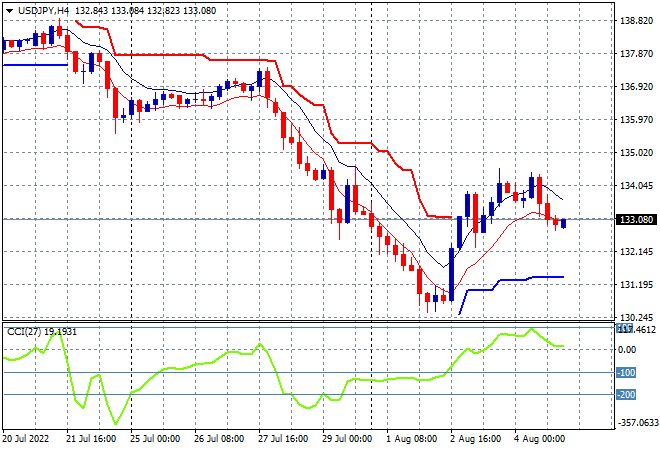

The USDJPY pair was pushed lower after recently bottoming out briefly at the 130 level to get back to the 134 handle before intrasession resistance and selling saw it retrace fully to the 133 handle early this morning. This has been a volatile period for Yen and it looks like this move is a dead cat bounce, with more Yen buying making sense as part of rising Asian tensions as well. Watch for a follow through in today’s session with a trend below the low moving average here on the four hourly chart as momentum retraces from its overbought status:

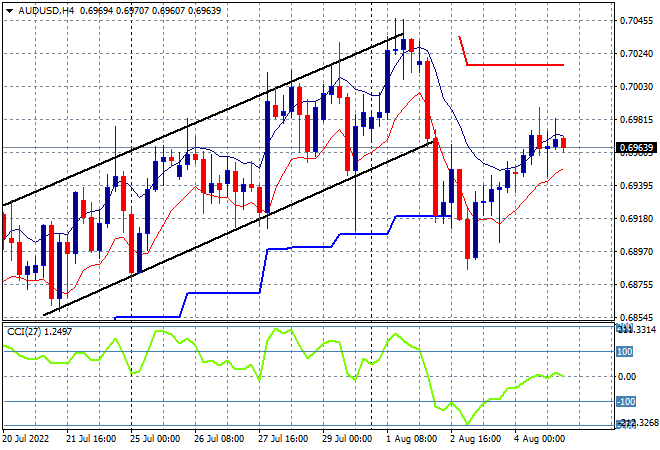

The Australian dollar is still trying to fill in its recent falls post the RBA interest rate meeting and hit another wall overnight, unable to get past the 70 handle after finding resistance at the mid 69 level. This may not be enough for the Pacific Peso as short term momentum and price action is indicating a swing play only for now – watch for a rollover tonight on stronger USD if the NFP print comes in “too” strong:

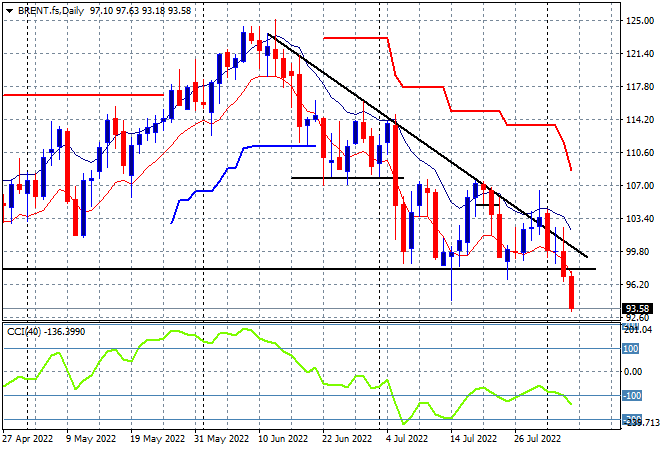

Oil markets are almost in freefall now after failing to recover in recent weeks, all but confirming a new downtrend, now off 25% from the June highs. Brent crude lost nearly 3% with a finish down below the $94USDper barrel level, accelerating the June downtrend. Price action failed to continue the previous week’s bounce off the $90’s lows, with the downtrend line yet to be beaten from the June highs and daily momentum couldn’t get out of its negative funk, so $100 level has turned into resistance here:

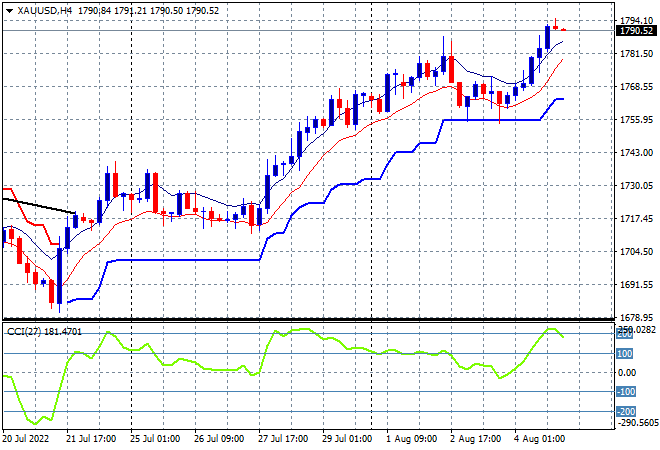

Gold stabilised and then punched higher overnight after its recent run that saw it almost reach the $1800USD per ounce level on hawkish comments from the Fed, with another go seemingly underway. This solid move that has pushed aside short term resistance to turn this bottoming action into a proper relief rally, but it must best the $1800USD per ounce level to call this a proper medium/long term bottom. On the four hourly chart, watch trailing ATR support as the key uncle point: