Last night saw the release of the latest US ISM manufacturing PMI which again came in weaker than expected, but US traders were more focused on getting off early for the 4th of July holiday with truncated trading sessions as a result. The USD moved slightly lower but most major currencies remain where they started the new trading week with Wall Street and European stocks also treading water.

US bond markets saw more new highs in yields however, with 10 Year Treasuries up another 4 basis points to the 3.86% level while oil prices stabilised despite more planned production cuts from OPEC and Ruzzia, with Brent crude holding near the $75USD per barrel level. Gold managed a small comeback alongside other undollars with a lift up towards the $1920USD per ounce level.

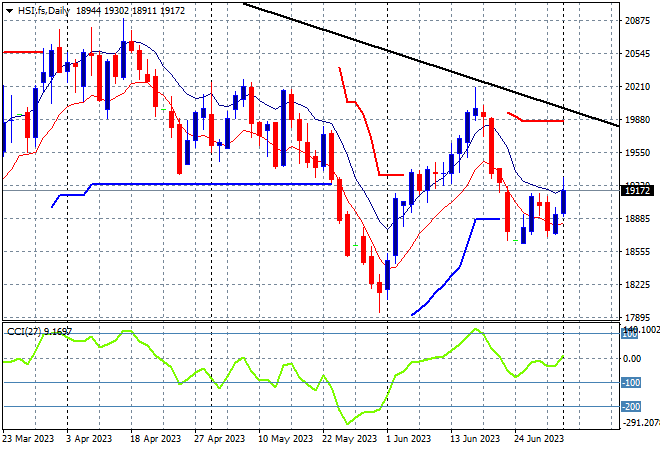

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are seeing a solid start to the new trading week with the Shanghai Composite closing more than 1.3% higher to 3243 points while the Hang Seng Index went even further, up more than 2% at 19306 points.

The daily chart had been showing a series of strong sessions that took it back above the previous resistance zone as daily momentum became positive and overbought, retracing most of the May losses. However this recent sharp reversal trend needs to be filled shortly or will follow through below the 19000 point level as part of the overall downtrend:

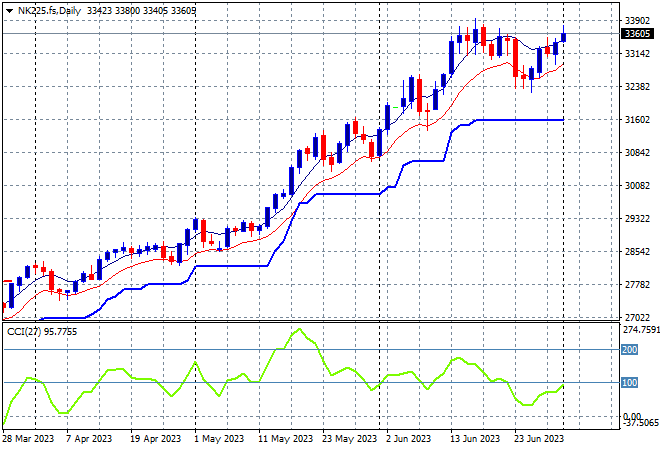

Japanese stock markets are not missing out in the fun with the Nikkei 225 closing 1.7% higher at 33753 points. Futures are indicating a slight pullback given the lack of a direction on Wall Street overnight.

Trailing ATR daily support had been ratcheting higher but has paused as the market has been going sideways for over a week now with a welcome consolidation. Daily momentum has retraced nicely from overbought settings but the lack of a further retracement back down to that support zone shows more buying will get underway:

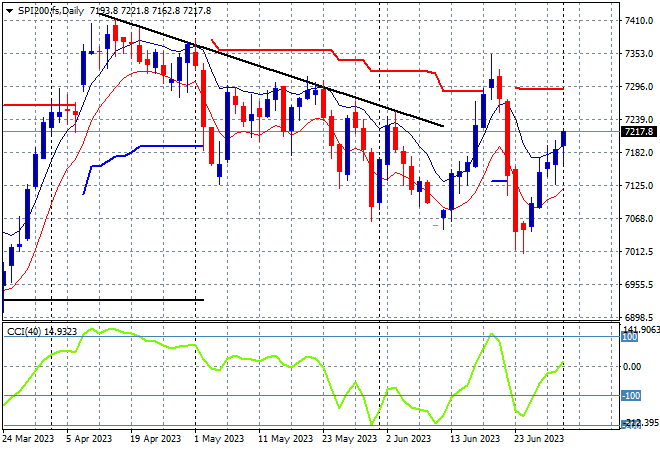

Australian stocks were the laggards with the ASX200 closing just 0.6% higher at 7246 points as traders await today’s RBA meeting.

SPI futures are dead flat given the similar finish on Wall Street from overnight with a steep recovery required to get back to the previous weekly highs near ATR resistance at 7300 points. This level may just be too far out of reach as medium term price action from the March highs remains somewhat intact but this bounce may have more legs:

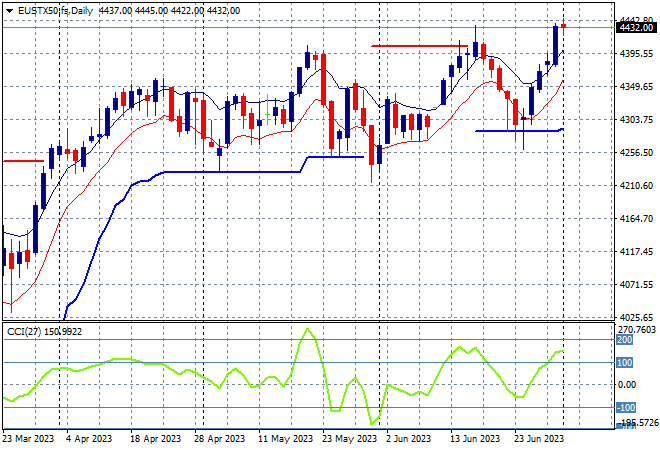

European markets were in slight hesitation mode overnight as the Eurostoxx 50 Index finished about 0.1% lower to 4398 points.

The daily chart is now showing another clear breakout that is unlikely to turn into a bull trap as weekly support at 4200 points has been continually defended. Weekly resistance at the 4350 points level was the true area to beat and here we are with a succession of higher weekly highs and momentum well supported for more upside potential:

Wall Street also put on the stops with only minor gains leading into the July 4th holiday, with the NASDAQ up just 0.2% while the S&P500 lifted only 0.1% higher to finish at 4455 points.

The four hourly chart was showing a decline from the start of last week that was nearly over mid week as buying confidence returned despite the Fed’s quite hawkish position. Friday night saw a sustained breakout above the 4400 point level as short term momentum switched to overbought mode and tossed aside overhead resistance. Remains to be seen when the market returns from holiday – and absorbing some pretty major Supreme Court rulings – if it can hold on to this new level:

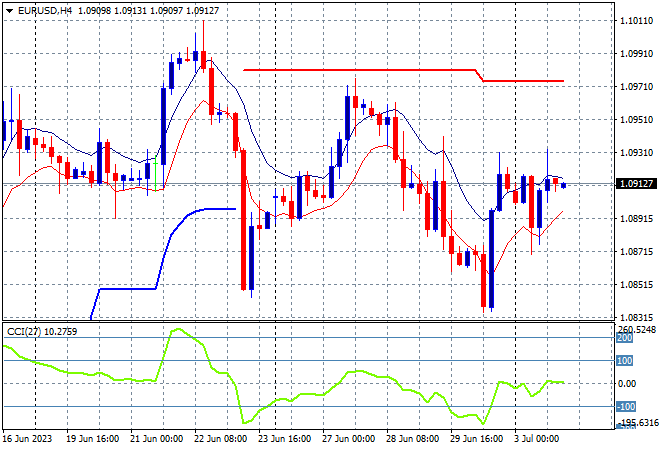

Currency markets saw a small pullback of USD strength on the weak ISM print but the lack of trading in the NY afternoon session is seeing no real movements across the complex. Euro is maintaining a relatively weak position here at the 1.09 handle.

The union currency was pushed back up to the 1.09 handle after reacting poorly to Powell’s suggestion of firming rate hikes from the Fed mid week but is still nowhere out of trouble. The previous attempted breakout to test the April highs above the 1.10 handle has been thwarted so watch for the start of week position just below the 1.09 level to come under threat next:

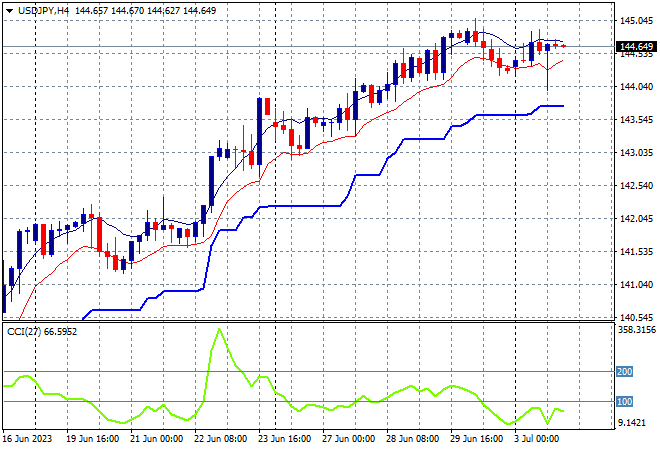

The USDJPY pair was unable to keep advancing with a pullback to the mid 144 level after almost making yet another record high by briefly breaching the 145 handle last week.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause and Fed Chair Powell’s comment is giving the pair new life. Four hourly momentum however has retraced back from overbought mode as short term price action rolls over in this very steady uptrend:

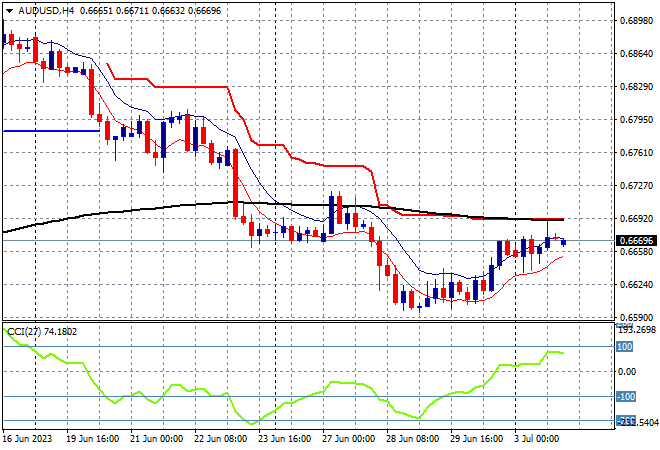

The Australian dollar is the one to watch today obviously as the head scratchers at Martin Place try to work out how to make more Australian’s unemployed buy keep house prices sky high.

Overnight saw short term price move slightly higher but ATR resistance and the 200 EMA (black line) is lurking ahead at the 67 handle where any rate hike by the RBA this afternoon could breach. However, its likely to be short lived as the Fed is expected to be much more aggressive:

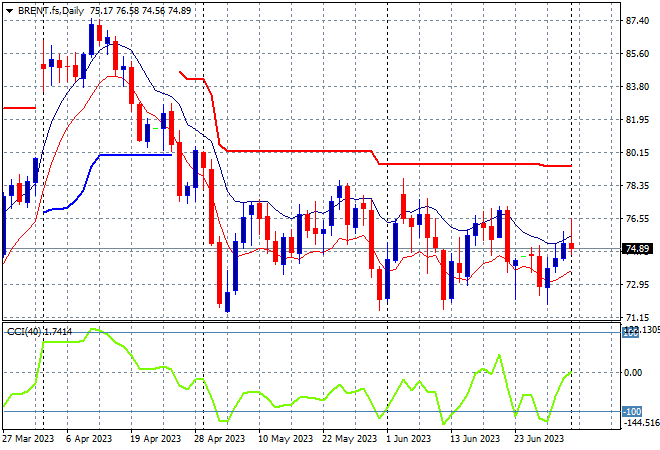

Oil markets were unable to make any firm movements overnight, as Brent crude staggers around the $75USD per barrel level, staving off a new weekly low but not making any new daily highs.

Price remains anchored around the December levels and the March lows with daily momentum still negative with no new weekly highs. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

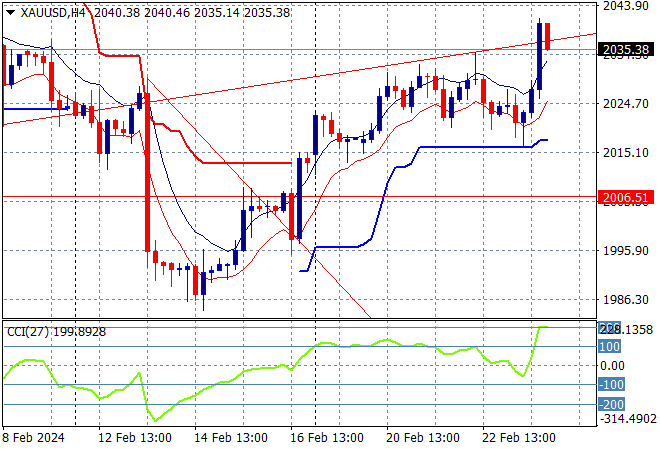

Gold is trying to stabilise with a surge at the start of this trading week in an attempt to forget last week as it bounces off the $1900USD per ounce level to almost back above the previous weekly high.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1930 but the rollover below the $1900 level has not yet eventuated with short term momentum looking to push higher: