Wall Street rebounded and the USD fell back on the latest employment reports from the US before tonight’s official unemployment NFP print, with the possible indication of a pause or slowdown in rate rises burgeoning risk taking. Some Fed officials and the interest rate markets don’t believe as much though with the 10 Year Treasury yield still high at the 2.9% level. Euro came back solidly as did the Australian dollar which almost hit the 73 cent level. Commodity prices were the most bullish with oil prices putting in new weekly highs as Brent races back towards the $120USD per barrel level while copper zoomed 5% higher and gold lifted more than 2% to get above the $1850USD per ounce level.

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets started off poorly but gradually made ground throughout the session with the Shanghai Composite closing some 0.4% higher at 3196 points while the Hang Seng Index was unable to hold on to its recent gains, down 1% to 21082 points. The daily chart is showing price wanting to get above trailing daily ATR resistance at the 21000 point level but failing to turn this into a sustainable trend. Daily momentum is still overbought but not translating into greater highs:

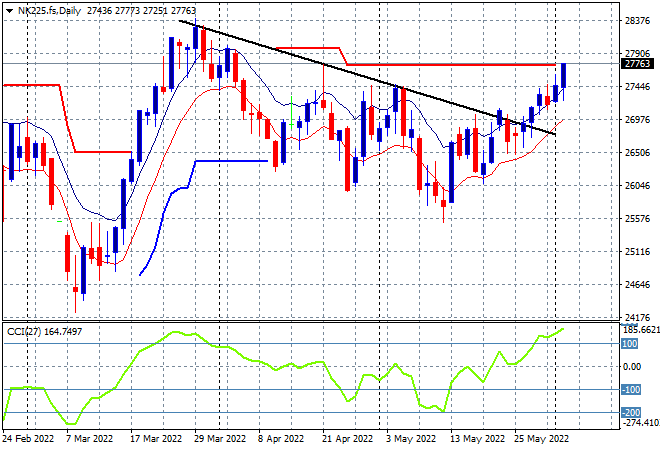

Japanese stock markets however tread water, with the Nikkei 225 index closing 0.2% lower at 27413 points. The daily chart of the Nikkei 225 shows a good attempt to get back above the previous daily/weekly highs near the 27500 point level underway, helped by a very weak {{3|Yen}]. To properly reverse the downward trend from the March highs requires a substantial move above the 27000 point level with futures indicating a much larger push today to help this current melt up rally:

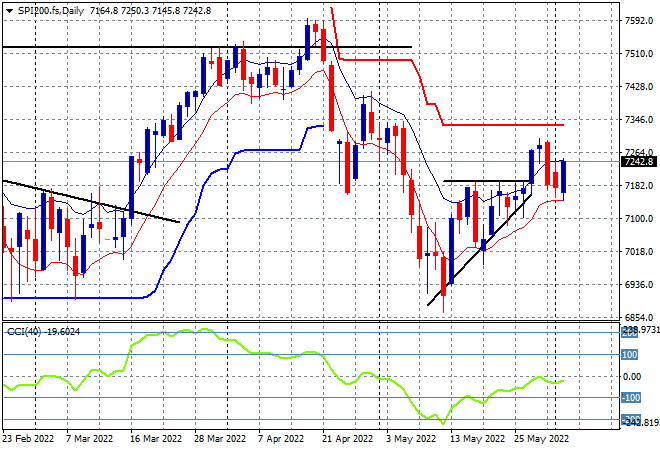

Australian stocks sold off all day with the ASX200 closing 0.8% lower at 7175 points. SPI futures are up at least 1% on Wall Street’s rally overnight so we should see the 7200 point level breached for the final session of the week. The daily chart was showing a clear breakout here with resistance at the 7200 point level cleared very quickly, but the bearish engulfing candle combined with daily negative momentum readings suggested another flop. Today’s candle suggests consolidation here at the 7200 point level at best:

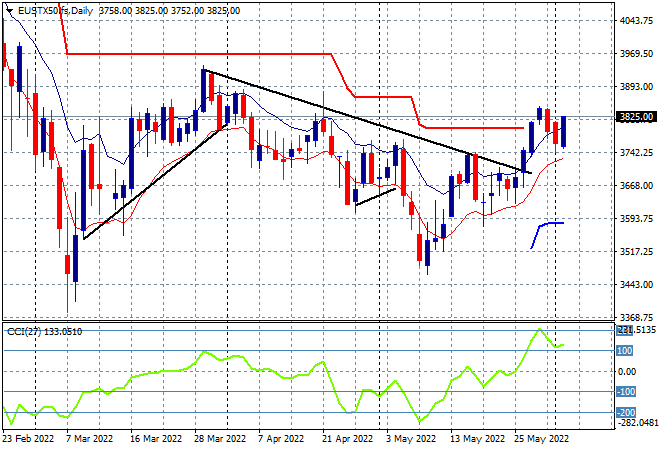

European stocks were a bit of a jumble, with the FTSE losing 1% while peripheral markets went nearly nowhere, the German DAX and hence the Eurostoxx 50 index finishing much higher, the latter putting on 0.9% to 3795 points. The daily chart picture is similarly showing a failed breakout that has stalled above the trailing ATR resistance level that had been keeping this market contained since the Ukrainian invasion. A similar picture to the ASX200 with support firming here at the low moving average, but I remain cautious:

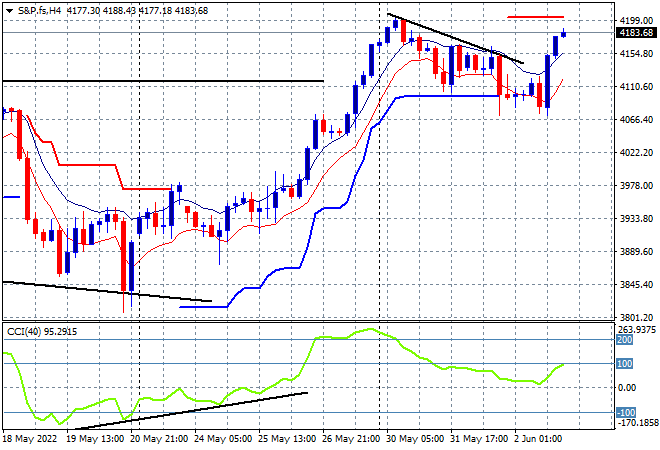

Wall Street loved the employment prints and let loose the buyers with the NASDAQ surging nearly 2.7% while the S&P500 lifted more than 1.8% to soar back above the 4100 point level, finishing at 4176 points. The four hourly chart shows how this reversal at trailing ATR support at the previous 4100 point resistance level was thwarted with four hourly momentum holding on above the the positive zone, but not yet overbought. Price action has yet to exceed the Friday highs, so wait and see for tonights NFP print first:

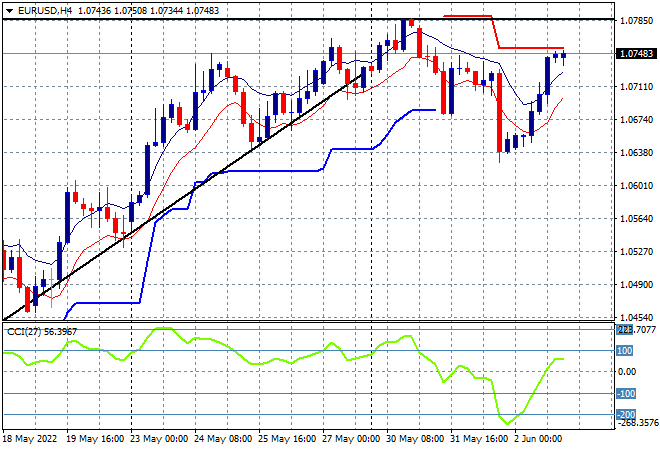

Currency markets saw USD reduced back to a defensive mode with the ECB hawks pushed aside with the Euro refilling its former collapse back above the 1.07 handle to be right on the start of week position. Price action remains contained by resistance at the 2020 lows (upper horizontal black line) however, combined with four hourly ATR trailing resistance which is yet to be breached:

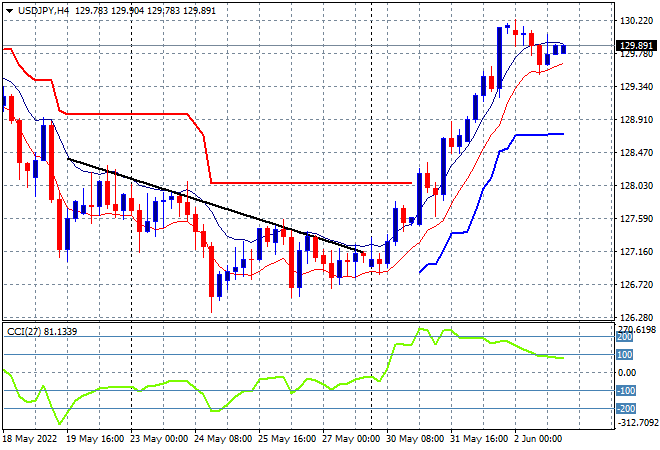

The USDJPY pair consolidated overnight after passing through the 130 level in a big surge in the previous session, having been extremely overdone in the process. Short term momentum has retraced from the highly overbought levels a result, with trailing ATR support very firm down below at the 128 handle proper cast aside, but I remain wary of a volatile retracement coming:

The Australian dollar finally pushed through the 72 handle overnight, after making a false attempt earlier in the week. Four hourly momentum has returned to its extremely overbought levels so this result in a minor retracement during the Asian session today, or perhaps during the NFP print tonight. The previous resistance level at 71 cents (upper black horizontal line) has proven solid support going forward:

Oil markets tried to push higher overnight and finally got traction towards the end of the session with Brent pushing up through the $118USD per barrel level. This technically creates a new daily and weekly high and pushes through trailing ATR daily resistance, but I’m wary of the intrasession volatility here. Daily momentum is very overextended and overbought which also adds to my caution:

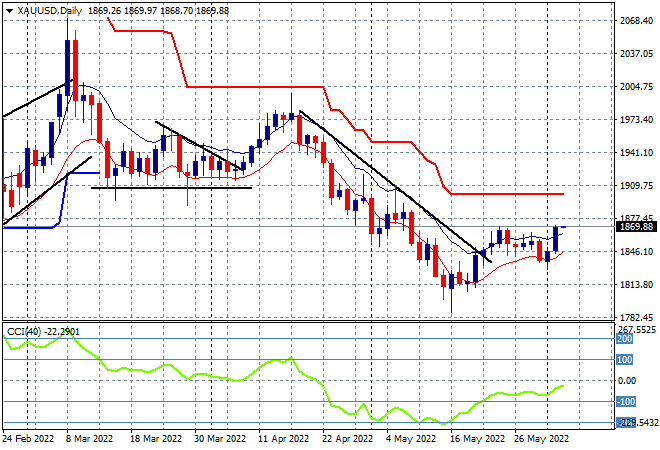

Gold found some life overnight, breaching the wobbly $1850USD per ounce level, and finally made a new daily and indeed, weekly high at the $1869 level. I’ve been pointing to the lack of a new daily high for sometime now, as a sign that this bounce from the January lows around the $1800 level was not sustainable. The lack of positive daily momentum keeps this is a low probability swing trade for now with trailing overhead ATR resistance also not under threat yet: