As risk markets gear up for tonight’s May US jobs report aka non farm payrolls, Fed officials overnight indicated a possible “skip” in the next US rate rise, sending the USD down sharply against the currency majors. Wall Street lifted across the board although the rally in tech stocks is waning, and more private employment data went against the“skip” trend, setting up for a potentially volatile NFP print tonight.

Currency markets reversed course swiftly on the skip comments, with Euro bouncing sharply above its previous weekly low while the Australian dollar also saw an escape and lept up through the 65 handle to make a new weekly high.

Meanwhile US Treasury yields slid further lower with the 10 year down another 4 pips to settle at the 3.6% level while oil prices took back their recent loss with Brent crude finishing just above the $74USD per barrel level. Gold continued its small bounce with a lift up towards the $1980USD per ounce level.

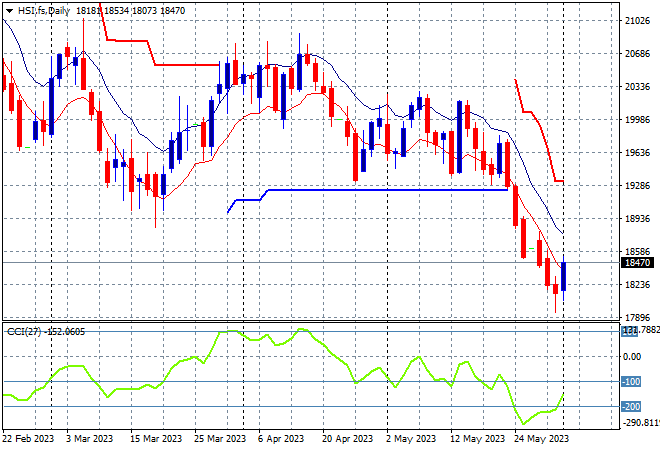

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were holding on to modest gains going into the close before a late selloff saw the Shanghai Composite finish dead flat at 3204 points while the Hang Seng Index actually lost ground to close 0.1% to 18216 points.

The daily chart has been showing resistance building above at the 20500 point level as price action wants to return to the start of year correction phase below 19000 points with a failure to make any new weekly highs since early April. This looks poised for another breakdown through the 19000 point level if it can’t clear those levels soon:

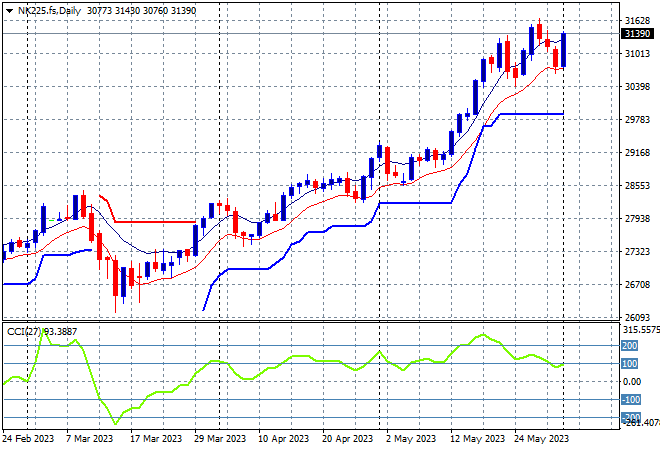

Japanese stock markets put in stronger sessions with the Nikkei 225 closing 0.8% higher at 31150 points. Futures are indicating a further gain on the open to solidify this trend.

Trailing ATR daily support keeps ratcheting higher as the 31000 point level is breached with daily momentum hovering around overbought settings as this market remains very well supported by a weaker Yen, but there is potential for a pause here post the NFP volatility:

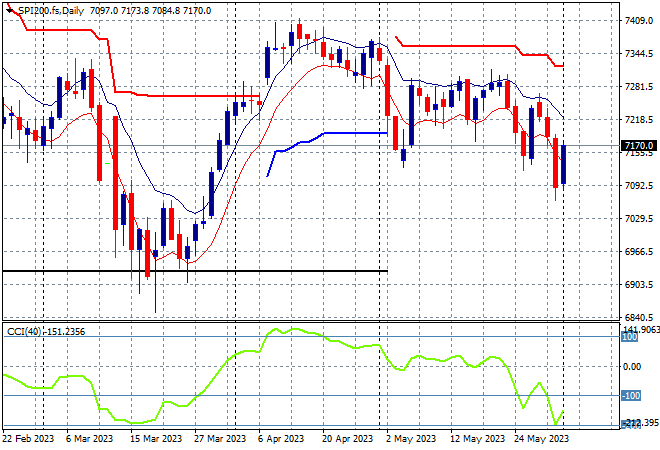

Australian stocks had a steady uplift with the ASX200 closing 0.3% higher at 7112 points.

SPI futures are up more than 0.6% following Wall Street’s lead overnight so its all up to confidence to return and see if the market can recover its recent losses. Daily momentum is still firmly in the oversold zone as price action remains near its new monthly low.

The upside target in the medium term was the April highs at 7400 points but this looks unattainable as price action has been unable to break above the high moving average band with movement towards support instead at the 7100 point area the next phase – watch 7200 points for signs of a breakout:

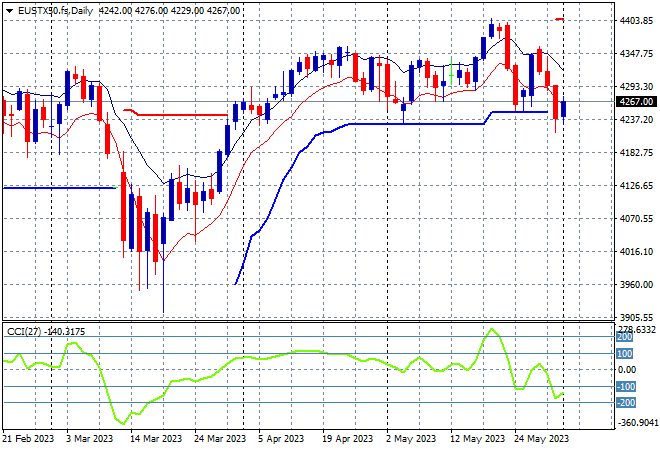

European markets had strong gains across the continent, arresting their recent decline with the Eurostoxx 50 Index managing to close nearly 1% higher to 4257 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but support at the 4200 point level has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next or further consolidation is likely:

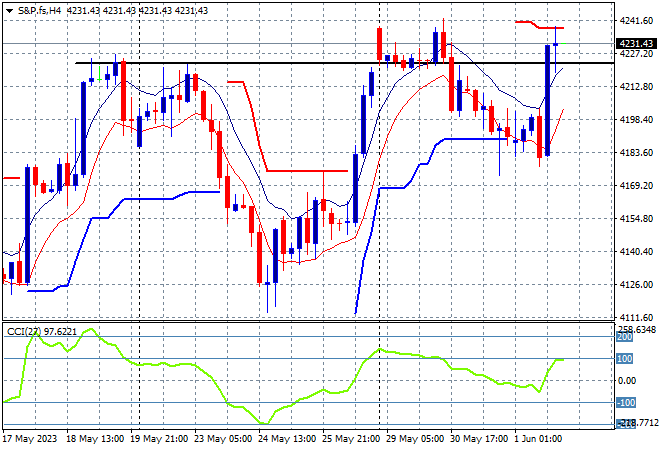

Wall Street had similar gains with the NASDAQ lifting 1.3% while the S&P500 gained nearly 1% to remain above the 4200 barrier level, finishing at 4221 points.

The four hourly chart shows how support has been relatively strong above the 4100 point level which looks like the bounce point as risk traders pivot on the Fed “skip” news going into tonight’s NFP print. The failure to push through medium term resistance (upper black line) had kept the market in check with a series of lower highs showing a lack of conviction but now the recent highs have been met so watch for another breakout to confirm a new uptrend:

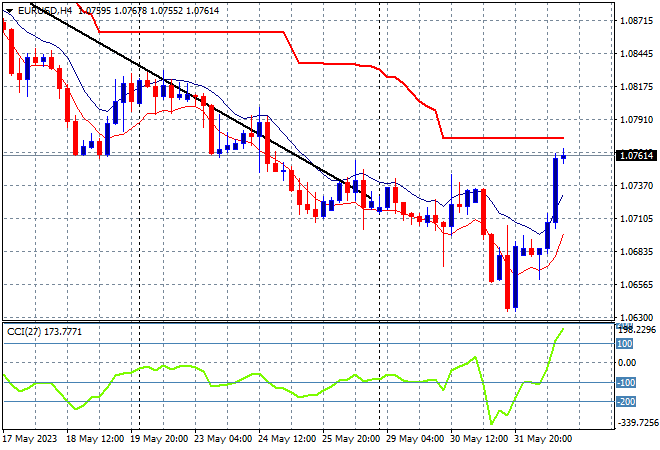

Currency markets had been set on their dominant USD trend before the “skip” comments overnight with sharp reversals across the complex as Euro led the way, breaking above the 1.07 handle and almost clearing short term resistance.

Short term momentum on the four hourly chart had been showing a continuation of oversold settings as resistance shifted to former support below the 1.08 level with more downside potential building before this reversal. To make this bounce stick beyond 24 hours – and through tonight’s all too important US jobs report – will require a clearance of at least the 1.08 handle:

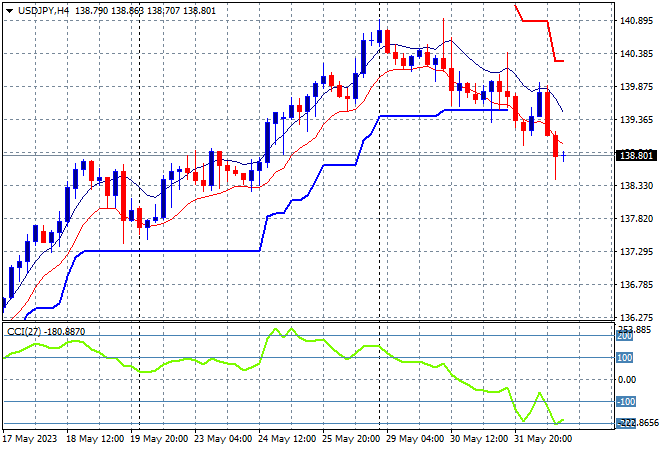

The USDJPY pair was pushed further down from its start of week downtrend, with a move below the 139 level overnight. The consolidation back down to trailing ATR support has turned into a downtrend to take back most of the previous weeks gains although support is coming up at the 138 handle here so this could be a temporary but needed consolidation:

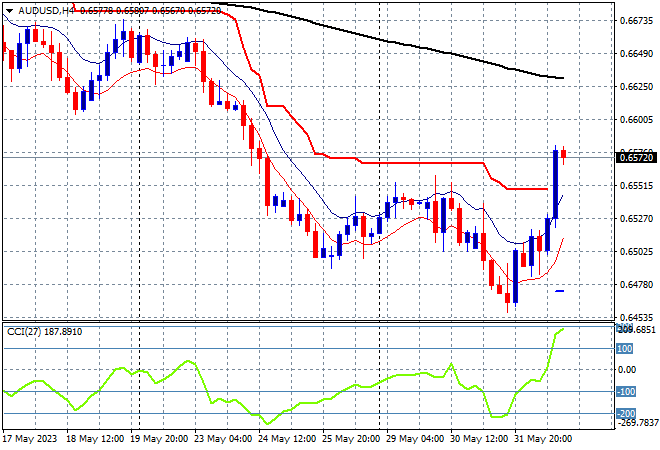

The Australian dollar had been totally depressed here and has now rallied solely on the “skip” with a big move above the 65 cent level against USD after basing at its new monthly low around the mid 64 cent level as domestic concerns had outweighed the USD pressure.

The Pacific Peso still needs to clear previous overhead resistance at 67 cents to make this stick, with tonight’s NFP the uncle point to pivot on further with the potential to lose all of this if it comes in too hot for the Fed to ignore:

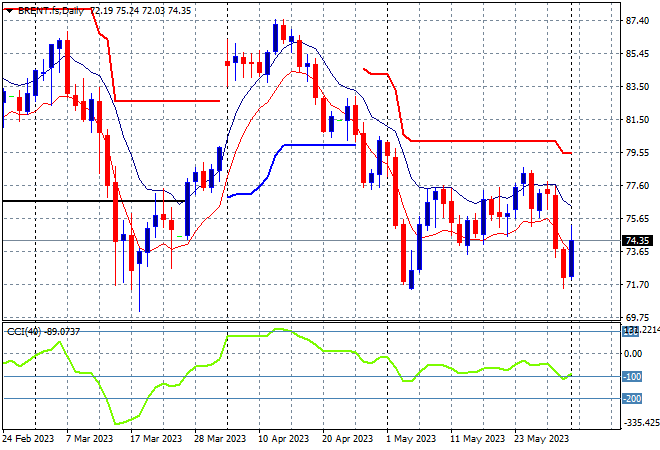

Oil markets are trying to get out of their recent funk with Brent crude moving back to the $74USD per barrel level, likely only because of the downturn in USD.

This still keeps price below the December levels (lower black horizontal line) after breaching trailing ATR support previously with daily momentum really not yet out of oversold mode. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

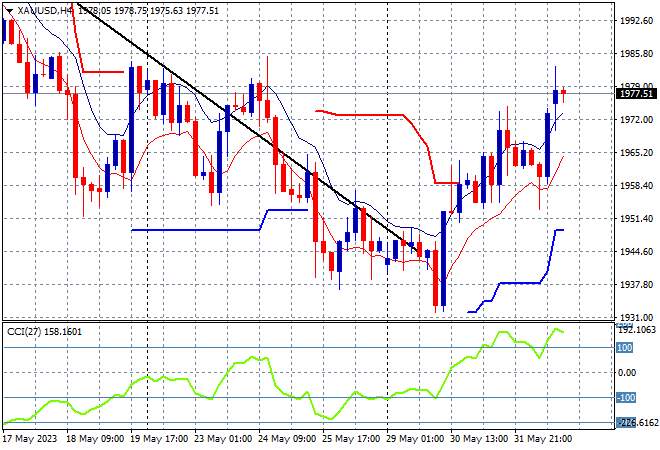

Gold remains in its bounce phase with a welcome boost from the anti-USD mood overnight, sending it almost to a two week high at just below the $1980USD per ounce level. This keeps it below the psychological $2000USD per ounce level of course as this breakdown phase is not yet complete, so watch for any rollover back to the $1950 level: