* MSCI Asia-Pacific index down 1.4 pct, Nikkei drops 0.9 pct

* Asia hit as Wall St tumbles on trade woes, growth concerns

* Dollar struggles amid declining U.S. Treasury yields

* Oil falls as trade woes stoke demand concerns

By Shinichi Saoshiro

TOKYO, Dec 5 (Reuters) - Asian stocks slid on Wednesday, dragged down by Wall Street's tumble as sharp declines in long-term U.S. Treasury yields and resurgent trade concerns stoked investor worries about global economic growth.

Global equities have been shaken as a flattening U.S. Treasury yield curve fans worries about a recession, and on growing doubts that Washington and Beijing will be able to clinch a substantive trade deal during a temporary cease-fire agreed at the weekend.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was down 1.4 percent.

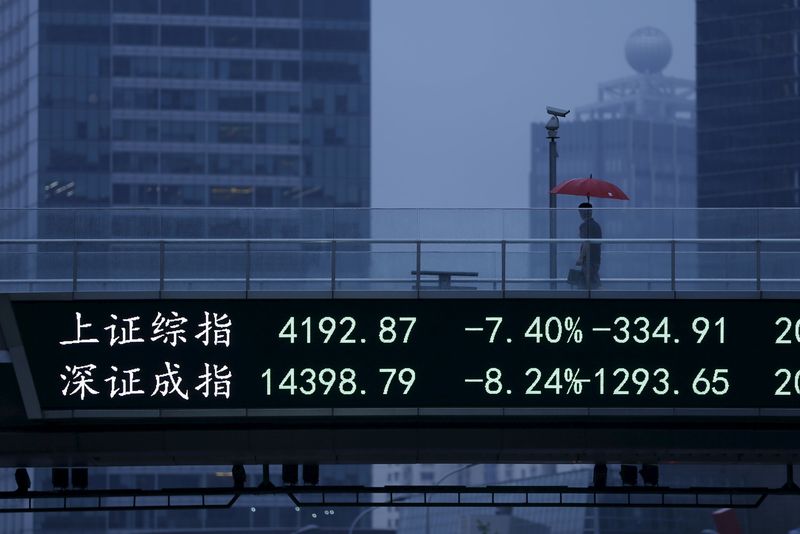

Hong Kong's Hang Seng .HSI retreated 1.5 percent and the Shanghai Composite Index .SSEC fell 1.2 percent.

Japan's Nikkei .N225 fell 0.9 percent and South Korea's KOSPI .KS11 shed 0.85 percent.

Australian stocks .AXJO lost 1.3 percent, pressured by global losses. The mood further soured after data showed Australia's third-quarter growth fell short of expectations. The Australian dollar AUD=D4 was down 0.4 percent at $0.7311. Dow .DJI retreated 3.1 percent and the Nasdaq .IXIC sank 3.8 percent on Tuesday. U.S. financial shares .SPSY , which are particularly sensitive to bond market swings, dropped 4.4 percent. .N

Following Wall Street's overnight tumble, S&P e-mini futures ESc1 nudged up 0.25 percent in Asian trade on Wednesday.

Signals from the Federal Reserve last week that it may be nearing an end to its three-year rate hike cycle has pushed the 10-year U.S. Treasury yield US10YT=RR to three-month lows below 3 percent.

Concerns about slowing U.S. growth have accelerated the flattening of the yield curve, a phenomenon in which longer-dated debt yields fall faster than their shorter-dated counterparts.

The spread between the two-year and 10-year Treasury yields was at its flattest level in over a decade.

"The market decline in the U.S. overnight and the flattening of the yield curve reflect that economic growth momentum is taking over as the primary concern for investors, even as the latest ISM manufacturing data is holding up well," wrote Tai Hui, market strategist at J.P. Morgan Asset Management.

A flatter curve is seen as an indicator of a recession, with lower longer-dated yields suggesting that the markets see economic weakness ahead.

"The U.S. economy is likely to be able to withstand another rate hike or two, therefore the flattening of the Treasury curve looks a little over done. That said, it is true that the economic outlook is murkier than before," said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

"There is also Brexit to keep an eye on, and this is a factor in the ongoing risk aversion."

British Prime Minister Theresa May suffered embarrassing defeats on Tuesday at the start of five days of debate over her plans to leave the European Union that could determine the future of Brexit and the fate of her government. markets were also weighed down as optimism faded over a truce made over the weekend between U.S. President Donald Trump and Chinese President Xi Jinping.

Trump threatened on Tuesday to place "major tariffs" on Chinese goods imported into the United States if his administration is unable to reach an effective trade deal with Beijing. doubts grew over whether the two sides can resolve their differences, China said on Wednesday it was confident that it can clinch a trade deal with Washington within the 90-day negotiating window that the two sides agreed. would raise the spectre of fresh U.S. tariff action and potential Chinese retaliation as early as March.

The dollar struggled in the wake of falling Treasury yields, with its index against a basket of six major currencies .DXY briefly stooping to a near two-week low of 96.379 overnight before edging back above 97.00.

The greenback fell against the safe-haven yen, losing 0.75 percent overnight before trimming some of the losses to stand at 112.94 yen JPY= .

The pound was down 0.25 percent at $1.2711 GBP=D4 having touched a 17-month low of $1.2659 overnight, rattled by Brexit setbacks in parliament.

Oil prices fell, weighed down by swelling U.S. inventories and concerns that slowing economic activity will sap demand for commodities. O/R

U.S. crude futures CLc1 were down 1.1 percent at $52.66 per barrel and Brent shed 1.2 percent to $61.33 per barrel LCOc1 . (Editing by Sam Holmes and Kim Coghill)