Investing.com-- Most Asian stocks rose on Tuesday, tracking an overnight rally on Wall Street as markets cheered the prospect of lower U.S. interest rates before a key address from Federal Reserve Chair Jerome Powell later this week.

But Chinese markets lagged their regional peers after the People’s Bank kept its benchmark loan prime rate unchanged as expected, disappointing some traders holding out for more surprise cuts from the central bank.

Other Asian markets were buoyed by a positive lead-in from Wall Street, as growing optimism over an interest rate cut in September saw investors pile back into equities, especially heavyweight technology stocks.

U.S. stock index futures rose slightly in Asian trade. Focus this week is squarely on an address by Powell at the Jackson Hole Symposium on Friday, where he is expected to provide more cues on the bank's plans to begin cutting rates.

Japan’s Nikkei near 3-week high, Seven & i slips

Japanese stocks were the best performers in Asia, with the Nikkei 225 index rising 1.8% and coming in sight of a three-week high. The TOPIX index added 1.2%.

The Nikkei was boosted chiefly by strength in heavyweight technology stocks, which rose tracking strength in their U.S. peers.

Convenience store operator Seven & i Holdings Co., Ltd. (TYO:3382) was an exception among Japanese stocks, falling over 6% as traders locked-in profits from Monday’s rally. The stock surged over 20% on Monday following reports that Canada’s Alimentation Couche Tard Inc (TSX:ATD) had approached Seven & i for a takeover.

Broader Asian markets were mostly positive. South Korea’s KOSPI added 0.9% on strength in technology stocks, while Australia’s ASX 200 added 0.2%.

Gains in Australian markets were limited as the minutes of the Reserve Bank of Australia’s August meeting showed that the bank had considered a rate hike, amid concerns over sticky inflation.

The RBA also signaled it will keep rates high for longer- a trend that bodes poorly for Australian markets. The prospect of weak economic growth in China also weighed on Australian stocks, given their large trade exposure to China.

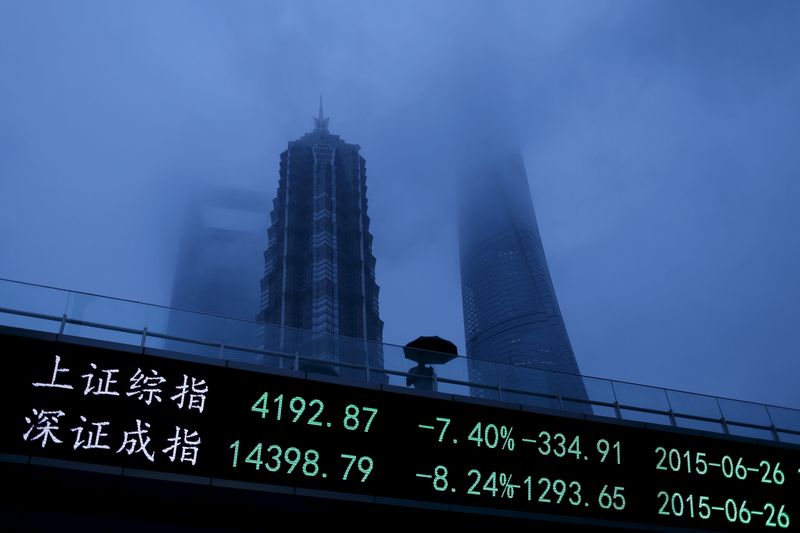

China stocks lag as PBOC leaves rates unchanged

Chinese markets lagged their peers, cutting short a recovery from six-month lows after the People’s Bank of China kept its benchmark loan prime rate unchanged.

The Shanghai Shenzhen CSI 300 and Shanghai Composite indexes lost 0.6% and 0.8%, respectively, while Hong Kong’s Hang Seng index shed 0.3%.

The PBOC left the its loan prime rate unchanged as widely expected. But the move still disappointed some traders holding out for more rate cuts in the country, especially after the central bank unexpectedly cut the rate in July.

While recent economic readings showed some improvement in Chinese consumer spending and inflation in July, overall sentiment towards the country was undermined by persistent concerns over slowing growth.