Risk sentiment lacks confidence with the absence of volatility on equity markets overnight possibly signalling downside action later in today’s session as Wall Street barely put in scratch sessions after their previous steep falls. German CPI was lower than expected, but this was offset by lower US GDP prints, with concern over personal consumption figures adding to the hesitancy. The USD remains strong against everything, with Euro slammed down to the 1.04 handle while the Australian dollar remains quite depressed below the 69 handle. Bond markets saw some retracement in yields, with 10 Year Treasuries pulled back below the 3.1% level while interest rate futures had a small pullback as well with a 190 bps suggested rate rises by the Fed this year. Commodity prices were also mixed, with oil prices down more than 1%, while gold had some large intrasession volatility, heading back down to the $1820USD per ounce level.

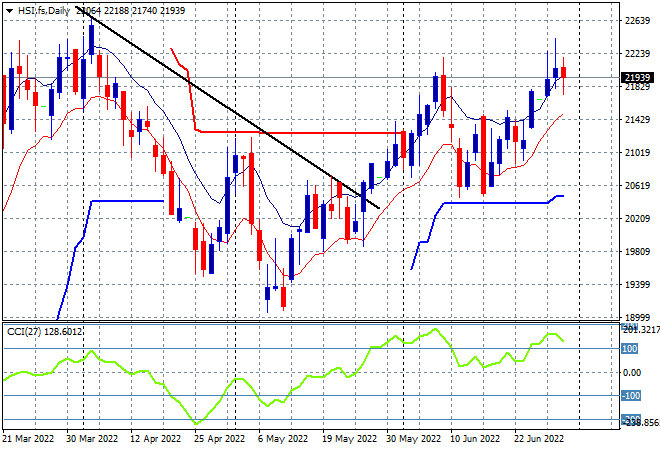

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets slumped across the board, with the Shanghai Composite finishing down more than 1.4% to 3361 points while the Hang Seng Index was also in full reverse mode with a 1.8% loss, currently at 21996 points. The daily chart was showing an attempt to breakout above the previous highs at the 22000 point level but as I warned yesterday, those overhead tails on the previous daily candles that matched the previous false breakout top were indicating a lot of intrasession resistance. Momentum is looking to rollover here, so be cautious of low volatility today that could beget higher downside volatility soon:

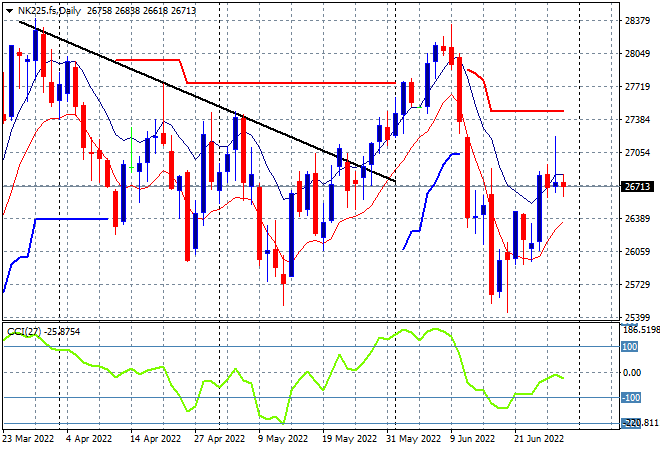

Japanese stock markets were also under stress, with the Nikkei 225 index closing 0.9% lower at 26804 points. Risk sentiment remains sour despite a lower Yen, with the daily futures chart showing possible further retracement with price action still unable to make any move above the high moving average. Daily momentum is still marginally negative but now out of the oversold zone but this requires a proper follow through above the high moving average to confirm a bottom, which has stalled so far:

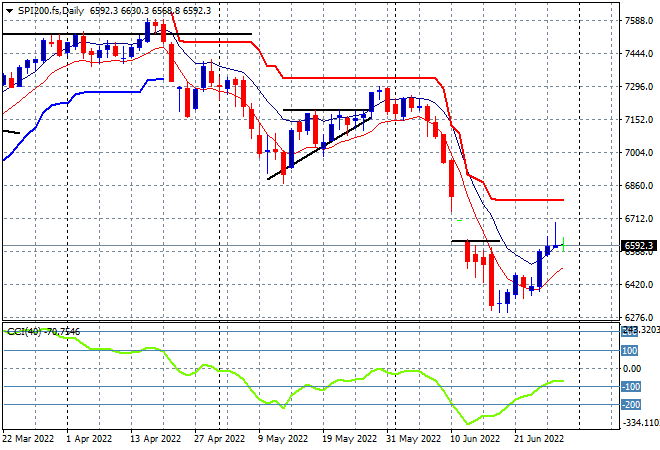

Australian stocks couldn’t escape the selling with the ASX200 finishing more than 0.9% lower, closing at exactly 6700 points. SPI futures are dead flat, reflecting the scratch sessions on Wall Street overnight. The daily chart is still not a pretty picture with my contention of price needing to recover well above the 6600 point level before calling any bottoming action still holding, as daily momentum reverts away from the very oversold zone yet is still quite negative:

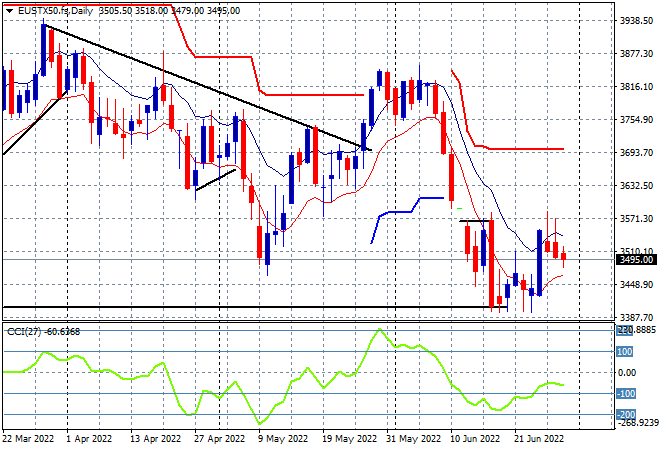

European stocks had a poor start to the session and stayed down with only some minor reprieve as Wall Street joined in as the Eurostoxx 50 index eventually closed 1% lower at 3514 points. The daily chart picture remains in a very bearish state here with price action still anchored around the the March dip lows as this classic swing action didn’t even get started, with daily momentum remaining negative. As I’ve said for awhile now, price needs to get back well above the 3570 point area that was resistance for the last couple of weeks:

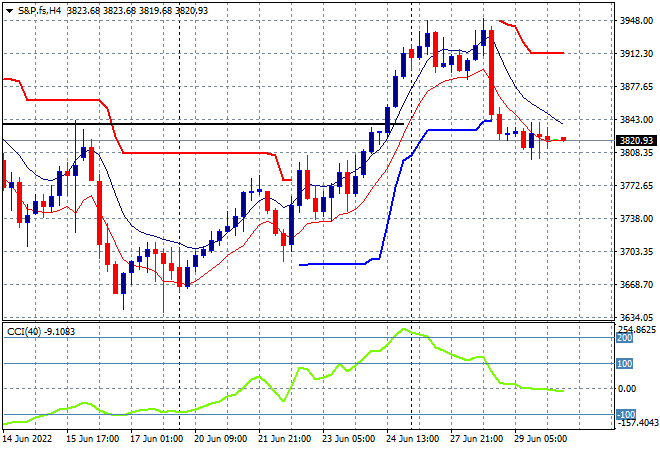

Wall Street couldn’t get out of its funk, but still managed to get some scratches on the board, with the NASDAQ almost dead flat while the S&P500 closed only 0.1% lower to finish at 3818 points. The four hourly chart support barely holding on at the 3820 point level, with price unable to get back above the previous resistance zone from the last false rally. A proper recovery out of this correction requires a rally back through the psychologically important 4000 point zone, which is seemingly out of reach:

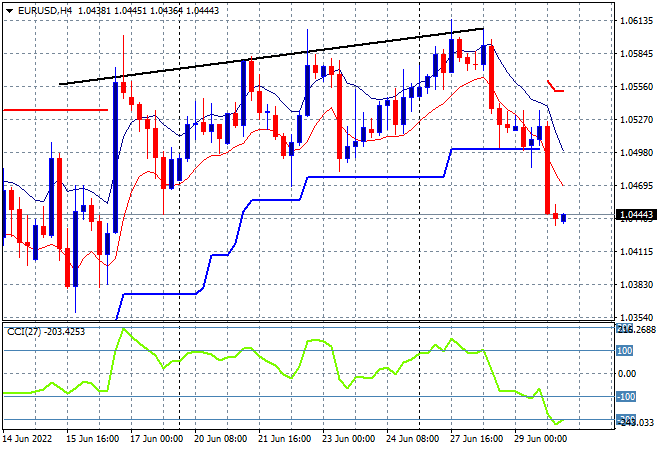

Currency markets continued to remain defensive with the USD still pushing higher against the undollars with Euro the main casualty again. The union currency was pushed well below the 1.05 handle for a new weekly low as price action retraced fully below trailing ATR support for a proper rollover, which it effectively broadcasted in the previous session. This could see a proper retracement down to the previous launch point at the mid 1.03 level next:

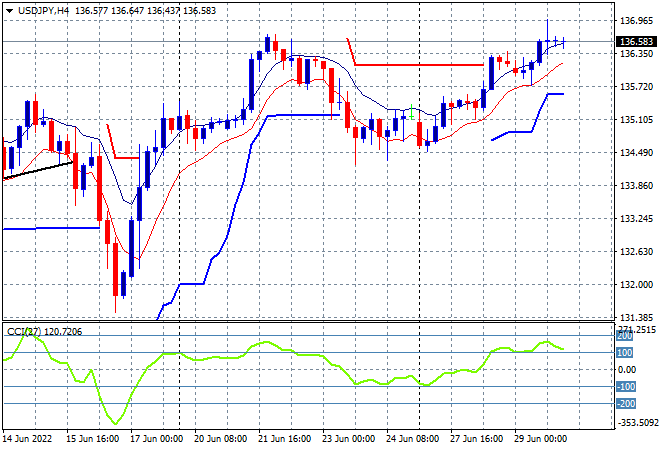

The USDJPY pair is trying to push on a string here, unable to really advance its liftoff after being down for the count on Friday night, still holding above the 136 handle but not pushing above last weeks intrasession high. While this confirms the uncle point at the 134 handle as four hourly momentum remains overbought, price is barely staying above the high moving average and has had no new session highs for awhile, so I remain cautious:

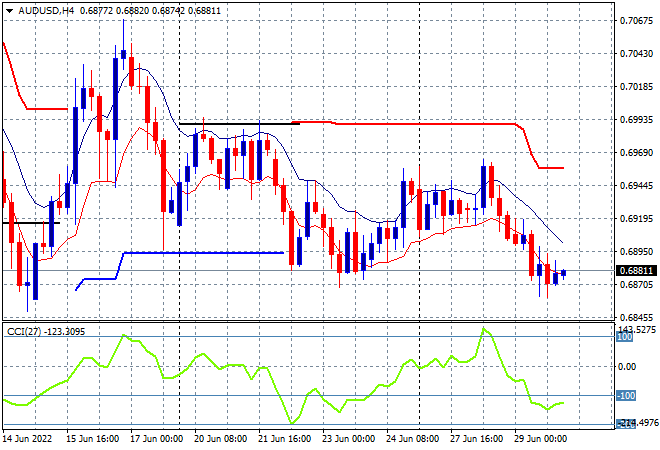

The Australian dollar remains in its place after previously failing to get back above the 70 handle, with overnight sellers keeping it depressed and wanting to push it back down to the previous weekly low at the mid 68 level. My contention of a further retracement below the 69 handle still holds as the Fed well remains ahead of the hapless boffins at Martin Place, with four hourly momentum remaining quite negative as the swing play turned into nothing, watch for a go at the 68.70 level next:

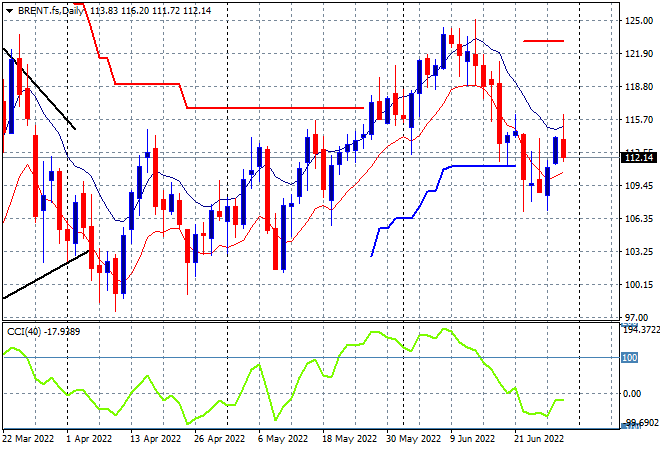

Oil markets are trying to stabilise with a volatile session that saw Brent crude pushed above to the $115USD per barrel level before retracing to the $113 level with a sideways directionless bent still evident. Daily momentum is still negative however, with price support moving back down to the $106 level so as I’ve been saying for awhile, if we don’t get a substantive move above the high moving average around the $115 area, it could turn into a push down to the $100 psychological support level next:

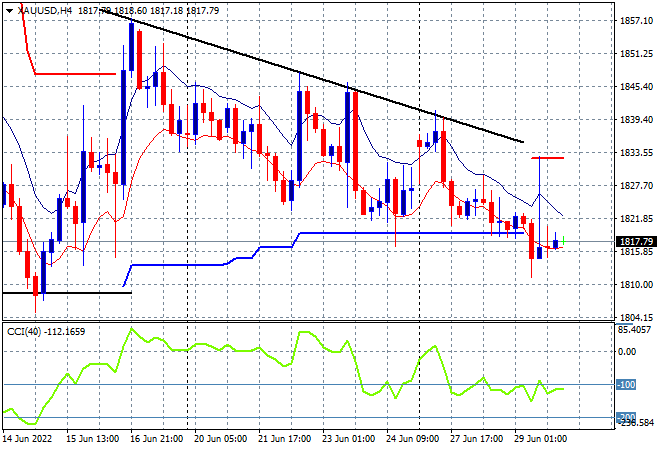

Gold had a wild ride overnight but still can’t get out of its sideways bearish oscillation with another down session seeing it pushed below the $1820USD per ounce level as resistance was once again rejected, now firming at the $1830USD per ounce level. Daily momentum remains negative as four hourly momentum rolls back into the oversold zone, with the short term trend showing a series of lower low sessions, so watch for a breakdown shortly: