Risk sentiment continues to sour on Wall Street overnight due to the plunge in Meta (NASDAQ:META), with the NASDAQ pulling back nearly 2% while European stock markets held fire alongside the ECB which kept interest rate rises on hold. The USD was relieved of pressure as the Euro fell back sharply while Pound Sterling remained relatively steady as the Australian dollar retreated below the 65 handle. US bond markets saw another mild pullback with 10 Year Treasury yields retreating below the 4% level to just above 3.9% as bond traders re-positioned following the ECB meeting. Meanwhile commodities are firming up slightly, with oil prices lifting as Brent crude finished just above the $96USD per barrel level again while gold consolidated to steady at the $1660USD per ounce level.

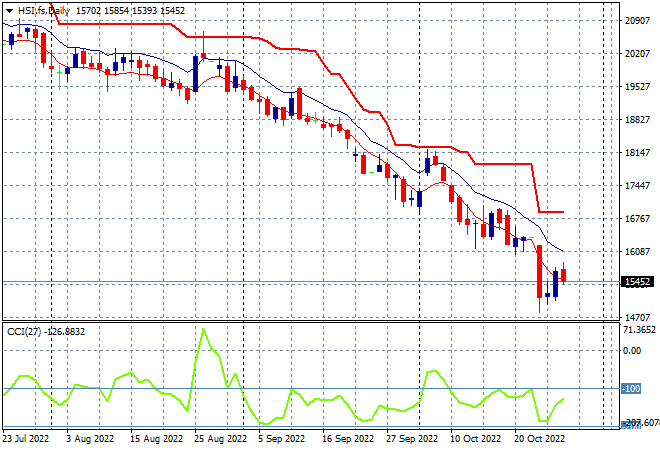

Looking at share markets in Asia from yesterday’s session where Chinese share markets retreated again going into the close, with the Shanghai Composite back below the 3000 point barrier, down 0.5% to 2955 points while the Hang Seng Index is moving higher instead, up 0.7% to 15427 points. The daily chart shows how swift this decline has been, wiping out over a decade of returns – so far. Just below this level is the 2008 lows, so watch for the 15000 point level to come under threat next if another session low is made:

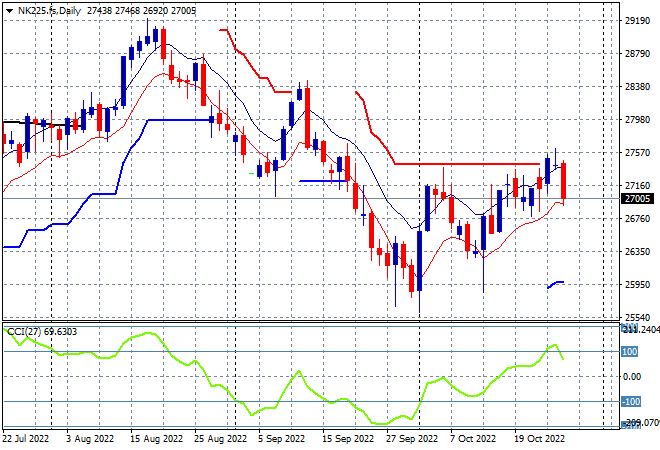

Japanese stock markets also pulled back as the Yen appreciated with the Nikkei 225 closing 0.4% lower to 27345 points. The daily price chart was showing a possible breakout brewing here under overhead resistance at the 27500 level with a very solid start to the trading week from Wall Street’s lead, although futures are indicating a pullback to finish the trading week on a glum note as momentum retraces from its briefly overbought reading:

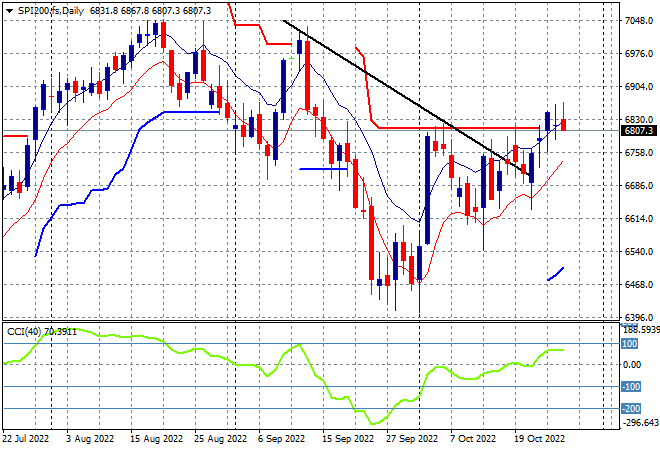

Australian stocks had a solid session with the ASX 200 closing 0.5% higher, building above the 6800 point level to close at 6845 points. SPI futures are down about 0.4% due to the continued pullback on tech shares on Wall Street overnight. The daily chart looks similar to Japanese stocks with futures suggesting price action will stall here around key trailing ATR resistance at the 6800 point level. Daily momentum has finally crossed into the positive zone but nowhere near overbought with the long tails of selling intrasession suggesting a lack of upside action:

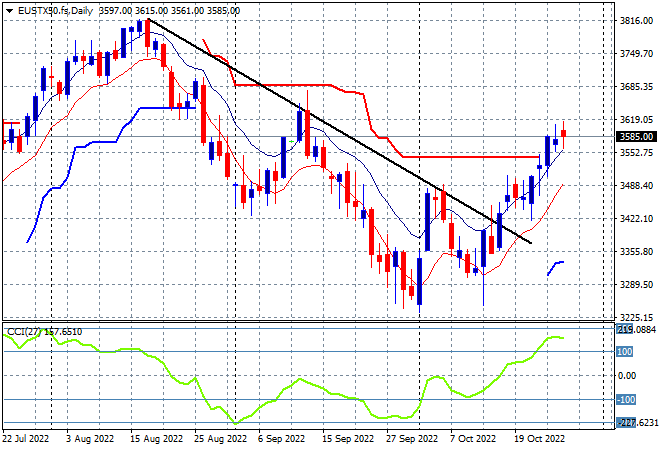

European stocks had a breather after their recent rally on newfound confidence with scratch sessions across the continent, as the Eurostoxx 50 Index finished dead flat at 3604 points. The daily chart is also showing similar price action to Asian markets, but with more momentum as it clears resistance at the 3550 level. The breakthrough of the downtrend from the August highs combined with overbought daily momentum should provide further moves higher here, as will a lower Euro but watch for correlations with Wall Street:

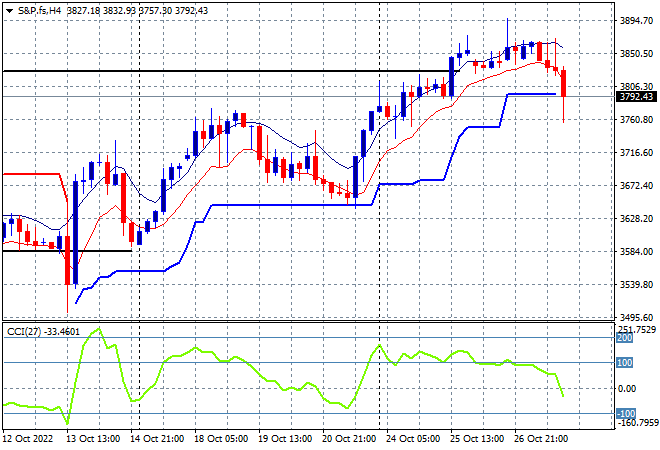

Wall Street continued to stumble due to tech stocks with the NASDAQ down 1.6% while the S&P500 followed along, down 0.6% to 3807 points. The four hourly chart shows price action failing to continue its strong bounce off support at the 3640 point level after clearing resistance at 3800 points and now falling back below. Momentum was just in the overbought zone as an inverse head and shoulders pattern completed its development but as I warned yesterday, there was too much overhead selling here with the 3900 point level a target that maybe out of reach in the short term:

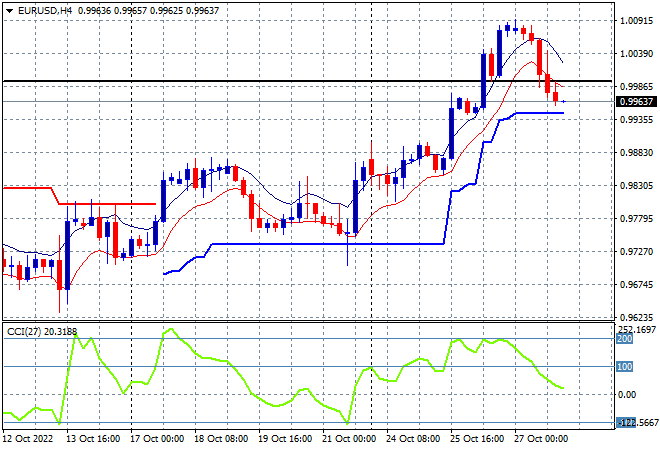

Currency markets reacted to the non-ECB decision with USD relieved of its recent pressure with the Euro’s brief dance with parity finishing overnight as it retraced to the mid 99 level instead. While this maybe in line with overall correlation in other risk markets, the union currency was pushing too high here in anticipation of last night’s ECB meeting with short term momentum quite overbought. Watch now for trailing ATR support at the 99.30 level to come under pressure next:

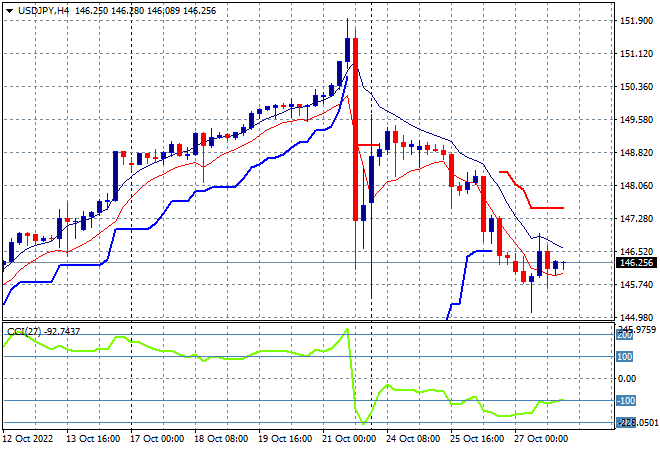

The USDJPY pair is trying desperately to stabilise as price action caught up with huge volatility from last Friday, with another downleg then rebounded overnight to finish this morning just above the 146 handle. The recent unsustainable push higher has unwound completely – moving over 600 pips again – with price action once more in a sideways move here but without any upside potential:

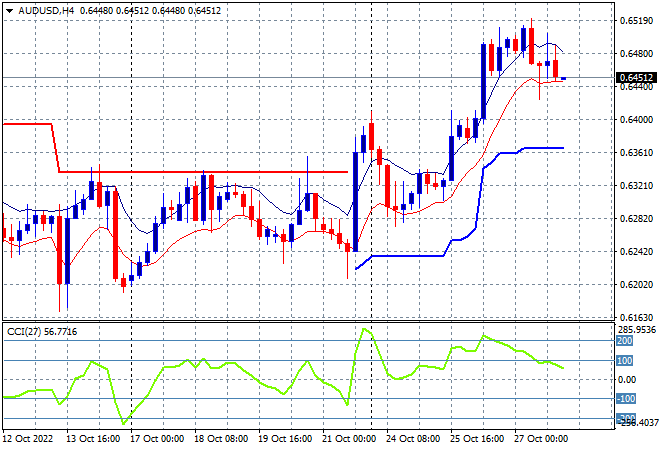

The Australian dollar is holding on for the ride with only a minor pullback overnight to still hold on to its three week high to finish at the mid 64 level this morning. I had contended that there was a lot of internal weakness here, not just because of the over strong USD, with resistance too strong at all the previous levels with the 65 handle still the area to beat in the medium term. Let’s see if that holds up in today’s trade because short term momentum has now retraced from being considerably overbought:

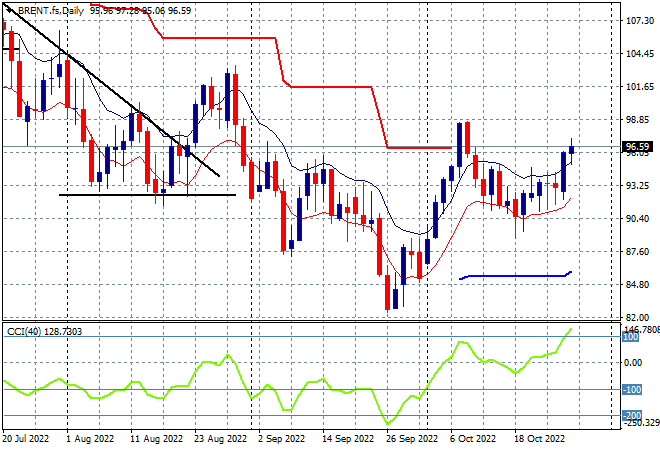

Oil markets continued to advance after the previous breakout higher with Brent crude lifting out of its funk to climb up through the $96USD per barrel level. Daily momentum looks like settling in to a positive mood here, changing to properly overbought as price action wants to get back to the magical $100 level. I’m watching for the $98 level to come under pressure next before getting too excited about a new move higher:

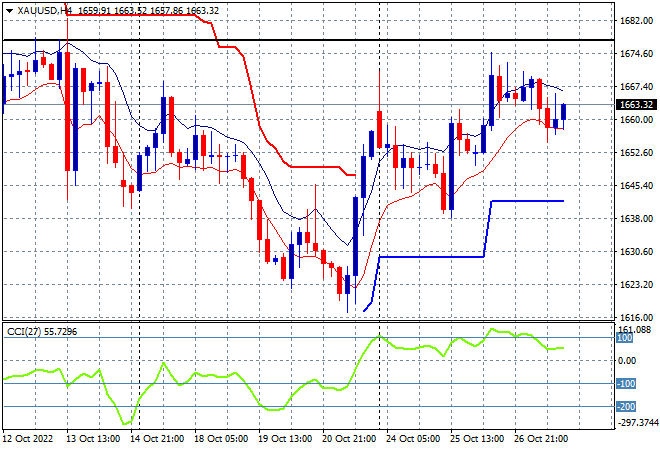

Gold was unable to build on its Friday night gains with a relatively sanguine session overnight, finishing where it started at the $1663USD per ounce level. As I opined previously, while there is a potential inverse head and shoulders pattern forming on the four hourly chart, the multi-month bearish setup remains in place. Overhead resistance at the $1675 level must be cleared next before calling that a proper bottoming action: