Overnight stock markets stabilised somewhat with a late rally in tech stocks (aka Meta Platforms Inc (NASDAQ:FB)) helping calm fears of growing poor earnings on Wall Street in the wake of an aggressive Fed rate rise regime. The USD is still growing stronger, now at a five year high with defensive Yen reversing as Euro and the Australian dollar get weaker and weaker, the latter unfussed by the latest inflation print. Bond markets are selling off again, with the 10 Year US Treasury yield pushed back up to the 2.8% level while commodity prices oscillated, with WTI and Brent crude oil both largely unchanged, while gold remains depressed falling more than 1% below the $1900USD per ounce level.

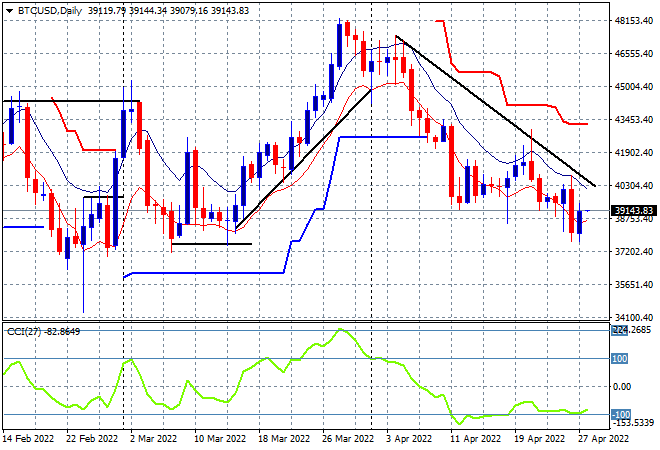

Bitcoin is still on a downward tear after recently making a new weekly low to breach the $38K level overnight, finishing just above the $39K level this morning. As I’ve been saying for awhile, the lack of confidence in the crypto world could see a further retracement down to the February lows at the $37K level next and we’re almost there as this trendline attests:

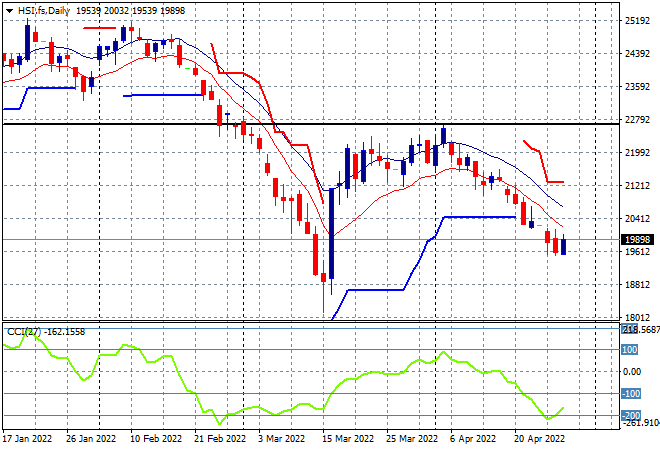

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were the only highlight in the region with the Shanghai Composite closing 2.5% higher at 2958 points while the Hang Seng Index held on for a mild scratch session at 19946 points. The daily futures chart remains in a near freefall on COVID and growth fears with a return to the early March lows at 18000 still possible here although a mild swing trade could be brewing to bounceback to the 20000 point level temporarily:

Japanese stock markets are still falling in the wake of a stronger Yen with the Nikkei 225 closing 1% lower at 26386 points but futures are indicating an uplift at the open as overnight moves in Yen give it more support. Daily momentum is still in a negative state with price below previous daily ATR support as it continues to reject weekly resistance at the 27500 point level. Any potential break below the low moving average will spell capitulation of confidence and a swift return to the 24000 point level, so a fill in buying session is required here soon:

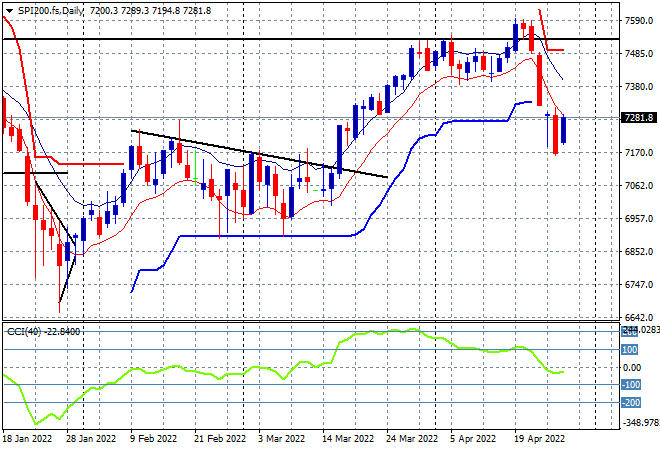

Australian stocks ended up a bit better than expected, absorbing the inflation print with the ASX200 losing nearly 0.8% to add to its poor start to a truncated trading week, closing at 7261 points. SPI futures are suggesting a pullback of those losses, up 0.7% so far but probably not enough to make a new daily short term high. The daily chart shows price action is well contained here at the 7200 point level with momentum now solidly neutral so I don’t expect any further upside unless another catalyst for commodity prices or election news comes through soon:

European shares had a much better night but its all relative following the recent sharp selloffs, with the Eurostoxx 50 index closing some 0.4% higher at 3734 points. The daily chart picture remains quite bearish (turn it upside down and you’d be a buyer no?) with my contention of another breakdown still holding with a return to the February lows as the energy crisis in Europe widens:

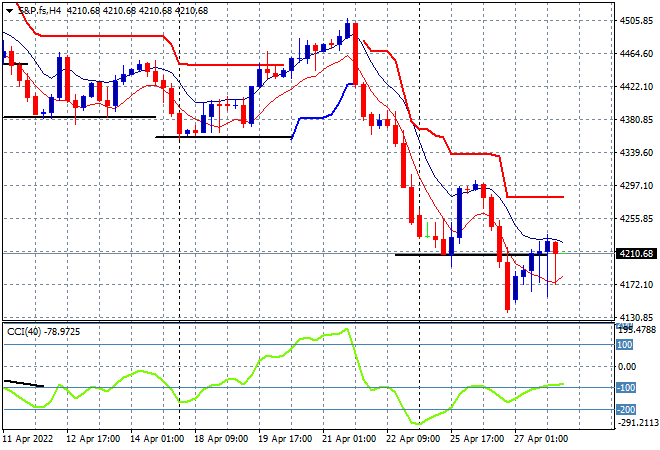

Wall Street is still in correction mode despite a small bounce overnight, with the NASDAQ remaining volatile to close with a scratch session while the S&P500 put on a handful of points to just finish in the green. Price action on the four hourly chart shows a series of dog tails wagging here – lots of intrasession buying support indicative that the BTFD crowd maybe building for another breakout with the 4200 point level the most likely jumping off point. This would be a swing play only, with the potential up to 4300 before turning into another dead cat bounce as the medium term target remains the 4000 point level:

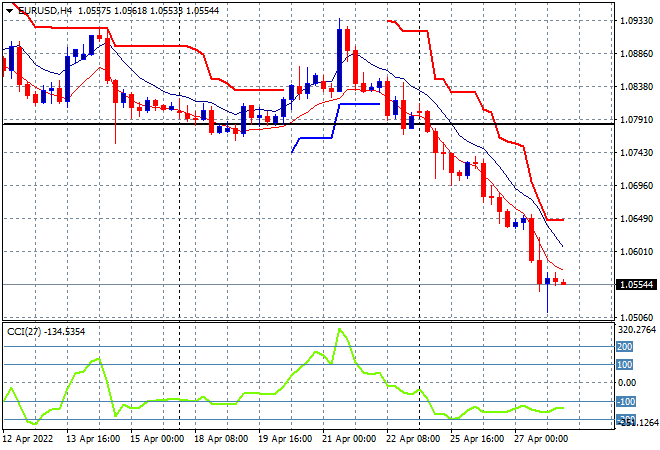

Currency markets remain stuck in a funk with the ever stronger USD pushing Euro and Pound Sterling to more new structural lows overnight. The union currency is seemingly losing a handle a session at the moment, falling below the 1.07 level to start the week and now well below the 1.06 level as it remains clearly oversold and ready for more downside although I still expect a short term swing bounce before a return to the long term trend down to parity:

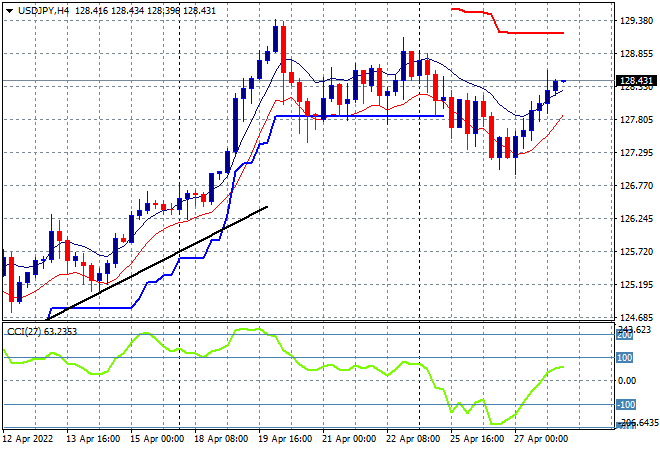

The USDJPY pair is coming back however, perhaps indicative of some oversold conditions on risk markets with a bounce back up through the 128 handle overnight. This might be the start of another consolidation after the too far, too fast early April trend blowout so watch for momentum to stabilise in the positive zone, if not quite overbought as we finish the trading week:

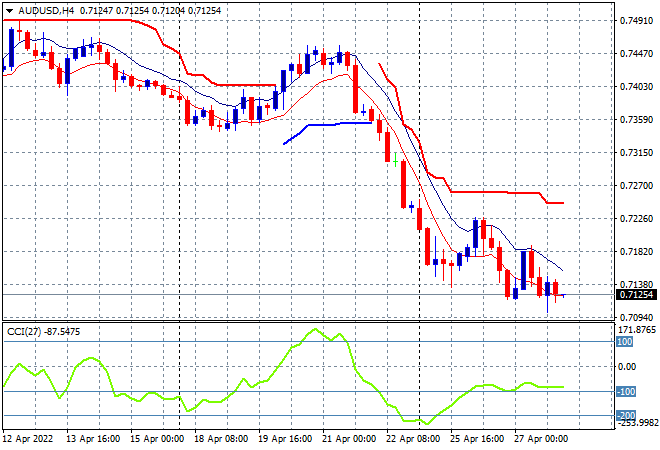

The Australian dollar is rolling around on the floor, not quite dead but possibly bleeding out here, maintaining a depressed condition below the mid 71 level overnight after absorbing the outsized CPI print yesterday. Expectations are the RBA will do almost nothing to arrest this, hence the drop in the Pacific Peso as commodity prices waver. I’m still watching for a drop below the 71 handle here very soon:

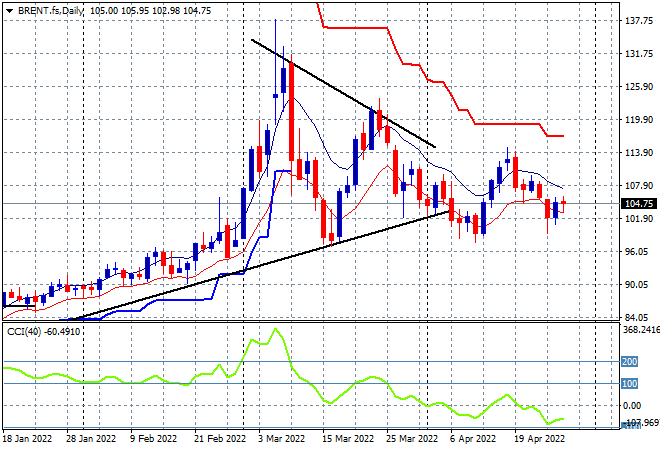

Oil markets are still trying to stabilise amid the turning off of the Putin taps across energy lines in Europe with Brent solidifying above the $100USD per barrel level overnight but not making any further advances. Daily momentum is still well in the negative zone, with minimal chance of any upside potential, with a drawback or breakdown below the key $100 level still possible with no new weekly highs being made for sometime now:

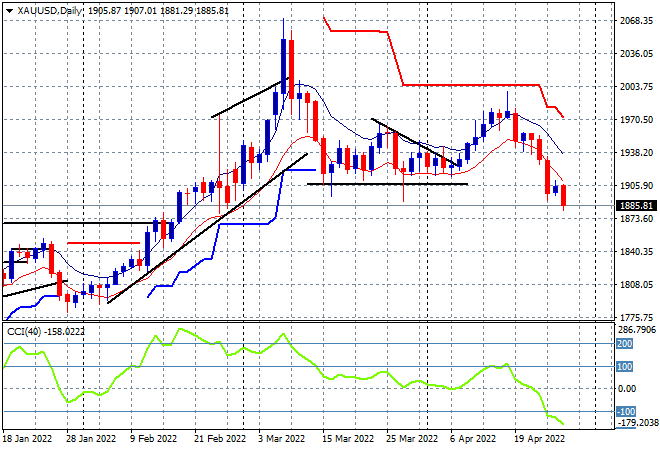

Gold continues to fall as it remains under a lot of pressure having blown through previous weekly support at the $1900USD per ounce level, finishing at $1885 this morning. Daily momentum is continuing to pick up and get into quite oversold territory with the January lows around the $1800 level quite possible: