Wall Street was able to follow through on its recent surge on the back of strong GDP data with European shares also lifting as Euro stopped climbing higher. The USD remains under some stress against the majors with Euro oscillating around the 1.09 handle while the Australian dollar holds firmly above the 71 cent level. US bond markets saw a small selloff with 10 year Treasury yields up slightly to just below the 3.5% level while the commodity complex saw oil prices move slightly higher in anticipation of the upcoming OPEC+ meeting as Brent crude finished at the $87USD per barrel level. Gold pulled back from its recent weekly high to finish below the $1930USD per ounce level.

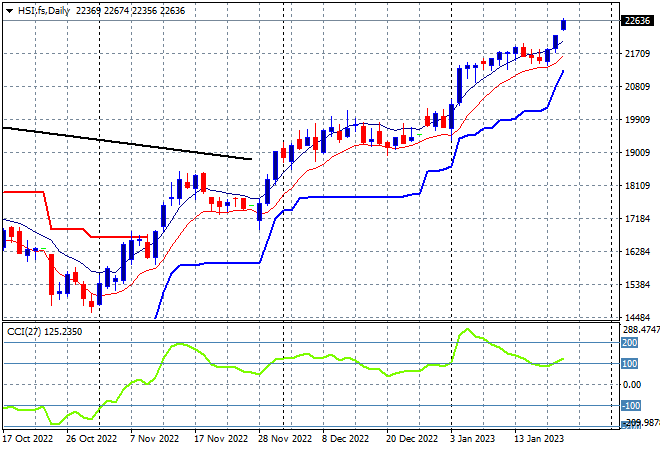

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets remain closed but the Hang Seng Index in Hong Kong reopened with a big surge higher, lifting 2.4% to 22566 points. The daily chart shows a clear breakout after building up a series of steps with daily momentum well overbought and ready for new highs from here:

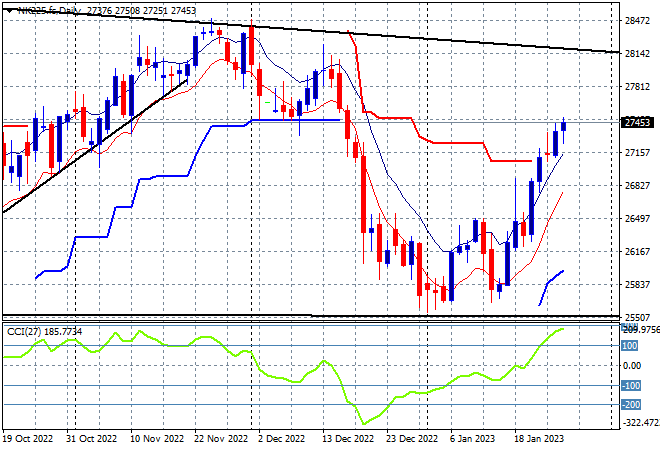

Japanese stock markets wavered however with scratch sessions with the Nikkei 225 closing 0.1% lower to 27362 points. After bottoming out a the 25000 point level, after absorbing a lot of BOJ and bond market problems, the recent positive correlation performance with Wall Street is helping lift price action back to the November highs. Clearing daily ATR resistance and getting daily momentum back into overbought mode should set up a further move higher to the 28000 point level next:

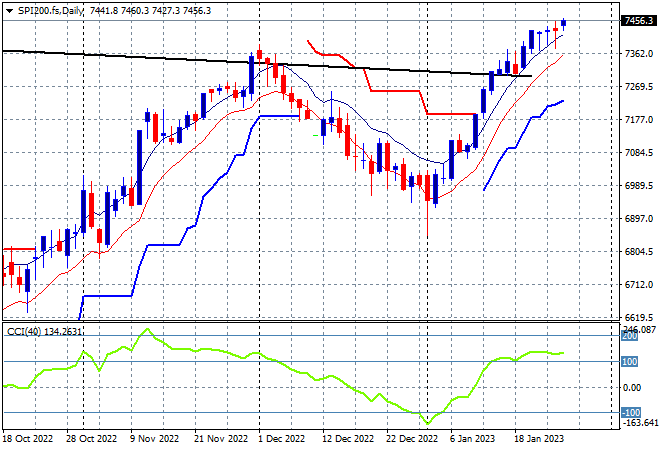

Australian stocks were closed yesterday with the ASX200 poised to finish the truncated trading week on a positive note with SPI futures up nearly 0.5% on the strong moves on Wall Street overnight. The daily chart had been showing price action and daily momentum in a decline since the start of December but the new breakout building here above the 7300 point level still has lots of legs. Previous overhead ATR trailing resistance at the 7200 point level is firming as short term support with resistance at the November highs now cleared:

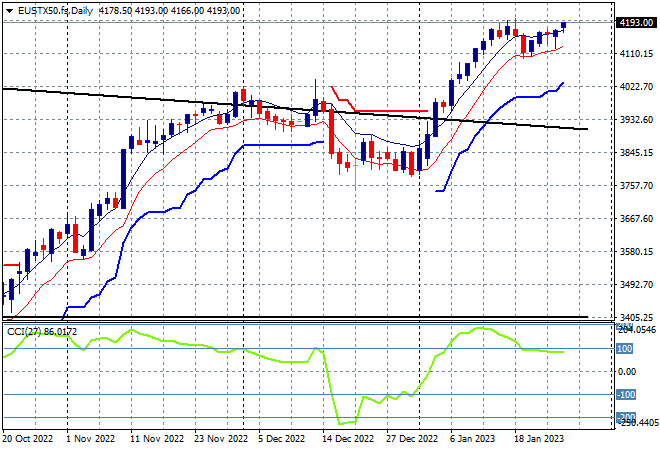

European markets were able to lift slightly higher after being unsettled midweek as the Eurostoxx 50 Index 0.6% higher at 4173 points. The trend above the 4000 point level has stabilised for now with the potential for a rollover almost gone as daily momentum takes a breather from its previously overbought settings. The 4000 point level is the key psychological resistance level here that could be turned into support going forward, but I’m wary of a top forming at the 4200 point level:

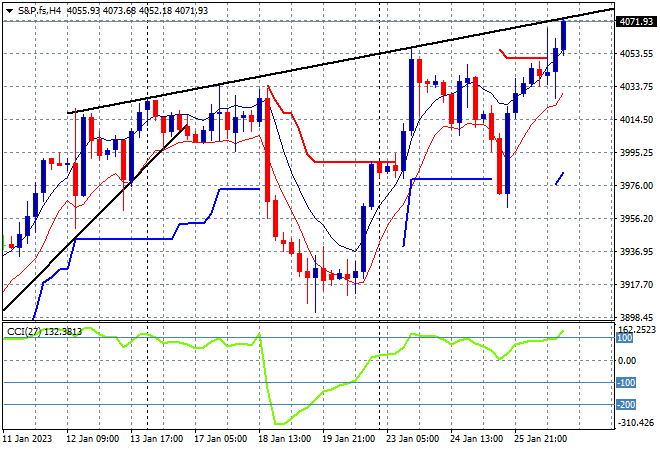

Wall Street was able to extend its breakout as earnings season gets underway, with the NASDAQ up 1.8% while the S&P500 lifted more than 1%, extending its gains above the 4000 point level, finishing at 4076 points. After breaking the series of lower daily highs since Xmas, price action has been trying to get further above the dominant medium term trendline after hovering around weekly support at the 3800 point level and with this breakout the bulls have seemingly cleared the way. While the technical level above 4000 points has been broken, I’m still wary of a bull trap as we head into an interesting earnings season:

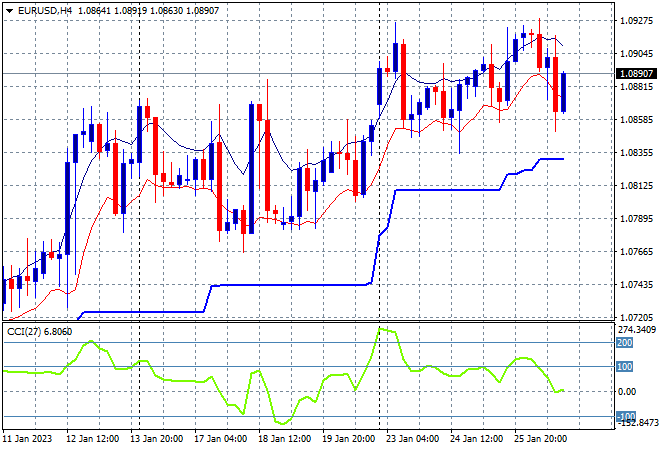

Currency markets remain in a sideways bearish mood against USD with Euro lifting through the 1.09 handle briefly before retracing back to where it started. After gapping slightly higher over the weekend, most of the major currency pairs are holding on to their gains against King Dollar. Continued retracements below the 1.08 level for Euro are being met with strong support as trailing ATR support remains intact. While price action is still well above the recent weekly highs and short term momentum remains somewhat overbought, there is little upside potential here if resistance cannot be cleared decisively:

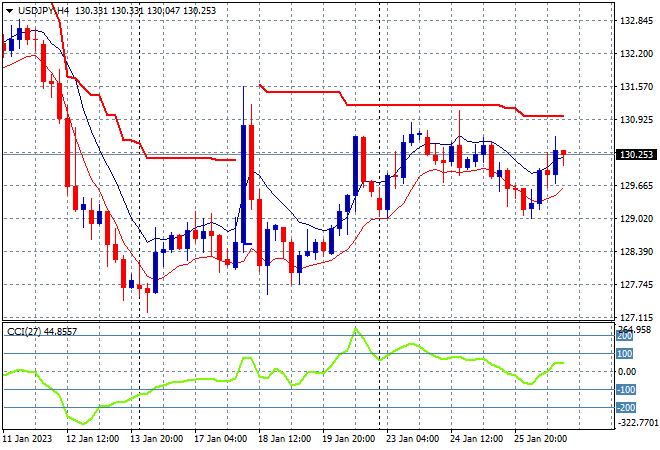

The USDJPY pair tried to lift off the floor again after the earlier false breakout in the week with a move above the 130 level again that is still below the last week’s intrasession high. Short term momentum is nominally positive but not going anywhere really as this could still be setting up for more downside below if it doesn’t translate into a proper swing rally soon:

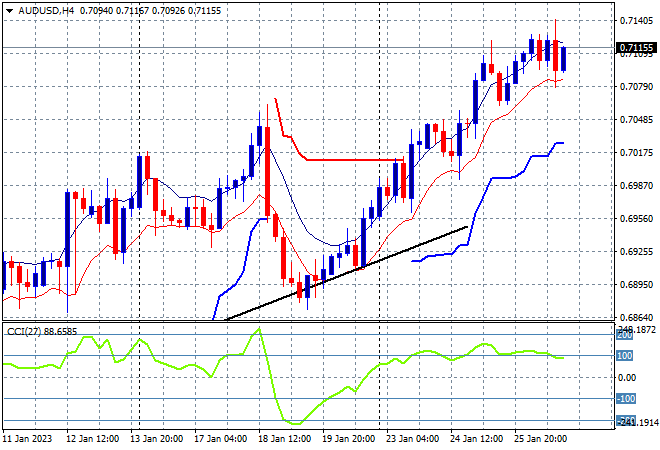

The Australian dollar has been surging since the latest inflation release and the absence of Aussie based traders yesterday didn’t hinder it getting pushed through the 71 cent level where its found more support overnight. Traders are obviously setting up for the upcoming February RBA meeting with price action pushing well above the broad weekly uptrend channel limits, and making a new weekly high above the 70 cent level:

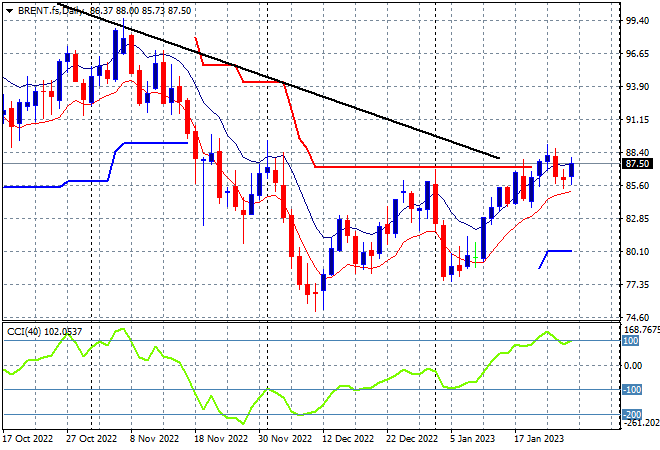

Oil markets had been gaining more traction in the last week or so but are still trying to make that final push with Brent crude able to get back above the $87USD per barrel level but no further. This keeps price action below the previous lows but the overall trend shows price ready to tackle overhead ATR resistance and the dominant downtrend, but not decisively as yet:

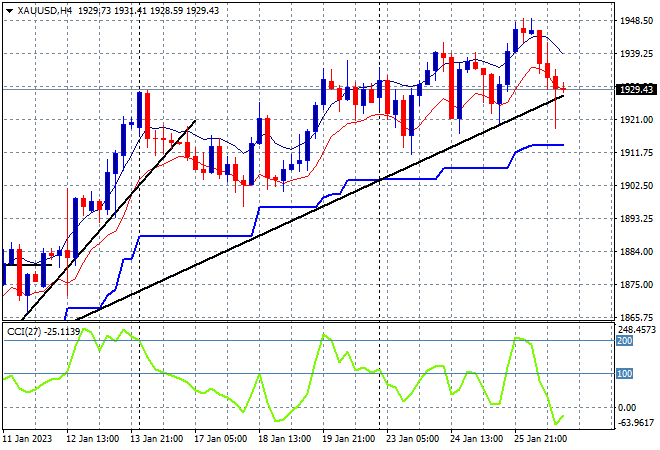

Gold is again moderating its previous boisterous price action with another selloff overnight, pulling back from the recent new daily high near the $1950 level to finish right on its trendline at the $1930USD per ounce level this morning. Price action on the four hourly chart shows a move back towards the more sustainable uptrend line as short term momentum retraces back to a more neutral setting and keeps above trailing ATR support. There is a lot of upside potential here as new highs are made with higher lows but watch that trend line: