Stock markets around the world remain in retreat mode following last week’s interest rate hike by the US Federal Reserve with local stocks at a new two month low. Wall Street and European shares remained in bear market mode falling another 2% on Friday night. The USD continues to strengthen against everything with Euro continuing its sharp drop below parity, with the Australian dollar and Pound Sterling still on the ropes, the latter at a decade new lows. Bond markets remain under pressure across the yield curve although 10 year Treasury yields stabilised at the 3.7% level with interest rate expectations still looking at another 150bps in rises by January. Commodities dropped below key support levels with WTI and Brent crude falling more than 4%, the latter down to the $85USD per barrel level while gold failed to stabilise at its recent lows and made a new monthly low at the $1640USD per ounce level.

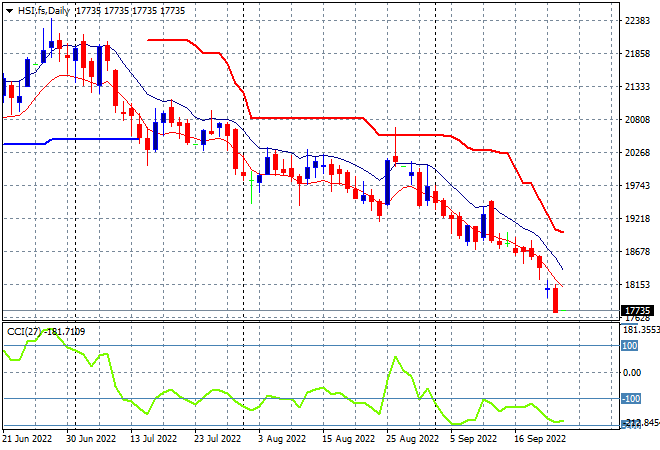

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets headed lower into the end of the trading week with the Shanghai Composite down 0.6% to 3088 points while the Hang Seng Index again sharply retraced, down more than 1% at 17933 points. The daily futures chart is still showing a very bearish mood and a distinct lack of buying support quite evident and indeed accelerating into an abyss. The bear market continues with daily momentum nowhere near out of its negative funk:

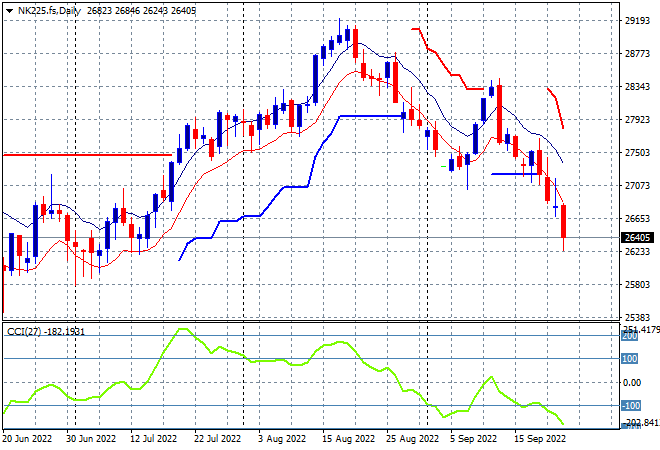

Japanese stock markets were still selling off with the Nikkei 225 closing 0.6% lower at 27153 points. The daily chart shows price action returning to the dominant downtrend after the recent dead cat bounce up to the 28000 point level with support at the 27000 point level taken out recently. Daily momentum remains negative and oversold with successive new daily low sessions pointing to a test of the June lows next as futures are indicating more selling ahead:

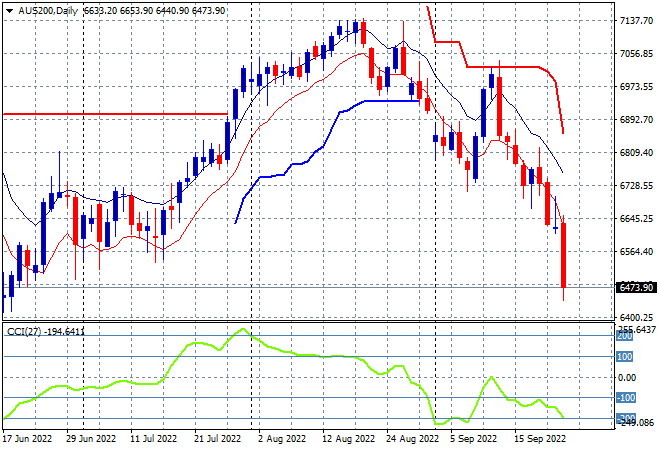

Australian stocks were the worst in the region with the ASX200 losing nearly 2% to close at 6571 points, playing catchup after yesterday’s holiday. SPI futures are indicating at least a 1% drop on the open in line with the Friday night falls on Wall Street with the daily chart showing even worse price action compared to other Asia stock markets as commodity prices move lower. This downtrend is likely to test the June lows next as daily momentum remains in full oversold mode, with buying support evaporating:

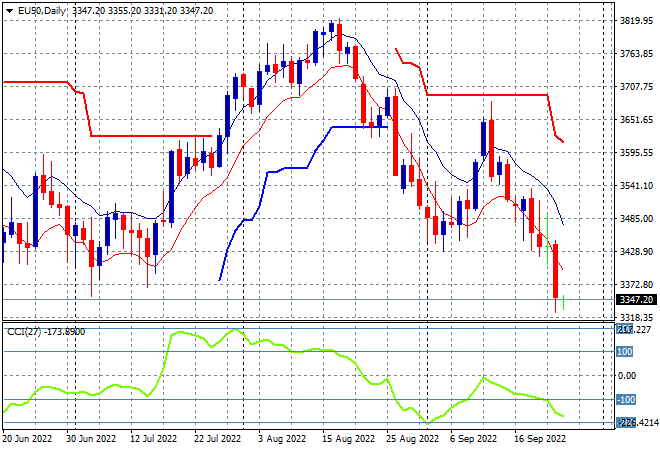

European stocks continue to accelerate their losses across the continent again, with co-ordinated falls sending the Eurostoxx 50 Index down 2.2% to 3348 points. The daily chart showed how bad a big dead cat bounce that preceded this fall, following the moves off the June lows at the 3300 level that look like the next target to reach. Another bearish engulfing candle and a failure of daily momentum to get back above positive readings suggests another leg down:

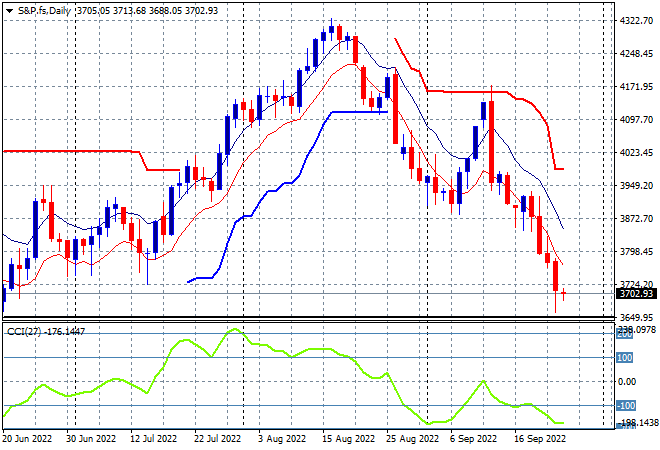

Wall Street had similar falls, with the NASDAQ down 1.8% while the S&P500 finished more than 1.7% lower at 3693 points. The daily chart looks similar to all other major stock markets showing how in line market expectations are with the hawkishness of the US Fed. Price has now returned to the June lows which wipes out all of 2021’s returns:

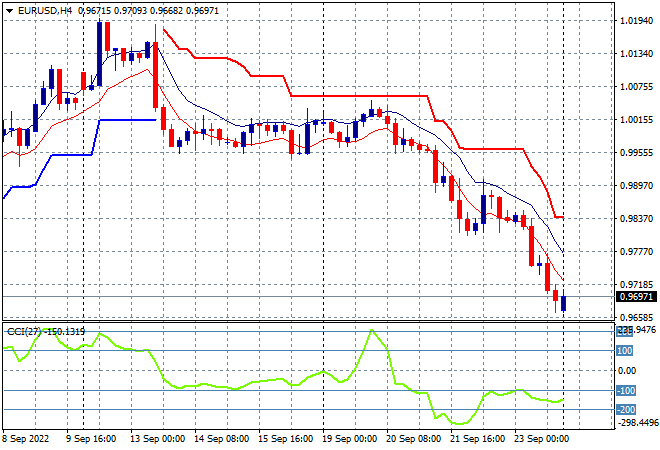

Currency markets remain firmly on the side of the USD, with Euro still well below parity and breaking through the 97 handle. As expected the union currency was broken by the interest rate hike and is likely to head lower as the Fed gets more hawkish than the ECB. Momentum remains nearly extremely oversold with the four hourly chart indicating more selling pressure as the high moving average is not under threat:

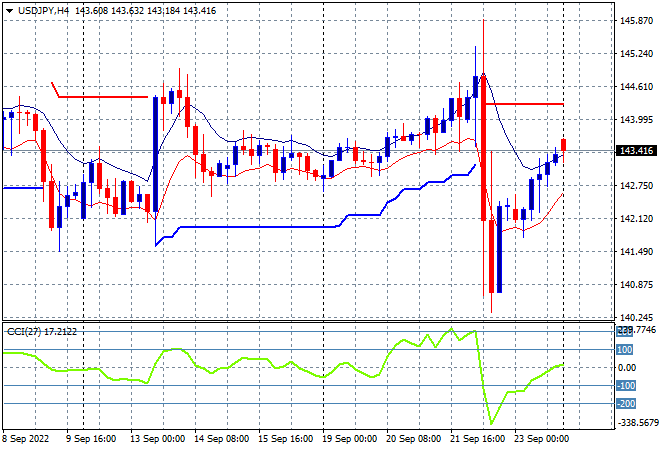

The USDJPY pair had some massive volatility last week around the Fed meeting, moving over 500 pips in 24 hours, with half of this returned by the end of the trading week, settling at the mid 143 level. Short term momentum has stabilised somewhat despite the volatility with price action back at the weekly neutral level so watch for any attempt above the 144 handle next:

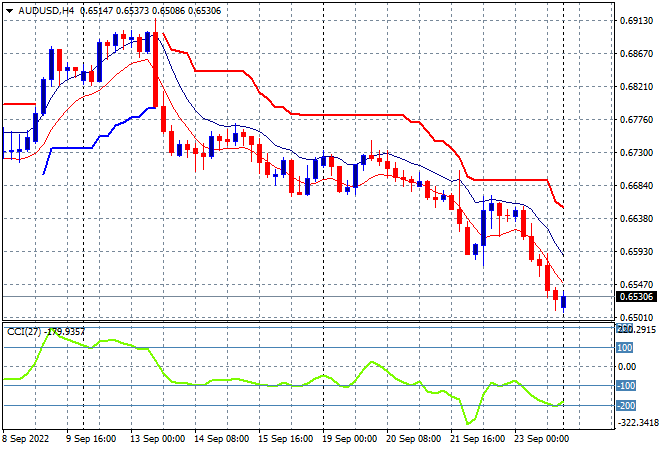

The Australian dollar continued to crack lower, finished at just above the 65 handle, moving in line with risk markets and the falls in commodity prices. My contention that resistance is just too strong at all the previous levels with the 68 handle the area to beat in the short term is holding, with the 67 level firming as well as trailing overheard ATR resistance is just not under any threat:

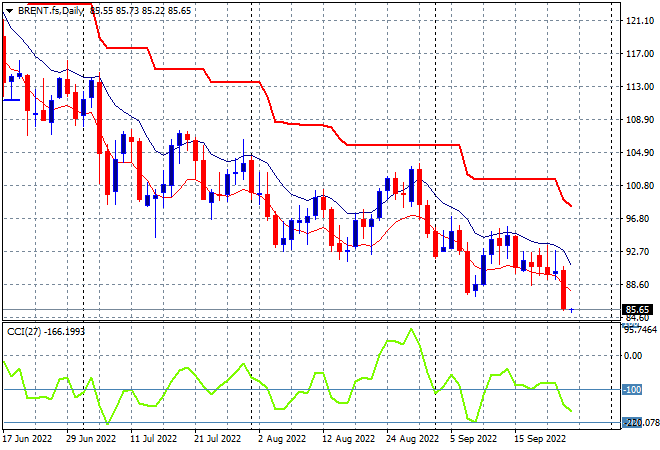

Oil markets were chugging along on the bottom with no buying support evident and then collapsed on Friday night, with Brent crude down 5% to the $85USD per barrel level again. Daily momentum had been persistently negative although not technically oversold but price action is no longer anchored at the recent weekly lows as new monthly lows are being made in this rout:

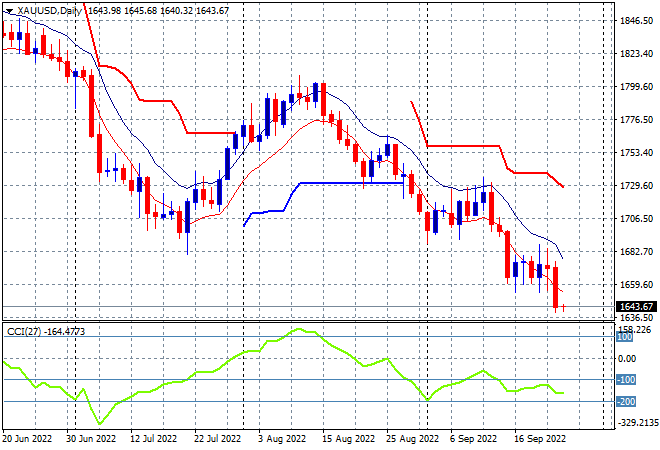

Gold like other undollars remained depressed through last trading week but didn’t suffer as much volatility or downside moves in the wake of the Fed, but finally played catchup to break well below the key $1700USD per ounce support level to finish at the $1643USD per ounce level. This takes the shiny metal below the 2020 lows and confirms the multi-monthly bearish setup: