Friday night saw Wall Street continue its week long losing streak alongside European shares as markets still bet on the US Federal Reserve raising rates aggressively following Fed Chair Powell’s testimony to Congress amid new PMI surveys showing global activity slowing down. The failed Russian coup over the weekend is likely to see further interest in safe haven USD which came back even stronger with the Australian dollar slumping well below the 67 cent level.

US bond markets saw some wavering but eventually the 10 year yield finished at the 3.73% level while oil prices fell back further due to economic slowdown concerns with Brent crude dropping to the $74USD per barrel level. Gold deflated yet again as it dropped sharply towards the $1900USD per ounce level without any bounceback as in previous routs.

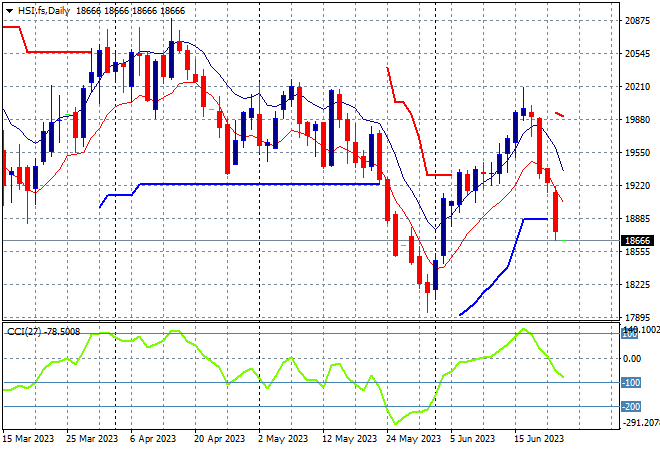

Looking at share markets in Asia from Friday’s session where mainland Chinese share markets were closed while the Hang Seng Index played catchup after also being closed for a holiday, slumping more than 1.8% to the 18875 point level.

The daily chart was showing a series of strong sessions that took it back above the previous resistance zone as daily momentum became positive and overbought, retracing most of the May losses. However this sharp reversal continues to take price action below that zone with this follow through below the 19000 point level indicative of further falls ahead:

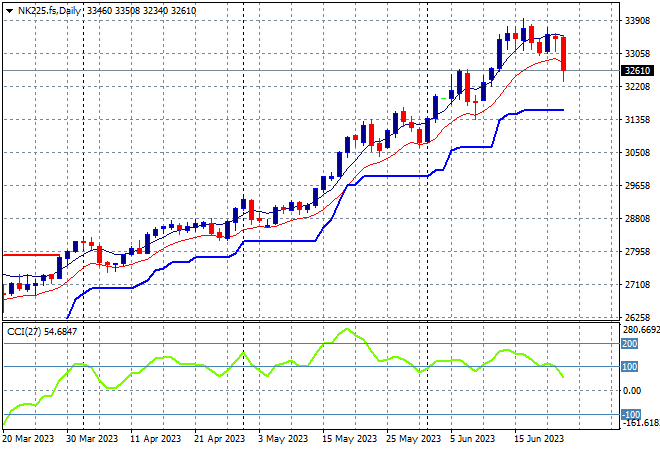

Japanese stock markets continued to selloff with the Nikkei 225 closing nearly 1.3% lower to 32781 points. Futures are indicating a further retracement as the new trading week gets underway.

Trailing ATR daily support had been ratcheting higher but with the 33000 point level now broken and daily momentum retracing from overbought settings we could see a further retracement back down to that support zone. A consolidation back to 31000 points is sorely needed to take some heat out:

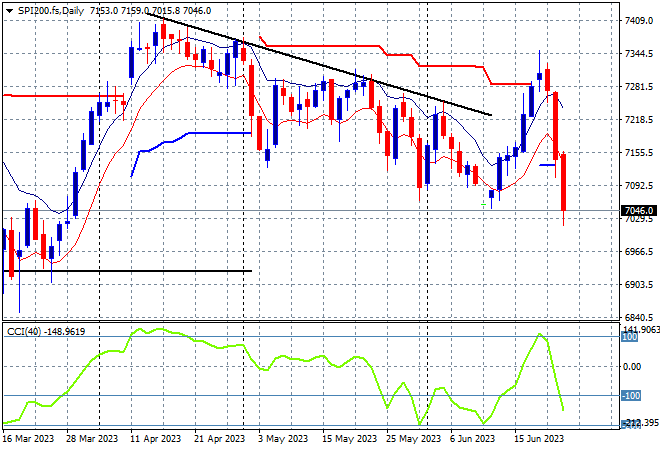

Australian stocks had another pullback with the ASX200 closing nearly 1.3% lower at 7099 points.

SPI futures are down to the 7040 point level or so given the falls on Wall Street on Friday night so price action is likely to continue this steep pull back to the recent weekly low. ATR resistance at 7300 points proved too tough a barrier to push through as the medium term price action rolls over completely:

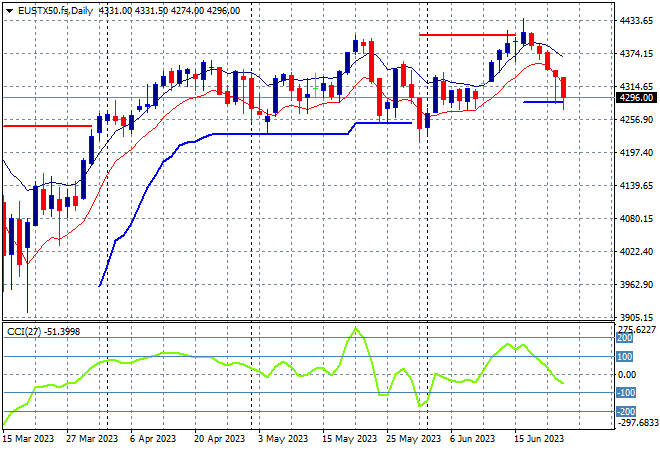

European markets still can’t find any confidence with moret losses across the continent again, as the Eurostoxx 50 Index finished 0.7% lower at 4271 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but support at the 4200 point level has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next with price action indicating a rollover is underway with subsequent closes below the low moving average setting up for a return to the 4200 level:

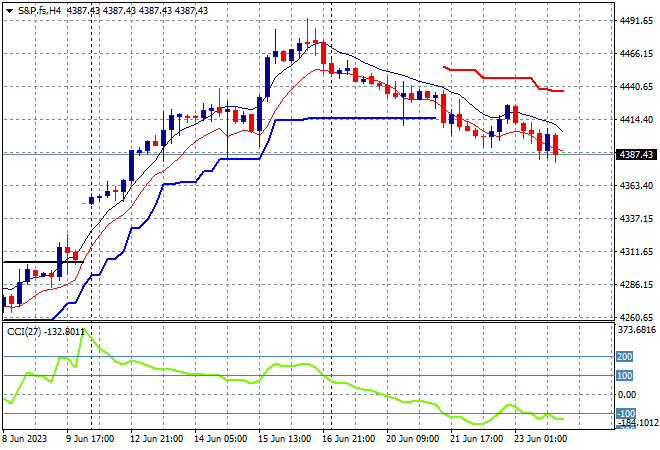

Wall Street was again unable to translate its recent bounce into anything sustainable with the NASDAQ taking back its recent gains, down 1% while the S&P500 finished some 0.7% lower at 4348 points.

The four hourly chart shows a decline throughout the week with a minor pause on the Thursday night session that was swept away as the 4400 point level was taken out on Friday night. Short term momentum remains negative and price action is likely to go lower from here:

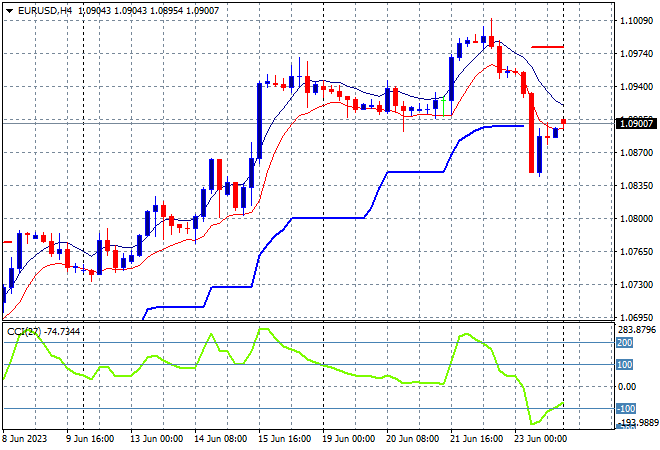

Currency markets saw further gains for USD amid the safe haven bid, including against Pound Sterling which had seen a surge following the BOE rate hike, while the Euro snapped back to the 1.08 handle after briefly touching the 1.10 handle in the penultimate session of the trading week.

Late in the session saw an uptick in Euro that had it finish right on the 1.09 level but this is likely to come under threat from the weekend gap action, with short term momentum still quite negative, if not in an overbought condition. The union currency failed to test the April highs above the 1.10 handle but we could see a recovery to that level on any “good news”:

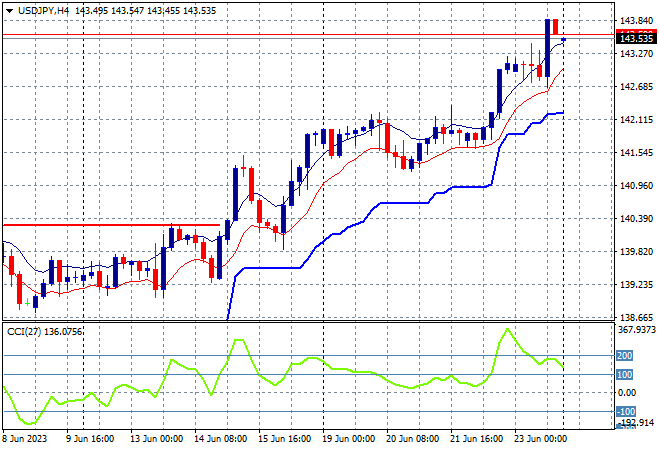

The USDJPY pair was able to keep pushing higher with the USD one way trade on Friday night almost seeing it breach the 144 level as Yen safe haven buying continues to dissipate amid more inflation worries in Japan.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause and Fed Chair Powell’s comment is giving the pair new life. Four hourly momentum remains very overbought mode as short term price action looks way overdone:

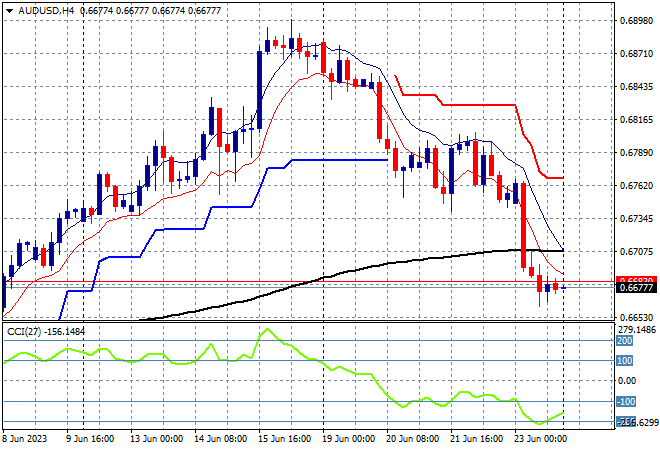

The Australian dollar rolled over again, sliding into the high 66 cent level in late trade on Friday making a new weekly low in the process.

ATR support is a long way away after the Pacific Peso failed to put previous overhead resistance at 67 cents aside with domestic recession concerns and an aggressive Fed overshadowing any attempt at the RBA in managing inflation, so we’re likely to see more downside ahead:

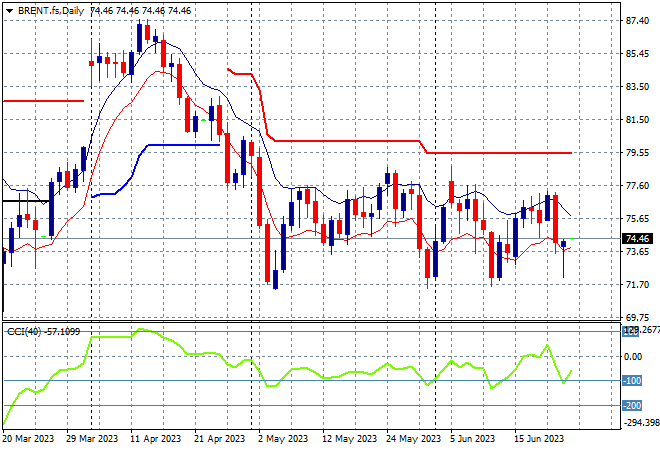

Oil markets continue to oscillate with US recessionary fears and macro concerns amid a higher USD pushing Brent crude down to the $71USD per barrel level intrasession before a late rally saw it finish where it started the week at the $74 level.

Price is contained around the December levels and the March lows with daily momentum still negative. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

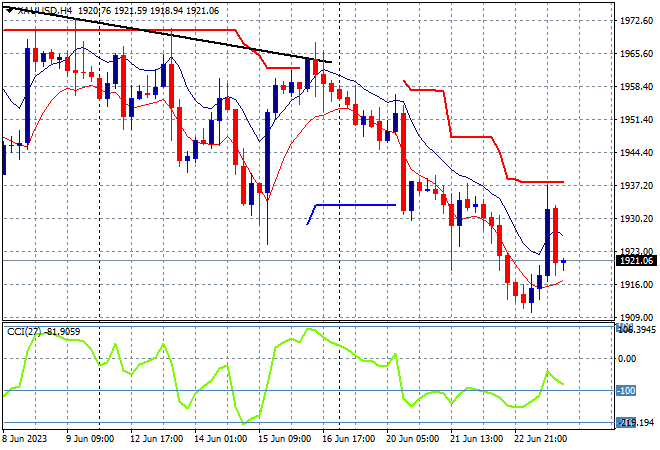

Gold continues to fail with another rout on Friday night straight down to the $1910USD per ounce level but again a small reprieve later in the session seeing it finish the week at the $1920 level in a very tenuous position.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1930 so watch for the $1900 level next: