The release of the latest FOMC Minutes combined with the disappointing US durable goods order print saw Wall Street rebound overnight, with intrasession volatility reduced somewhat as European shares got some relief as Euro pulled back slightly in the wake of a stronger USD. The bond market range traded, with the 10 year US Treasury yield still hovering around the 2.7% level, with interest rate markets confirming the FOMC’s take on a 50 bps rise for the Fed’s June meeting. The Australian dollar remains contained below the 71 handle with commodity prices mixed across the board as oil prices lifted a little higher, copper and iron ore down while gold retraced back towards the $1850SD per ounce level .

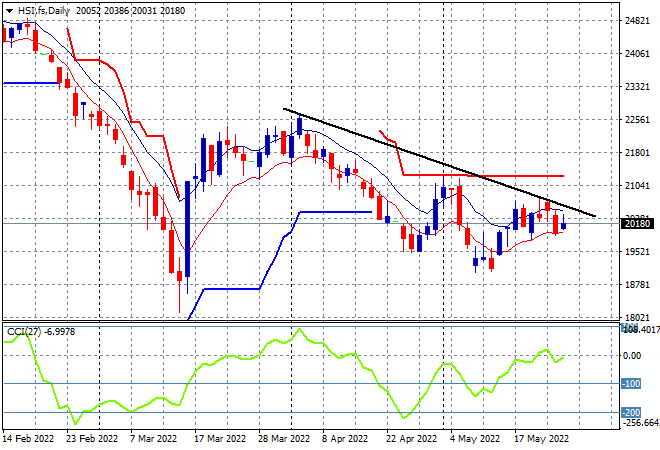

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets rebounded with the Shanghai Composite up more than 1% to 3107 points while the Hang Seng Index basically treaded water, up only 0.3% to keep above the 20000 point level. The daily chart is showing price action unable to lift higher and remaining contained below trailing daily ATR resistance at the 21000 point level that has firmed as strong resistance:

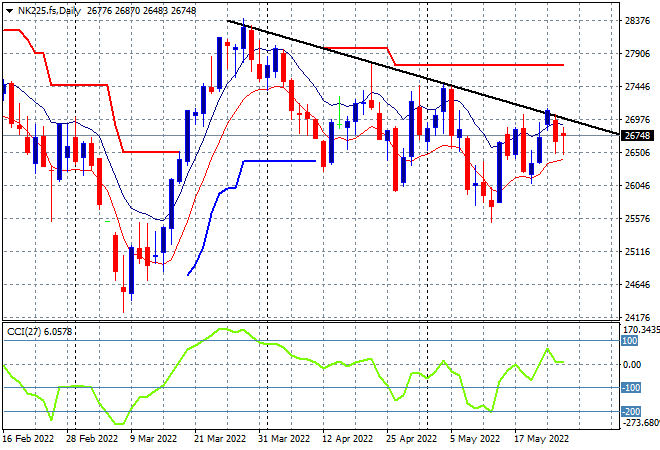

Japanese stock markets remained on the downside as the Nikkei 225 index lost nearly 0.3% to close at 26677 points. The daily chart of the Nikkei 225 still has a bearish bent with another attempt to get back above the previous daily/weekly highs near the 27500 point level seeming to fail before it even gets going. To properly reverse the downward trend from the March highs requires a substantial move above the 27000 point level but futures are indicating a flat start despite a weaker Yen overnight:

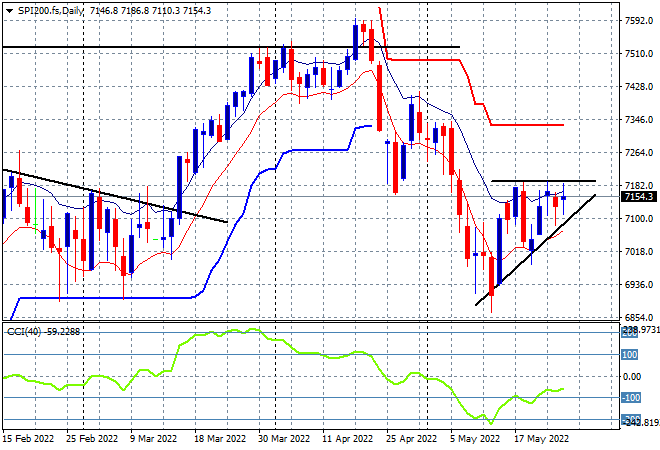

Australian stocks ended slightly higher with the ASX200 finishing up 0.3% at 7155 points, taking back the previous losses and keeping the key 7100 point support level intact for now. SPI futures are up nearly 20 points with the daily chart showing a bunching up of price here at the 7100 point level with a second bounce that could turn into a proper swing action up to the resistance level at 7200 points, but daily momentum readings remain tenuous:

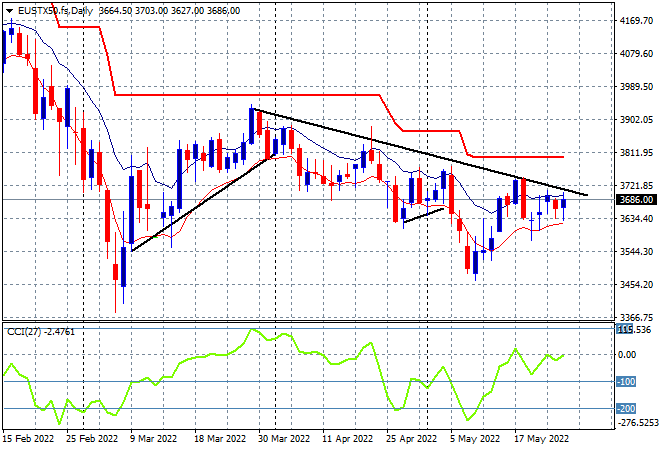

European markets started off slightly better and held on to some midsize gains throughout the session with the Eurostoxx 50 index finishing 0.8% higher at 3677 points. The daily chart picture remains bearish in the medium term, and while the short term picture is suggesting a potential move back up to trailing ATR resistance at around 3800 points, daily momentum is nowhere near enough to fulfill that move:

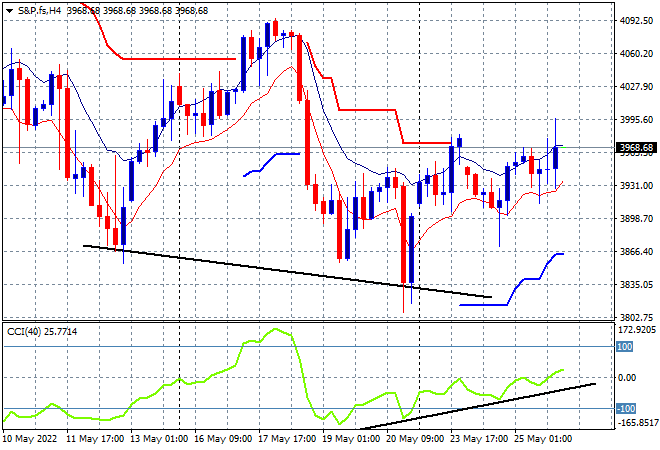

Wall Street remains in a volatile state but it was to the upside this time, with the NASDAQ still in full bear market mode with another dead cat bounce, up 1.5% while the S&P500 closed nearly 1% higher as it tried to return to the psychologically important 4000 level. The four hourly chart is still unsettled as substantial resistance at the 4100 point level remains a distant memory with the new weekly low still suggesting a bear market is firming here. There is the potential for a breakout here as momentum gathers so watch for a break above 4000 points, but be mindful that a break below the 3850 point level will be the stronger catalyst for further selling:

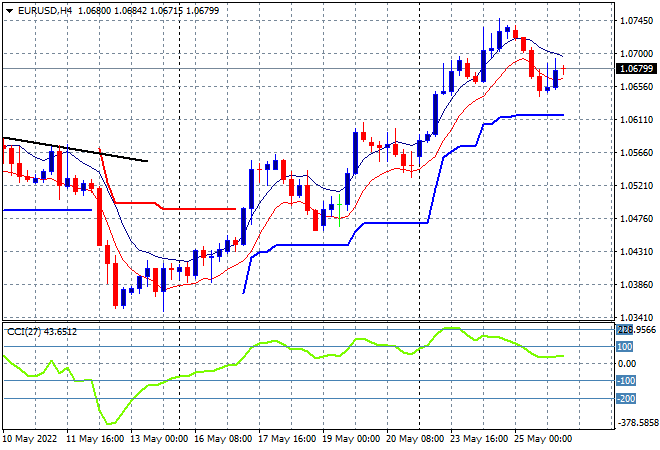

Currency markets are seeing some USD strength return after Euro lead the way since the start of the week as the union currency pulled back below the 1.07 handle overnight, having gotten ahead of itself in a 300 pip plus rally since bottoming a only a week or so ago. As I said yesterday, a short term retracement on exuberance was probable here, but a new medium term uptrend is definitely underway here and will be solidified if trailing ATR support at the 1.06 level proper is defended. Watch for any retracement below the previous session lows at the mid 1.06 level to prove that wrong:

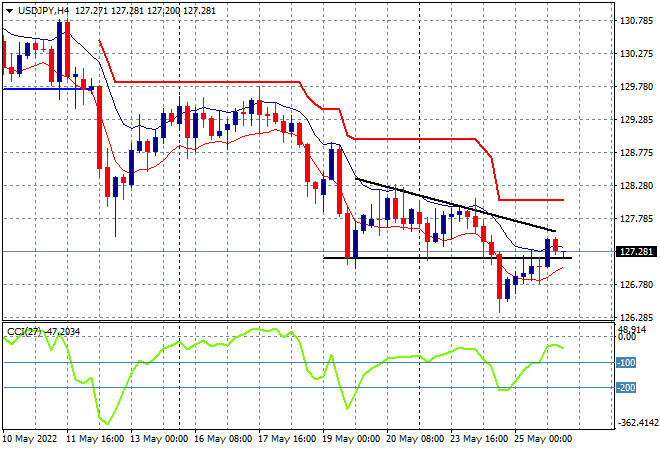

The USDJPY pair is trying to pullback after sustained defensive Yen bidding, having lost key support at the 129 level last week it finally climbed back above interim support at the 127 level overnight. This forms a descending triangle pattern on the four hourly chart that needs to be negated to the upside as momentum remains negative, or it will setup another rollover and back down to the 126 handle instead:

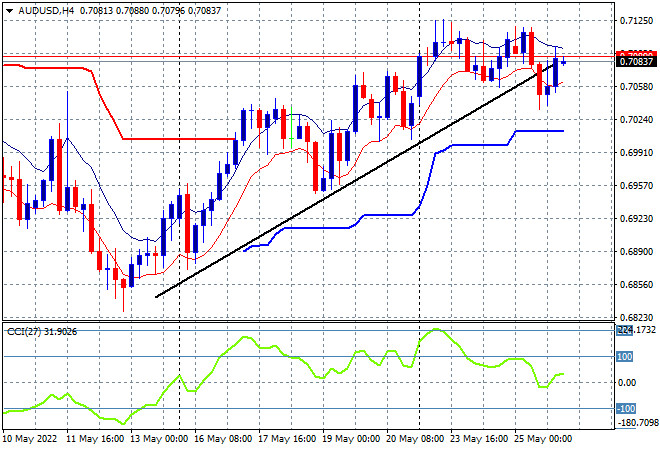

The Australian dollar pulled back on its recent uptrend from last week’s low, after stalling out previously at resistance at the 71 handle, ending up this morning at the 70.8 level. Four hourly momentum had been at extremely overbought levels and then retraced with my contention of catch up here to the trendline fulfilled here. To get back above the 71 cent level requires a solid move above the high moving average on the four hourly chart, but there are intrasession signs of a capitulation or consolidation at best forming here:

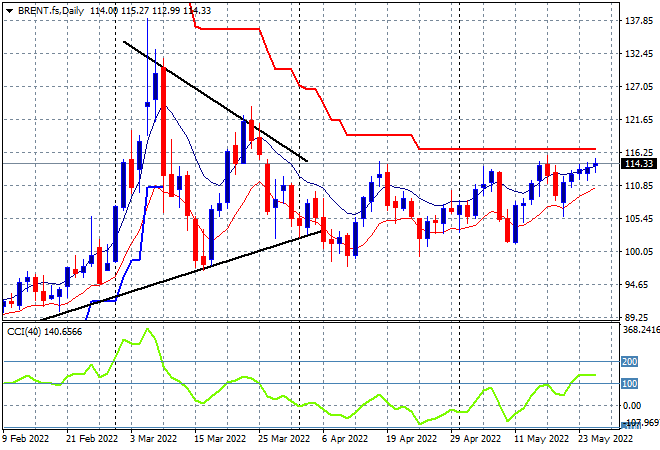

Oil markets continue to bounce along, as traders consolidate and await further catalysts arising out of the Russian invasion of Ukraine, but I continue to see signs that short positions are no longer building with a series of daily sessions with higher lows and tighter intrasession volatility. This is usually a prelude to a breakout. Brent crude closed back above the $114USD per barrel level, almost exceeding its previous weekly high, but without any downside to the session. Daily momentum recently pushed into overbought status and remains there – another good sign a bigger breakout is coming – with trailing ATR daily resistance at the $116 area the next level that has to be broken through or we continue this sideways play:

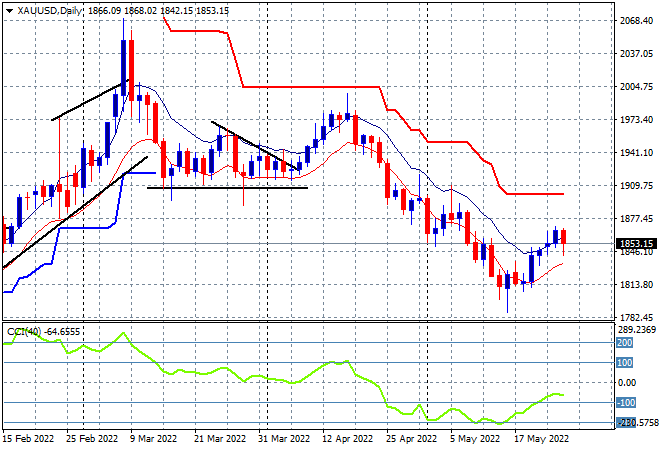

Gold stalled out overnight, pulling back after a near week long series of uptrends to finish just above the $1850USD per ounce level, as USD flexed its strength. This nascent uptrend was looking better and continues to firm up the possibility of a bottom forming in the short term, but as I warned before the downtrend will remain entrenched as long as daily momentum remains stuck in oversold territory. The January lows around the $1800 level remain the downside target that has yet to transform into a new support level: