Wall Street was closed overnight, while the USD remained weak against the major currencies on firming expectations of a slower pace of Fed rate rises. Euro remained at a monthly high above the 1.04 level as the Australian dollar advanced but is still shy of the recent weekly high. The action on bond markets was muted with US physical markets closed but futures are indicating 10 year Treasury yields will drop to the 3.67% level. The commodity complex saw minimal movement in oil prices as Brent crude remains around the $85USD per barrel level while gold was steady after playing catchup to the other undollars at the $1755USD per ounce level.

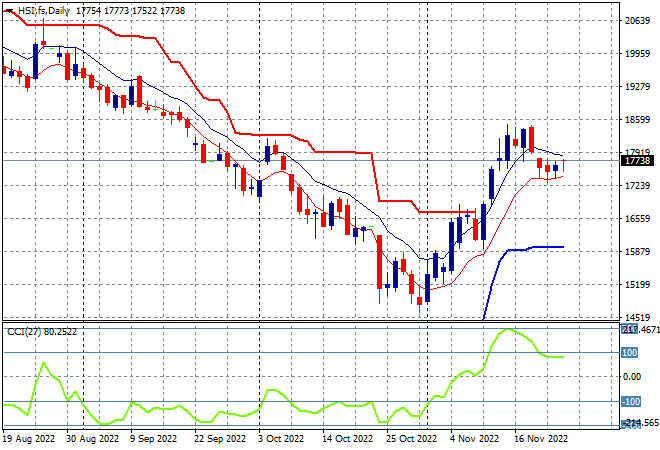

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets fell slightly after the lunch break with the Shanghai Composite down 0.2% to close at 3090 points while the Hang Seng Index bounced back somewhat, closing up 0.8% to 17660 points. The daily chart is still showing a small slowdown after having gained nearly 4000 points since testing the 2008 lows with the possibility of a further retracement growing but so far defended at the low moving average area. Its pretty obvious that daily momentum was getting ahead of itself before reaching the magical 20000 point level so watch this retracement to continue to test the recent daily lows below the 18000 point level:

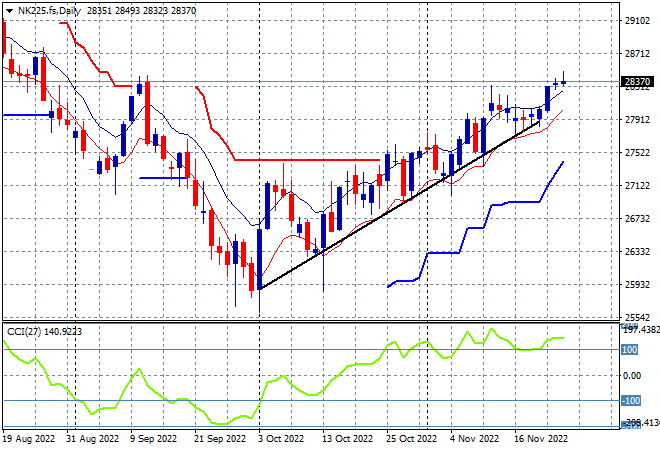

Japanese stock markets returned from their mid week holiday with the Nikkei 225 closing nearly 1% higher at 28383 points. As I suggested yesterday a further breakout was brewing here as overhead resistance at the 27500 level is now cleared. However the lack of a lead from Wall Street may hamper further gains into the end of the trading week even as price bounces off the trendline as daily momentum remains overbought. Support is however holding nicely at the 27500 point level to continue this uptrend:

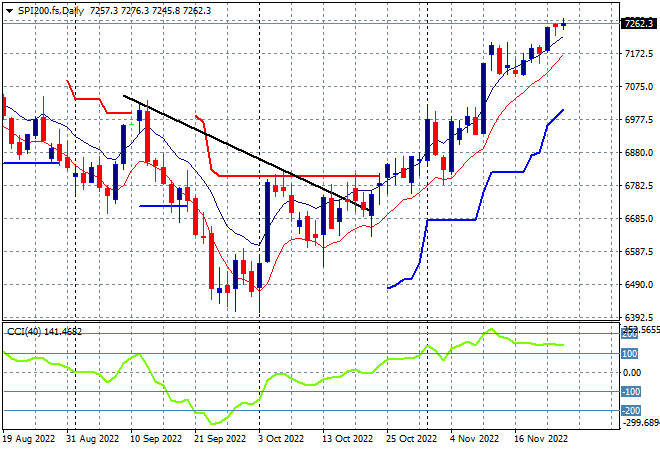

Australian stocks floated into a scratch session by the close with the ASX200 closing just 0.1% higher at 7241 points. SPI futures are up slightly due to the closed sessions and lack of lead on Wall Street overnight, with the daily chart still looking very similar to Japanese stocks, but with more upside potential. Daily momentum remains solidly overbought, with strong support below at 7000 points as the uncle point on any pullback:

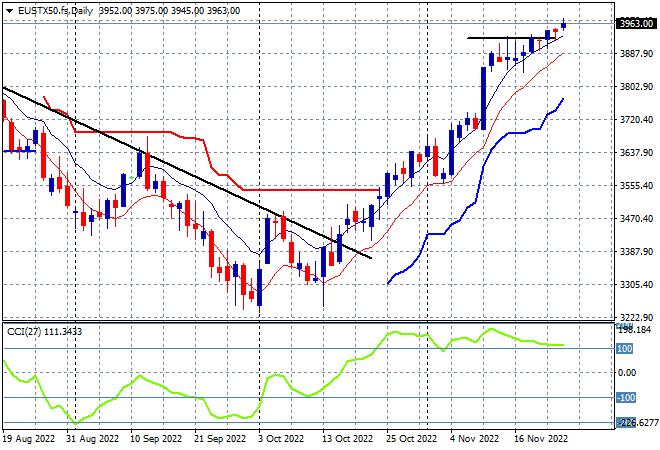

European markets kept creeping higher overnight, but only across the continent as the Eurostoxx 50 Index finishing up 0.4% at 3961 points, this time the UK FTSE was dead flat. The daily chart shows how the key point going forward will be clearing overhead resistance at the 3900 point area, with daily momentum having a small pause this looks good to keep going higher with the low moving average a clear uncle point in the uptrend:

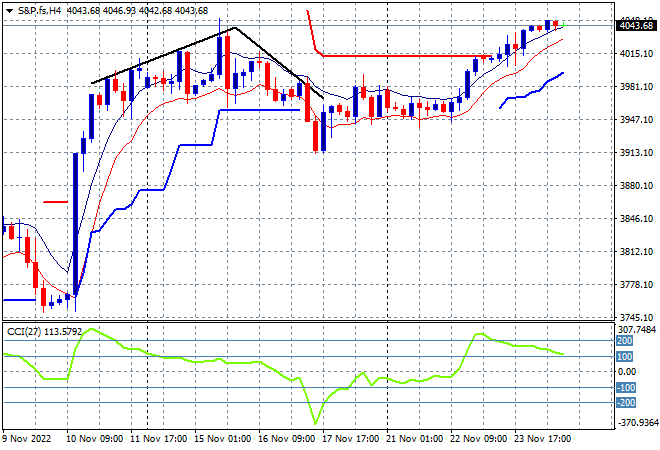

Wall Street was closed for Thanksgiving but S&P500 futures are suggesting more upside above the 4000 points that could clear the previous weekly highs. The chart picture is still quite different to other stock markets as it continues to battle many more layers of resistance but the August highs are in sight after clearing the October highs and the 4000 point psychological level. Price action had been bunching up nicely here but the lack of a new weekly high was holding the market back – watch for a continued break above trailing ATR resistance and the early November high next:

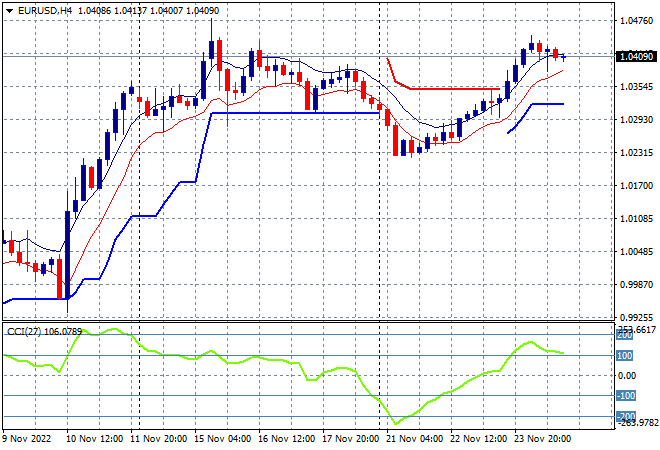

Currency markets had a pause overnight due to closed US markets with King Dollar still losing ground against all the majors. Pound Sterling extended its monthly high while Euro was contained at the recent weekly high at just above the 1.04 handle. A rounding top pattern was forming here on the four hourly chart but has been thwarted with very strong support evident at the mid 1.02s. Watch now for resistance to be tested at the 1.0450 level next:

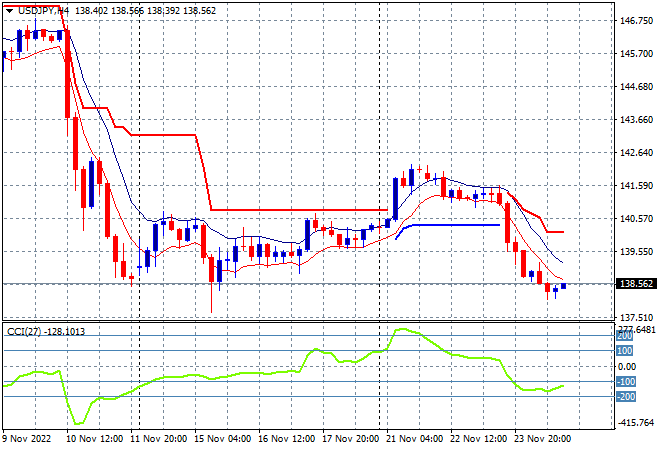

The USDJPY pair is still in depression mode, continuing to fall below temporary support and breaking down below the 139 level overnight. This was looking good for a continuation rally that had a lot of upside potential, but four hourly momentum had already retraced to a neutral setting after being overbought, so this is not unexpected. Watch for a possible return to the previous weekly lows next, although short term momentum is being extremely oversold:

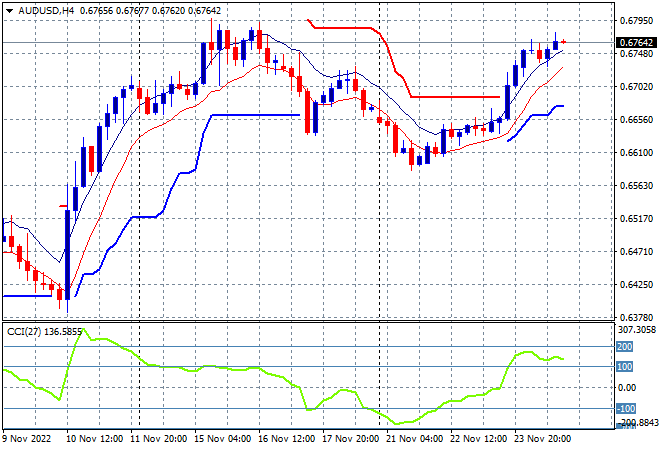

The {{%|Australian dollar}} wants to push further as well but just can’t seem to breach the previous weekly highs at just below the 68 handle. Momentum is nicely overbought but is not going anywhere without a lead from US markets next, so I expect a further pause into and through the end of the trading week. Watch for a possible retracement below the low moving average however:

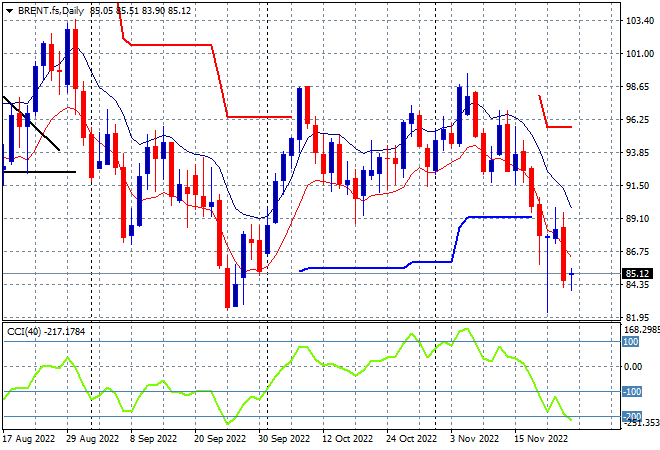

Oil markets are trying to stabilise in the wake of the European energy crisis talks but the lack of open US markets overnight saw some stability with Brent crude holding just above the $85USD per barrel level. Daily momentum was already oversold before this move with the lack of new daily highs and the continued inability of price action to return to the magical $100 level or even clear resistance at the $98 level extremely telling. The next stage is set to test the September lows at $80 or so:

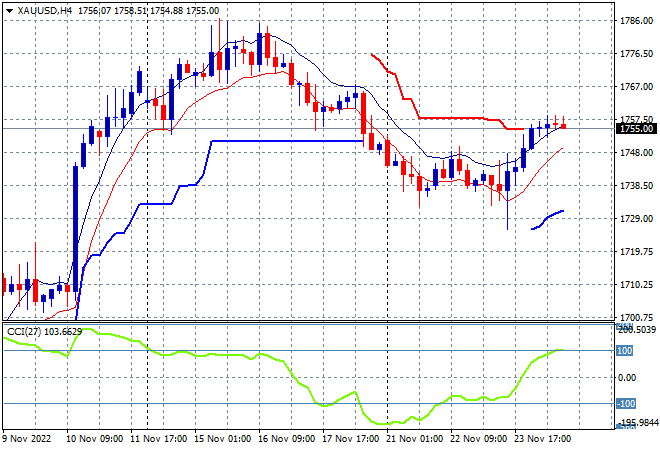

Gold is also still and steady but looking a bit weak here after finally playing catchup to the other undollars and getting back to last week’s low. While price action is still well above the October highs (upper horizontal black line) its super apparent that there are no buyers circulating around the $1800 level. Short term momentum is no longer oversold, with building potential for a swing play here to get back to the previous highs or at least get back above trailing support at the $1750 level: