Street Calls of the Week

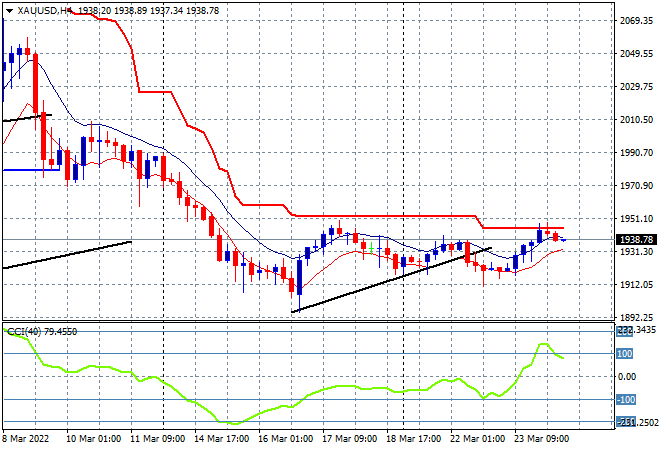

Asian stock markets are basically treading water, which is better than expected given the selloffs overnight on Wall Street. The USD remains strong against Yen and Euro with the latter now dragging the once buoyant Pound Sterling down while the Aussie dollar is trying to breach the 75 level again. Oil prices remain elevated with Brent crude pushing above the $120USD per barrel levels as gold moved sideways during the Asian session after a late surge overnight, still hovering below short term resistance at the $1950USD per ounce level:

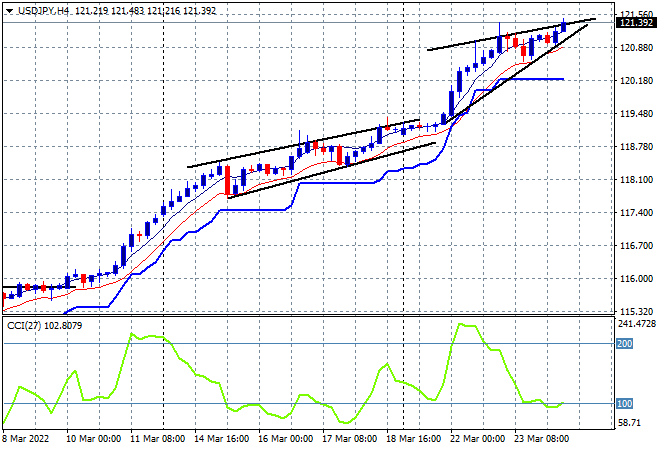

Mainland Chinese shares are directionless again going into the close, with the Shanghai Composite currently down 0.5% at 3255 points while the Hang Seng Index is pulling back slightly after its previous solid session, up 0.2% to 22117 points. Japanese stock markets are also just floating along with the Nikkei 225 closing just 0.15% higher to 28085 points while the USDJPY pair continues above the 121 handle with a menacing bearish rising wedge forming here on the four hourly chart:

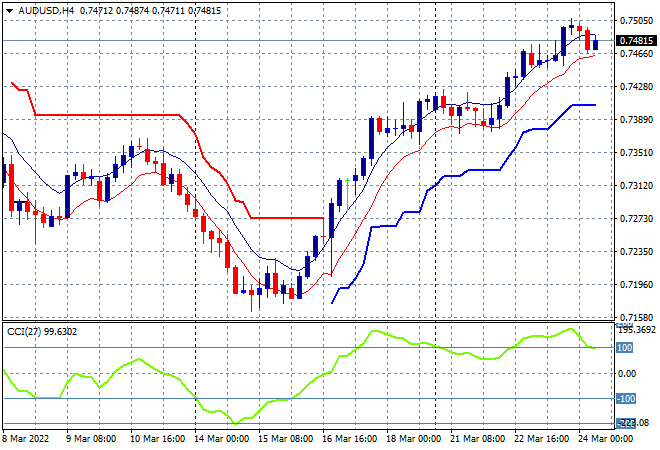

Australian stocks had a scratch session, which was better than expected, with the ASX200 lifting 0.1% to finish at 7387 points. Meanwhile the Australian dollar is treading water at just below the 75 level, possibly coming up against stronger resistance which makes sense after such a good run in the last week or so:

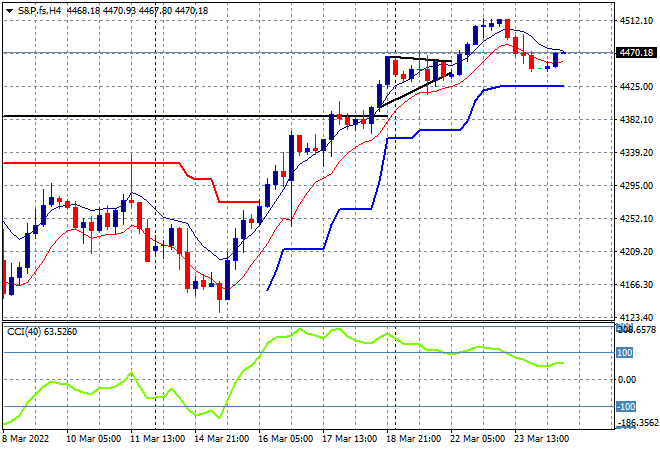

Eurostoxx and Wall Street futures are again trying to inch higher with the S&P500 four hourly chart showing a desire to return to the 4500 point level after testing resistance at the 4400 point area, which should continue to act as short term support going forward:

The economic calendar is full of flash PMI’s across Europe and the US, but more importantly there’s the latest durable goods orders and initial weekly jobless claims to digest.