Upside volatility returned to risk markets overnight as Wall Street returned after a long weekend, with the major bourses all up more than 2%, as they play catchup to the relatively positive moves in other stock markets at the start of the trading week. In currency land, USD saw a slight pushback but mainly against Euro as Yen weakened substantially and the Australian dollar remains under the 70 handle without any change. Bond markets saw slight gains in yields, with 10 Year Treasuries up to 3.3% while interest rate futures are still firming up to another 200 bps in rate rises by the Fed this year. Commodity prices fell back again, although oil prices stabilised later in the session as gold again slipped well below the $1850USD per ounce level.

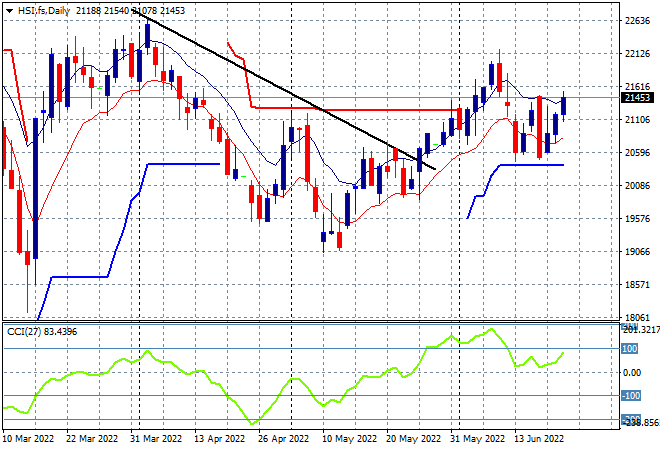

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were mixed with the Shanghai Composite slipping some 0.2% to close at 3307 points while the Hang Seng Index has launched much higher, up nearly 2% to close at 21559 points. The daily chart was showing price anchored at trailing daily ATR support at the 20500 point level with daily momentum barely positive before this bounce, with a much more positive potential move setting up here now. Price action is still a fair way from the May lows at the 19000 point level, but the overall market remains well contained:

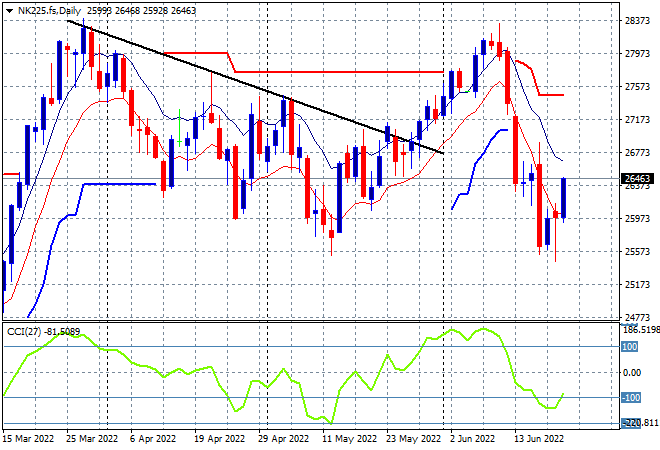

Japanese stock markets finally bounced back with the Nikkei 225 index closing more than 1.8% higher at 26246 points. The daily futures chart of the Nikkei 225 is showing a very solid start to the trading week, with a much weaker Yen overnight hopefully helping push this price action back above the key high moving average level. Watch daily momentum readings however which need to get back out of the oversold zone:

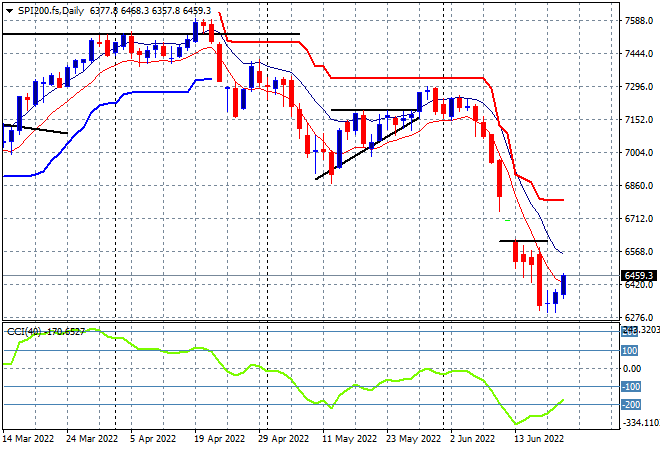

Australian stocks finally put in a solid lift, with the ASX200 finishing more than 1.4% higher at 6523 points. SPI futures are up around 0.7% or approx. 50 points, so we could see the 6600 point level taken out. However, the daily charts continue to show price that needs to recover well above the 6600 point level before calling any bottoming action as daily momentum is still in the very oversold zone:

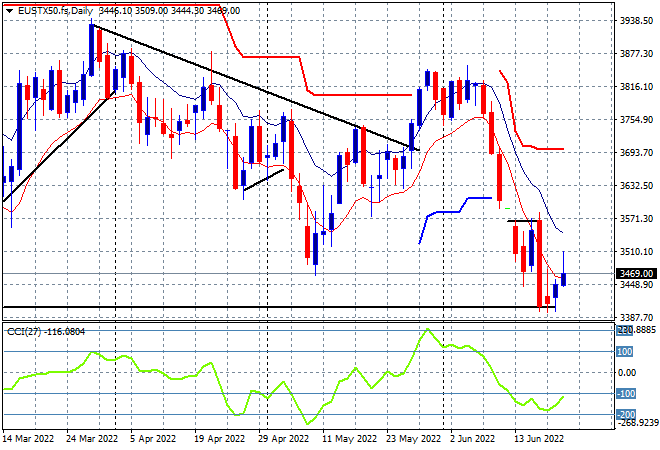

European stocks again had very positive sessions out the gate, with the FTSE taking the back seat, up only 0.4% as the Eurostoxx 50 index eventually closed some 0.7% higher at 3494 points, but pulled back slightly in post close futures. The daily chart picture remains bearish at best as price hovers right on the previous daily/weekly lows from the March dip. Daily momentum remains in quite an oversold position with price needing to get back above the 3570 point area very quickly or it will roll over here:

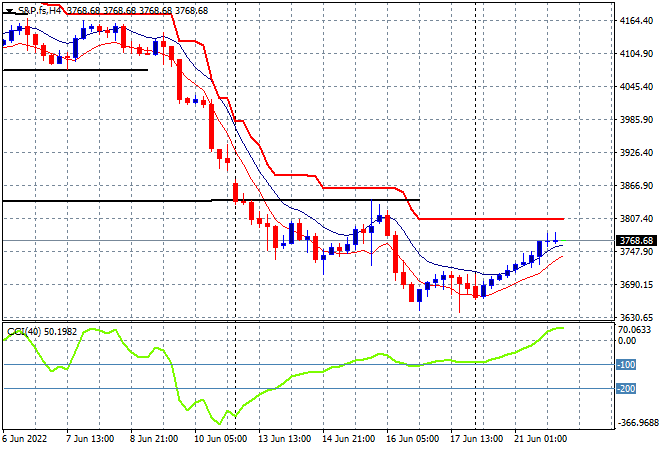

Wall Street reopened after the long weekend public holiday, with big gains across the three bourses as the NASDAQ lifted 2.5% while the S&P500 put on some 2.4% higher as it broke through the 3700 point zone to close at 3764 points. The four hourly chart was showing a very weak picture, and indeed despite this major rally its not yet enough to get it out of trouble as hesitation remains below the March lows which are not yet filled (lower horizontal black line). To recover out of this correction requires a rally that must go through the 3845 point area, the lows from last week and then back up through the psychologically important 4000 point zone:

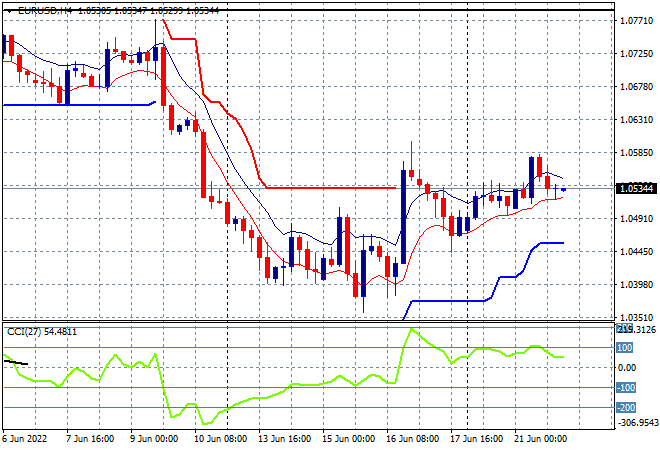

Currency markets were basically contained despite the return of US traders with the continued lack of economic events leading to a push and shove in USD against the undollars, as commodity currencies underperformed. The Euro tried to breakout overnight but was thwarted again, pushed back down to the 1.05 handle proper throughout the session. While traders might be anticipating more ECB rate rises on the back of the BOE/SNB rises, as I said last week this repricing maybe temporary given the 75bps scheduled by the Fed next month, so watch for any retracement below former trailing ATR resistance here:

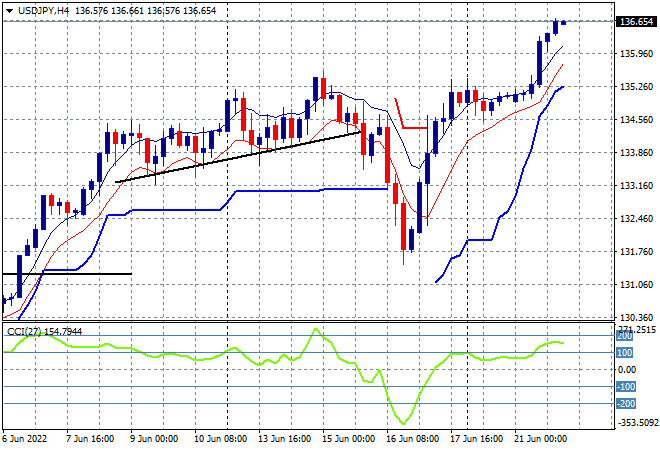

The USDJPY pair stabilised at the start of the trading week but has now blown higher after the return of US traders, with a new historic high well above the 136 handle overnight. Price action had come back almost to the previous highs near the 135 area, and was building with lower volatility, usually a sign of an imminent breakout. We now have a better indication of trend direction – back on the lower Yen train:

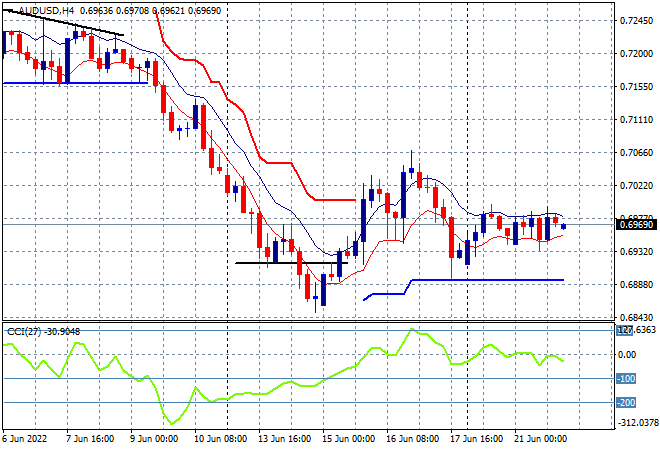

The Australian dollar still can’t get any momentum here having rolled over last week with its bounce back above the 70 handle thwarted, with overnight price action keeping it contained below that level despite incresed upside volatility on risk markets. I’m still watching for a retracement below the 69 handle next as the Fed remains ahead of the boffins at Martin Place:

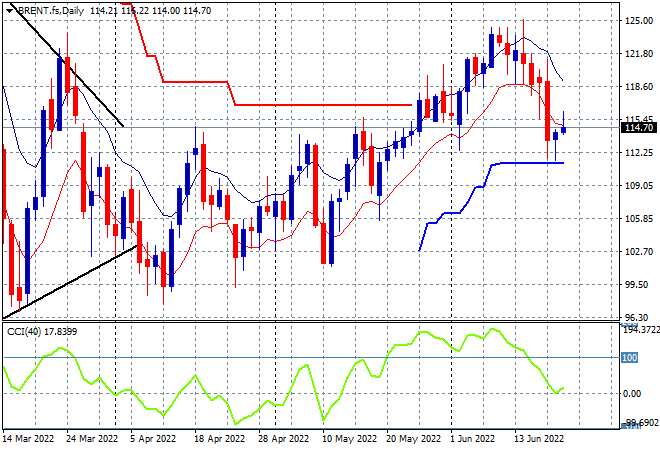

Oil markets are trying to stabilise after the end of week downside volatility with another small bounce overnight keeping Brent crude above the $114USD per barrel level. Daily momentum has retraced from its overbought status but price is no longer supported at the $115 area and is now below the previous ATR trailing resistance level as well. The next area to watch is trailing daily ATR support at the $110 level:

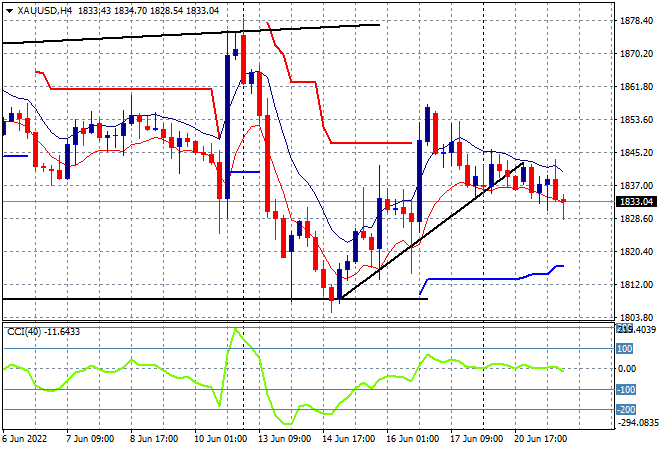

Gold still can’t get out of its sideways bearish move with another retracement overnight as resistance continues to firm at the $1840USD per ounce level. Daily momentum remains negative as four hourly momentum rolls over, and while the recent bounce off the $1800USD per ounce level is a good sign of a bottom forming, the short term trend is showing a series of lower low sessions, so its not yet enough to convince more buyers to step in: