Share markets are still clutching their pearls over “inflation concerns” with European shares playing catchup overnight as Wall Street put in a scratch session with no new news to further spook equity traders. The bond market however saw more firming with the 10 Year US Treasury yield pulling back to the 2.77% level, with interest rate markets still continuing to price in nearly 2% of rate rises to come from the Fed by the end of the year with a 50 bps rise predicted for next month. Meanwhile the USD lost ground again with the Dollar Index down over 1% as commodity currencies and other undollar assets swung back again. Commodity prices all swung higher after some downside action previously, with WTI and Brent crude up by nearly 3% while gold and copper rebounded by more than 1 and 2% respectively.

Bitcoin is still going nowhere, although a small blip overnight saw it breach the $30K level but price is still contained as shown clearly on the four hourly chart below. After cracking through the $25K level last week, momentum remains oversold and price action has not yet recovered as trailing ATR resistance remains overhead for now:

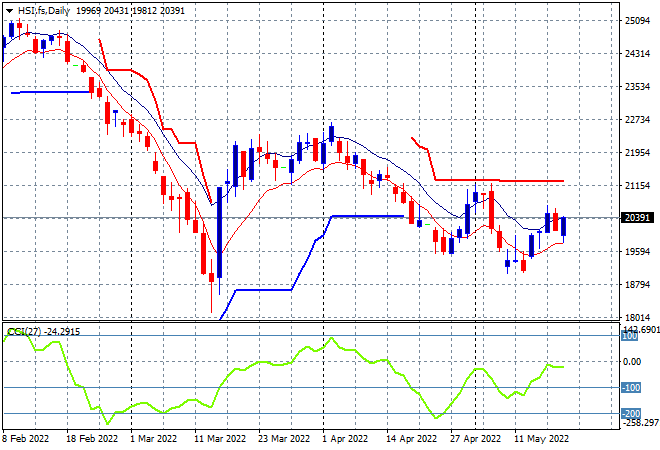

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets are doing okay with the Shanghai Composite closing up 0.3% to 3092 points while the Hang Seng Index went down swiftly, losing more than 2% to finish at 20120 points. The daily chart is showing price action wanting to lift higher yet its still below the high moving average with as price is still nowhere near the trailing daily ATR resistance at the 21000 point level that continues to firm as strong resistance:

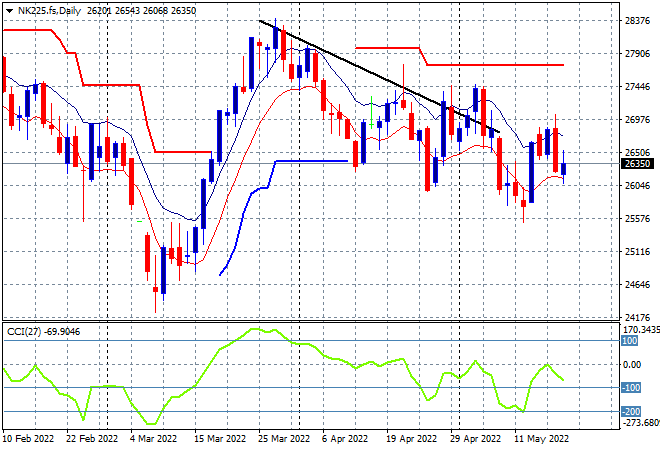

Japanese stock markets are also on the downbeat, with the Nikkei 225 index closing nearly 2% lower at 26402 points.The daily chart of the Nikkei 225 still has a bearish bent with a breakout above the previous daily/weekly highs near the 27500 point level required to properly reverse the downward trend from the March highs. Futures are indicating a final containment session for the week so that remains unlikely:

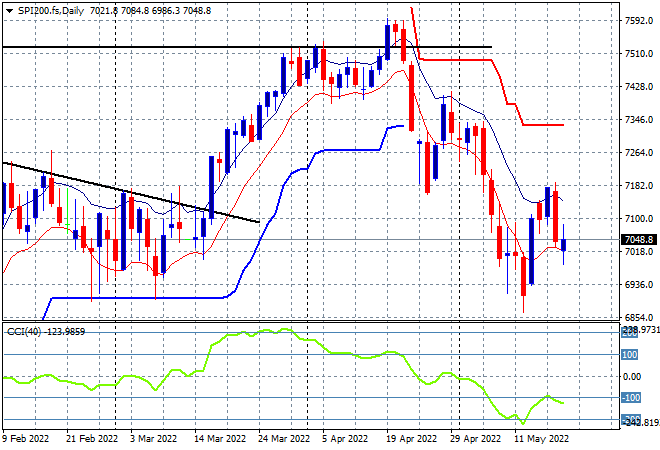

Australian stocks dropped but not as far as many expected, with the ASX200 finishing some 1.6% lower at 7064 points, keeping the 7000 point level intact for now. SPI futures are down only 10 points or so, which does point to more support building at that key 7000 point level. The daily chart was showing a continuation of this bounce up towards the previous support, now resistance level at 7200 points but this is likely to turn into a dead cat bounce at worst or consolidation here at best:

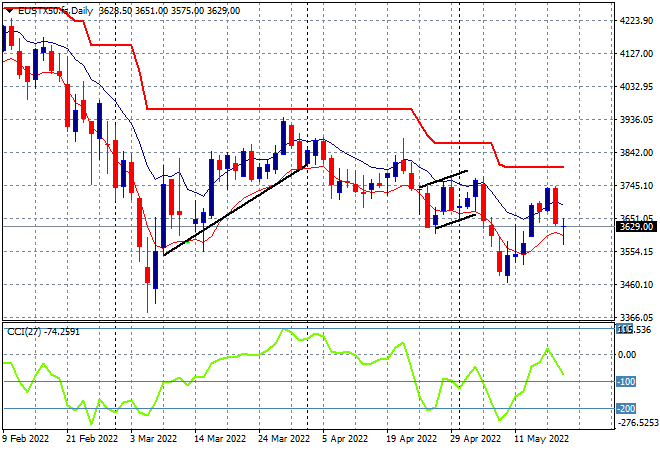

European markets were red across the board in response to the Wall Street response to their respective inflation prints with the Eurostoxx 50 index finishing 1.3% lower at 3640 points. As I’ve been warning for sometime, the daily chart picture remains bearish in the medium term, while the short term picture is about to turn ugly as the blood of bath on Wall Street spreads. A break above trailing ATR resistance at around 3800 points is required to indicate a proper bottoming action and this is growing increasingly unlikely:

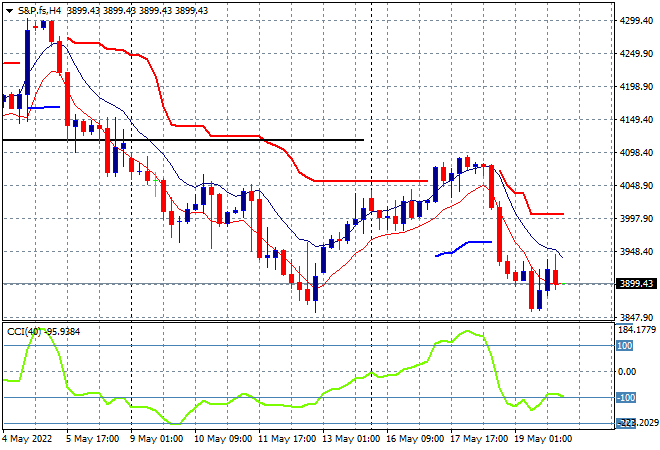

Wall Street managed to eke out only small losses this time around – the bath of blood being nearly empty – with the NASDAQ only losing 0.3% while the S&P500 dropped nearly 0.6% to remain well below the key 4000 point support level, finishing at 3900 points. Price is now back to the previous weekly lows with momentum about to cross back over into oversold territory so watch for any break below the 3850 point level as a catalyst for further selling:

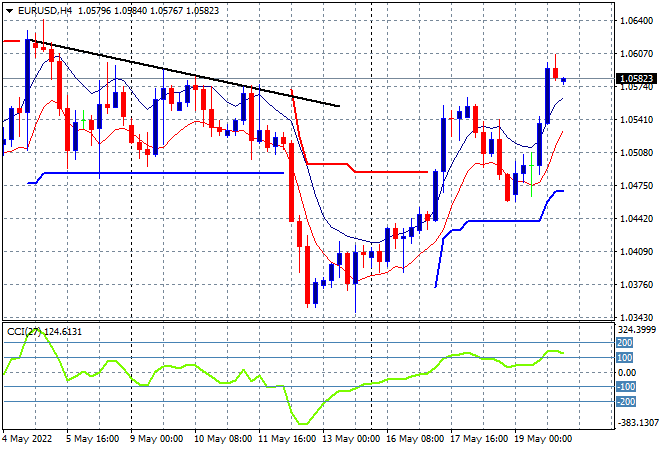

Currency markets are turning against USD once more following the absorption of the inflation prints with Euro returning well above the 1.05 handle overnight, pushing through with a new weekly high. This has seen an abandonment of the previous anchoring point with four hourly momentum into overbought mode and possibly a little overdone. The 1.06 handle is the key target here:

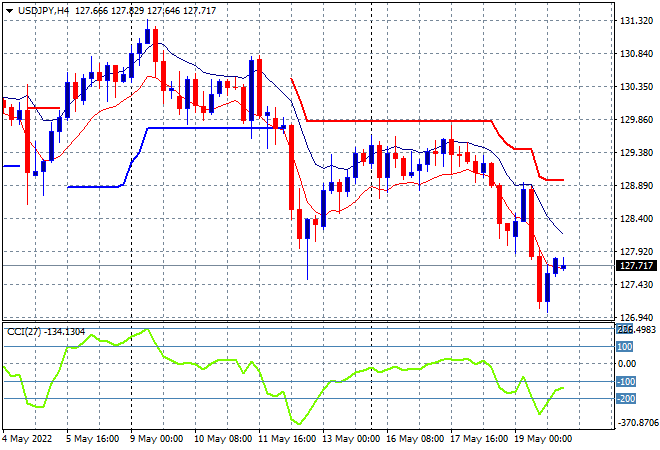

The USDJPY pair is no longer being contained with defensive Yen bidding continuing, losing key support at the 129 level and falling back below the 128 handle instead. This is a sharp pullback that wipes out a few weeks of gains with four hourly momentum now well oversold there is a potential to cross below the 127 level next:

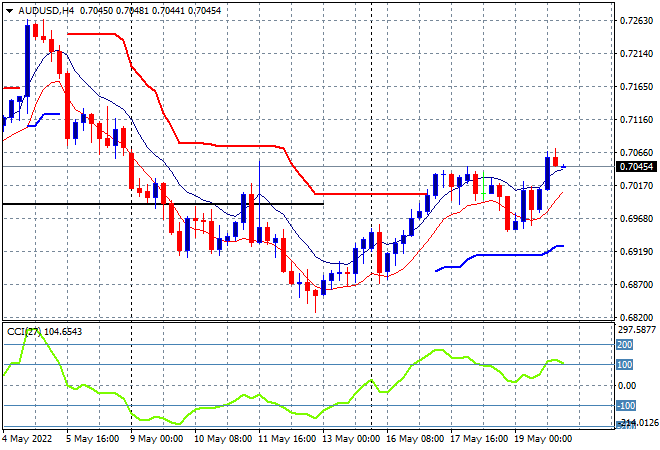

The Australian dollar came back from its classic rollover, heading back above the 70 level as other undollar assets have all pushed back against King Dollar. This makes for a new two week high if it can hold on here, but watch for any cross below the high moving average as this looks tenuous:

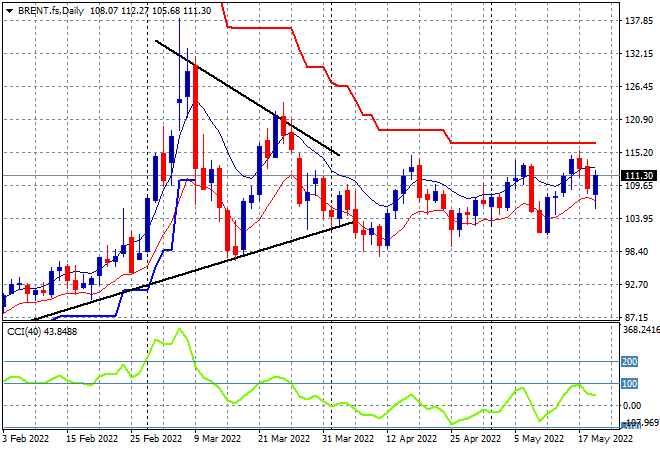

Oil markets rebounded slightly, relatively speaking with Brent closing back above the $111USD per barrel level, still shy of its previous weekly high. Daily momentum remains nicely positive but not yet overbought so I remain cautious here with trailing ATR daily resistance at the $116 area the next level possibly stiffening here:

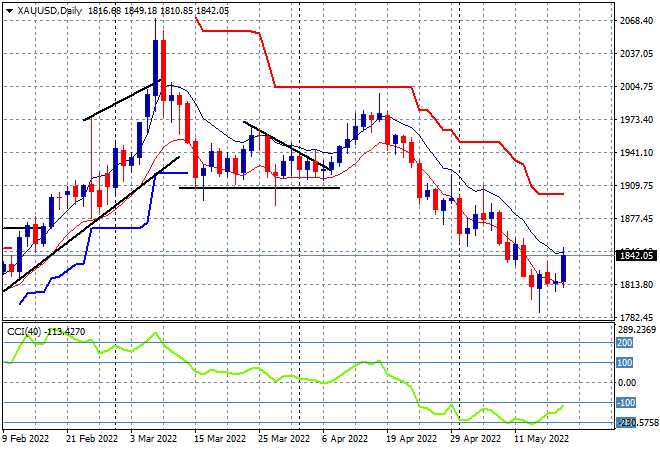

Gold has been anchored near the $1800USD per ounce level for nearly a week and finally let go overnight, rebounding and managing to put in a proper new daily high, finishing at the $1842USD per ounce level. This once again firms up the possibility of a bottom forming in the short term, but this downtrend will remain entrenched as long as price doesn’t close above the high moving average and daily momentum remains stuck in oversold territory. The January lows around the $1800 level remain the downside target that has yet to transform into a new support level: