Asian stock markets continue to have their mixed start to the trading week with some commercial measures from China announced to try to shore up the disappointing GDP print while Japanese stocks returned without much fuss as Wall Street provides no firm lead to the rest of the risk market as its earnings season gets underway. The USD is firming slightly against some of the majors after a big move against King Dollar last week due to softer than expected inflation numbers, but Euro is pushing higher while the Australian dollar consolidates.

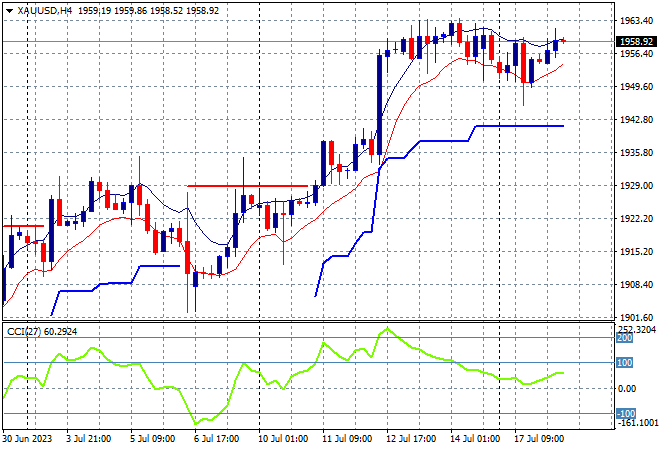

Oil prices are holding on to their gap low from weekend trade with Brent crude looking to start just above the $78USD per barrel level while gold is steady at just above the $1950USD per ounce level:

Mainland Chinese share markets are trying to get a handle on the latest GDP print and possible stimulus measures with the Shanghai Composite about to finish some 0.3% lower at 3201 points while in Hong Kong the Hang Seng Index reopened with a shocker, down nearly 2% after closing yesterday due to a typhoon.

Japanese stock markets reopened from their long weekend with the Nikkei 225 lifting some 0.3% to close at 32483 points while the USDJPY pair is still holding on here just below the mid 138 level after sliding down all last week:

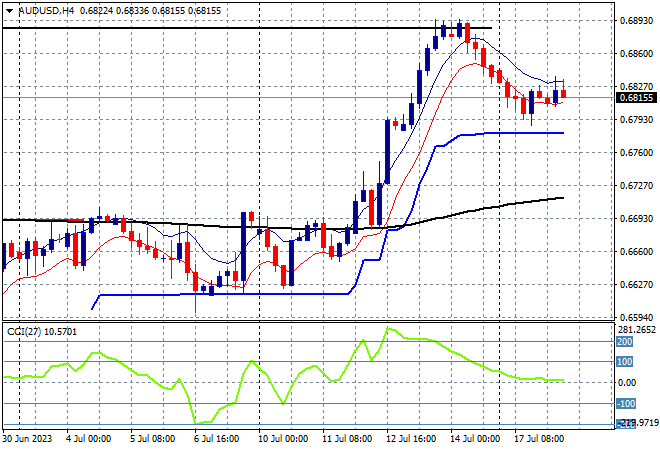

Australian stocks continue to struggle to find direction with the ASX200 closing 0.2% lower at 7283 points. The Australian dollar also continued its consolidation following a minor pullback from Friday night, holding here just above the 68 handle proper as it takes some heat out of last week’s price action:

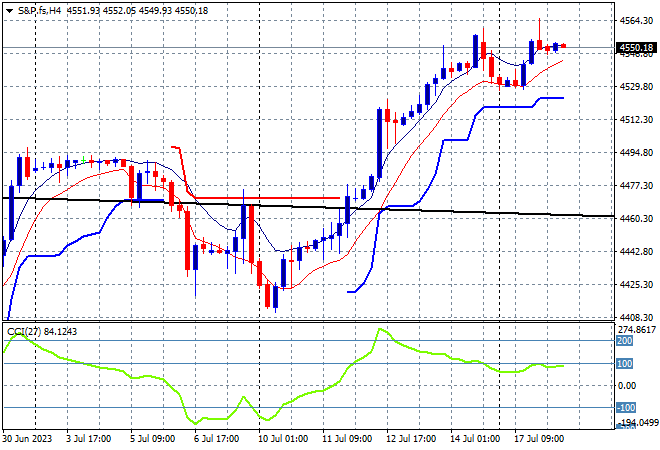

Eurostoxx and S&P futures are up around 0.1% with tech stocks likely to drag a bit as the S&P500 four hourly chart is still showing price action wanting to extend above the 4500 point level which had been staunch resistance before the series of soft CPI and PPI inflation prints last week:

The economic calendar will focus squarely on the latest US retail sales print later tonight.