- With the stock market facing a renewed bout of volatility, finding undervalued stocks with massive upside potential can provide substantial returns.

- As such, I used the InvestingPro stock screener to find high-quality, underpriced stocks with strong upside potential.

- For investors seeking high-quality stocks with upside potential, these three market leaders present attractive buying opportunities at current levels.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

In an era of market uncertainty and extreme volatility, identifying undervalued stocks with strong fundamentals is key to achieving long-term investment success.

Using the InvestingPro stock screener, I identified three market leaders—ExxonMobil (NYSE:XOM), Wells Fargo (NYSE:WFC), and Alibaba (NYSE:BABA) —that are trading at compelling valuations while maintaining strong financial health.

Source: InvestingPro

These industry giants not only dominate their respective sectors but also stand to benefit from several tailwinds in 2025. Moreover, according to InvestingPro Fair Value estimates, all three companies are significantly undervalued, making them attractive buys for investors looking to maximize returns.

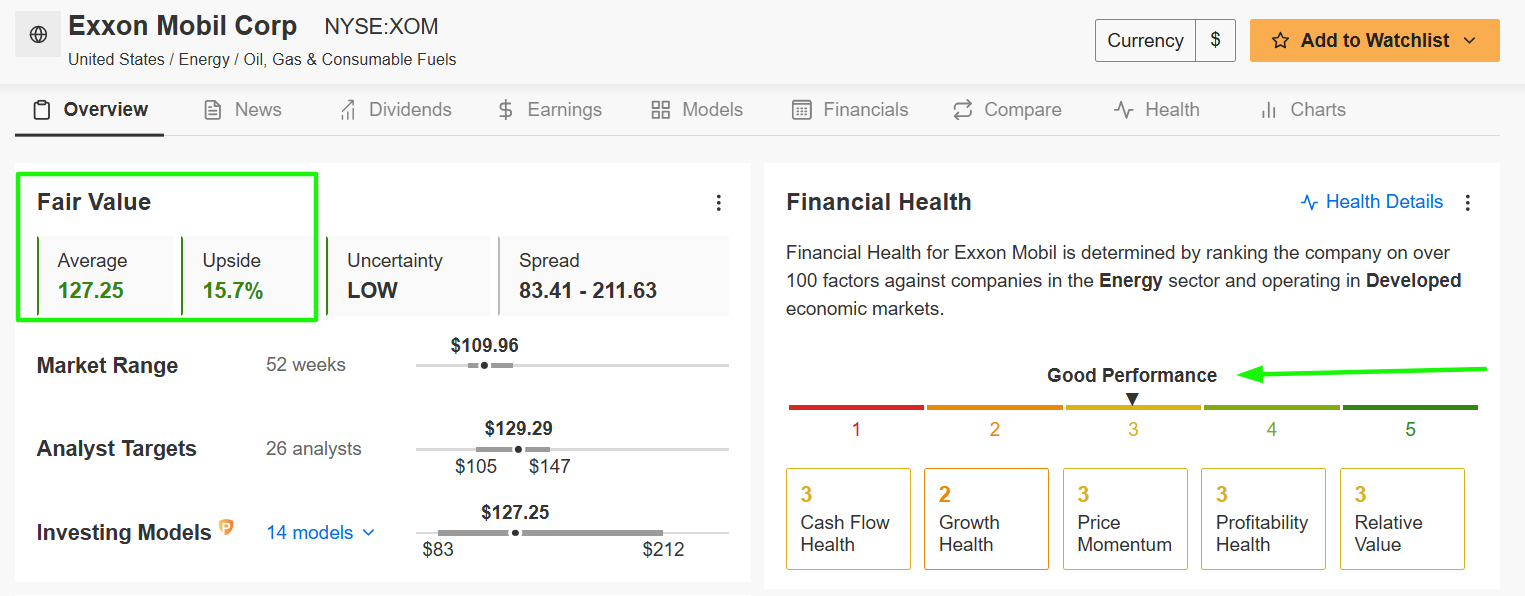

1. ExxonMobil

- Tuesday’s Closing Price: $109.96

- Fair Value Estimate: $127.25 (+15.7% Upside)

- Market Cap: $478.7 Billion

ExxonMobil is one of the largest integrated oil and natural gas companies in the world, with a diversified portfolio spanning upstream, downstream, and chemical operations.

Source: Investing.com

Despite volatility in crude oil prices, the Irving, Texas-based energy giant has remained resilient due to its robust cash flow generation and disciplined capital allocation. Furthermore, Exxon has been aggressively returning capital to shareholders through dividends and share buybacks.

The ‘Big Oil’ company demonstrates a solid Financial Health Score of 3.1 out of 5.0 (rated as Good). A particularly interesting aspect is its robust shareholder yield of 9.1% and healthy dividend yield of 3.6%.

InvestingPro's Fair Value estimate suggests that ExxonMobil is significantly undervalued relative to its long-term earnings potential. The AI models predict a 15.7% potential upside from the current market value of $109.96.

Source: InvestingPro

In addition, Wall Street remains optimistic on the oil-and-gas behemoth, as per an Investing.com survey, which revealed that 16 analysts have a ‘Buy’-equivalent rating on the stock vs. 11 ‘Hold’-equivalent ratings and just one ‘Sell’-equivalent rating.

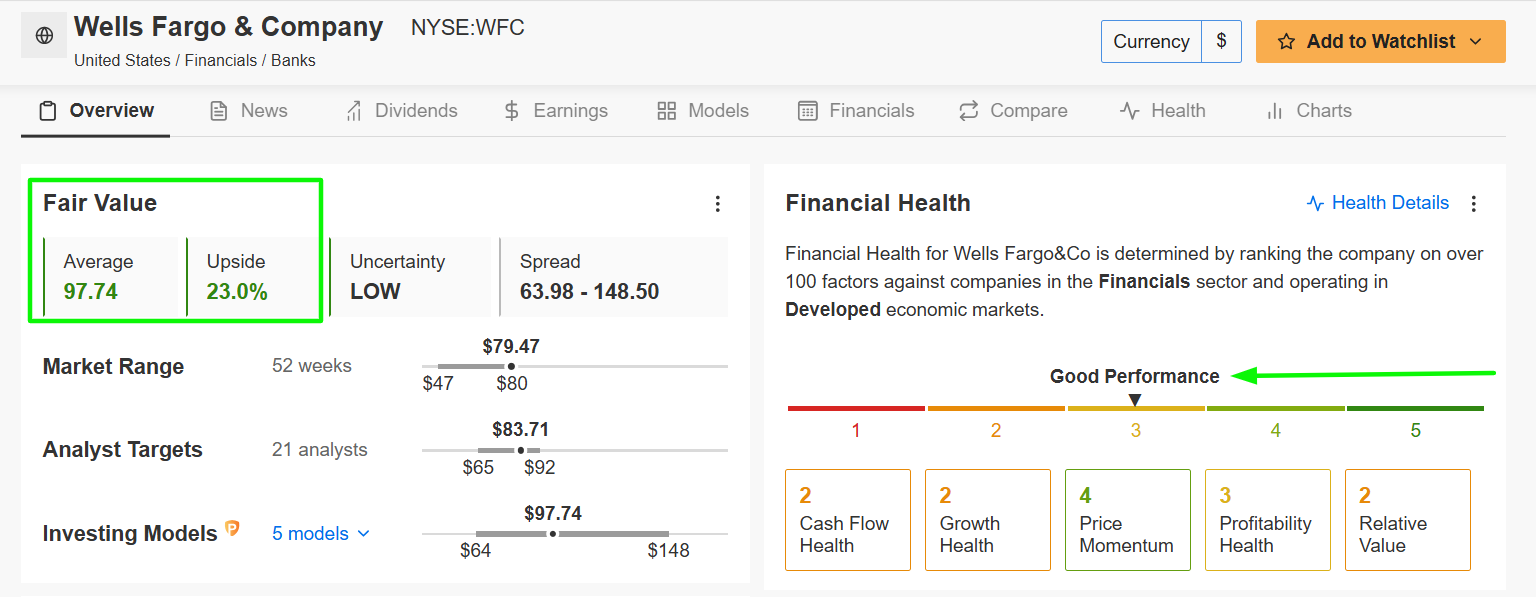

2. Wells Fargo

- Tuesday’s Closing Price: $79.47

- Fair Value Estimate: $97.74 (+23% Upside)

- Market Cap: $261.4 Billion

Wells Fargo remains one of the largest and most recognizable financial institutions in the U.S., boasting a strong deposit base and a diversified loan portfolio. Shares recently hit an all-time high of $79.85, representing a remarkable 63% increase over the past year.

Source: Investing.com

After years of regulatory scrutiny, the bank is steadily regaining investor confidence as it focuses on operational efficiency and growth. The third-largest U.S. lender by market value has aggressively reduced expenses and streamlined operations, leading to better profitability.

Despite its improved financial standing, Wells Fargo's stock still trades at a substantial discount compared to its historical valuation metrics. InvestingPro's Fair Value analysis indicates an upside potential of 23% for WFC stock to $97.74.

Wells Fargo maintains a Financial Health Score of 2.6 (rated as Good). It should be noted that the financial services company has increased shareholder returns through higher dividends and share repurchase programs, making it a more attractive investment.

Source: InvestingPro

In addition, Wall Street has a long-term bullish view on Wells Fargo, with 22 out of the 23 analysts surveyed by Investing.com rating it as either a ‘Buy’ or a ‘Hold’.

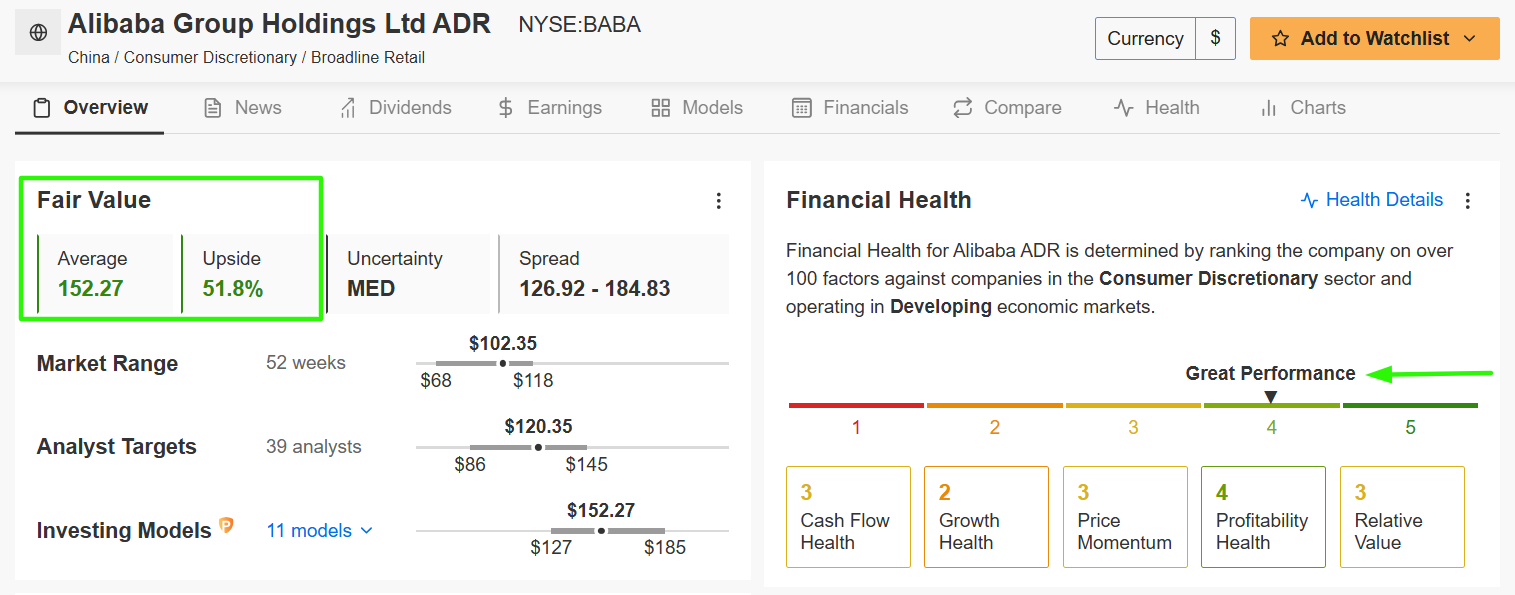

3. Alibaba

- Tuesday’s Closing Price: $102.35

- Fair Value Estimate: $152.27 (+51.8% Upside)

- Market Cap: $231.3 Billion

Alibaba, China’s e-commerce and cloud computing giant, continues to dominate the Chinese digital economy despite facing regulatory and macroeconomic headwinds.

Source: Investing.com

The tech giant’s vast ecosystem, spanning online retail, digital payments, and logistics, solidifies its position as an industry titan. Furthermore, Alibaba Cloud remains the market leader in China and continues to expand its global presence, driving higher-margin revenue streams.

InvestingPro’s Fair Value assessment suggests BABA stock is trading well below its intrinsic worth, presenting a compelling investment opportunity. There's a possibility of a 51.8% increase from last night’s closing price of $102.35, bringing shares closer to their Fair Value set at $152.27.

Alibaba boasts the highest Financial Health Score of the three at 3.6/5.0 (rated as Great). Tailwinds such as the ongoing digitalization of the Chinese economy and the company's strategic investments in areas like cloud computing, artificial intelligence, and logistics further support its growth trajectory.

Source: InvestingPro

Also worth mentioning is that Alibaba remains a favorite on Wall Street, with all 41 of the analysts surveyed by Investing.com rating shares as either ‘Buy’ or ‘Hold’.

Conclusion

ExxonMobil, Wells Fargo, and Alibaba each offer a unique combination of market leadership, financial strength, and significant undervaluation. With strong industry tailwinds supporting their businesses, these companies are well-positioned for substantial gains in 2025.

For investors seeking high-quality stocks with upside potential, these three market leaders present attractive buying opportunities at current levels.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.