- Investing in cheap wallet-friendly stocks priced under $10 can offer potential growth without the need for significant capital.

- As such, I used the 'Under $10/Share' stock screener to find high-quality, underpriced stocks with strong upside potential.

- For investors seeking growth at a bargain, these three stocks are worth a closer look.

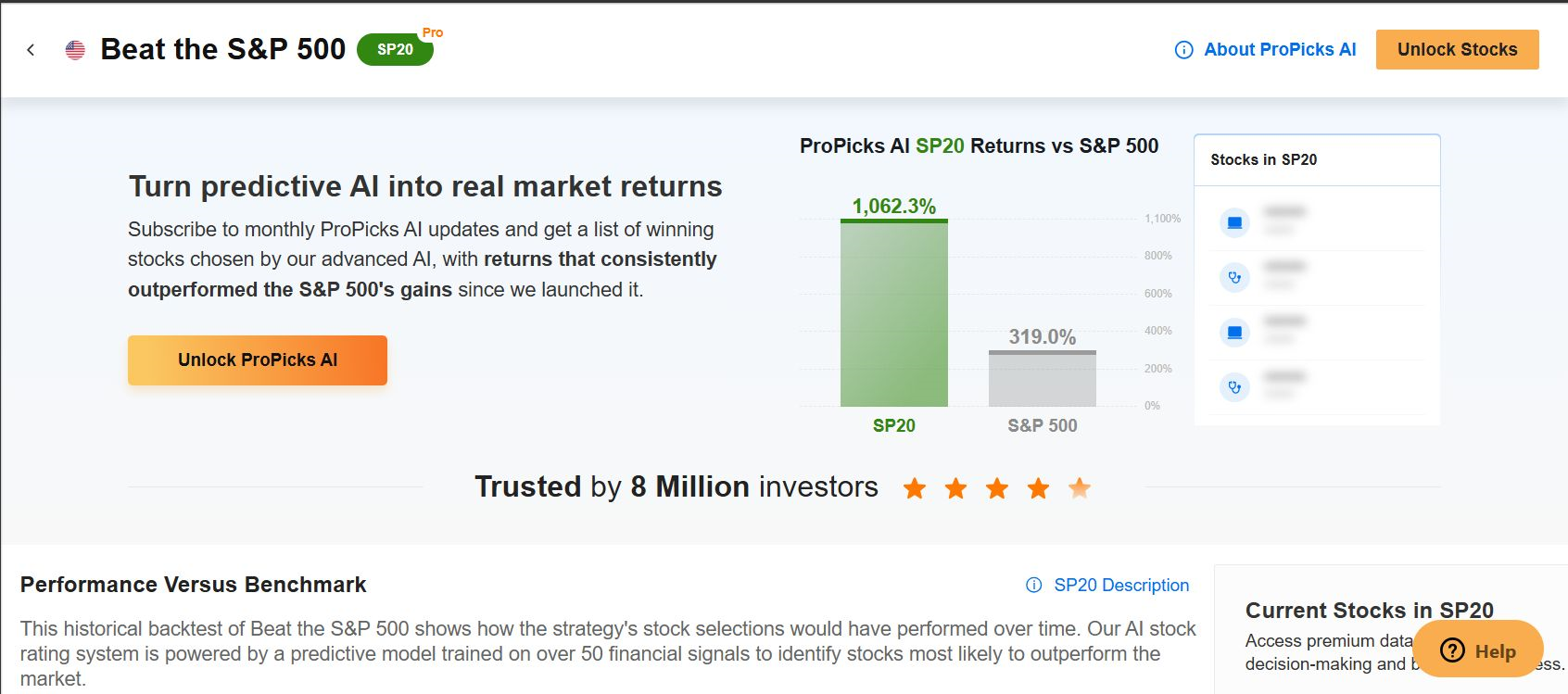

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

For investors searching for undervalued companies with strong growth potential, low-priced stocks can offer lucrative opportunities. While stocks under $10 often come with added volatility, they also present the possibility of outsized returns when backed by solid fundamentals and a clear path to expansion.

In this article, we highlight three companies— AdaptHealth (NASDAQ:AHCO), ADT (NYSE:ADT), and Olo (NYSE:OLO)—that are trading below $10 but have the potential to deliver significant gains in the coming months.

Source: Investing.com

For investors seeking growth at a bargain, these three stocks are worth a closer look.

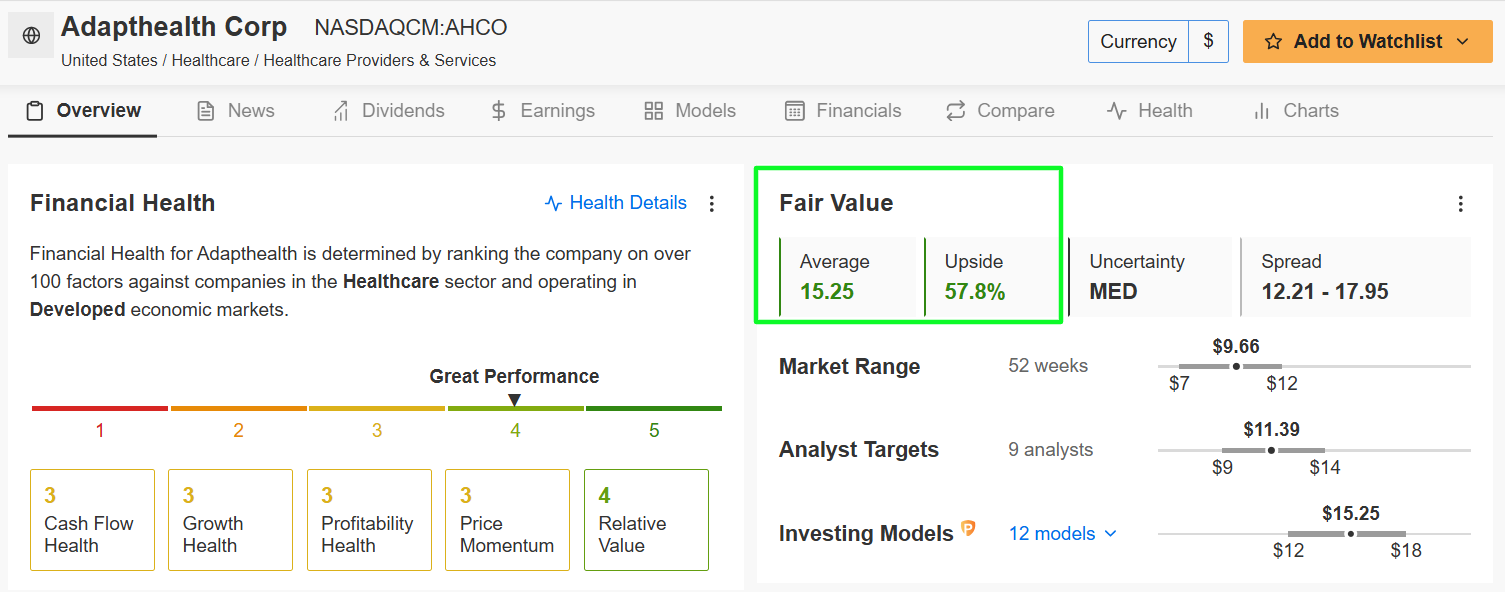

1. AdaptHealth

- Current Price: $9.66

- Fair Value Estimate: $15.25 (+57.8% Upside)

- Market Cap: $1.3 Billion

AdaptHealth is a leading provider of home medical equipment (HME) and healthcare-at-home solutions. The company specializes in respiratory therapy, sleep apnea treatment (CPAP machines), diabetes management, and mobility equipment, helping patients manage chronic conditions outside of traditional healthcare facilities.

AHCO stock has delivered a 37.8% return over the past 12 months.

Source: Investing.com

Why It’s a Buy Under $10:

With a growing emphasis on home-based healthcare, AdaptHealth is well-positioned to benefit from the rising demand for cost-effective and convenient medical solutions.

The company’s fundamentals remain strong, making it potentially attractive for investors seeking growth with moderate risk. More healthcare services are moving out of hospitals and into home settings, a trend that strongly benefits AdaptHealth’s business model.

It is worth noting that revenue growth is expected to be modest at 1.1% for FY2024, but the company's EPS growth forecasts are particularly striking, with Q1 2025 projected to show remarkable growth of 1,336.8%.

Source: InvestingPro

AdaptHealth trades at $9.66 with a notably strong Financial Health Score of 3.6 (Great) and a Fair Value estimate of $15.25, suggesting a significant 57.8% upside potential.

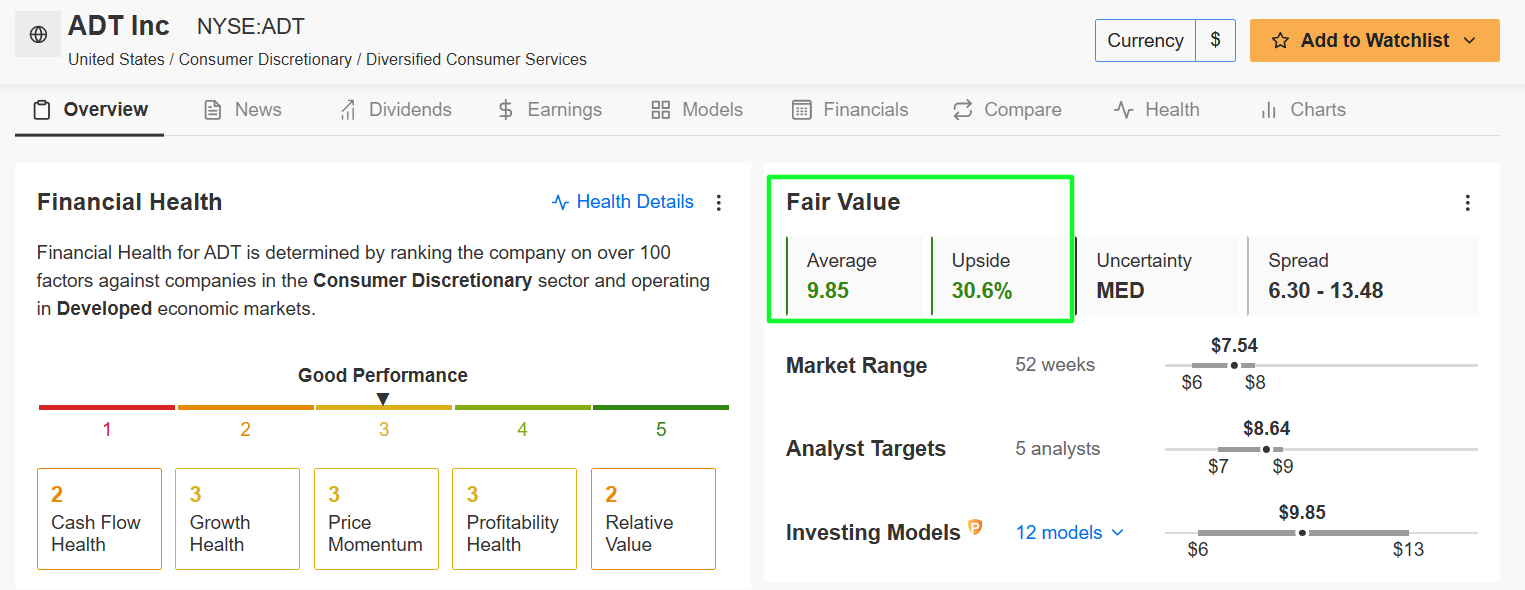

2. ADT

- Current Price: $7.54

- Fair Value Estimate: $9.85 (+30.6% Upside)

- Market Cap: $6.7 Billion

ADT is one of the largest providers of home security, monitoring, and automation solutions in the U.S. The company offers 24/7 professional monitoring, smart home integration, and commercial security services. With a focus on innovation, ADT has partnered with Google's Nest to enhance its smart security offerings.

ADT stock has demonstrated impressive resilience with a 15.1% one-year return.

Source: Investing.com

Why It’s a Buy Under $10:

Despite its low stock price, ADT remains a dominant player in the home security industry. With nearly 7 million customers, the company generates stable recurring revenue from its subscription-based monitoring services, ensuring consistent cash flow.

Furthermore, ADT stands out with its solid fundamentals, including a healthy 12.9% return on equity and an impressive EBITDA of $2.47B. What makes ADT particularly attractive is its combination of growth potential and income characteristics, offering a 2.1% dividend yield and a 5.1% shareholder yield.

The increasing adoption of smart home technology and AI-powered security solutions positions ADT for future expansion, making it a compelling play amid the current environment.

Source: InvestingPro

Shares present a compelling value proposition at their current price of $7.54, backed by a strong Financial Health Score of 2.8 (Good) and a Fair Value estimate of $9.85, indicating a substantial 30.6% upside potential.

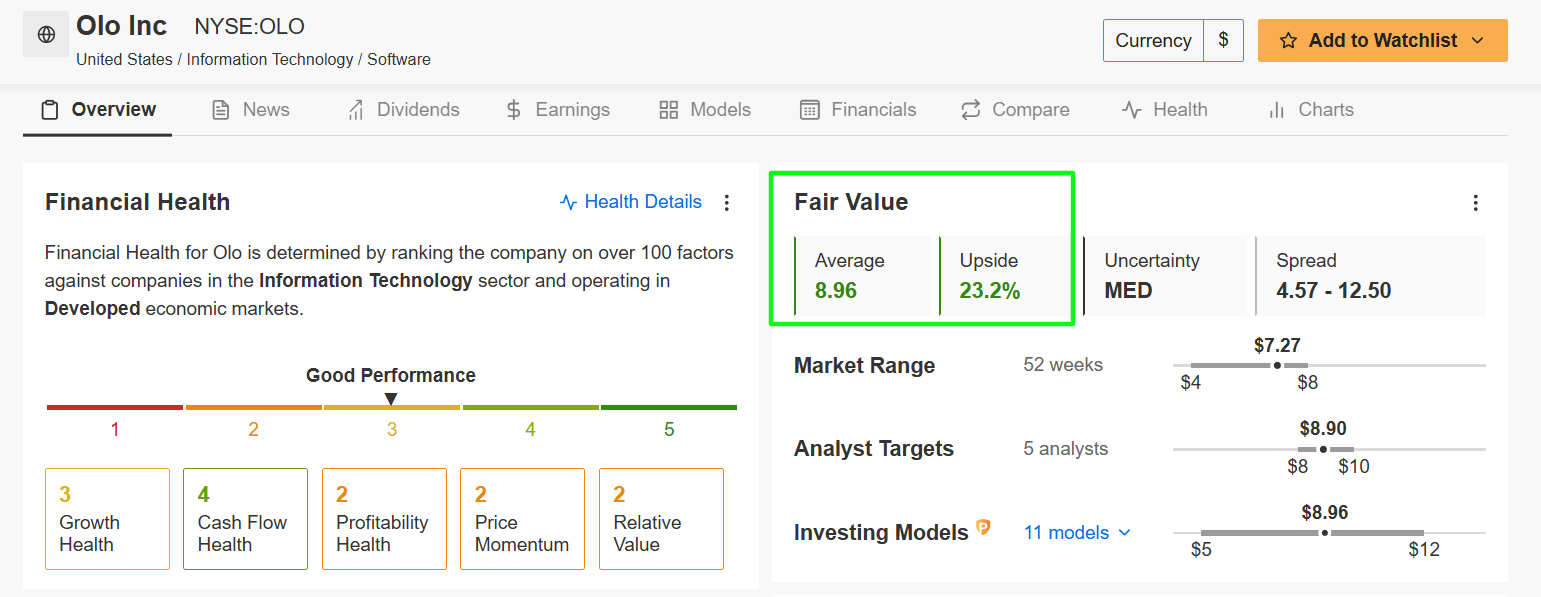

3. Olo

- Current Price: $7.27

- Fair Value Estimate: $8.96 (+23.2% Upside)

- Market Cap: $1.2 Billion

Olo is a leading software-as-a-service (SaaS) provider for the restaurant industry, offering digital ordering, delivery integration, and payment processing solutions. The company enables thousands of restaurant brands to streamline online ordering and enhance customer engagement through its cloud-based platform.

OLO stock has shown strong momentum with a 35.9% one-year return, demonstrating market confidence in its business model.

Source: Investing.com

Why It’s a Buy Under $10:

Olo’s stock has struggled since its post-IPO highs, but its strong financial position and growing market adoption make it a compelling investment at current levels. The company has no debt, a strong balance sheet, and a scalable business model that benefits from the digital transformation of the restaurant industry.

While currently operating at a loss ($46.65M in FY2023), the company's Q4 2024 EPS forecast shows promising growth of 165.8%. What's particularly noteworthy is the impressive revenue growth trajectory, with FY2023 showing 23.1% growth and FY2024 projected to maintain this momentum at 23.4%.

Furthermore, Olo is diversifying its business and increasing its long-term growth potential with its recent expansion into payment processing and AI-driven analytics.

Source: InvestingPro

Olo is currently trading at $7.27, with a solid Financial Health Score of 2.8 (Good) and a Fair Value estimate of $8.96, suggesting an attractive 23.2% upside potential.

Conclusion

AdaptHealth, ADT, and Olo are three undervalued stocks under $10 that present compelling growth opportunities. Each company operates in a high-potential industry with strong tailwinds supporting future expansion.

While low-priced stocks come with inherent risks, these three companies have the fundamentals, partnerships, and innovation strategies needed to drive significant upside in the years ahead.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.