Last night saw Wall Street fall back despite strong retail sales numbers, with the inflationary effect overriding actual consumer sales, while the latest UK inflation print overshot. Amid the background of the Poland missile crisis, European shares also fell back with the USD firming ever so slightly on a safe haven bid. Euro remained relatively strong above the 1.03 level while Pound Sterling lifted slightly on the inflation print, as the {{%|Australian dollar}} pulled back to the 67 cent level. US bond markets saw more yield inversion with 10 year Treasury yields pulled back below the 3.7% level while commodities remain mixed as Brent crude finished below the $93USD per barrel level and gold had another consolidating session, maintaining its current uptrend but no longer extending above the $1770USD per ounce level.

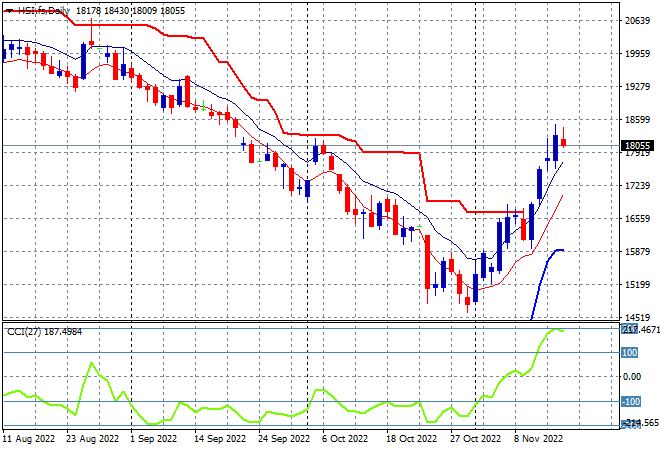

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets lost confidence going into the close with the Shanghai Composite down nearly 0.5% at 3119 points while the Hang Seng Index had a similar return, down 0.5% to finish at 18256 points. The daily chart is finally showing a slowdown after having gained nearly 4000 points since testing the 2008 lows. Its pretty obvious that daily momentum was getting ahead of itself before reaching the magical 20000 point level so watch for a this retracement to possibly expand further:

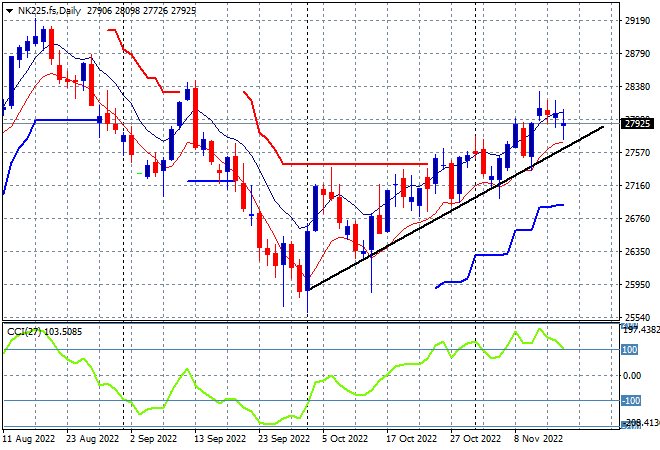

Japanese stock markets only put in scratch sessions with barely any change, the Nikkei 225 closing at 28028 points. The daily price chart was showing a breakout brewing as overhead resistance at the 27500 level is cleared but more wobbles are appearing here as the too strong Yen and lack of upside action on Wall Street hampers buying confidence. A potential pullback is building here as price action stalls amid although daily momentum remains overbought. Support needs to hold at the 27500 point level:

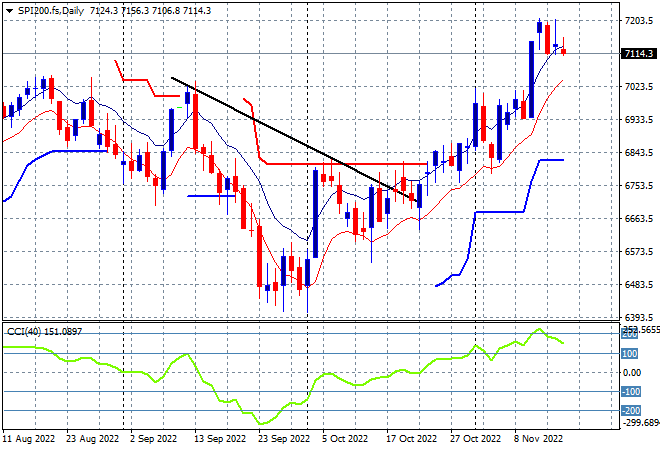

Australian stocks were unable to advance again yesterday with the ASX200 closing 0.3% lower at 7122 points. SPI futures are down around 0.2% again so we are likely to see a continuation of a mild pullback with the daily chart still looking very similar to Japanese stocks, albeit with more upside potential. Daily momentum remains solidly overbought, with strong support below at 7000 points as the uncle point on any pullback:

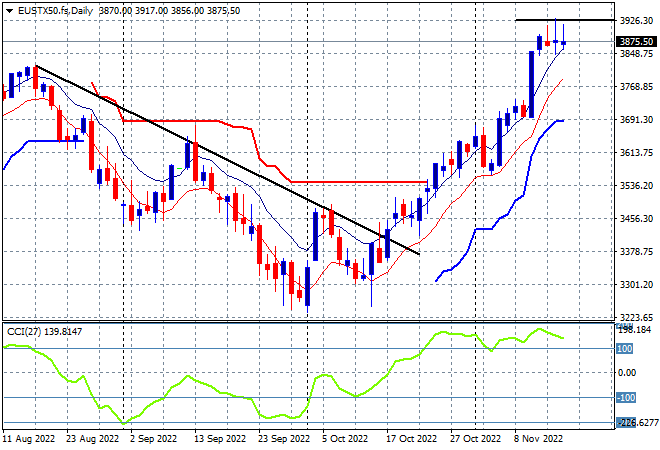

European markets were red across the board due to the Ukrainian missile crisis, with the Eurostoxx 50 Index slumping some 0.8% to finish at 3882 points. Again, another daily chart picture that looks similar to Asian markets, but with much more momentum as it recently cleared resistance at the 3550 level and bounced off the 3600 point area. The key point going forward will be the reaction to the Polish missile strikes, with daily momentum already over extended this is ripe for a reversal so watch for any moves below the high moving average here at the 3850 point level:

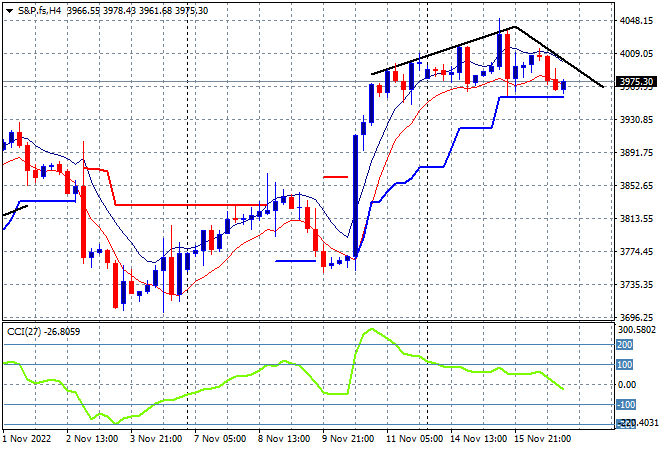

Wall Street was down across the board but the returns were mixed with the NASDAQ falling the most, down 1.5% while the S&P500 finished 0.8% lower at 3958 points. The chart picture remains slightly different to other stock markets as it is battling many more layers of resistance that must be overcome to get back to the August highs, with the October highs cleared and the 4000 point psychological level the next to beat this trading week. Watch for a potential rollover below trailing ATR support here on the four hourly chart:

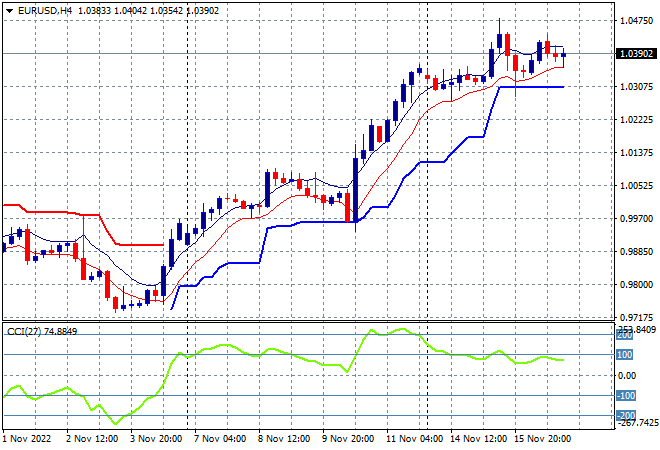

Currency markets reduced in volatility overnight despite some big economic prints with Pound Sterling pushing to a new three month high on its outsized inflation print while Euro consolidated just below the 1.04 level in a stable session. This provides the technical setup to launch even higher but as I warned yesterday I’m wary of a very crowded trade here with a one-way move usually meaning a pullback – potentially violent – is forthcoming:

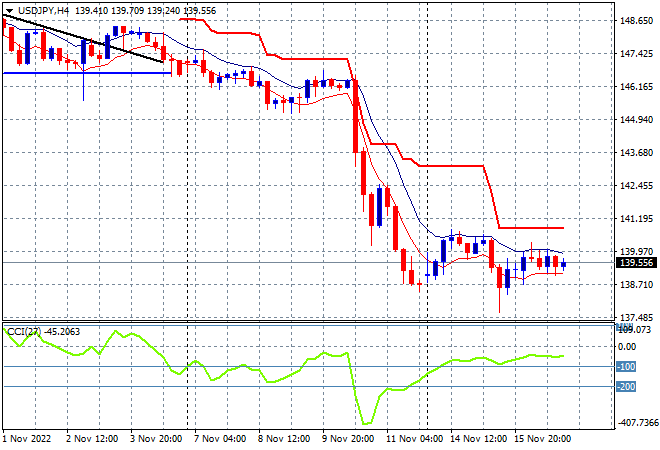

The USDJPY pair remained depressed again overnight with a steady session at the mid 139 level, with no upside potential appearing. This keeps price action near the new monthly low as the October and September rallies are all but wiped out, with more potential for downside action. While there is some evidence of deceleration at the 139 handle as momentum rebounds out of extremely low oversold readings, price action is pointing to another test of the recent lows instead:

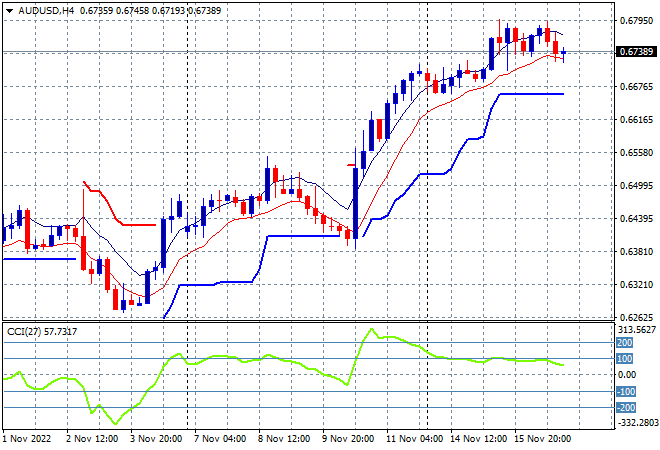

The Australian dollar also steadied overnight after failing again to push up through the 68 cent level having looked through the recent European volatility. My previous contention that resistance was still too strong at the 65 handle is no longer intact as this outsize move rejigs the Pacific Peso as the Fed is more likely to be in line with the RBA on future interest rate rises. That still means less upside potential in my view, but negates the idea of a crash below the 60 handle:

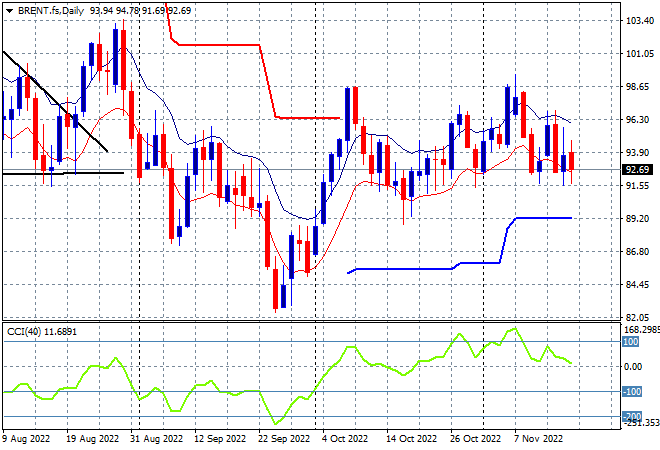

Oil markets again were unable to find a bid overnight, still responding to the echos of a failed attempt earlier last week to break above the former October highs as Brent crude finished just below the $93USD per barrel level. Although daily momentum remains positive, the lack of new daily highs is quite telling here as is the inability of price action to return to the magical $100 level as it keeps coming up against resistance at the $98 level:

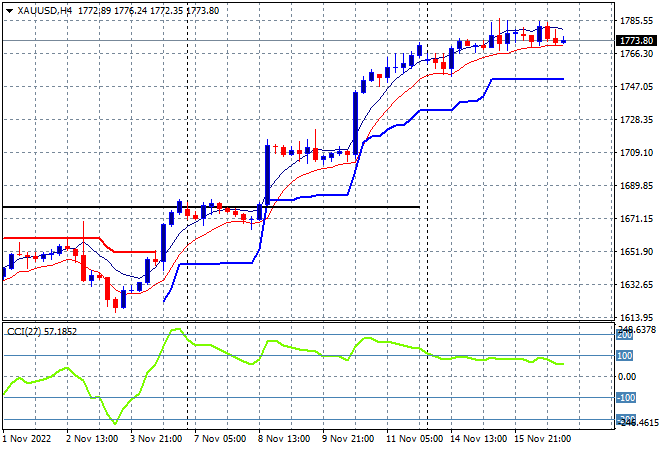

Gold was slowly climbing and has now paused here after its recent upmoves that took it well past the October highs (upper horizontal black line), stalling just above the $1770USD per ounce level. This is a welcome pause in a very fast uptrend, with a steep series of steps that looks like flattening out to a landing until more buyers circulate around the $1800 level. Short term momentum is no longer overbought, so watch for a potential short retracement back down to trailing ATR support at the $1750 level: