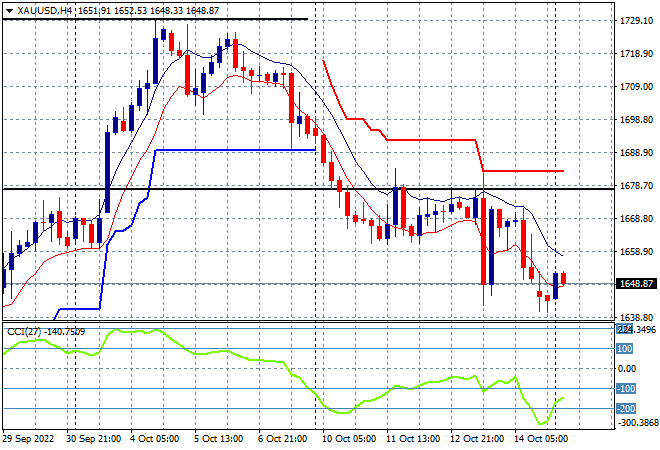

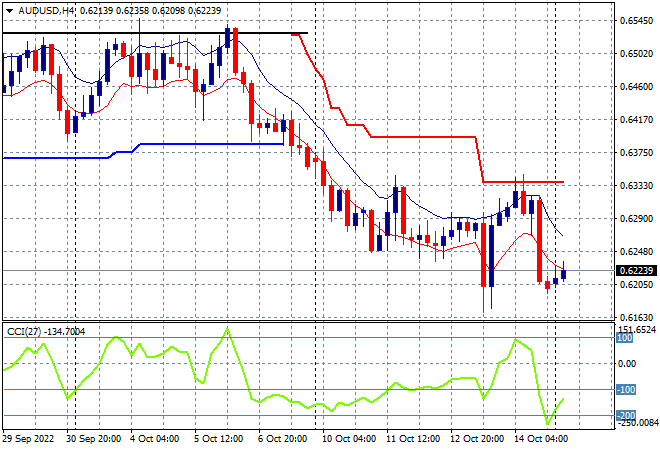

Asian stock markets have all pulled back in unison to the falls on Wall Street on Friday night with all eyes on the latest Chinese Communist conference. The USD remains strong following the release of the latest US retail sales print with commodity currencies still under the pump as the Australian dollar remains stuck at the 62 cent level. Oil prices are flat following the recent OPEC production cuts, with Brent crude stable above the $92USD per barrel level while gold is trying hard not to make yet another new daily low, still crushed below the $1700USD per ounce level, currently at $1648:

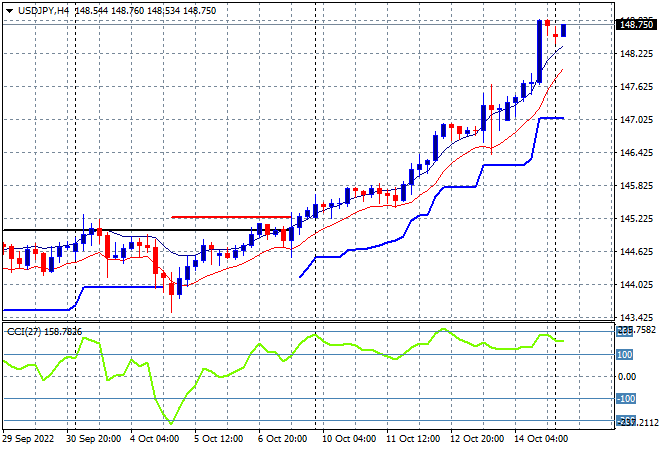

Mainland Chinese share markets are the best relative performers with the Shanghai Composite down slightly and just holding above the 3000 point barrier while the Hang Seng Index is still in sell mode, down another 1% to take back the meagre Friday gains to retreat back below the 17000 point level, currently at 16399 points. Japanese stock markets are also moving lower, with the Nikkei 225 currently down 1.4% to 26712 points, while the USDJPY pair is stable just below the 149 level after the huge surge on Friday night:

Australian stocks were unable to escape the selling, with the ASX200 starting the trading week well below the 6700 point level, down more than 1.4% at 6660 points. The Australian dollar is really trying hard to get off the floor here, currently hovering above the 62 handle after recently making a new two year low and Friday night’s whiplash moves:

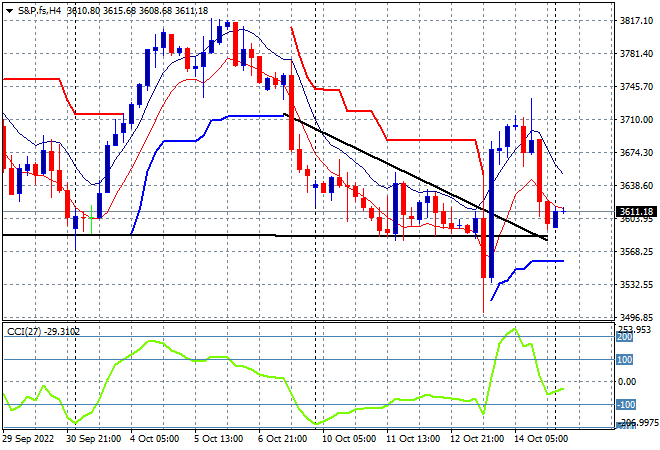

Eurostoxx and US futures are drifting sideways around their Friday night closing positions as we head into the London session, with the S&P500 four hourly futures chart showing price action wanting to drag back down to the 3600 point level. Medium term and possibly psychological long term resistance at the 4000 point level is a distant memory, and it seems the 3800 point level may turn out the same as momentum remains negative:

The economic calendar starts the week very quietly with some Treasury auctions and not much else.